Growth targets, subscription models, customer retention, and product innovation while navigating through a sea of complex financial data—welcome to the SaaS world. All important, but accounting doesn’t seem exciting. Many SaaS leaders overlook its true power, dismissing it as mere number-crunching.

But what if we told you that smart accounting is more than that—it’s about turning numbers into smarter, faster decisions? In this guide, we’ll break down the must-know principles of SaaS accounting, tackle the common pain points, and explore how automation can transform your financial workflows.

Key takeaways:

- SaaS accounting focuses on recognizing revenue over time, not when the cash comes in.

- Following standards like ASC 606 is essential in SaaS accounting, as they define the entire process.

- Most SaaS companies target gross margins of 75–90%.

- The best way to overcome SaaS accounting challenges is by using specialized automation tools like Synder RevRec.

The basics: Why SaaS accounting isn’t just bookkeeping

Unfortunately, SaaS accounting isn’t just bookkeeping with a fancy title. A subscription-based business brings its own set of brain-twisting challenges that basic bookkeeping simply can’t handle. From tracking subscription changes to managing deferred income, SaaS accounting requires precision, compliance, and forward-thinking strategies.

Unlike basic bookkeeping, which records transactions as they happen, SaaS accounting focuses on recognizing revenue over time.

Quick example: A customer pays upfront for a year-long subscription. In a traditional setup, you’d recognize the payment as revenue immediately. But in SaaS accounting, that revenue gets carefully distributed month by month, reflecting the value you deliver over time.

What other revenue recognition challenges does the SaaS model entail?

- Deferred revenue is a constant reality, acting as a recurring liability until earned.

- Subscription billing dominates, with frequent mid-cycle changes like upgrades, cancellations, or downgrades.

- Tax regulations are complex—handling sales tax, VAT, and international rules adds extra layers of work.

- Multi-year contracts require precision, with transaction prices allocated to specific performance obligations.

As the foundation is set, the next step is to determine the best approach for managing it.

Accounting method for SaaS

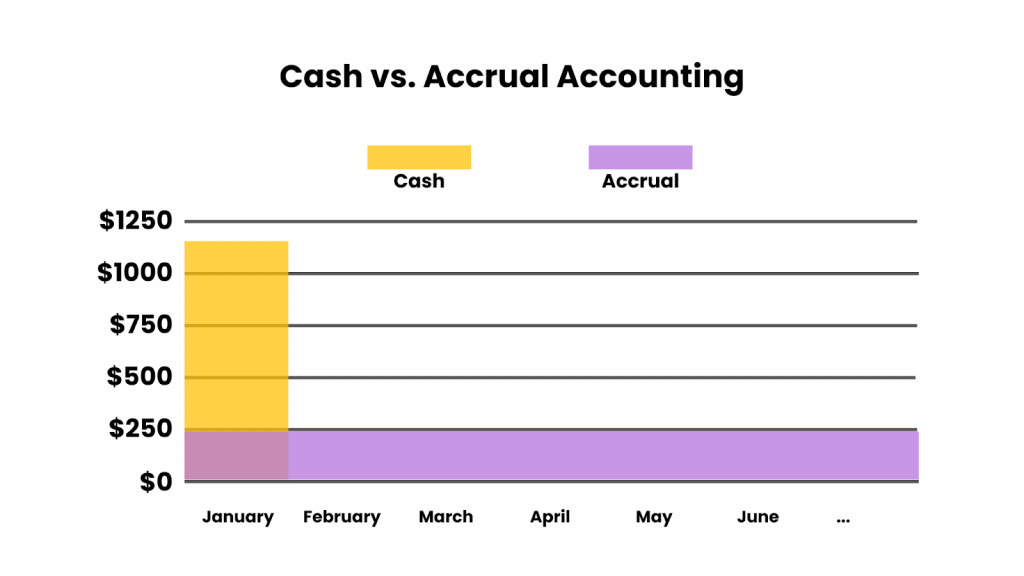

Under GAAP, SaaS companies must use accrual accounting when recognizing revenue. Unlike cash-basis accounting (aka the “money in, money out” approach), it provides a clear and accurate financial picture by recognizing revenue and expenses when they are earned or incurred, not when cash changes hands.

