If you’ve ever wondered how two businesses in different industries can have comparable financial statements, the answer lies in certain standards that make this possible. Generally Accepted Accounting Principles (or GAAP) unify the documents, allowing for the comparison of the financial states of vastly different companies.

This article is zooming in on GAAP compliance, its principles and accrual accounting method with revenue recognition as one of the most important requirements under GAAP.

Key takeaways:

- GAAP is a set of accounting standards managed by the Financial Accounting Standards Board (FASB) that regulated and publicly traded U.S. companies must follow.

- GAAP ensures financial statements are compiled for easy comparison across companies and periods, preventing data tampering and guaranteeing reliable reporting.

- GAAP requires an accrual accounting method with revenue recognition.

Contents:

2. How does GAAP compliance work?

4. GAAP compliance: Accrual accounting and revenue recognition

5. How can Synder help with revenue recognition for subscriptions under GAAP?

What is GAAP?

GAAP goes back to the times of the Great Depression after the Stock Market Crash in 1929. The Securities Act of 1933 and the Securities Exchange Act of 1934 are considered to be the start of the GAAP rules as the government together with accounting professionals focused on standardization of financial reporting and working out the best accounting practices.

What’s the modern definition of GAAP?

GAAP is a set of detailed accounting guidelines and standards published and managed by the Financial Accounting Standards Board (FASB). This set of rules aims at providing transparency in compiling financial data by the for-profit companies, non-profits, and government entities in the United States.

All the U.S. states follow GAAP requiring their local entities, such as counties, cities, towns, and school districts, to comply with GAAP. Although it’s legally binding for regulated and publicly traded businesses, some private companies also choose to comply with these rules.

Under GAAP, all the financial information including tax preparation, liability and asset declarations is presented in the same unified or standardized way. That means that all the interested parties can compare the financial information of the companies and evaluate said companies efficiently.

Note: The international equivalent for GAAP is the International Financial Reporting Standards (IFRS).

4 rules that make GAAP important

Aside from the 10 principles discussed in the previous part, there are also four ways GAAP influences bookkeeping practices:

Rule 1. Transparency

GAAP guarantees that financial information provided is transparent and accurate, fostering informed decision-making on the part of the stakeholders.

Rule 2. Consistency

Under GAAP guidelines all the business should maintain consistency in record-keeping, making financial statements on different periods of time comparable.

Rule 3. Comparability

Companies compliant with GAAP have standardized bookkeeping practices, which makes their financial statements easy to compare.

Rule 4. Reliability

GAAP compliance means that the financial statements and records are reliable, minimizing the risk of errors and misrepresentations. That brings increased investor confidence and gives easier access to credits.

How does GAAP compliance work?

As previously mentioned, GAAP is a set of rules and standards regarding how financial information is recorded and reported. It covers balance sheet classification, revenue recognition, accounting method, and materiality.

GAAP compliant companies pass external audits successfully and are more attractive for investors. Publicly-held companies should have one annual external audit due to the regulations of the Securities Act of 1933 and the Securities Exchange Act of 1934.

Breaking GAAP principles leads to significant monetary fines and ruins the reputation of the company. GAAP compliance is ensured by a professional accountant or accounting team trained in GAAP and the results of an external audit by a CPA firm.

