Navigating tax-related concerns can be a daunting experience for many. When the need arises, understanding how to reach a live person at the IRS can significantly ease the process. This article guides you on how to call the IRS representative and solve all your questions effectively.

Learn what happens when you report someone to the IRS.

How do I speak to a live person at the IRS?

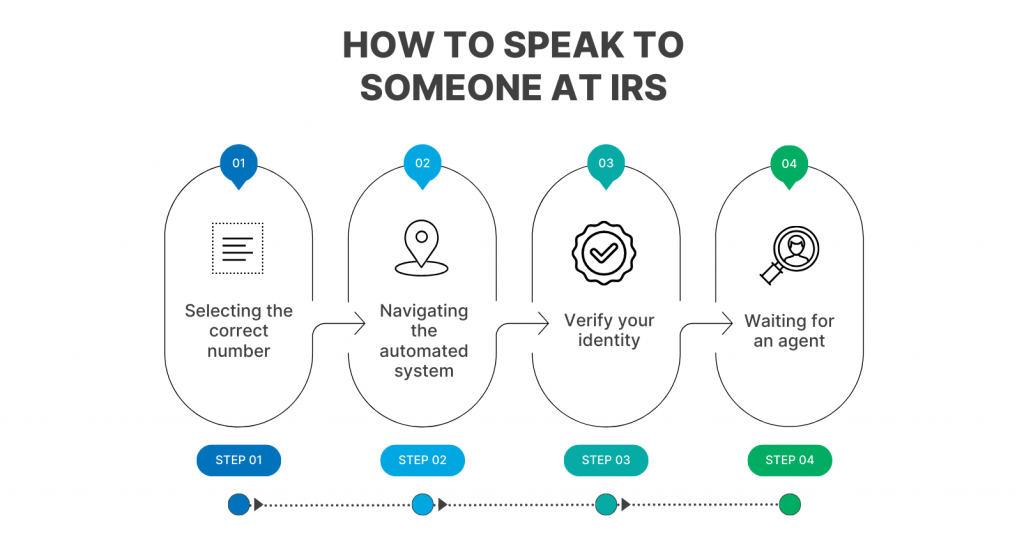

Talking to the IRS customer service can be difficult because there are a lot of calls, especially during tax time. However, here’s a step-by-step guide that may assist you in reaching an IRS representative:

Step 1: Selecting the correct number

The most known option is to call one of the IRS phone numbers.

- General inquiries: For individual tax questions, you can call 1-800-829-1040 7 AM – 7 PM ET Monday through Friday local time.

- Business inquiries: If you’re calling regarding a business, the number is 1-800-829-4933.

Other specialized numbers are available for specific issues and are listed on the IRS website.

Step 2: Navigating the automated system

Once connected, you will encounter an automated voice system. Listen carefully to all the options. Typically, selecting the option for “questions about your tax return” or “to discuss a personal tax issue” might lead you toward speaking with a live agent.

Learn how to file your income tax return.

Step 3: Verify your identity

Be ready to verify your identity. Depending on why you’re calling, you may have to give your SSN or EIN. Additional information may include your filing status, address, date of birth, or information from your tax return.

Step 4: Waiting for an agent

Be prepared for potentially long wait times, especially during peak tax seasons or close to filing deadlines.

Be prepared for a tax season by automating the sales recording from the sales channel and/or payment platform, eliminating manual data entry from the process. Learn how Synder Sync can help.

Tips for effective communication

Gather necessary documents

- Identification: Have your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) ready. If you’re calling about a business issue, have the Employer Identification Number (EIN).

- Tax returns: Have the tax return in question on hand. This could be the current year’s return or a previous year if that’s the topic of discussion.

- IRS notices/letters: If the IRS sent you any notices, letters, or other correspondence, have them available. Each notice usually has a specific number that helps the representative quickly identify the issue.

- Supporting documentation: Depending on your concern, gather relevant documents. For instance, if disputing a claimed discrepancy, have any supporting evidence like W-2s, 1099s, receipts, or other pertinent documents.

- Previous call information: If you’ve spoken with the IRS before about the same issue, note down the date of the call, the representative’s name or ID, and a summary of what was discussed.

Set aside ample time

IRS wait times can be lengthy, especially during peak tax season. Ensure you have a significant amount of uninterrupted time to wait and discuss your concerns.

Don’t hesitate to ask questions

If there are specific things you need clarification on, write down your questions beforehand to ensure you remember them during the call. If something is unclear during the call, ask for further explanation or examples. Before ending the call, make sure you understand the next steps and have no additional questions.

Be aware of the best time to call

Try calling early in the morning or late in the afternoon for potentially shorter wait times. Avoid Mondays, as they tend to be particularly busy.

Familiarize yourself with IRS procedures

Some knowledge about standard IRS protocols or your rights as a taxpayer can be beneficial. For instance, knowing about the Taxpayer Bill of Rights can help you understand your rights during disputes.

Have a backup plan

If you’re unable to get through or if the wait time is too long, know what alternative methods of contact are available. This could include the IRS’s online tools, local IRS offices, or even seeking external professional help.

Follow-up if necessary

If your issue isn’t resolved in a single call, or if you’re waiting for a callback, don’t hesitate to follow up after a reasonable time frame.

Consider professional help

If your issue is complex or if you’re feeling overwhelmed, it might be worthwhile to consult a tax professional or an attorney who can advocate on your behalf.

By being well-prepared for the call, you’ll increase the chances of a productive conversation and hopefully find a resolution to your issue more quickly. Remember, the IRS deals with millions of taxpayers, so clear communication and patience are essential.

Learn how to avoid getting tax audited by the IRS.

Conclusion

Navigating tax matters can often seem overwhelming, but understanding how to speak to someone at the IRS effectively is a crucial step in ensuring your concerns are addressed accurately and efficiently. Always approach interactions with preparation, clarity, and patience. Remember, while the IRS is a vast entity, at its core, it consists of individuals ready to assist and guide you. With the right tools and knowledge at your disposal, you can confidently handle any tax-related matter that comes your way.

Interested in learning more about accounting? Learn what an asset is.