According to a recent survey, a significant 45% of small to medium-sized businesses (SMBs) identify manual invoicing as one of the major obstacles. And while more businesses are shifting towards electronic accounting and invoicing, manual invoicing remains a concern. This prevalent challenge leads to errors, time inefficiencies, and a control loss over cash flows. In light of this, the advantages of invoicing software over manual (or spreadsheet) invoicing become palpable – be it a standalone solution or a part of a more comprehensive business system. Minimized processing time and lower associated costs are just the most obvious ones.

Today, we’re looking at invoicing software for small businesses, including accounting software that possesses invoicing functions.

Here’s what you’re going to learn about:

1. Understanding invoicing: How do companies approach invoice management?

2. Benefits of invoicing software for small businesses

3. Key features to look for in invoicing software for small businesses

4. Easy invoicing with Synder Sync

5. 5 invoicing software for small businesses to consider

Key takeaways

- Manual invoicing remains a significant obstacle for small to medium-sized businesses (SMBs), leading to errors, inefficiencies, and difficulties in managing cash flows.

- Invoicing software offers numerous benefits over manual or spreadsheet invoicing, including minimized processing time, lower costs, automated invoicing processes, and improved security features.

- When choosing invoicing software, businesses might want to prioritize features like invoice creation, automatic invoicing, payment tracking, integration capabilities, security measures, mobile access, customer support, and tax reporting. Options range from standalone invoicing software to integrated accounting solutions, offering flexibility to meet diverse business needs.

Understanding invoicing: How do companies approach invoice management?

Invoicing is one of the processes at the heart of efficient financial operations, playing a crucial role in maintaining transparency and ensuring a smooth revenue flow.

Invoicing involves requesting payment for goods or services rendered. An invoice is a formal document issued by a seller to a customer detailing the items sold or services provided, their quantities, prices, and terms of sale.

It plays the role of a financial record for both parties involved in a transaction, ensuring clarity and accountability in exchanging of goods or services for money.

A typical invoice includes information such as the invoice number, date of issue, payment due date, and payment methods accepted. Invoicing helps businesses track their sales, manage cash flow, and maintain accurate financial records for taxation and accounting purposes.

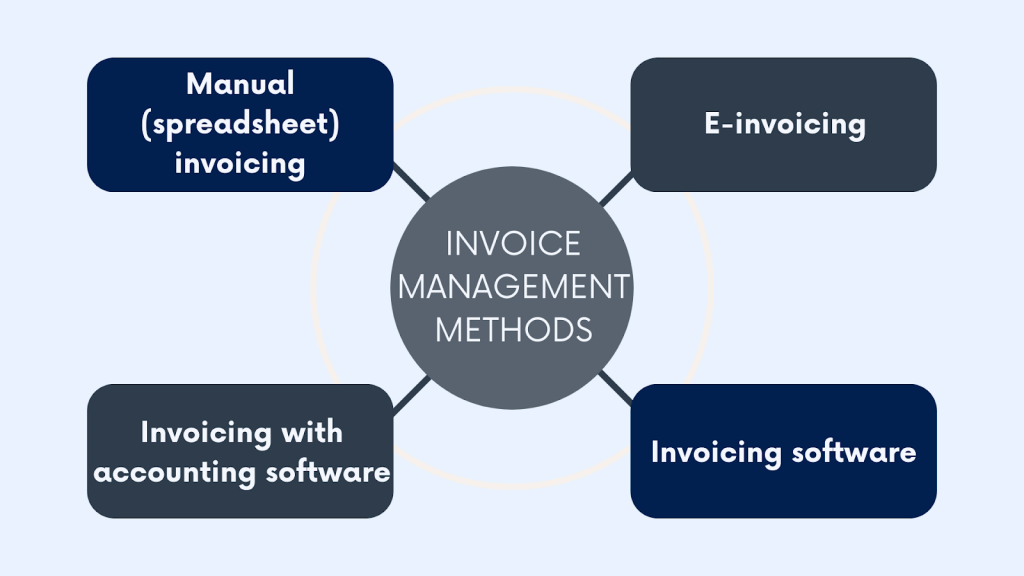

Businesses use various invoicing methods, each with its own strengths and challenges. From the traditional manual invoicing to the efficiency-driven invoicing software – the choices are diverse and impactful.

