If you use QuickBooks for your business accounting, you may need to merge accounts to streamline your financial records. This process consolidates duplicate entries, improving accuracy and efficiency. However, merging accounts requires careful preparation and adherence to best practices.

Today, we’ll discuss why merging accounts is important, how to prepare for it, and the steps to perform it effectively in QuickBooks.

Key takeaways

- Merging accounts in QuickBooks simplifies financial records by consolidating duplicates, saving time and reducing the risk of errors during data entry.

- QuickBooks allows merging of bank accounts and credit cards, but not income or expense accounts, ensuring transactional integrity and preventing inadvertent errors.

- The merging process involves careful steps, including selecting primary and secondary accounts, reviewing merging details, and conducting post-merge checks to ensure accuracy in financial reporting, though reversing the merge isn’t directly supported in QuickBooks, so users should back up their data and communicate changes with stakeholders beforehand.

Why would you want to merge accounts in QuickBooks?

First of all, why merging accounts in QuickBooks?

In fact, merging accounts in QuickBooks offers several benefits, allowing you to streamline your financial records and enhanceyour financce management efficiency.

One primary advantage is the ability to consolidate duplicate or redundant accounts, providing a clearer and more concise overview of your financial data. This simplification not only saves time during data entry but also minimizes the risk of errors associated with managing multiple accounts.

Moreover, merging accounts in QuickBooks allows for improved financial reporting accuracy. Which is quite logical, as eliminating duplications by merging accounts contribute to more precise and meaningful financial statements. This enhanced clarity facilitates better decision-making processes for business owners and financial professionals. In essence, the consolidation feature in QuickBooks proves to be a valuable tool in maintaining a well-organized and accurate financial ecosystem.

Level up your QuickBooks experience with smart automation! Integrate financial data from all your sales channels in QuickBooks to have always accurate records ready for reporting, analysis, and taxation. See it in action with a 15-day free trial or spare a spot at our weekly public demo to have your questions answered.

What types of accounts can be merged in QuickBooks?

Generally, QuickBooks allows the merging of accounts such as bank accounts, credit cards, and other balance sheet items. However, it’s important to note that income and expense accounts, as well as accounts connected to online banking, cannot be merged. This limitation ensures the integrity of transactional data and prevents inadvertent errors that could arise from consolidating certain types of accounts.

When contemplating merging accounts, users should conduct a thorough review of their Chart of Accounts to identify eligible candidates for consolidation. This proactive approach ensures a smooth merging process and mitigates the risk of attempting to merge incompatible accounts within the QuickBooks platform.

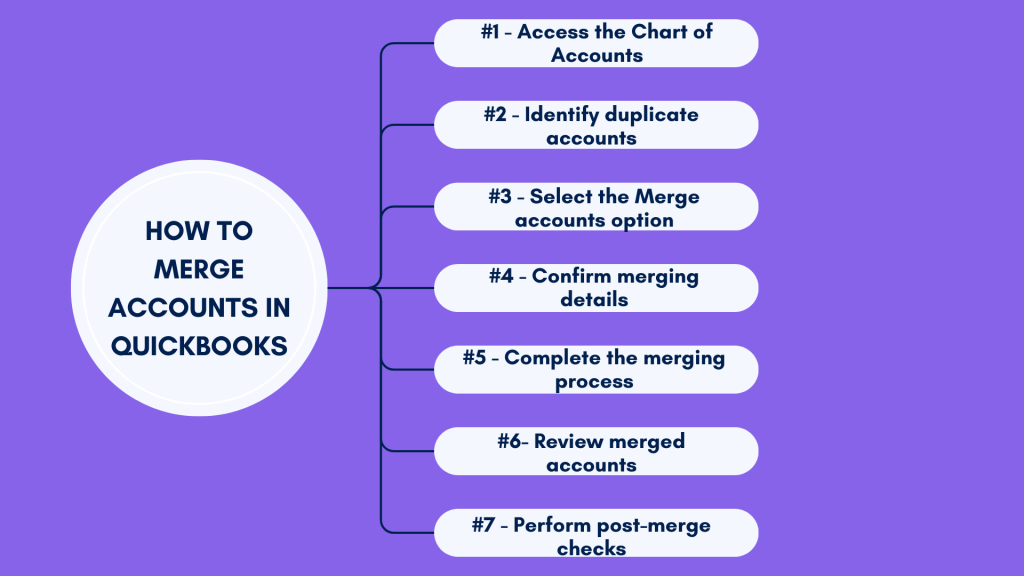

How to merge accounts within QuickBooks step-by-step?

Merging accounts in QuickBooks follows a straightforward process, but it’s essential to proceed with caution to avoid unintended consequences. Here’s a step-by-step guide to merging accounts within the QuickBooks platform:

Step#1 – Access the Chart of Accounts

Begin by navigating to the Chart of Accounts section in QuickBooks. This feature is typically located within the company settings or the accounting menu.