Just what a subscription-based SaaS business needs.

Accrual accounting shows the revenue you’re earning over time, reflecting the true value of your recurring business model. It also helps you manage deferred revenue seamlessly, keeping you in line with the ASC 606 standard.

The purpose of accounting standards

Put simply, the purpose of accounting standards is to ensure consistency, transparency, and compliance in financial reporting. Ignore this, and you’re practically begging for an audit showdown.

- GAAP states that revenue must be recognized when the obligations are fulfilled.

- Standards like ASC 606 and IFRS 15 set the rules for revenue recording.

- Accurate and compliant financial records are essential for those businesses seeking funding, entering IPOs, or undergoing mergers and acquisitions.

- Standards ensure correct expense classification like R&D, marketing, and COGS, which are important for understanding profitability.

However, understanding these standards is only half the battle—the real challenge lies in applying them to the revenue recognition process.

Revenue recognition explained

For SaaS, accrual accounting dictates when and how revenue gets recorded in your books, and for subscription-based models, it’s a challenge you can’t afford to fumble. Nail it, and your financial reports stay accurate, compliant, and investor-ready. Mess it up, and you’re looking at compliance headaches and audit nightmares.

As the main principle, revenue recognition ensures you don’t jump the gun by counting revenue as soon as you receive cash. Instead, revenue is recognized incrementally as you fulfill your service obligations. For instance, if a customer pays $1,200 upfront for a 12-month subscription, you can only recognize $100 of revenue each month.

And those advance payments? They’re not a jackpot—they’re a liability (yes, really). Until you deliver the goods or services, that cash sits on your balance sheet as deferred revenue, waiting to graduate to the income statement.

| Accounting automation software focused on SaaS businesses provides solutions that cover major (if not all) peculiarities of such a business model. Take Synder RevRec, for example. It tackles the quirks of the SaaS model head-on, recording revenue in line with ASC 606 standards and ensuring a GAAP-compliant sync with QuickBooks Online. In simple words, your revenue tracking stays precise, compliant, and stress-free. |

Now that we’ve covered the foundation of SaaS accounting, let’s look at the challenges SaaS businesses face and how to tackle them effectively.

The major challenges of SaaS accounting

#1. Deferred revenue

Deferred revenue is the sneaky little liability that sits on your balance sheet, waiting for its big moment. It’s the cash you’ve collected for services you haven’t delivered yet—a promise you have to keep. And it’s not just a technicality: mismanaging deferred revenue can lead to compliance headaches, audit risks, and distorted financial statements.

Tips:

- Use accounting software with automated revenue recognition to track deferred revenue accurately over the subscription period.

- Conduct regular audits to ensure that deferred revenue balances match the services delivered.

- Clearly define contract terms with customers to specify the service delivery timeline, reducing ambiguity in revenue allocation.

How accounting software can help

Accounting software automates the process of tracking and recognizing deferred revenue, ensuring standards compliance.

As an example, Synder RevRec automatically records invoice amounts as deferred revenue on your balance sheet. At the end of each month, it shifts the right portion to income, which keeps your P&L statement fresh and accurate, showing exactly how your revenue aligns with the services you’ve delivered.

#2. Multi-currency transactions

Fluctuating exchange rates, multi-currency invoicing, and diverse tax regulations add layers of complexity. If you’re not careful, all this complexity can turn your financial reporting into a bunch of errors that are hard to fix and slash your profitability.

Tips:

- Implement accounting tools that support multi-currency transactions with real-time exchange rate updates and currency conversion capabilities.

- Use hedging strategies to mitigate the financial risks associated with currency fluctuations.

- Stay updated on local tax regulations to ensure compliance across all regions where you operate, and consider consulting with international tax experts.

How accounting software can help

Accounting software like Synder is built to simplify the chaos. It supports multi-currency functionality, automatically converting transactions into your base currency with real-time exchange rates. This means smoother billing, error-free reporting, and fewer headaches when managing international operations.

#3. Billing and collections

With varied pricing models, mid-cycle changes (hello, upgrades and downgrades), and customers who conveniently “forget” to pay, it’s easy for the whole system to spiral out of control. Left unchecked, these inefficiencies can drain your revenue and test your customer relationships.

