If you’re struggling to make your Amazon numbers match what you see in QuickBooks Online, you’re not alone. Between sales, refunds, fees, and taxes, it’s easy for things to get messy. However, there are better ways to sync Amazon transactions with QuickBooks. With a tool like Synder you can automatically categorize Amazon expenses, so your books finally make sense without hours of manual work.

How to import Amazon purchases into QuickBooks?

There are a few ways to handle it:

- Manually import settlement reports;

- Use QuickBooks’ built-in Amazon Business Purchases app;

- Try third-party integration tools.

While each option works, many sellers find that using an automation tool like Synder is the most efficient and accurate solution. It syncs Amazon transactions directly into QuickBooks, categorizes them properly, and saves you from the stress of messy reconciliations.

How to set up Amazon QuickBooks integration in Synder

To sync Amazon transactions to QuickBooks through Synder, follow these steps:

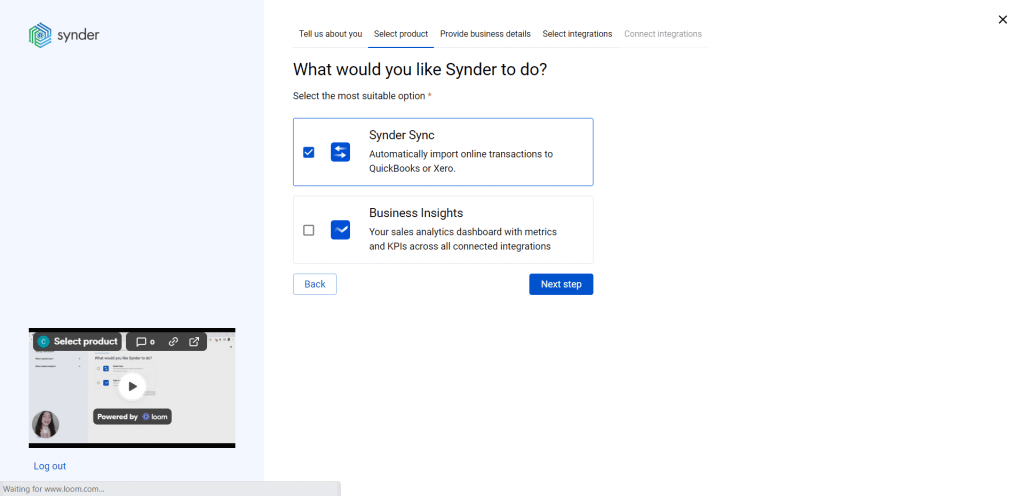

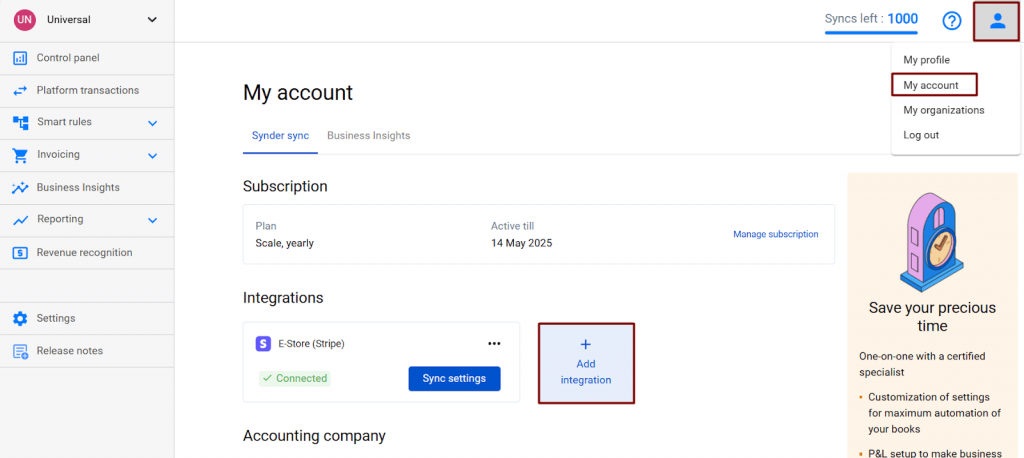

1. Start by creating a Synder Sync account if you don’t already have one. Fill in your business details to set up your organization.