Manual (spreadsheet) invoicing

Manual or spreadsheet invoicing involves creating and managing invoices in PDFs or using spreadsheet software such as Microsoft Excel or Google Sheets. (Traditionally, it took pen and paper to create invoices, but let’s not speak of, you know, ancient times.)

Using this method, you manually input and calculate the details of each invoice, including item descriptions, quantities, prices, and totals. Afterward, you send the invoice to the customer by traditional mail or email it to them.

While cost-effective, manual invoicing is prone to errors and inefficiencies due to manual data entry and calculations. It requires extreme attention to detail, which can be time-consuming. As a business grows, so does transaction volume, and the load of effort becomes palpable. At this point, manual invoicing can provide a simple and accessible solution for businesses just starting or with straightforward invoicing needs and not so many transactions to handle.

E-invoicing

E-invoicing, or electronic invoicing, involves generating, delivering, and processing invoices digitally over electronic networks or systems.

E-invoices can be automatically created and imported into a customer’s accounting system, making payment processes faster and more efficient. While lacking visual presentation, they can be temporarily displayed during processing or converted into visual formats as needed.

E-invoicing solutions utilize various technologies and standards to facilitate secure and efficient invoice exchange between trading partners, including EDI (Electronic Data Interchange), XML (Extensible Markup Language), and PDF (Portable Document Format). E-invoicing offers numerous benefits over traditional invoicing methods, including reduced processing costs, faster payment cycles, improved accuracy, enhanced invoice tracking and reconciliation, and better compliance with regulatory requirements.

This solution has been gaining momentum for several years already. The global e-invoicing market is expected to amount to $16.68 billion by 2030 from $5.87 billion in 2020. The adoption of e-invoicing shows an optimistic pace – around 50% of companies in North America have added digital collection systems, and one in four companies has moved to e-invoicing since 2020.

A subset of invoicing software, e-invoicing is still a bit different concept. Simply put, e-invoicing is about exchanging invoices between systems a seller and buyer uses. E-invoices should be specifically structured to be compatible with the receiving system. An e-invoicing system is a rather substantial investment. At this point, using e-invoicing is more typical for larger enterprises. Invoicing software, in contrast, is accessible to a broader audience.

Invoicing software

Invoicing software is a digital tool designed to streamline the invoicing process for businesses of all sizes. It automates the invoicing routine, allowing users to generate and deliver professional-looking invoices quickly and efficiently.

Invoicing software typically offers handy features like customizable invoice templates, automated calculations, recurring billing, payment reminders, invoice tracking, and reporting capabilities. Many invoicing software solutions integrate with accounting and payment systems, enabling seamless data synchronization and financial management.

Invoicing within accounting software

Many accounting software solutions include invoicing as one of the features, allowing businesses to make professional invoices and keep track of them alongside other financial tasks like expenses and revenue.

Businesses can easily make invoices for what they sell or provide as services, customize invoices, calculate totals automatically, and handle taxes. The software also lets them track invoice status and received payments and send reminders for overdue payments, which helps manage cash flow better.

Using invoicing in accounting software enables businesses to keep all their financial information organized and make invoicing smoother. It helps ensure accuracy and follow accounting rules and laws. Overall, invoicing within accounting software is vital for managing finances well and running a business smoothly.

