Many users don’t even realize that a music subscription or a gym membership is an example of recurring billing. These options have integrated into our daily lives. With no need to constantly re-enter payment information, many people forget they’re subscribed and just enjoy the services. As a business owner, you can use this opportunity to improve your business, achieve financial stability, and enhance your reputation. Curious about how it all works and how it can benefit your business? Let’s find out!

Contents:

1. Understanding recurring billing

2. What are recurring billing types?

3. What types of businesses use recurring billing?

4. What are the pros and cons of recurring billing for your business?

5. Are subscription and recurring payment the same thing?

6. Subscription models and recurring billing

- Subscription billing: Recurring billing for financial stability and customer loyalty

- How does recurring billing work?

7. Recurring billing management with Synder RevRec

Key takeaways

- Recurring billing involves merchants charging customers at regular intervals for goods or services, simplifying payments for both parties.

- There are two main recurring billing types: fixed recurring billing (e.g., gym memberships) and variable recurring billing (e.g., utility bills).

- Recurring billing provides consistent revenue, fosters long-term customer relationships, and improves customer loyalty and satisfaction through seamless service access.

Understanding recurring billing

Recurring billing is simple: merchants bill the customer for goods or services that are produced monthly or annually, depending on the agreement. Through these policies, the customer provides their information to the merchant and gives permission for the merchant to process payments.

Examples of automatically recurring payments include bills for utilities, streaming services, and subscriptions.

What are recurring billing types?

There are only 2 types of recurring billing:

- Fixed recurring billing;

- Variable recurring billing.

Want to know the difference? As the name suggests, in fixed recurring billing, the charge to the customer is fixed and remains the same, like gym membership or different subscriptions offered by SaaS businesses.

Variable recurring billing, on the other hand, depends on how many services or products the customer has used. Utilities often work on this principle.

What types of businesses use recurring billing?

Many businesses across a variety of industries use recurring invoicing to optimize payments and improve the customer experience. Here are a few examples:

- SaaS: Microsoft Office 365, Salesforce, Adobe Creative Cloud;

- Health and fitness: Peloton, Planet Fitness;

- Ecommerce & DTC: Chewy’s Auto-Ship, subscription boxes like HelloFresh, Blue Apron;

- Publications: The Wall Street Journal, newsletters like The Hustle;

- Education and e-learning: Coursera, MasterClass;

- Entertainment: Disney+, Spotify, HBO Max.

What are the pros and cons of recurring billing for your business?

| Pros of recurring billing | Cons of recurring billing |

| Predictable revenue: Ensures steady cash flow, helps manage market changes, and allows for better planning and investment. | Customer churn: Subscribers can cancel anytime if they don’t see value, so keeping customers happy is extremely important. |

| Revenue growth: Gives SaaS businesses an opportunity to increase revenue by offering higher-value plans and add-ons. | Complexity: More complicated than one-time payments due to add-ons, multiple pricing tiers, discounts, and taxes. |

| Customer convenience: Saves customers time and money, and offers personalized experiences like custom subscription boxes. |

Are subscription and recurring payment the same thing?

Yes and no. In fact, subscriptions and recurring billing are interchangeable terms and can be used in the same context. But note that subscriptions are a more common concept than recurring billing. However, there’s a slight difference.

Platforms offering subscriptions may have several tariff plans, such as Basic, Advanced, and Pro versions. To be more specific, subscriptions are part of fixed recurring billing.

With recurring billing, the billing mechanism doesn’t change, making the tariff plan irrelevant. But this difference isn’t so significant, as the meaning of these two terms remains the same.

Subscription models and recurring billing

Above, we mentioned that recurring billing is characteristic of the subscription business model, which is gaining momentum today. From streaming services like Netflix to SaaS platforms like Adobe Creative Cloud (and more), recurring subscription models have become the gold standard for pricing strategies across various industries. This surge in popularity can be due to the remarkable benefits it offers businesses and consumers. At this point, we need a closer look at it.

