Since PayPal is a well-known, reliable, and accessible payment method, more and more customers prefer it for online shopping. Setting up a PayPal Business account is a smart move for any business owner to meet this growing demand.

With PayPal’s global presence in over 200 markets, creating a PayPal Business account not only meets customer expectations but also expands your reach to international buyers. But how do you set it up, and what benefits will you gain? Let’s figure it out together!

Key takeaways:

- PayPal offers two types of accounts: Personal and Business, which cannot be created using the same email address.

- While opening a PayPal Business account costs nothing, transaction fees still apply depending on the payment type.

- Consider how you’ll manage finances, especially with a new business account. It’s best to use automation tools like Synder.

Contents

What’s the difference between a PayPal Business account and a Personal account?

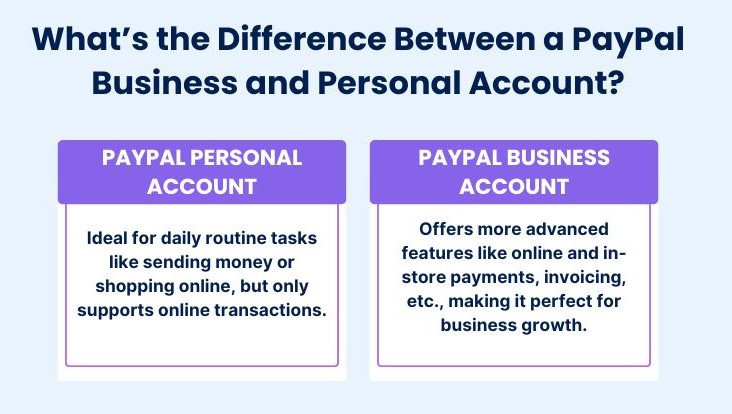

PayPal offers two account options: Personal and Business. Both let you send and receive payments, but each is designed for different needs and comes with its unique features and benefits:

As a seller, you’ll likely benefit more from the Business option, but it’s also helpful to know your clients’ perspective. So let’s explore the differences between these two types of PayPal accounts in more detail.

PayPal Personal account

A Personal account is perfect for everyday needs like sending money, shopping online, or splitting payments. If you’re a freelancer, casual seller, or just sending money to friends and family, the Personal account may work for you. It’s simple but has some limitations for business use.

If you choose a Personal account, your name (not your business name) will appear on all transactions. Also, this account is for online payments only — no in-person options.

PayPal Business account

A Business account is packed with features to help your business grow, like sending invoices that link to your accounting software or the PayPal platform. It’d be ideal for online business owners and sellers who operate on marketplaces.

With a Business account, you can accept both online and in-store payments, and even set up subscription services. It also offers transaction management, label printing, order tracking, 24/7 support, and PayPal Credit. You’re covered by the PayPal Seller Protection Program to help prevent fraud and chargebacks as well. A Business account is more suitable for sellers’ needs, so if you want to create one, let’s explore the setup process.

If you want to know more about the differences between PayPal Personal and Business accounts read our article “How Does PayPal Work? Guide to Business and Personal PayPal Accounts and their features”.

How to set up a PayPal Business account

Setting up a PayPal Business account is easy, but be sure to pay attention to every detail as you’re filling out the fields. Here’s the step-by-step breakdown of the process to see how the account creation unfolds:

Step 1: Visit the PayPal website

- Go to the PayPal website;

- Find the Sign Up button in the top right corner and click on it;

- Choose Business Account;

- Click Next.

Step 2: Enter your email address

- Enter your active email address;

- Click Next.

| Note: Use an email address that’s not linked to a PayPal Personal account. If you use one that’s already linked, that account will be closed. |

PayPal will send a confirmation email to the address you provided. Open this email and click on the link to confirm your email address. This step verifies that you have access to the email address you provided.

Step 3: Add your business information

You’ll now need to provide information about your business. This includes:

- Legal business name;

- Business phone number;

- Business address;

- Your business website (if you have one);

- The products or services you offer;

- Your estimated monthly sales.

Step 4: Fulfill your personal information

Now, you’ll need to provide personal information, including:

- Your legal first and last name;

- Your home address;

- Your date of birth;

- Your Social Security Number (for U.S. users).

This information is necessary for PayPal’s security checks and verifying your identity.

Step 5: Agree to terms and conditions

- Read the PayPal User Agreement, Privacy Policy, and Electronic Communications Delivery Policy;

- Click Agree and Create Account.