Benefits of invoicing software for small businesses

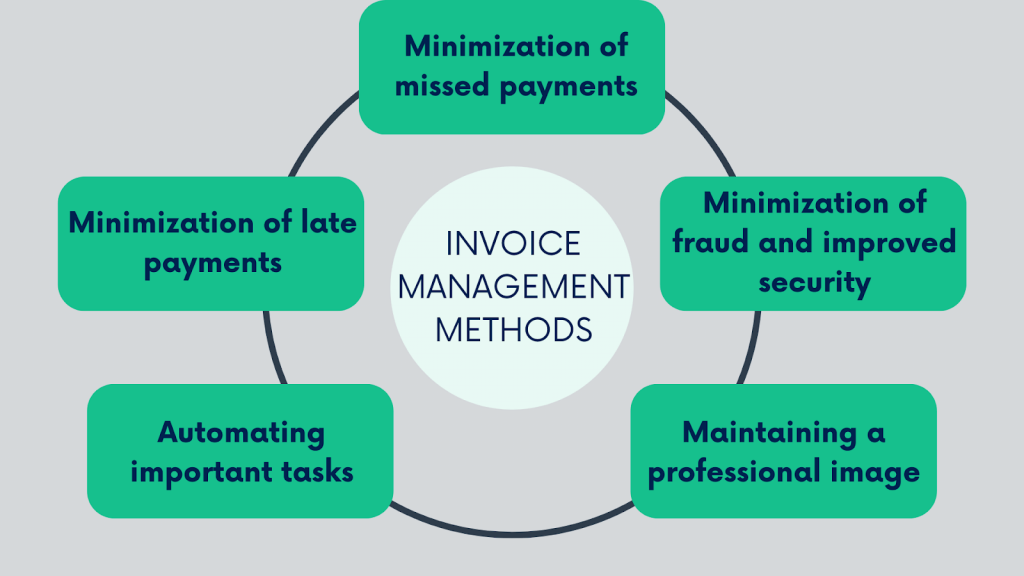

Aside from the before-mentioned shift to e-invoicing and invoicing software in general, which means that sooner or later manuals will become a thing of the past, the best invoicing software performs all invoice-related tasks for small businesses and provides the following benefits:

Minimization of late payments

If you delay the invoicing process, this can potentially lead to delayed payments, which will negatively affect your cash flow. A good invoicing software streamlines your billing and invoicing process, which helps send invoices and receive payments on time. Keeping it all organized will certainly boost profitability.

Minimization of missed payments

Tracking all the billing commitments will make sure that all the payments are collected, which gets a business to a positive bottom line.

Minimization of fraud and improved security

Good invoicing software provides security features to ensure the protection of the entire billing-to-payment process from hacks. In this respect, e-invoicing certainly surpasses sending paper invoices by mail.

Maintaining a professional image

Using good invoicing and billing software contributes to boosting your company’s reputation. Customized designs of invoices, logos, and other improvements make a business look professional.

Automating important tasks in accounting and financial processes

While faster payment of invoices helps increase cash flow, shorter time of fixing possible errors wins good customer relations. Automation always means cutting costs and redirecting hours spent on manual procedures into something more valuable.

Key features to look for in invoicing software for small businesses

As you can see, invoicing software is more than just creating invoices. Searching for invoicing software to implement into your finance management processes, you might want to know what features to look for. It’s worth mentioning that features can vary depending on the specific product. But let’s look at what to expect from invoicing software in general.

Invoice creation

A good invoicing software should allow you to easily create and customize invoices with your logo, payment terms, and other relevant information.

Automatic invoicing

Many invoicing software solutions allow you to set up automatic invoicing for recurring payments or subscriptions, saving you time and reducing the risk of errors.

Payment tracking

Your invoicing and billing software should enable you to track payments received and overdue payments, so you can keep track of your accounts receivable.

Payment options

Reliable invoicing software should offer multiple payment options, such as credit card, PayPal, bank transfer, payment links, and others.

Invoice management

A good invoicing solution should help you manage and organize your invoices, including archiving old invoices and generating reports.

Integration

Invoicing software often integrates with other business software, such as accounting software, free project management software, and CRM software, to streamline workflows and reduce manual data entry.

Security

A reliable invoicing software should have strong security measures in place to protect your sensitive financial data.

Mobile access

You should be able to access and manage your invoices from any device, including smartphones and tablets.

