If you’ve been using cash basis accounting for your business, making the transition to the accrual is a huge step. So you need to know how to do it the right way.

Let’s make this clear: You can’t just start recording your transactions under the accrual method without following the proper process and regulations (this applies both to a small business taxpayer and a large corporation).

So here’s a guide that’ll help you understand the steps you need to follow to change your accounting method from cash to accrual.

Key takeaways:

- Accrual accounting provides a clearer, more accurate view of your financials by recognizing income when earned and expenses when incurred.

- Conversion to accrual accounting involves several steps, including filing Form 3115 with the IRS and adjusting your general ledger.

- A Section 481(a) adjustment ensures accurate tax filings when transitioning to a new accounting method, preventing income or expenses from being double-counted or missed.

Contents:

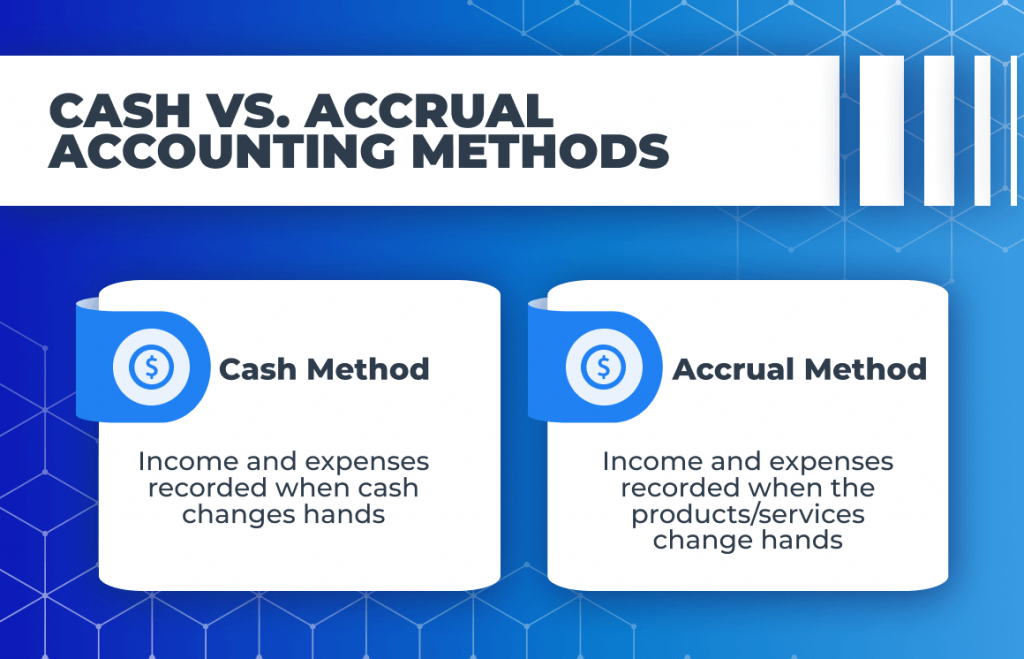

Cash method vs. accrual accounting method

If you’re changing the method, you probably know all too well the differences between cash and accrual. But if you want to brush up on this, here’s a short summary. Otherwise, head straight to the next section.

Accounting methods depend on when you record transactions, so it’s all about timing.

In the cash method, income is recorded when cash is received and expenses when cash is paid. In other words, when cash changes hands.

That’s a necessary element for an adequate recording of cash flow but not an accurate revenue/loss recognition according to GAAP (Generally Accepted Accounting Principles).

On an accrual basis, income is recorded when earned and expenses when incurred, regardless of when cash is received or paid. In other words, when the product/services change hands.

In the US, GAAP sees it as the right method to reflect your revenue and loss in specific accounting periods. In principle, this is when the product/service is fulfilled.

Does your business need switching to the accrual basis?