Bonus step: Set up the payment method

You’ve created your account, but to start using it in full, you need to enter your bank account details. Just follow the prompts in the email, log into PayPal, and add your bank information.

If you don’t have a business bank account, don’t worry — you can use your personal one, but it’s better to create a separate business bank account to avoid mixing up your finances. Simply provide your bank’s name, account number, and routing number to wrap up this step. PayPal will verify your bank by making two small deposits into your account. This usually takes 3-5 days, so keep an eye on your bank account for these deposits.

| Note: PayPal’s requirements can differ by country, so be sure to check what’s needed for your location before setting up your Business account. |

What’s next?

Now that you know how to set up your PayPal Business account, you’re off to a great start — but this is just the beginning of your journey. Keeping your account information up to date is important for smooth operations. Whenever your business details change, simply go to the Profile section in your PayPal account to make those updates.

Opening a PayPal Business account is free, but once transactions start flowing, fees that PayPal charges for Business account owners come into play. These fees can impact your bottom line, and knowing them ahead of time can help you plan better. So, that’s exactly what we’ll share with you next.

What are the PayPal Business account fees?

PayPal’s fee system, though extensive, is well-structured, with fees depending on the type of transaction. Here’s a quick look:

| Payment type: | PayPal fee for domestic transactions: | PayPal fee for international transactions: |

| PayPal checkout | 3.49% + $0.49 (fixed fee) | + 1.50% (additional percentage-based fee) |

| QR code transactions | 2.29% + $0.09 | + 1.50% (additional percentage-based fee) |

| QR code transactions through third-party integrator | 2.29% + $0.09 | + 1.50% (additional percentage-based fee) |

| Pay with Venmo | 3.49% + $0.49 (fixed fee) | + 1.50% (additional percentage-based fee) |

| Send/receive money for goods and services | 2.99% | + 1.50% (additional percentage-based fee) |

| Standard debit and credit card payments | 2.99% + $0.49 (fixed fee) | + 1.50% (additional percentage-based fee) |

| All other commercial transactions | 3.49% + $0.49 (fixed fee) | + 1.50% (additional percentage-based fee) |

Want to see the full list of PayPal seller fees? Read our guide to PayPal fees and fee tracking.

However, fees are just the beginning of the challenges you’ll face as a business owner. You’ll also need to tackle transaction recording, tax management, and reconciliation — all of which can be overwhelming if done manually. So, is there any way to streamline your financial tracking process?

The answer is simple — automate it.

Managing PayPal accounting with Synder

As a business owner, you’re likely juggling a lot of tasks, and accounting can be a real hassle if not handled well. If PayPal is one of your payment methods, tracking transaction fees in software like QuickBooks, Xero, or Sage Intacct can be tricky.

PayPal deducts fees automatically, and if those aren’t properly recorded, your sales won’t match your bank payouts. This leads to discrepancies and frustration during reconciliation. That’s where Synder Sync steps in to make things easier.

Just imagine — no more manual tracking or mistakes. With Synder’s PayPal QuickBooks Online integration, all your PayPal fees are automatically categorized and recorded, keeping your books perfectly in sync.

With Synder, you’ll be able to automatically sync transaction data from PayPal and an additional 30+ platforms, which include sales channels and other payment platforms, without duplicates. But that’s just the beginning. Synder also offers:

- Flawless bank reconciliation;

- Historical data import of PayPal transactions;

- Smooth multicurrency transactions;

- Accurate P&L and Balance Sheet reports;

- 24/7 support.

Learn even more about Synder’s features at our Weekly Public Demo or test it yourself with a 15-day free trial.

Wondering what else you need to know about PayPal? Let’s dive into its benefits!