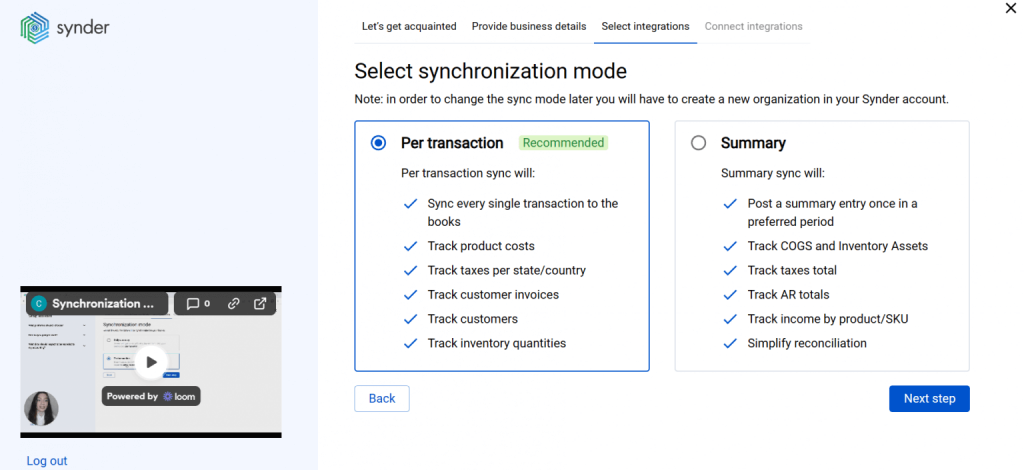

2. After that, link QuickBooks Online. Synder will ask you to choose your sync mode: either per transaction or daily bundles, so pick whichever works best for your bookkeeping workflow. The Per Transaction mode is ideal for businesses that need a detailed breakdown of every Amazon sale, refund, fee, and adjustment. If you prefer a cleaner QuickBooks file and don’t need each transaction recorded individually, the Summary Sync mode is a better fit.

3. Then go to Integrations, choose Amazon as your platform and connect it by selecting your store region and entering your Seller ID as needed.

4. Select a payout account, usually your checking account, to enable seamless reconciliation in QuickBooks.

Once everything is connected, Synder begins syncing your Amazon orders, fees, taxes, refunds, and payouts straight into QuickBooks with as much detail as you need.

Alternative ways to categorize Amazon expenses in QuickBooks Online

There are also a few different ways to import Amazon transactions into QuickBooks:

- Manual import of settlement reports: gives you full control but is time-consuming and prone to errors.

- QuickBooks’ Amazon Business Purchases app: simplifies the connection, but only works for Amazon Business accounts and may not capture all details like fees and refunds.

While these methods work, many sellers find that using an automation tool like Synder is the most efficient method, as it categorizes transactions automatically and eliminates the stress of messy reconciliations.

Why do companies choose Synder for Amazon QuickBooks integration?

Using a connector app like Synder is the ultimate solution for importing Amazon purchases into QuickBooks, helping businesses save up to 70 hours a month on manual data entry.

Business leaders often highlight these important advantages of Synder:

- Smart categorization: Synder automatically sorts transactions, including sales, refunds, fees, shipping, and discounts, into the correct QuickBooks accounts. This ensures your profit & loss, balance sheet, and cash flow reports are accurate without manual touch-ups.

- Error-free reconciliation: Amazon payouts are recorded in a dedicated clearing account and matched to actual bank deposits, reducing errors and simplifying reconciliation.

- Multicurrency support: For global sellers, Synder handles transactions in multiple currencies, recording sales in the original currency and converting them into your home currency for precise financial reporting.

Want to simplify your Amazon QuickBooks reconciliation and save hours on manual work? Book a free demo with Synder to see how it can streamline your workflow.

FAQ

Can I import historical Amazon transactions into QuickBooks?

Yes, with Synder, you can automatically pull past sales, refunds, fees, and payouts into QuickBooks, properly mapping them to accounts and taxes for accurate, complete records. Included for free on the Premium plan, 3 months free on Pro, and available for a fee on Basic and Essential.

How are fees and discounts categorized?

Synder handles discounts in two ways: as discounted totals, which records only the net amount spread over the billing period, or as gross and discount, which records full product revenue and discounts separately for complete visibility in reports. Fees are automatically recorded as separate items in QuickBooks.

Are Amazon returns and refunds imported as well?

Yes. Synder brings in returns and refunds as separate transaction types so nothing slips through, and you can track them correctly in QuickBooks.

How frequently does data sync into QuickBooks Online?

Synder usually syncs data with QuickBooks Online automatically, with the frequency depending on your chosen sync mode. In the Per Transaction mode, data typically syncs about once an hour, while in the Summary Sync mode, it syncs once a day. You can also initiate a manual sync at any time for immediate updates.