Customer support

The software provider should offer reliable customer support to help you with any questions or issues that arise.

Tax report

A good online invoicing software should eliminate the need to use external systems for tax reporting and allow you to perform it within the same system without losing hours to summarize information.

Easy invoicing with Synder Sync

There are far more options for invoice management than the top 5 we compiled. If you turn to stand-alone invoicing software, you might find such popular solutions as Invoice Simple, Invoicera, Hiveage, Harvest, Invoicely, Bill.com, and others. Should you decide to rely on a stand-alone invoicing software, it’s wise to research these options too.

But while that might be a good solution for invoice management, a small business has to address many more requirements and needs. That leads us to the idea that a more comprehensive accounting software solution with an invoicing function might be a good value for the money paid.

Synder is an example of such an exhaustive solution. It’s an accounting automation software that offers a set of features and benefits for managing business finances in general and invoices in particular. Users can choose to utilize Synder as their primary accounting solution or use it as an intermediary between their accounting software and sales channels, joining them all into a single ecosystem. Let’s look at what Synder offers real quick.

Seamless integration

Synder integrates with a variety of ecommerce platforms, payment gateways, and accounting software, allowing users to sync transactions and automate bookkeeping tasks.

Multi-currency support

Synder supports multiple currencies, allowing users to transact with customers and suppliers in their local currency and automatically convert transactions to the user’s base currency.

Automated reconciliation

Synder’s reconciliation feature automatically matches transactions with corresponding invoices and payments, streamlining the bookkeeping process and reducing the risk of errors.

Real-time syncing

Synder offers real-time syncing of transactions, ensuring that financial data is always up-to-date and accurate.

Advanced reporting

Synder offers a variety of financial reports, including profit and loss statements, balance sheets, and cash flow reports, allowing users to gain insights into their business performance.

Customization

Synder allows users to customize invoices and receipts with their branding, logos, and messaging, creating a more professional and cohesive look.

Excellent customer support

Synder offers excellent customer support, with a knowledgeable and responsive team available to assist users with any questions or issues.

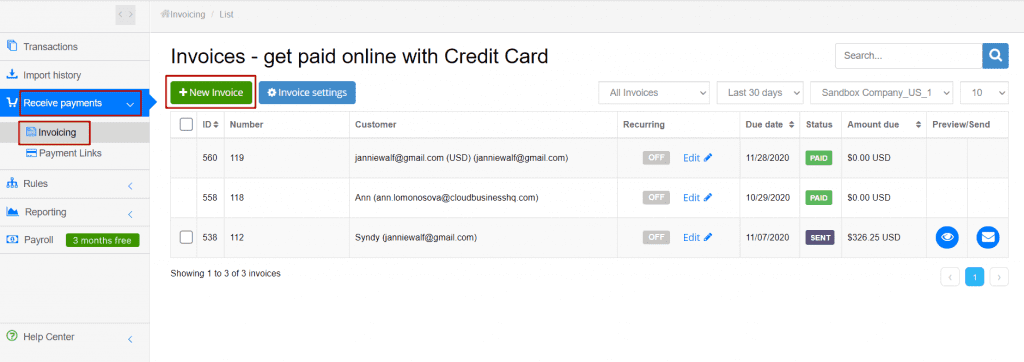

In the example of Synder, I want to demonstrate how simple and straightforward the invoicing process can be.