Step#2 – Identify duplicate accounts

Review the list of accounts to identify any duplicate or redundant entries that you intend to merge. It’s crucial to verify account details and ensure accuracy before proceeding with the merging process.

Step#3 – Select the Merge accounts option

Once you’ve identified the accounts for merging, select the option to merge accounts. QuickBooks will prompt you to choose the primary account (the one you want to keep) and the secondary account (the one you want to merge into the primary).

Step#4 – Confirm merging details

Review the merging details carefully to ensure accuracy. QuickBooks will display information regarding the impact of merging accounts on transactions and financial reports.

Step#5 – Complete the merging process

After confirming the merging details, proceed to complete the merging process. QuickBooks will consolidate the selected accounts, transferring transactions and balances from the secondary account to the primary account.

Step#6- Review merged accounts

Once the merging process is complete, review the Chart of Accounts to verify that the accounts have been successfully merged. It’s advisable to check transaction histories and balances to ensure data integrity.

Step#7 – Perform post-merge checks

After merging accounts, conduct post-merge checks to ensure that financial reports and records accurately reflect the consolidation. Additionally, review any affected transactions to confirm that data remains consistent and error-free.

How does merging accounts impact financial reporting and data accuracy in QuickBooks?

As mentioned above, merging accounts in QuickBooks can significantly impact financial reporting and data accuracy. Let’s, now break it down a bit.

- Simplification of financial statements

One primary impact of merging accounts is the simplification of financial statements. Merged accounts eliminate redundancies, providing a clearer picture of the company’s financial health. This enhanced clarity enables stakeholders to make informed decisions based on accurate and reliable financial information.

- Maintaining data consistency

Merging accounts helps maintain data consistency across various reports and analyses. By centralizing related transactions and balances, QuickBooks users can generate comprehensive financial reports without the confusion or discrepancies associated with duplicate accounts.

However, it’s worth noting that merging accounts can also have implications for historical data and comparative analysis. Users should carefully consider the potential impact on prior period reports and ensure that historical information remains accessible and accurate following the merging process.

Can merged accounts be unmerged or reversed in QuickBooks?

One common concern when merging accounts in QuickBooks is whether the process is reversible. It’s crucial to understand that, as of the current software version, QuickBooks does not provide a direct ‘unmerge’ feature. Therefore, users should exercise caution and carefully review account details before initiating the merging process. In the absence of a dedicated undo function, users may need to manually recreate accounts or restore from a backup if they wish to reverse the merging action.

To minimize the impact of irreversible merging, it is advisable to create a backup of the company file before making any significant changes. This precautionary measure ensures that users can restore their data to a previous state in the event of unexpected issues or the need to undo a merged account.

Considerations to keep in mind before merging accounts in QuickBooks?

So, merging accounts in QuickBooks, as mentioned, needs some preparatory work to ensure a smooth transition and minimize potential risks. Here are some key considerations:

Backup company data

Prior to merging accounts, ensure a backup of your QuickBooks company file is made, utilizing formats such as QBM files. This precautionary measure serves as a safeguard in case of unexpected issues or the need to revert to a previous state.

Review transaction history

Carefully review the transaction history of both the primary and secondary accounts slated for merging. Ensure that all transactions are accurately recorded and categorized to avoid discrepancies or data loss during the merging process.

Evaluate impact on reports

Assess the impact of merging accounts on existing financial reports and statements. Consider how the consolidation will affect balance sheets, income statements, and other financial analyses. It’s important to anticipate any potential discrepancies or changes in reporting metrics following the merging action.

Communicate with stakeholders

If applicable, communicate with relevant stakeholders, such as accounting teams or financial advisors, regarding the decision to merge accounts. Ensure that all parties are informed about the rationale behind the merging action and any anticipated changes in financial reporting procedures.

Consider tax implications

Take into account any potential tax implications associated with merging accounts, especially if the consolidation involves accounts with different tax treatment or reporting requirements. Consult with tax professionals or advisors to understand the tax consequences and ensure compliance with relevant regulations.

Document merging process

Document the merging process, including the accounts involved, merging criteria, and any adjustments made to transaction records. Maintaining comprehensive documentation facilitates transparency and auditability, helping to resolve any potential discrepancies or inquiries in the future.

Bottom line

As you can see, effective financial management in QuickBooks, particularly when utilizing features like QuickBooks multicurrency, often relies on organizing and consolidating accounting data. Utilizing QuickBooks’ merging feature allows users to update their Chart of Accounts, reducing redundancies and improving the accuracy of financial reporting.

However, the merging process requires careful consideration and preparation, underscoring the need to navigate through QuickBooks problems. From backing up data to assessing historical records, users must exercise diligence to ensure a smooth transition.

Several best practices and transparent communication can help users go through the accounts merging process smoothly, maximize QuickBooks’ merging feature, and foster greater financial transparency and efficiency within their organizations.

Continue reading: What to do if QuickBooks migration failed unexpectedly?

Share your thoughts

Have you ever had to merge accounts in QuickBooks? Please share your experience with the community! We’d love to read your comments.