For some businesses it’s a choice, for others it’s a must. In the US, ‘the must’ rules are set by:

- The IRS;

- GAAP issued by the Financial Accounting Standards Board (FASB) and the Governmental Accounting Standards Board (GASB).

Let’s see what the conditions are.

When you must make the switch

As outlined by GAAP, publicly traded companies must use the accrual method when preparing their financial statements, which are then filed with the Securities and Exchange Commission (SEC).

Even if you aren’t a public company, you might still need to use accrual accounting, as the IRS requires it in certain situations. In a broad sense, it applies to certain business structures (i.e. corporate), inventory businesses, and those that reach a certain revenue.

| How to determine the revenue threshold? There’s a special test called the gross receipt test that can help taxpayers determine whether they must transfer to accrual accounting. The gross receipts test threshold for 2023 is $29 million, based on the annual average over the past 3 years. If you cross this threshold, then you must change your accounting method to accrual. |

There are also some business entities (or special circumstances), like a tax shelter for example, that regardless of the gross receipt test need to use accrual basis.

When can you choose which method to use?

If you don’t fall under any of the mandatory rules, then you have a choice of which method to go for, as long as you’re consistent with it. The IRS may also allow certain businesses to use a third method—the hybrid method, which, as the name suggests, combines elements of both cash and accrual accounting.

| Did you know? 67% of small businesses use accrual accounting. Even though many don’t have to, they opt in for the perks that come with it. |

Here are some common reasons why businesses switch to accrual accounting:

- Better financial planning, visibility, budgeting, and forecasting

- Securing loans and investments as most banks, lenders, and investors want to see your financials on an accrual basis to see the full picture

- Meeting industry and contract requirements (e.g. manufacturing, retail, and construction)

- Making your books audit-ready

Simply put, accrual accounting elevates your financial management by opening up various opportunities and giving you a more accurate and comprehensive view of your business’s performance.

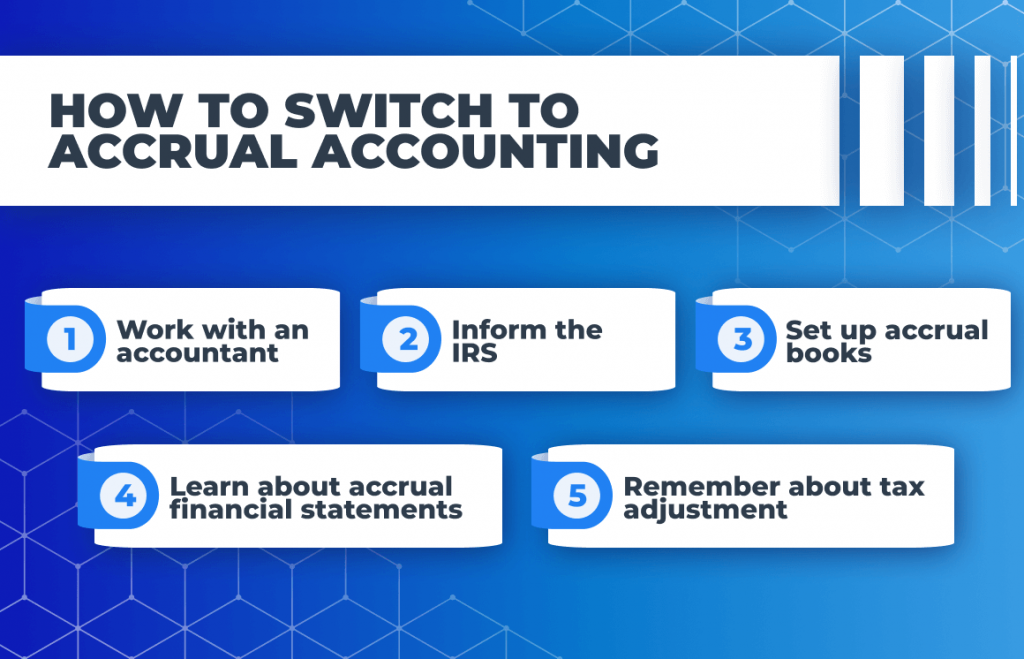

How to switch to accrual accounting: Practical steps for a proper transition

Going accrual isn’t a fast move, as it requires a general overhaul of your chart of accounts, but once it’s done you can reap the perks of improved financial visibility.

