Effective financial management is the backbone of any successful business, and at the heart of this lies the Internal Rate of Return (IRR). It is a crucial metric for evaluating the profitability of an investment project, guiding decision-makers in assessing the potential returns on capital.

In this guide, we’ll answer 7 key questions about IRR to understand the metric, learn how its calculated, interpretated, and applied in practice of managing business and finance.

Level up your accounting with smart automation! Integrate financial data from all your sales channels in your accounting to have always accurate records ready for reporting, analysis, and taxation. See it in action with a 15-day free trial or spare a spot at our weekly public demo to have your questions answered.

What is Internal Rate of Return (IRR) and how is it calculated?

Internal Rate of Return (IRR) is a financial metric used to assess the profitability of an investment by determining the discount rate that makes the net present value (NPV) of its future cash flows equal to zero.

In simpler terms, IRR is the rate at which the present value of expected cash inflows equals the present value of cash outflows.

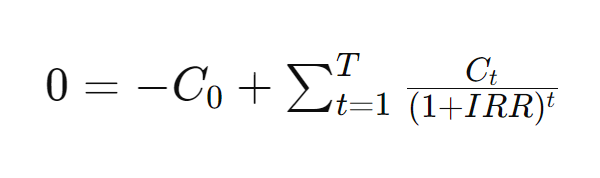

The formula for calculating IRR involves setting the NPV equation to zero and solving for the discount rate, typically done using financial calculators or software.

Consider a hypothetical investment with an initial outlay and subsequent cash inflows. The IRR is the discount rate at which the sum of the present values of these cash flows equals the initial investment. If the calculated IRR is greater than the cost of capital or hurdle rate, the investment is deemed profitable. However, if the IRR falls below the cost of capital, the project may not meet the required return threshold.

But let’s break it down.

How to calculate IRR: the formula and examples

So, as mentioned, The IRR is found by setting the NPV formula to zero and solving for the discount rate (IRR). Let’s look at the formula, which is as follows:

Let’s break down the components.

- Ct – Net cash inflow during the period t;

- C0 – Total initial investment costs (usually, a negative value because it’s an outflow);

- IRR – Internal rate of return;

- t – Number of time periods.

As you can see, the formula involves the summation notation (or the sigma notation), which you might be unfamiliar with. In simple terms, utilizing this sygma operator allows to write down a long sum in a single expression.

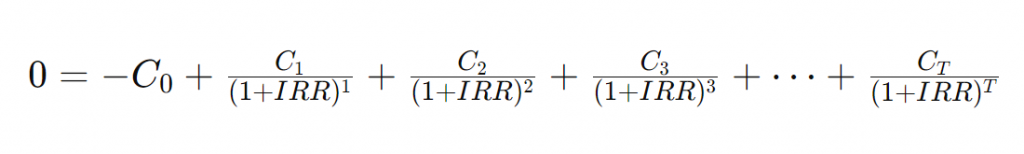

Here’s an alternative way to write down the formula.

So, here:

- C0 – Initial investment (a negative value);

- C1,C2,C3,…,CT – Net cash inflows during periods 1, 2, 3, …, T;

- T = Total number of periods;

- IRR – Internal rate of return.

Steps to calculate IRR

Now, let’s look at how you caculate IRR using these formulas.

- Identify cash flows

Determine the initial investment and subsequent cash flows. For example, an initial investment of $1000 and returns of $200, $300, $400, and $500 over four years. - Guess the rate

Since there is no analytical formula to directly solve for IRR, start with an initial guess rate (e.g., 10%). - Calculate NPV

Using the guessed rate, calculate the NPV of the cash flows. - Adjust the rate

If the NPV is not close to zero, adjust the rate up or down and recalculate the NPV. - Iterate

Repeat steps 3 and 4 until the NPV is as close to zero as possible. The rate at which NPV is zero is the IRR.

As you can see, the calculation is indirect because we’re using the formula of calculating another metric in combination with some guess work.

That’s to say, a manual calculation can be pretty tough, so, usually, you can use Excel or financial calculators to figure out IRR.

For example, to calculate IRR in Excel, you can do the following:

- List your cash flows in a column.

- Use the formula

=IRR(range), whererangeis the range of cells containing the cash flows.

How does IRR differ from other investment metrics, such as Net Present Value (NPV)?

While IRR and Net Present Value (NPV) are both essential tools for evaluating investments, they approach the assessment from different perspectives. NPV calculates the present value of expected cash flows by discounting them at a specified rate, usually the cost of capital. The result is a dollar value that represents the project’s net contribution to shareholder wealth.

In contrast, IRR identifies the discount rate at which the NPV is zero. It is essentially the breakeven point where the investment’s gains match its costs. The primary distinction lies in interpretation – NPV provides a dollar value, indicating the absolute contribution to wealth, while IRR gives a percentage, representing the return rate required for break-even.

A key point to note is that NPV is more straightforward in cases where cash flows are conventional (negative followed by positives). However, IRR can pose challenges with unconventional cash flow patterns, potentially yielding multiple solutions or requiring additional scrutiny.