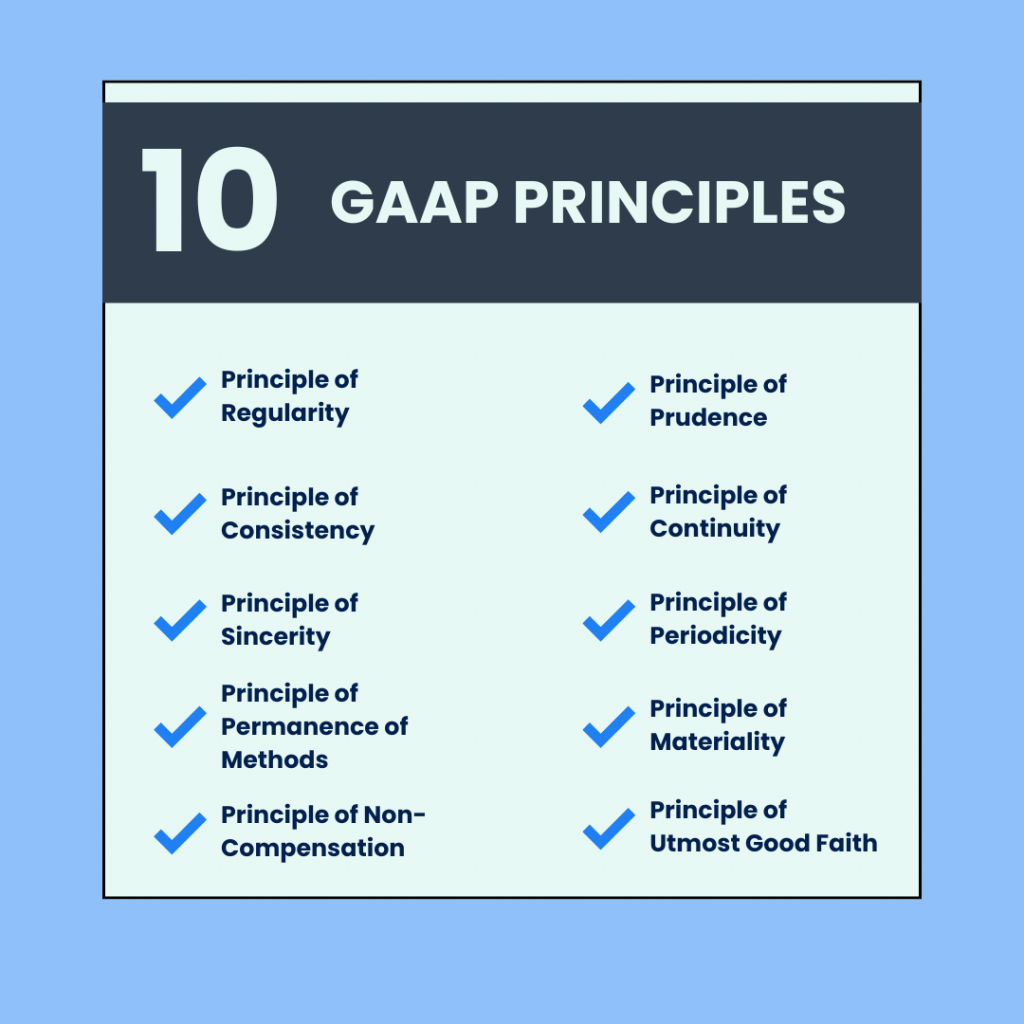

GAAP: 10 key principles

GAAP is based on 10 key principles that guide the collection, recording, and reporting of a business’s financial information, helping to prevent data tampering and unethical practices. The following list relies on the article published by Forbes Advisor.

1. Principle of Regularity

This principle requires businesses and accountants to follow GAAP at all times. The regulations can’t be modified or ignored by the financial team under any circumstances.

2. Principle of Consistency

The same standards and practices should be used by the financial team or an accountant during all the accounting periods. If a company chooses to change some method or practice, or a new accounting team brings its practice, it should be fully documented, explained in the financial statements. For example, GAAP allows a company to use all three of inventory accountability methods, and if your business changes from LIFO (not accepted by the IFRS) to FIFO, it should be noted. Thus, all information that the company presents should be consistent.

3. Principle of Sincerity

The Principle of Sincerity means that an accountant or a financial team provides the financial information in an accurate and unbiased manner. Even though the business might be in an unfavorable financial situation, such a situation should be reported as it is.

4. Principle of Permanence of Methods

This principle focuses on financial statements prepared by the team and states that the same reporting methods should be used for all financial statements prepared. This will make it possible to effectively compare the financial statements for different periods.

5. Principle of Non-Compensation

This principle is very close to the Principle of Sincerity and states that a financial team or an accountant shouldn’t try to compensate a debt with an asset to make the financial performance look better. All the negative and positive values must be reported without changes.

6. Principle of Prudence

This principle means that all reported financial data should be based on facts and numbers. While the management of the company may speculate and try to forecast the future of the business, accountants should keep their feet on the ground and report the real, existing and not projected situation.

7. Principle of Continuity

When an accountant is valuing assets or compiling the report, they must assume that the business will continue to operate. So, the resources should be valued based on their original cost, not on their current value.

8. Principle of Periodicity

Under this principle, the accounting team must report the financial information related to a particular accounting period, which prevents tampering with numbers over different periods. If a company has uneven revenue over different quarters, it should be reported so, instead of trying to mask such differences.

9. Principle of Materiality

When reporting any financial information, accountants must fully disclose it. The financial team should get such information in detail from the company and report it.