Subscription billing: Recurring billing for financial stability and customer loyalty

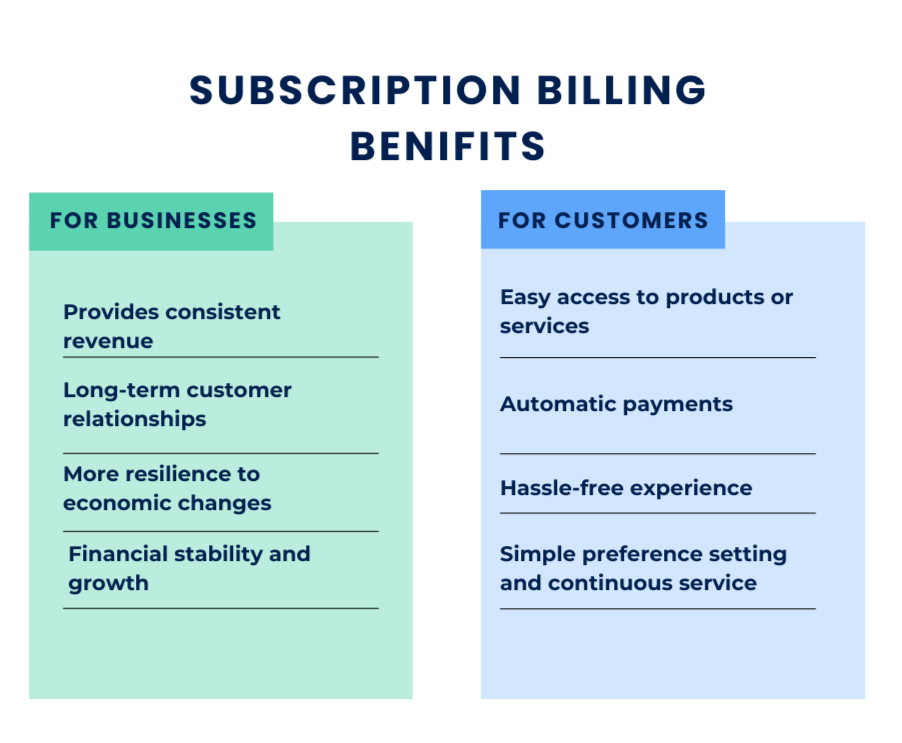

The subscription billing model offers a win-win scenario for businesses and their customers.

For businesses, it provides a consistent and predictable revenue stream. This financial stability is invaluable for effective pricing strategy, resource allocation, and strategic growth initiatives.

Besides, subscription fosters long-term customer relationships, a cornerstone of sustainable success. Customers who subscribe to a service or product are often more committed and engaged. They’re less likely to switch to competitors and more inclined to become brand advocates.

On the customer side, subscription eliminates the need for repeated purchasing cycles, making access to desired products or services seamless and hassle-free. Streaming movies, accessing premium software, or receiving monthly beauty product samples – subscription-based services simplify the consumer experience. Customers can set their preferences and enjoy uninterrupted service while remaining in control of their subscriptions, adding to their overall satisfaction.

Automatic payments are very important to the subscription model. They minimize administrative tasks, eliminating the need to manually process payments or send invoices, which saves time and resources. This system also reduces missed payments and late fees, improving financial efficiency.