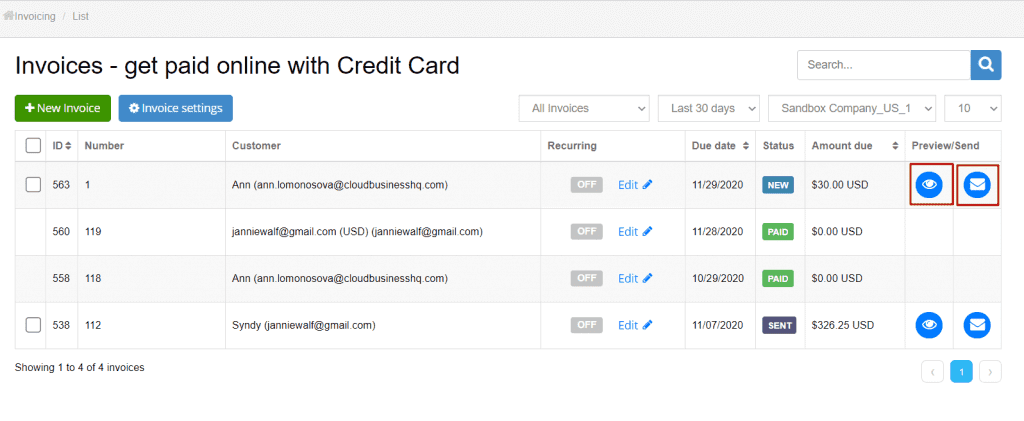

So, let’s imagine you already logged into your Synder account and see the initial dashboard in front of you. From here you can:

- Click on Invoicing in the left side menu;

- Press the New invoice button.

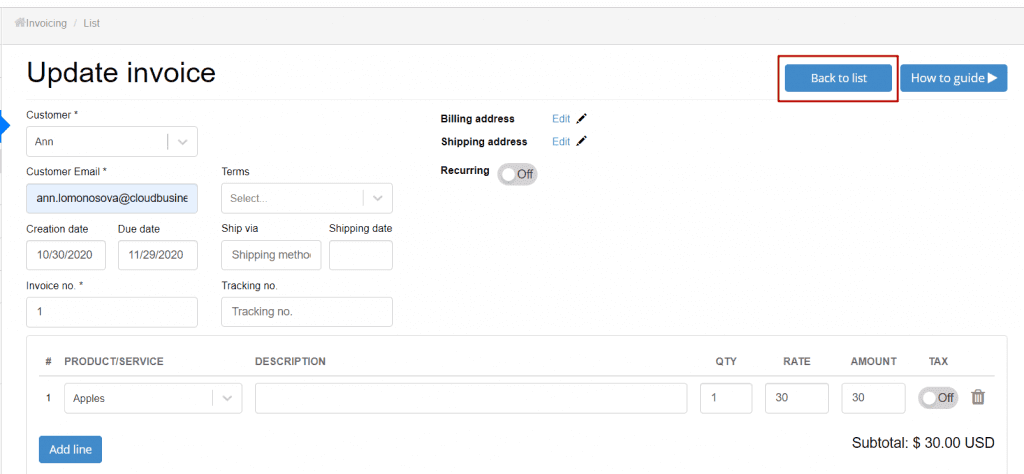

You’ll get to the invoice template, where you can fill out invoice information and press the Create invoice button.

In the page that appears you’ll see the created invoice at the top of the list. Now you can use Preview and Send buttons in the right column of the invoices list, allowing you to review your invoice or send it to your client.

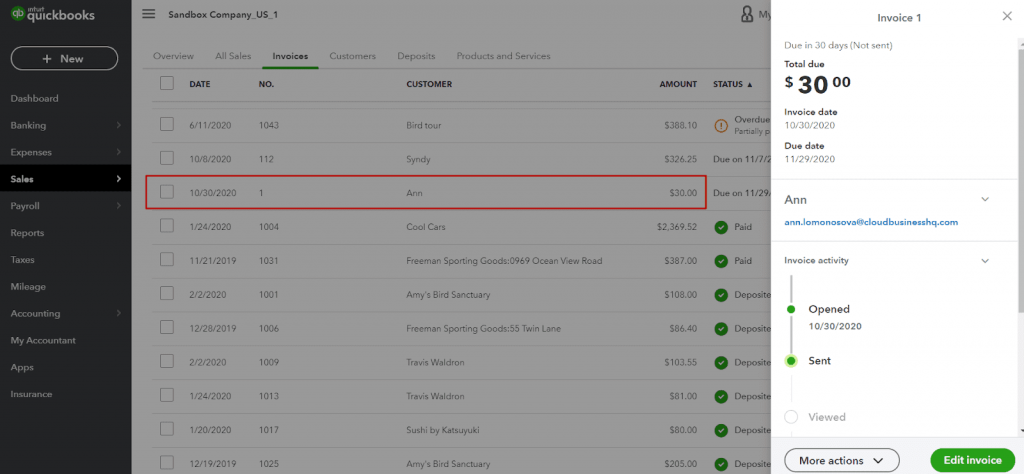

After pressing the Send button, you’ll get this invoice in your QuickBooks company right away.