10. Principle of Utmost Good Faith

The principle presupposes that all the parties dealing with the financial side of the business are honest and behave in an ethical way. It also means that financial responsibility should be taken seriously.

GAAP compliance: Accrual accounting and revenue recognition

Accrual accounting is the only accounting method compliant with GAAP. In a nutshell, this method recognizes revenue when it’s earned and expenses when they happen, not when cash is actually received or paid.

So as you can see, revenue recognition is an inseparable part of accrual accounting. It’s especially important for SaaS businesses dealing with subscription revenue recognition.

Here’s why this might be a little tricky. Let’s look at 3 cases:

Case 1: A company selling physical products

A company should recognize its revenue when the product that was sold is delivered to the customer. The customer in their turn receives the product and has to pay. Thus, the recognition process doesn’t depend on receiving the cash for the product.

Case 2: A company selling services

When selling services, the company recognizes the revenue when the service is performed, while it might be paid for later.

Case 3: A SaaS business selling software subscriptions

When it comes to SaaS companies selling software subscriptions with advance payments, the revenue should be recognized not on receiving the payment, but at the end of subscription period if the software performed its function. And the subscription payment is called deferred revenue or the revenue that hasn’t been earned yet.

How can Synder help with revenue recognition for subscriptions under GAAP?

Recognizing revenue correctly means complying with GAAP and it’s probably the most important thing when a company uses an accrual accounting method.

To help you with that, there’s nothing better than Synder RevRec, a revenue recognition tool for businesses with Stripe subscriptions. Synder RevRec guarantees GAAP compliance with complete support for IFRS 15 and ASC 606.

It works as an add-on on top of Synder Sync, recognizing Stripe subscriptions and syncing them to QuickBooks. Let’s see what important benefits Synder RevRec can provide.

1) Automated tracking of subscription changes

Synder will keep your recognition process accurate taking into account such things as upgrades, downgrades, cancellations, multiple products in one invoice or one-time products. All the subscription changes are automatically picked up from Stripe and recorded in QuickBooks Online. For example, if a user asks for a refund in the middle of the subscription, Synder automatically transfers these changes from Stripe and to QuickBooks.

2) Multicurrency support

GAAP states that you must recognize revenue in one currency. Multicurrency support based on Stripe’s conversion rates ensures that all the entries will be in home currency if you process payments in multiple currencies. And Synder RevRec will do exactly that for your subscription-based business.

3) Processing invoices with extended payment terms

Synder RevRec allows you to handle invoices with extended payment terms (Net 30, Net 60, etc.) so you can start recognizing revenue even if the payment comes later. Synder can sync and match invoices from Stripe, accurately identifying and recognizing them, which saves a lot of manual work.

4) Deferred revenue

Synder RevRec helps the businesses to recognise revenue according to GAAP when it’s earned. With multiple revenue recognition methods available, you can, for example, recognize equal portions of annual subscription revenue each month. A deferred revenue account on the balance sheet holds the invoices which are recognized as earned revenue in their profit and loss over time.

Here’s a video explaining Synder RevRec’s functionality:

https://youtu.be/AgzLYoacuYw

If you’re currently having troubles with your revenue recognition or starting your SaaS business and want to set things right from the start, go for a 15-day free trial to see how Synder can transform your accounting and schedule a discovery call to learn more about Synder RevRec to make an informed decision.

The future of GAAP

As all the standards change over time and the world becomes more and more globalized,we can spot some signs of the future unified accounting standards. There are a lot of talks on the topic of convergence between IFRS (International Financial Reporting Standards)and GAAP, including the potential future shift towards IFRS adoption in the USA, focusing on sustainable reporting and tech-driven solutions.

Although a unified set of accounting principles would eliminate many hurdles in the way of international businesses, it might also be a significant stretch for the accounting industry and professionals, who will have to adopt new rules and guidelines. Such changes don’t happen overnight and the future of GAAP and IFRS convergence remains to be seen.

Bottom line

While GAAP compliance is only required from publicly traded U.S. companies, complying with GAAP standards for any business is a good way to make their accounting transparent and reliable, which earns trust of potential investors. It’s clear that GAAP compliance demands some investment in accounting software and professionals, but such investments are sure to pay off in the near future

It’s especially true for SaaS companies that handle subscription-based services and have revenue recognition-related issues. They should rely on revenue recognition software to get a streamlined and GAAP compliant revenue recognition process.

%20(1).png)

Excellent article!

Thank you, David!