Accurate books aren’t just about what’s happening today. They depend on the full picture, including your past transactions. Without that history, it’s harder to track progress, stay compliant, or make smart decisions. Your reports are only as reliable as your data.

So if you need to import historical Stripe transactions into QuickBooks Online, there’s good news—you absolutely can, and it’s way easier than you might think. With Synder, you can backdate and sync your historical data seamlessly, keeping your books clean and your reports on point.

Here’s how to do it, step by step.

Importing historical Stripe transactions into QuickBooks Online with Synder

Moving to a new system? Rushing to catch up before tax season? Or just patching up some holes in your records? Getting your historical Stripe data into QuickBooks using Synder is way easier than you think.

1. Start with a connection

First things first: you’ll set up Synder to connect Stripe and QuickBooks Online. Just create your Synder account (you get a 15-day free trial to start!), then link up both platforms. That’s the step that lets Synder grab all the data and make it usable in your accounting system.

2. Tell Synder how far back to go

During setup, Synder will offer to import your historical transactions. Make sure to accept! You can choose the precise time frame, whether it’s the last 30 days or even several years. That way, none of your data gets missed, and you’ll easily see where everything stands.

3. Customize the sync to fit your books

And here’s where Synder stands out. You’re not stuck with a rigid, “one-size-fits-all” integration. You have total control over how your historical data lands in QuickBooks.

It’s totally up to you to:

- Sync specific transaction types (charges, refunds, fees)

- Map sales, taxes, and payouts to the exact accounts you want

- Automate categorization using Smart Rules (like tagging transactions by customer or product)

We designed it to fit your business, not the other way around.

4. See before you sync

Hate surprises in your financial statements? Synder’s got you covered. You can actually preview how your Stripe transactions will appear in QuickBooks before they’re officially recorded. This lets you confirm your mappings, adjust your rules, and feel good about everything being spot-on.

5. Hit sync and let Synder do the work

Once you’ve got everything dialed in, just hit import. Synder will pull all that historical Stripe data you picked right into QuickBooks, keeping every single detail perfectly intact: customer names, taxes, fees, and net amounts.

When the sync is done, you can check out your financials in QuickBooks—profit & loss, balance sheet, all the important things—knowing they tell the whole story. You might want to tweak a few things, but the hard part’s over.

From there, turning on real-time sync is just a click away. Synder will then keep your Stripe and QuickBooks accounts in sync automatically, so you’ll always be up-to-date and never have to play catch-up again.

Want to see what else Synder can do for your business? Book a demo and learn straight from a product specialist.

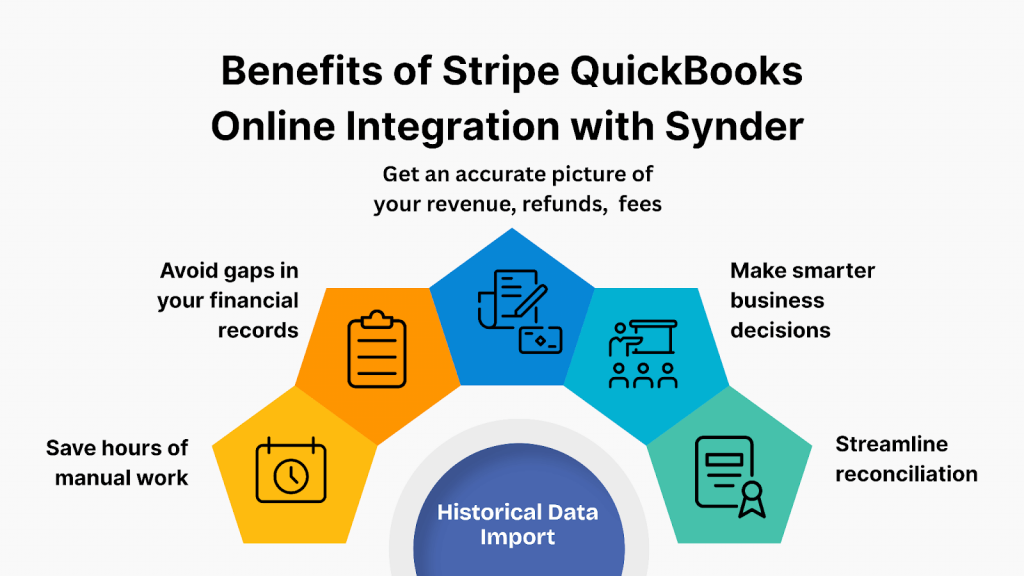

Why automating Stripe QuickBooks integration for past data matters

Nobody wants to manually type in historical transactions – it’s slow and prone to errors. Instead, automating your Stripe QuickBooks Online integration with Synder helps you:

- Save hours of manual work by importing historical Stripe transactions in just a few clicks

- Avoid gaps in your financial records that can throw off reports or lead to compliance issues

- Get an accurate picture of your revenue, refunds, and processing fees, not just your net payouts

- Make smarter business decisions with clean, complete, and categorized data

- Streamline reconciliation by matching Stripe transactions to bank deposits automatically

So, syncing your historical Stripe data into QuickBooks Online using Synder means your books stay clean, your reports are spot-on, and your work life gets a lot less stressful.

FAQ

Will importing historical data affect my current QuickBooks Online records?

Here’s a slightly more professional but still human-sounding option:

No, importing historical data with Synder won’t impact your existing QuickBooks Online records. It’s designed to prevent duplicating or altering current transactions, and you’ll have the opportunity to preview everything before syncing. This ensures your books remain accurate and entirely within your control.

Can I import transactions older than 30 days from Stripe into QuickBooks Online?

Yes, you absolutely can. Synder lets you pick your own date range, so you’re not stuck with just 30 days. Feel free to import Stripe transactions from months, or even years, back. As long as that data is still in your Stripe account, you’re good to go.

Are there any limitations to the amount of historical data I can import?

There are no hard limits from Synder here, and Stripe usually lets you access up to 7 years of data. Just remember that really large imports can take a bit longer, and if you go over your plan’s sync limit, there might be an extra charge.

Do I need to manually categorize each imported transaction?

No, you don’t have to manually categorize anything. Synder’s Smart Rules feature lets you automate all that based on your own conditions: customer, product, or even payment method. This saves you a lot of time and keeps everything consistent across your imported transactions.