Tips:

- Invest in a comprehensive billing platform that automates invoicing and collections, supports multiple pricing structures, and integrates seamlessly with accounting software.

- Set up automated reminders for upcoming or overdue payments to ensure customers stay informed.

- Regularly review billing workflows to identify inefficiencies and improve collection rates.

How accounting software can help

Accounting software streamlines recurring billing cycles by automating invoice generation, payment reminders, and collections. Advanced systems like Synder RevRec even handle the tricky stuff, like upgrades, downgrades, and refunds, all without throwing your financials off balance.

#4. Expense tracking

Accurately tracking expenses, especially those related to customer acquisition and service delivery, is vital for proper business management and growth. Misclassification or overlooked expenses can distort financial insights.

Tips:

- Utilize integrated accounting software that offers real-time expense tracking and categorization.

- Ensure visibility into spending patterns, aiding in budgeting and financial planning.

- Regular expense audits can further ensure accuracy and compliance.

How accounting software can help

Integrated expense tracking features allow accounting software to categorize and record expenses in real time. Tools like Synder can automatically sync expenses from connected accounts and payment gateways. This visibility into spending helps SaaS businesses monitor customer acquisition, infrastructure, etc.

#5. SaaS taxation

SaaS taxation is where things get truly wild. With the sales tax, VAT, and international tax laws that vary by region, it’s a complex puzzle. One wrong move, and you’re staring down fines, penalties, or a serious hit to your reputation.

Tips:

- Use tax compliance software to automate calculations and ensure accurate reporting across all regions where you operate.

- Stay updated on regional tax laws by subscribing to updates from authoritative sources or working with local tax consultants.

- Structure contracts with clear tax implications and ensure tax liabilities are accurately reflected in customer invoices.

How accounting software can help

Most accounting software with tax automation features takes the hassle out of compliance, calculating sales tax, VAT, or GST for transactions across regions without missing a beat. Synder can go the extra mile, automatically handling tax-inclusive and tax-exclusive pricing, breaking out taxes from revenue, and managing custom rules to exclude tax line items from revenue recognition.

Synder RevRec as a solution: The one tool to rule them all

As you can see from the points above, Synder RevRec takes the heat off by automating a massive chunk of those routines but still important for accounting process tasks. This SaaS software simplifies the workflow for both business owners and accountants in practice working with such businesses.

The RevRec module keeps you on the straight and narrow with GAAP standards, IFRS 15, and ASC 606 compliance—tailor-made for the complex world of SaaS. From automating the tracking of subscription changes to mastering tricky billing scenarios and nailing revenue recognition timing, Synder RevRec has everything covered.

Trade stress for peace of mind, knowing your revenue recognition is in perfect order. Curious to see it in action? Join our Weekly Public Demo sessions for a closer look, or check it yourself with a 15-day free trial.

Bonus: Must-know accounting metrics for SaaS businesses

You can’t steer the ship if you’re sailing blind. Otherwise, you’ll be drifting, which sounds chill… until you realize you’re heading straight for an iceberg.

And that’s basically the whole concept of SaaS metrics, which can provide you with a deeper understanding of business performance. They reveal how customers interact with your business and, most importantly, the value they’re bringing to the table.

So, here are the top 6 SaaS metrics to keep in mind when running your business:

- Monthly recurring revenue (MRR);

- Annual recurring revenue (ARR);

- Customer acquisition cost (CAC);

- Customer lifetime value (CLV);

- Churn rate;

- Gross margin.

1. Monthly recurring revenue (MRR)

MRR is the monthly pulse of your business, showing predictable revenue from subscriptions. It’s your go-to metric for tracking growth and forecasting income. A steady climb means you’re scaling, while dips can reveal churn or retention issues that need fixing.

Why it’s important:

- Tracking MRR over time shows how the business is scaling and whether revenue is growing consistently.

- Investors prioritize MRR because it reflects the stability and scalability of the SaaS business model.

- Changes in MRR highlight customer behavior trends, such as increased usage (expansion) or dissatisfaction (churn).

2. Annual recurring revenue (ARR)

If MRR is your business’s heartbeat, ARR is its big-picture roadmap. It represents the predictable, recurring revenue you’ll generate over a year, offering a clear, long-term perspective on your revenue base and growth trajectory.