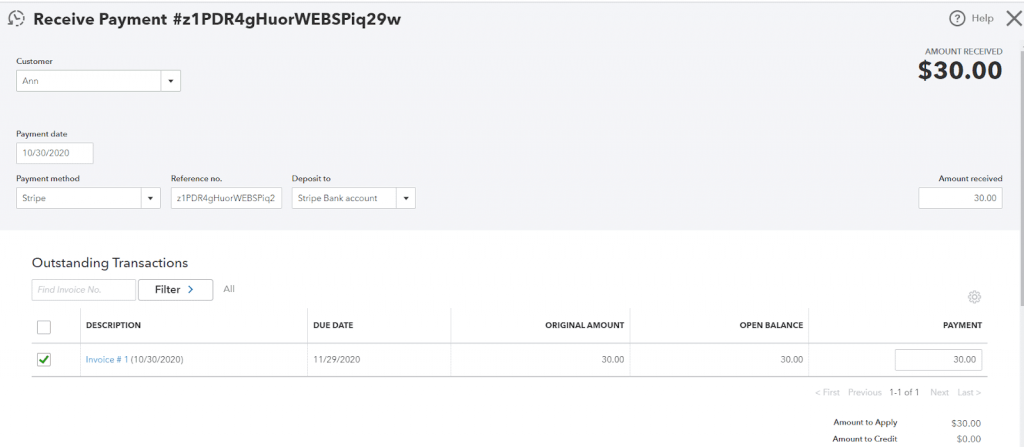

Once the invoice is paid, Synder will create a payment in QuickBooks associated with this invoice and change its status in QuickBooks to Paid . The money received will go to your Stripe account.

Learn more about how Synder can help your business (with invoicing and many other things) by booking a seat at the Weekly Public Demo with one of our Customer Support specialists or explore Synder yourself with a free 15-day trial.

5 invoicing software for small businesses to consider

There’s a variety of stand-alone invoicing software and accounting software programs available, and the choice of the “best” one for you will depend on your specific needs and preferences. You can rely on user reviews on trusted review platforms and various ratings from reliable sources, which eliminates the need to research all the possible options on your own. We looked through the ratings of the best invoicing software for small businesses on forbes.com, fitsmallbusiness.com, investopedia.com, and nerdwallet.com and chose our top 5 invoicing software programs for small businesses that are worth considering:

QuickBooks Online

QuickBooks Online is a well-known and popular cloud-based accounting software that provides a range of features for small businesses, including invoicing. QuickBooks Online offers a variety of features that aren’t found in most invoicing software (inventory management, in-person payment, and tax features). This software might be a good option for small brick-and-mortar businesses that accept payments online and in person.

Let’s have a look at the advantages and disadvantages of using QuickBooks Online as an invoicing option for small businesses.

QuickBooks advantages

- User-friendly

QuickBooks Online is easy to set up and use, with a user-friendly interface that allows even non-accountants to handle basic invoicing tasks. - Automated invoicing

QuickBooks Online offers automated invoicing, which saves time and reduces the likelihood of errors. You can create recurring invoices, schedule future invoices, and set up payment reminders. - Payment options

QuickBooks Online provides multiple payment options, including online payment through credit cards and bank transfers. - Integration

QuickBooks Online integrates with a wide range of other software and services, including payment gateways, payroll software, and inventory management software.

Let’s now look at some drawbacks

- Cost

The pricing plans of QuickBooks Online can be expensive for small businesses. And the cost increases as you add more features, such as payroll and inventory management.