Step 1. Have an accountant on board

You really shouldn’t do it alone. There’s a lot at stake (tax liabilities and the mess in accounting, to say the least) so getting extra help at this stage is wise. This is also a great moment to talk about this change and how it’ll affect your company in terms of its financials, budgeting, forecasting, and taxes.

Step 2. Inform the IRS

Once you’re ready to proceed, you need to get a green light from the IRS. You do that by filing an Application for Change in Accounting Method (Form 3115).

In the form, you’ll be asked to explain why you’re changing your accounting method and provide details on how the change will be implemented, including the specific items being adjusted.

When you apply, you might fall under the automatic approval category, meaning, once you submit the documents you can already make the transition. The IRS provides a full list of all automatic changes. If your business doesn’t fall under any of these circumstances, you need to wait for the IRS’s approval (or denial) of your request until you change the method.

| Did you know? Under the IRS rules for automatic changes, you can convert from cash to accrual accounting method once every 5 years. If you need to make another change within that period, you typically have to get special approval from the IRS, unless certain exceptions apply. |

Step 3. Set up the accrual system in your books

This step will need an accountant’s help to not only update your books to the accrual method but also make sure all future transactions are recorded accurately. Let’s see what you can expect.

A. Choose the right software

Accrual accounting can be tricky, so it’s best handled by software rather than manually. However, not all software can manage complex accrual situations, so it’s a good idea to review your current software’s capabilities to ensure it meets your new accrual needs. If it doesn’t, you can shop for better tools.

| How does complex accrual accounting work? Imagine a subscription-based business that switches to accrual accounting. Instead of recording a single yearly payment as revenue all at once when it’s received, they now need to spread that revenue over 12 months (or 365 days in theory). Each month, they’ll recognize a portion of the revenue while keeping the remaining balance as deferred revenue on the balance sheet until it’s earned. That’s a lot of work if done by hand! |

If you run a subscription-based company and you want to move to the accrual method, Synder RevRec software is a robust choice. Here’s what it can do for you during the change process and beyond:

- Customize schedule settings to fit your exact accrual needs

- Pull in historical data from your connected payment processor and automatically apply the schedules from a specific date

- Create new schedules for all incoming subscription payments

- Accurately recognize both one-time payments and subscriptions even coming from the same client

- Automatically recognize revenue as it gets earned

- Automatically apply any changes, cancellations, and refunds to the schedules and reflect them in your books

- Prepare these transactions for monthly reconciliation

Synder can handle the tricky parts so you can focus on the benefits of detailed bookkeeping without getting lost in the nitty-gritty. Plus, using automation to manage your subscriptions isn’t just easier—it’s also the most cost-effective way to keep your finances in check.

‘Synder RevRec appears to be the best and most automated way to get Stripe revenue recognition into QuickBooks. That’s really impactful for startups, as we’re not going to be able to spend on NetSuite or other higher-end accounting software. So being able to scale your business across tons of subscriptions in a cost-effective and scalable manner is critical as a startup.’ says Derek Sessions, CTO at Yoodli

Ready to make the switch? Chat with one of Synder’s experts to see how the software can simplify your move to accrual accounting. And if you’re already using accrual-based accounting, discover how much time and money Synder can save you by automating your bookkeeping tasks. Join our Weekly Public Demo to see how it works or opt for a free trial.

B. Update your general ledger

If you have your software ready, next up is your general ledger, which will expand as you add more accounts to accurately track each stage of your transactions. Depending on your business type, your chart of accounts might now include:

- Accounts Receivable (A/R) – money owed to you by customers for sales made on credit.

