Clover POS users often face a familiar situation: your Clover daily batch payout hits the bank, but in QuickBooks Online, nothing adds up. Tips, taxes, and sales get lumped together. Fees go missing. And reconciliation becomes a guessing game.

Here’s what you can actually do: automation tools like Synder help you sync Clover transactions to QuickBooks Online accurately, mapping all sales, taxes, and tips, to the right accounts. This ensures that your transactions are correctly categorized, and reconciliation finally makes sense.

What to do to sync Clover POS data into QuickBooks Online with Synder

1. Connect Clover and QuickBooks Online to Synder

You start with creating a Synder account. From your dashboard, connect both your Clover POS system and QuickBooks Online. This creates a real-time bridge between the two platforms and sets the stage for seamless data sync.

2. Configure Clover to QuickBooks Online mapping settings

In Synder’s settings, configure how each transaction type maps into QuickBooks — these mappings are for the Summary Sync mode. For example:

- Sales → Sales Revenue account

- Taxes → Tax Payable

- Tips → Gratuity Liability or Other Income

This ensures Clover sales, tips, and taxes integrate with QuickBooks Online in the correct way, without manual edits later.

3. Enable automatic sync or use one-click manual sync

Choose whether to let Synder sync new Clover transactions automatically or review them before syncing. Both options allow you to control your data flow depending on your workflow.

4. Reconcile transactions with bank feed

Since Synder records gross sales and refunds in the Summary Sync mode, your QuickBooks entries align with actual payout totals. This ensures a smooth, accurate reconciliation process that matches your bank feed without the extra hassle.

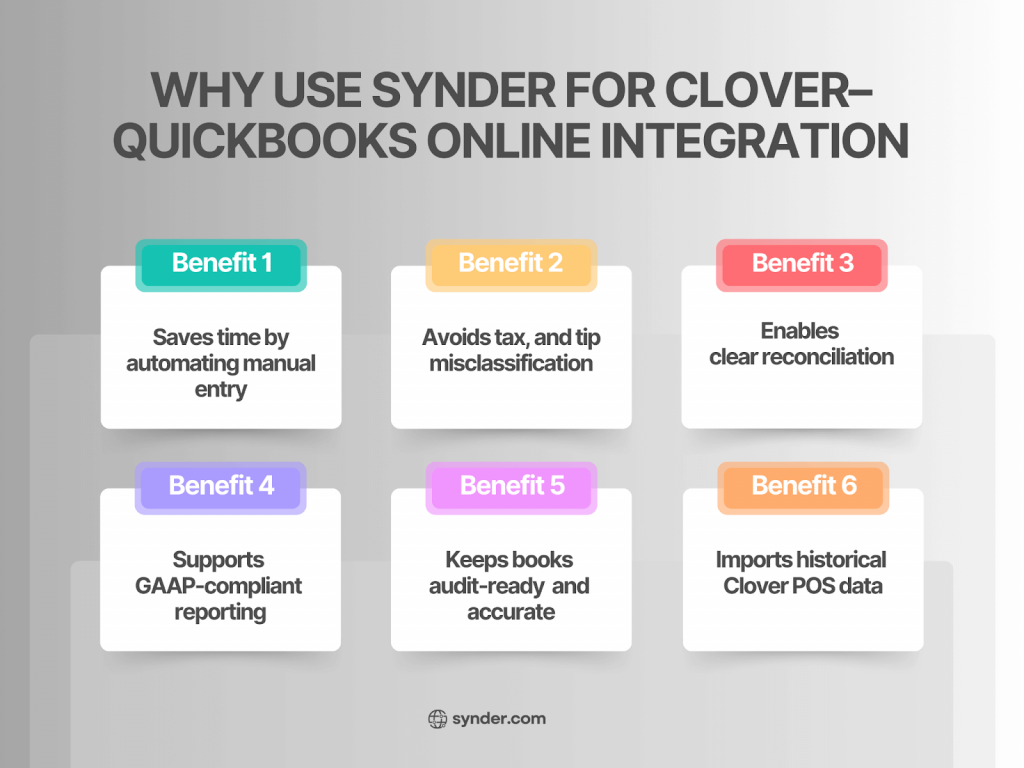

Solve 6 common Clover–QuickBooks integration issues with Synder

1. Manual data entry eats up your time

Problem: Manually copying Clover sales into QuickBooks is tedious and error-prone.

Synder’s fix: Automates the entire sync process: just connect, configure, and let it run in the background.

2. Tips and taxes get miscategorized

Problem: Tips and taxes often end up in the wrong accounts, leading to inaccurate financials.

Synder’s fix: Correctly maps Clover tips, sales, and taxes to the right QuickBooks accounts, ensuring clean, reliable books.

3. Clover payouts don’t match your bank deposits

Problem: Reconciling batch payouts from Clover with your actual deposits is confusing.

Synder’s fix: Groups transactions to match Clover batch payouts, so reconciliation is quick and accurate.

4. Compliance is unclear and stressful

Problem: Handling sales tax, deferred revenue, and tips without a clear system creates compliance risks.

Synder’s fix: Supports GAAP-compliant reporting for clearer financials and easier tax filing.

5. Your books aren’t audit-ready

Problem: Inconsistent or delayed entries leave your books vulnerable during audits.

Synder’s fix: Syncs categorized records in real time, keeping your books audit-ready all year round.

6. You’re missing historical sales data

Problem: Past Clover transactions aren’t reflected in QuickBooks, making reporting incomplete.

Synder’s fix: Lets you import up to 12 months of historical data (3 months free on Pro), so you can fill in the gaps and close your year with confidence.

Interested? Come visit our demo to see for yourself.

FAQ

Can Clover taxes and tips sync separately into QuickBooks Online?

Yes. With Synder, tips and taxes are synced into distinct categories, allowing you to track liabilities and income cleanly.

Can I import historical Clover POS transactions into QuickBooks Online?

Absolutely. Synder allows you to import up to 12 months of historical data with transaction data, including sales, taxes, and tips, with the first 3 months for free included on the Pro plan.

What if I have refunds on Clover?

Refunds are also supported. Synder syncs them into QuickBooks as negative sales and adjusts income and taxes accordingly.

Can Synder separate cash and card Clover sales in QuickBooks Online?

Yes, Synder can categorize cash and card payments separately, so each payment type is properly tracked in QuickBooks Online.

Does Synder support multiple Clover locations in one QuickBooks Online file?

Yes, Synder supports syncing data from multiple Clover locations into a single QuickBooks Online account, and each location is clearly tracked.