- Limited customization

While QuickBooks Online offers a range of customizable invoice templates, the level of customization is limited compared to other invoicing software. - Limited reporting

QuickBooks Online provides basic invoicing reports, but its reporting capabilities are limited compared to other accounting software. - Learning curve

You might have to face a learning curve when using QuickBooks Online, especially if you aren’t familiar with accounting software.

QuickBooks offers different subscription tiers, and the available feature set depends on the chosen plan. There’s a free 30-day trial and 50% off for the first three months.

Freshbooks

FreshBooks is a user-friendly invoicing software program that offers a range of accounting features for small businesses and freelancers. This software provides its clients with customizable invoices and options for recurring invoicing and auto payment.

Let’s look at the advantages and disadvantages that might influence your choice.

Freshbooks advantages

- Easy-to-use interface

FreshBooks has a user-friendly interface that makes it easy to create and send invoices, track time and expenses, and manage projects.

- Professional-looking invoices

FreshBooks offers a variety of customizable templates for invoices that can be tailored to fit your brand. - Online payments

FreshBooks allows you to accept online payments from clients, which can help you get paid faster and reduce the need for manual payment processing. - Time tracking

FreshBooks includes built-in time tracking features that allow you to easily bill clients for your time. - Mobile accessibility

FreshBooks is accessible from anywhere with an internet connection, and offers a mobile app for iOS and Android devices, allowing you to manage your finances on the go.

Freshbooks limitations

- Limited accounting features

While FreshBooks offers basic accounting features such as expense tracking and financial reporting, it doesn’t have the comprehensive accounting features of more robust accounting software programs. - Limited integrations

FreshBooks integrates with a range of tools and services, but it may not have the same level of integration options as other invoicing software programs. - Pricing

FreshBooks can be more expensive than other invoicing software programs, particularly for businesses with multiple users or a high volume of transactions. - Limited customization

While FreshBooks offers customizable invoice templates, there may be limited options for customization beyond the available templates.

FreshBooks offers a 30-day trial and if you decide to stay with it, you can choose one of three paid plans, depending on your business needs.

Zoho Invoice

Zoho Invoice is a free cloud-based invoicing and billing software that offers a range of features for businesses of all sizes. It can help you track projects and billable hours, send estimates, and create custom invoices from approved estimates or projects. Zoho Invoice provides its clients with a built-in client portal to simplify communication with customers and get approval for billing. The only cost associated with Zoho Invoice is that you have to pay transaction fees any time you get paid through an invoice as you use payment gateways.

Here are some of the advantages and disadvantages of using Zoho Invoice.

Zoho Advantages

- Easy to use

Zoho Invoice is user-friendly, and it’s easy to set up and navigate through its various features. - Customizable

Zoho Invoice allows users to customize invoices, estimates, and other documents to match their brand.

- Mobile-friendly

Zoho Invoice has a mobile app that allows users to create and manage invoices on the go. - Integrations

Zoho Invoice integrates with a range of third-party apps, such as PayPal and Stripe, making it easy to accept payments online. - Cost-effective

Zoho Invoice offers a range of pricing plans, including a free plan, making it an affordable option for small businesses.

Zoho drawbacks

- Limited customization options

While Zoho Invoice is customizable, some users may find the range of customization options limited. - Limited reporting

Zoho Invoice’s reporting capabilities are basic compared to other invoicing software options, which may be a drawback for some small businesses. - Limited features

Zoho Invoice may not offer as many features as other invoicing software options, which may also be a minus for small businesses with more complex invoicing needs. - Customer support

Some users have reported issues with Zoho Invoice’s customer support, including slow response times and difficulty resolving issues.

Zoho Invoice is free with no hidden charges, in-app purchases, and ads.