What does a positive, zero, or negative IRR indicate about an investment?

The sign of the IRR provides crucial insights into the potential success or failure of an investment. A positive IRR signifies that the project is expected to generate returns greater than the cost of capital, indicating profitability. In this case, the higher the IRR, the more attractive the investment.

Conversely, a zero IRR implies that the project’s cash inflows exactly offset the outflows, resulting in no net gain or loss. While this might seem neutral, it’s essential to recognize that achieving the cost of capital may not be sufficient for an investment to be considered successful, as it doesn’t provide a positive return.

A negative IRR indicates that the project is not expected to generate returns sufficient to cover the cost of capital. In practical terms, this suggests that the investment is likely to result in a financial loss and is generally considered unviable. Therefore, the sign of the IRR serves as a clear indicator of the project’s financial feasibility.

What are the limitations or drawbacks of using IRR as an investment evaluation metric?

Despite its widespread use, IRR is not without limitations. One significant drawback is its sensitivity to the timing of cash flows. The assumption that interim cash flows are reinvested at the IRR can distort results, especially in situations where reinvestment opportunities are scarce or inconsistent. This can lead to unrealistic projections of returns.

Another limitation lies in the potential for multiple IRRs, particularly in projects with unconventional cash flow patterns. When cash flows change direction more than once, the IRR equation may yield multiple discount rates that satisfy the zero NPV condition. This ambiguity can complicate decision-making and requires careful consideration or alternative evaluation methods.

Additionally, IRR does not account for the scale of investment. Two projects with the same IRR might have significantly different NPVs, potentially favoring the smaller investment. Therefore, businesses should use IRR in conjunction with other metrics, such as NPV, to gain a more comprehensive understanding of an investment’s viability.

How does the IRR concept apply to projects with unconventional cash flow patterns?

The IRR concept remains applicable even when dealing with projects exhibiting unconventional cash flow patterns. In such cases, where cash flows change direction multiple times, calculating the IRR might result in multiple discount rates satisfying the zero NPV condition. It’s crucial to approach these situations with caution and use additional analytical tools to make informed decisions.

One way to handle unconventional cash flows is to critically examine the project’s cash flow timeline. Understanding the timing and magnitude of cash inflows and outflows is essential for interpreting IRR accurately. In cases with irregular cash flows, consider employing modified internal rate of return (MIRR), which addresses some of the shortcomings associated with traditional IRR calculations.

Furthermore, businesses should be aware that unconventional cash flow patterns might require a more nuanced analysis, considering factors such as project scale, financing structure, and the potential impact on overall business operations. Sensitivity analysis can be particularly useful in assessing the robustness of IRR results under varying assumptions.

In what situations might the IRR rule lead to incorrect investment decisions?

While IRR is a valuable metric, blindly adhering to the IRR rule can lead to incorrect investment decisions in certain situations. One such scenario is when comparing projects with significantly different scales of investment. IRR doesn’t account for the absolute dollar value of returns, potentially favoring smaller projects with higher percentage returns over larger, more lucrative investments.

Another situation to exercise caution is when dealing with mutually exclusive projects with different cash flow profiles. In such cases, IRR may recommend an investment with a shorter payback period, even if the overall profitability (NPV) of a competing project is higher. It is essential to consider the broader financial implications and align investment decisions with the overall strategic goals of the business.

Additionally, the assumption that interim cash flows are reinvested at the IRR may not hold true in real-world scenarios. If suitable reinvestment opportunities are scarce or do not align with the calculated IRR, relying solely on this assumption can lead to overly optimistic projections of investment returns.

How can sensitivity analysis be used to assess the reliability of IRR in decision-making?

Sensitivity analysis is a valuable tool for assessing the reliability of IRR results and understanding the potential impact of variations in key assumptions. By systematically adjusting input parameters such as cash flow estimates, discount rates, or project timelines, businesses can evaluate how sensitive the IRR is to changes in these variables.

For instance, a sensitivity analysis might involve assessing the effect of different discount rates on the IRR. If the project remains viable across a range of discount rates, it suggests a higher degree of reliability in the IRR result. Conversely, if the project’s viability is highly sensitive to small changes in the discount rate, decision-makers should exercise caution and explore alternative evaluation methods.

Sensitivity analysis also helps identify critical assumptions and uncertainties that can significantly influence IRR outcomes. By understanding these sensitivities, businesses can make more informed decisions, mitigate risks, and enhance the robustness of their investment evaluations.

Bottom line

Internal Rate of Return (IRR) is a powerful tool in the financial toolkit, guiding businesses in assessing the profitability of investment projects. This question-answer guide has unraveled the complexities of IRR, from its calculation and distinctions from other metrics to its limitations and practical applications in real-world scenarios. By understanding the nuances of IRR and its potential pitfalls, businesses can make more informed financial decisions, ensuring the success and sustainability of their investments.

Continue reading: What’s remittance advice?

Share you thoughts

Please feel free to ask your questions or share you opinions in the comments section below!