- Accounts Payable (A/P) – money you owe to suppliers and vendors for purchases made on credit.

- Accrued Expenses – expenses that have been incurred but not yet paid, such as wages, utilities, or interest.

- Prepaid Expenses – payments made for expenses that’ll benefit future periods, such as insurance or rent paid in advance.

- Deferred Revenue (or Unearned Revenue) – payments received in advance for services or goods to be delivered in the future.

- Accrued Revenue – revenue that has been earned but not yet invoiced or received.

- Inventory Accounts – accounts tracking the value of inventory on hand, cost of goods sold (COGS), and inventory adjustments (for businesses handling inventory).

- Interest Receivable – interest income that has been earned but not yet received.

- Interest Payable – interest expenses that have been incurred but not yet paid.

That’s a lot of accounts as you can see. Not all need to apply to your specific situation, but you can expect many of them to land in your accrual-based books.

N.B. To bring your staff up to speed, it’s best to conduct employee training where all the ins and outs of the new system can be clearly explained to them by your accountant.

C. Learn about adjusting entries

There’s also one more thing you should know when it comes to your new bookkeeping – adjusting entries. They’re special journal entries that record any unrecognized transactions, at the end of the accounting period. They’ll also find their place in the new bookkeeping tasks.

| How do adjusting entries work? Here’s an example. When the year ends, a company might have used electricity in December, but the bill won’t arrive until January. To ensure December’s expenses are accurate, an adjusting entry is made to estimate the cost. This keeps the financial statements on the accrual track. When the actual bill arrives, the entry is adjusted to match the real amount. |

Step 4. Learn how your P&L, balance sheet, and cash flow statements will change

Your income statement (or Profit and Loss statement) and balance sheet will get a significant makeover with the switch to accrual accounting. As you start calculating revenues and expenses differently, you’ll see more line items added to these statements. The accounts mentioned earlier will now show up in your financials. Plus, figures like gross profit, net income, and retained earnings will be more accurate, giving you a clearer picture of your business’s performance.

When it comes to the cash flow statement, it’ll be calculated differently (using the indirect method) since your net income no longer matches the cash you have on hand. To fix this misalignment, the accountant will adjust the operating activities step by step, reconciling them with the accrual-based data. This will ensure that your cash flow statement accurately reflects the actual money inflows and outflows.

Step 5. Remember about tax adjustment

Switching to a new accounting method will impact your taxes, especially when it comes to timing, income, and deductions. You might even discover new types of deductions and potential tax benefits.

However, there’s a final step you should remember about—a Section 481(a) adjustment. This happens when you file taxes for the year you make the switch.

So, what does this mean? When you move to accrual accounting, your tax liabilities might change, which could even affect your past filings. If you end up owing more, the IRS lets you spread that extra tax over four years. But if you’re due a refund, you’ll get it in the year you make the switch.

This adjustment makes sure your income and deductions are properly aligned with the new method, so nothing gets counted twice or missed*.

*Remember the examples of the electricity bill and yearly subscriptions? Without the Section 481(a) adjustment, these expenses and revenues could skew your taxable income when using the accrual method.

Changing accounting methods: Closing thoughts

Shifting to the accrual method is a big and complex step, but it’s one that’ll give you a much clearer and more detailed view of your financials. The process might seem daunting, but a skilled accountant can guide you every step of the way and set up your books just right.

With the support of robust software, like Synder, the complex side of accrual accounting will take care of itself. What you’ll have is more reliable numbers at your fingertips, ready to be used for budgeting, forecasting, and making informed financial decisions.

Share your experience

Have you started preparing for the accounting method change or maybe you’ve already changed it? What challenges have you faced so far and how did you overcome them?

Disclaimer :

The information provided in this article is for general informational purposes only and shouldn’t be considered as professional financial or legal advice. Every business’s situation is unique, and specific tax or accounting advice should be sought from a certified accountant or legal advisor.

.png)