Square Invoices

Square Invoices is a cloud-based invoicing software that allows businesses to create and send professional invoices to their customers. With Square Invoices, businesses can customize invoices with their branding and accept payments via credit card, debit card, or bank transfer. Square Invoices is a part of the Square ecosystem of products, which includes point-of-sale hardware and software, payroll, and other financial services. Square Invoices is designed for medium-sized and small businesses and is a popular invoicing software option for freelancers, consultants, and service-based businesses.

Here are some of the advantages and disadvantages of using Square Invoices.

Square Invoices advantages

- Easy to use

Square Invoices has a user-friendly interface, making it easy to set up and navigate through its features. - Customizable

Square Invoices allows users to customize invoices with their brand logo, colors, and other elements. - Payment options

Square Invoices allows users to accept payments via credit card, debit card, or bank transfer, which can help businesses get paid faster. - Automated reminders

Square Invoices can send automated payment reminders to customers, which can help businesses get paid on time. - Mobile app

Square Invoices has a mobile app that allows users to create and manage invoices on the go.

Limitations of Square Invoices

- Limited reporting

Square Invoices’ reporting capabilities are basic compared to other invoicing software solutions. - Limited customization options

Some users may find the range of customization options limited. - Fees

Square Invoices charges fees for credit card transactions, which may be a drawback for businesses that need to process a large volume of transactions. - Customer support

Slow response times and difficulty resolving issues might be a problem in some cases.

Square Invoices offers a free plan and a paid plan with extended invoicing features.

It’s important to note that Square Invoices charges some additional fees you should be aware of:

- Invoices paid online: 2.9% plus 30 cents per transaction;

- Tap, dip, and swipe payments: $2.6% plus 10 cents per transaction;

- Card-on-file payments: 3.5% plus 15 cents per transaction;

- ACH payments: 1% per payment—maximum of $1 per transaction.

Invoice Ninja

Invoice Ninja is a cloud-based invoicing and payment platform that offers a range of features and benefits for small businesses. Invoice Ninja’s Forever Free offers a free plan for users to send unlimited invoices and estimates to up to 20 clients and access many features that can make account management easier.

Here are some of the advantages and disadvantages of using Invoice Ninja.

Invoice Ninja advantages

- Affordable pricing

Invoice Ninja offers a range of pricing plans, including a free plan, which makes it an affordable option for small businesses. - Customization

Invoice Ninja offers a high degree of customization, which allows businesses to create professional-looking invoices. - Payment integration

Invoice Ninja integrates with a variety of payment gateways, including PayPal and Stripe.

- Time tracking

Invoice Ninja includes a time tracking feature, which allows businesses to track the amount of time spent on a project and bill clients accordingly.

- Client management

Invoice Ninja includes a client management feature, which allows businesses to keep track of their clients’ contact information and payment history.

Invoice Ninja disadvantages

- Limited integrations

While Invoice Ninja integrates with a variety of payment gateways, it has limited integrations with other software and services. - Limited reporting

Invoice Ninja’s reporting feature is somewhat limited compared to other invoicing software. - Limited automation

Invoice Ninja’s automation features aren’t as extended compared to other invoicing platforms, which can make it time-consuming for businesses to complete certain tasks, such as recurring invoicing. - Limited mobile app

While Invoice Ninja has a mobile app, it has limited functionality compared to the desktop version.

Invoice Ninja offers a free plan for businesses having up to 20 clients and two paid plans featuring unlimited clients and invoices and multi-user access.

Bottom line

As you can see, business has plenty of choice when it comes to invoicing. And manual invoicing is just an option (that is gradually going to extinction). Automated invoicing solutions gain momentum, catering to the needs of businesses regardless of size. Be it sophisticated e-invoicing tools, dedicated invoicing software, or invoicing within accounting software – each offers plenty of opportunities to simplify and improve invoicing for businesses and their clients.

Ultimately, the best invoicing software for your small business will depend on your specific needs and budget. It might be a good idea to research several options and get free trials before making a decision.

Share your thoughts

How do you manage your invoicing? What are the hardships you faced? Or maybe you get some best practices under the hood? Share your thoughts and opinions in the comments section below!

Thanks for the article! Will check out these invoicing softwares.