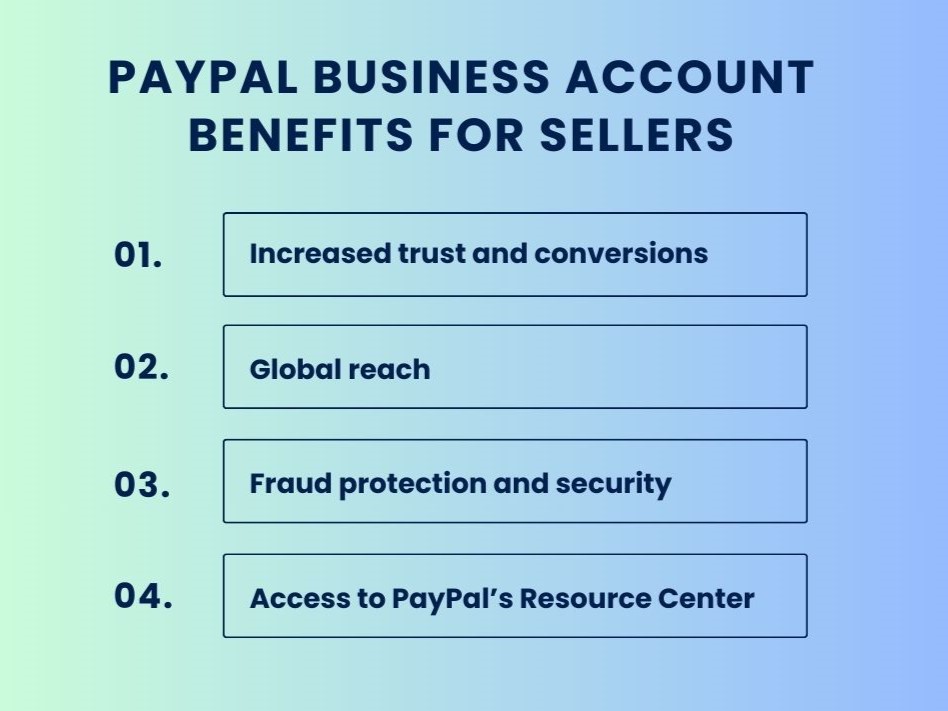

PayPal Business account benefits for sellers

Here are some compelling benefits of using a PayPal Business account highlighting its effectiveness for businesses:

Increased trust and conversions

PayPal is trusted by millions globally, and research shows that 74% of PayPal users are more likely to complete a purchase when PayPal is available at checkout. This can significantly boost your conversion rates, especially if you’re a small business looking to build trust with customers.

Global reach

Since PayPal is a globally recognized payment platform trusted by millions of users, your customers are likely to trust it too. With over 36 million merchants using PayPal in more than 165 countries, you can confidently rely on its reputation — and it even enhances yours. With PayPal, you can accept payments in 25 currencies across 200+ markets.

Fraud protection and security

On average, companies deal with about 679 fraud-related chargebacks monthly, which PayPal helps manage. PayPal offers strong fraud protection with 24/7 monitoring, encryption, and purchase protection to keep transactions secure. Businesses using PayPal report fewer issues with common online fraud, such as chargebacks and phishing.

Access to PayPal’s Resource Center

Beyond its payment services, PayPal offers a Resource Center packed with helpful tools and information for businesses to help you optimize your operations.

The Resource Center includes:

- Educational content: Insights into PayPal features and processes.

- Tools and best practices: Tips to help run your business more efficiently.

- Updates and news: Information on the latest trends and features.

- Industry insights: Knowledge base about your sector.

- Customer support: Solutions to common issues.

- Webinars and events: Expert-led learning and updates on best practices.

By leveraging these resources, business owners can better understand PayPal’s offerings, stay informed on industry trends, and enhance their overall operations.

Closing thoughts

Growing your business means seizing every opportunity, and creating a PayPal Business account is one of them. Not only can you reach more customers, but you’ll also boost your credibility by offering PayPal as a payment option. With this payment gateway, you can accept payments faster and manage everything from one simple dashboard.

Even more, it integrates with your existing sales channels, helping you create a smooth, engaging customer experience. Sure, there are fees, but the benefits far outweigh the hassle. And automation tools like Synder can help you handle most of your PayPal accounting tasks. So, why wait?

If you feel like PayPal isn’t the best fit for your needs, check out our list of the best PayPal alternatives to find your perfect solution.

help me to close my business paypal account

Hi Elize, to get more information on closing a PayPal account, you can read our guide Remember, once you close your PayPal business account, you won’t be able to reopen it or access any transaction history. So, make sure to download or save any necessary information before closing the account. If you encounter any issues or need further assistance, we recommend contacting PayPal’s customer support directly. They can provide specific guidance based on your account’s status and assist with any complications during the closure process. Best of luck!

Thanks for the article! This PayPal account management guide will be useful for my own UK accountants business, Nacstaccs.

We are happy that this article was useful to you, David! Thanks for your comment!