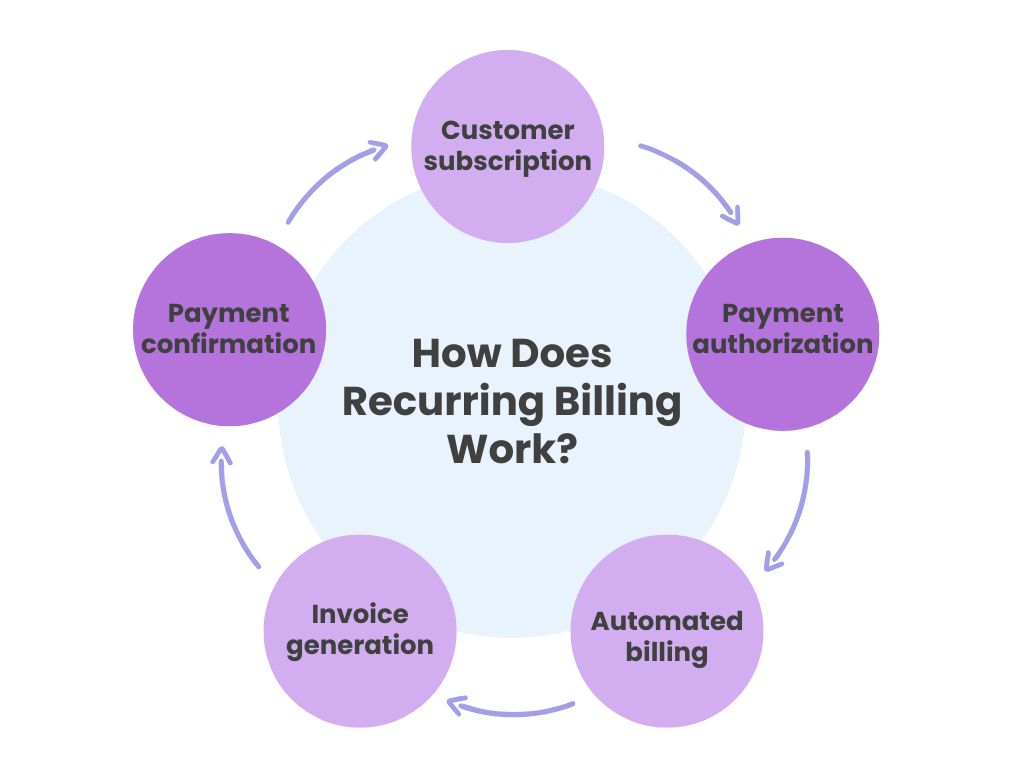

How does recurring billing work?

When the billing cycle arrives, the system automatically processes the payment, deducting the specified amount from the customer’s account. Invoices are generated and sent to customers (often through email or a customer portal). The payment records are updated in real time, maintaining transparent and accurate financial records. The entire process, therefore, is tailored to be hands-free, reducing the need for manual intervention and enhancing the overall efficiency of financial operations.

Recurring billing management with Synder RevRec

Recurring billing is an excellent opportunity for businesses to generate stable income, for example, by offering subscriptions. But, such a business may have troubles when it comes to recording and tracking subscriptions. How to properly handle that problem? Synder will help you here. Let’s see how.

Revenue recognition is all about properly recording money as income once it’s actually earned. This is especially important for subscription-based businesses, where revenue is recognized gradually over the period as the service is provided.

Synder RevRec allows businesses to recognize revenue when it’s earned, not when the money hits the bank. It seamlessly manages revenue recognition for Stripe subscriptions in QuickBooks, using a Deferred Revenue account to allocate funds and gradually transferring them to the appropriate income accounts on a set schedule. Plus, Synder RevRec provides GAAP compliant revenue recognition in accordance with IFRS standards.

For example, if a customer signs up for a one-year software subscription at $180, the revenue is usually spread out evenly over the 12 months, with $15 recognized as revenue each month.

However, if the subscription has upfront setup fees or other one-time charges, revenue recognition can become more complex. In these cases, the revenue might need to be divided between the subscription period and additional services, based on the fair value of what’s provided.

Synder solves this problem and integrates with QuickBooks Online to make the process smoother and more accurate.

Level up your SaaS business with Synder! Sign up for our all-inclusive 15-day free trial to try Synder and schedule a call with our team to explore Synder RevRec for your business.You can also reserve a spot at our Weekly Product Demo to see smart accounting automation in action.

Conclusion

So, let’s answer the main question: how to boost your business with recurring billing? In fact, everything is simple:thanks to the subscription business model, you can offer your clients a convenient format of services, enabling you to receive consistent income through regular subscription payments. This will also lead to financial stability, allowing you to grow your business at a steady pace. Additionally, your customers will appreciate the convenience, which will enhance your reputation. And software like Synder will help you address any subscription challenges that may come your way.

FAQs

What’s recurring billing?

Recurring billing is a system in which customers are automatically charged at regular intervals, such as monthly or annually, for a product or service.

Can you cancel recurring billing?

Yes, you can cancel recurring billing. Most subscription services offer an option to opt out through their website or customer service, allowing you to stop future automatic payments. Just check the specific terms and conditions of your service for any cancellation policies.

What is the difference between recurring billing and invoicing?

Recurring billing automatically charges customers on a set schedule, while invoicing sends a bill to customers, who then manually pay each time. The main difference between them is the automation of the process.

What are the steps in the recurring billing process?

The recurring billing process involves:

- Customer subscription;

- Payment authorization;

- Automated billing;

- Invoice generation;

- Payment confirmation.

What is the opposite of recurring billing?

The opposite of recurring billing is one-time billing, where the customer is charged only once for a specific purchase, and no further automatic charges are made. For example, if you do not buy a subscription to the entire streaming service, but a specific movie.

.png)

This blog provides a concise yet comprehensive overview of recurring billing, offering invaluable insights into efficient payment management—highly recommended for businesses navigating the complexities of modern commerce!

Hi David, thank you for your positive feedback! If there are any other topics or areas you’d like us to explore, please let us know. Your engagement helps us create content that truly benefits our readers. Thank you again for your support!