Why it’s important:

- ARR shows the predictable revenue that a SaaS business can expect over the next year, helping with long-term financial planning and resource allocation.

- ARR allows businesses to compare their growth rates and performance against industry standards, identifying opportunities for improvement.

- ARR segments (e.g., New ARR vs. Churned ARR) provide insights into customer satisfaction and the effectiveness of retention strategies.

3. Customer acquisition cost (CAC)

CAC measures the cost of acquiring a new customer. From sales pitches to marketing campaigns, it’s all the effort (and dollars) it takes to make someone swipe right on your product, divided by the number of customers who actually say “yes.”

Why it’s important:

- CAC is a key factor in determining the viability of a SaaS business model. If CAC is too high compared to revenue, the business may struggle to achieve profitability.

- A sustainable CAC ensures that acquiring more customers leads to growth without excessive financial strain.

- CAC, combined with metrics like Customer Lifetime Value (LTV), helps determine whether the cost of acquiring a customer is justified by the revenue they generate.

4. Customer lifetime value (CLV)

CLV is the grand finale of your customer relationships—the total revenue you can expect from a customer over their entire time with you. It helps assess the value of acquiring and retaining customers, providing insight into profitability and long-term growth.

Why it’s important:

- CLV determines whether the revenue generated by a customer outweighs the cost of acquiring and serving them.

- Understanding CLV can guide pricing models, subscription tiers, and upselling opportunities to maximize revenue.

- A healthy CLV:CAC ratio is typically 3:1—every dollar spent acquiring a customer should bring in three.

5. Churn rate

The churn rate shows the percentage of customers (or revenue) that say goodbye over a specific period. Whether they cancel their subscription or ghost your service, churn tells you how well your product is sticking and how stable your business really is.

SaaS companies typically experience an average annual churn rate of 5–7%.

Why it’s important:

- Churn directly affects MRR and ARR.

- Retaining existing customers is more cost-effective than acquiring new ones. A high churn rate increases the cost of maintaining revenue.

- Churn impacts revenue projections, CLV, and budgeting for sales and marketing efforts.

6. Gross margin

Gross margin lets you see how much of your revenue sticks around after you’ve covered the Cost of Goods Sold (COGS). Expressed as a percentage, it’s the ultimate measure of operational efficiency and profitability, showing just how well your business turns revenue into results.

Why it’s important:

- Gross margin reveals how well you’re managing the costs tied to delivering your services.

- Gross margin helps businesses compare their performance against industry benchmarks. Most SaaS companies aim for gross margins of 75–90% due to their low marginal costs.

- High gross margins scream scalability and profitability, making your business way more attractive to investors and stakeholders.

The uniqueness of SaaS gross margin

SaaS businesses operate on a model where gross margins thrive on efficiency and scalability. Once the software is developed, the cost of serving an additional customer—such as hosting, support, or payment processing—is relatively low.

This minimal marginal cost, combined with a subscription-based revenue stream, enables SaaS companies to achieve gross margins of 75–90%.

In contrast, traditional businesses face a different reality. Their gross margins are heavily tied to physical goods, with costs like raw materials, production, shipping, and inventory stacking up with every product sold. This leads to gross margins that typically range between 25–50%, depending on the industry.

| Aspect | SaaS business | Traditional business |

| COGS | Cloud hosting, customer support | Raw materials, manufacturing |

| Revenue model | Recurring (subscriptions) | Transactional (one-time sales) |

| Gross Margin | 75–90% | 25–50% (industry-dependent) |

Bottom line

As you can see, running a SaaS business is a full-on icy rollercoaster with unexpected twists, bumps, and the occasional loop-de-loop. Trust us, we’ve ridden the ride and felt every bump along the way.

To scale successfully, SaaS businesses need a tool that handles subscriptions and recurring billing with one hand while streamlining your finance operations with the other. A tool that keeps everything running like a well-oiled machine, giving business owners peace of mind and freeing up accountants to tackle the big-picture stuff. In other words, something like Synder.

And once you’ve got it up and running? That’s when your SaaS business starts hitting its stride.

But that’s a story for another day.