If you’re selling on Amazon and manually entering transactions into QuickBooks, you’re wasting hours on work that could be automated. Amazon’s transaction volume, combined with FBA fees, Marketplace Facilitator Taxes, and multiple payment cycles, creates a bookkeeping headache that manual entry can’t solve efficiently. According to McKinsey research, 77% of general accounting operations can be fully automated, yet many Amazon sellers still wrestle with spreadsheets and duplicate data entry.

Here’s why connecting QuickBooks to Amazon matters: Amazon generated approximately $144 billion in retail ecommerce sales in the United States in 2024. That’s millions of transactions flowing through seller accounts daily, each requiring accurate accounting for tax compliance, financial reporting, and business decisions.

This article will tell you how to actually integrate Amazon with QuickBooks, which tools work best, and practical ways to keep your books accurate without the weekly data entry nightmare.

TL;DR

- Manual Amazon accounting takes up a long time: Most Amazon sellers spend hours monthly on transaction entry, fee categorization, and reconciliation, time that automation eliminates entirely.

- Integration isn’t native: Amazon and QuickBooks don’t connect directly. You need third-party software to sync sales, fees, refunds, and taxes automatically between platforms.

- Automation accuracy beats manual entry: Manual invoice processing has declined sharply as businesses recognize that automation reduces errors. Accounting tools like Synder bridge the gap, automatically syncing your Amazon data to QuickBooks so your books stay current without manual work.

Why Amazon sellers need QuickBooks integration

Say you sold 200 units yesterday across three products. Amazon deposited $4,327 to your bank, but that’s after deducting $847 in referral fees, $312 in FBA fees, $89 in storage fees, $156 in advertising costs, collecting $387 in sales tax that goes to state governments, processing two refunds totaling $143, and handling a chargeback for $67. Now, manually categorize all of that into QuickBooks. Then do it again tomorrow. And then the next day. That’s why Amazon sellers need integration with QuickBooks!

Amazon’s settlement system is tough to handle manually. It holds funds, deducts fees, withholds taxes, processes refunds on its own schedule, and pays out every two weeks. To keep your books accurate, you need to track the original sale dates, match net payouts to deposits, categorize all the different fee types, handle collected vs. withheld tax, and track inventory changes from FBA sales.

Available integration methods for Amazon and QuickBooks

Amazon and QuickBooks don’t connect natively, and there are three main approaches:

- Manual CSV exports: You download settlement reports from Amazon Seller Central, format data in spreadsheets, and import them to QuickBooks each settlement period. This approach requires Excel skills and consistent execution.

- Accounting automation tools: Software like Synder syncs Amazon data to QuickBooks automatically. These tools handle everything from sales and fees to refunds and taxes, with options for both transaction-level and summary reporting.

- Custom API development: You build your own integration using Amazon’s SP-API and QuickBooks’ API. This route requires dedicated developers to build and maintain the system.

Quick comparison

| Method | Pros | Cons |

| Manual CSV exports | • No monthly software costs • Full control over data format • Works with basic Excel skills | • Hours spent weekly on downloads and formatting • High error rate as volume increases • No automated bank reconciliation • Loses transaction details in CSV format |

| Accounting automation tools | • Automatic syncing (hourly/daily) • Accurate fee categorization • Built-in bank reconciliation • Handles tax complexities • Multi-marketplace support | • Monthly subscription cost • Learning curve during setup • Dependent on third-party service |

| Custom API development | • Tailored to exact business needs • Complete data control • Integration with proprietary systems | • High upfront development cost • Ongoing maintenance required • Needs dedicated technical resources • Long implementation timeline |

Choosing the right method

Here’s how to decide which integration approach fits your business:

Tip 1: If you’re selling fewer than 50 orders monthly and have time for weekly data entry, manual CSV exports work. Beyond that volume, automation pays for itself in time saved.

Tip 2: Automation tools make sense when you value accuracy over cost savings. The monthly fee is typically less than what you’d pay someone for the manual work hours.

Tip 3: Build custom integration only if you’ve already tested existing tools and confirmed they can’t handle your specific workflow requirements. Most sellers never need this option.

How automation handles Amazon QuickBooks integration challenges

Amazon doesn’t pay you when customers buy your products. They hold your money for up to two weeks, deduct a dozen different fee types, withhold sales tax, process refunds, and then deposit whatever’s left. Your bookkeeper sees the net amount in your bank account and has to reverse-engineer what happened to match everything in QuickBooks. Automation tools exist specifically to handle this mess:

- Settlement cycles vs. transaction dates: A sale might happen on January 5 but won’t show up in your bank until the January 18 payout. You need the sale date for revenue and the payout date for reconciliation. Automation tools like Synder use a clearing account that mirrors Amazon’s hold period, so sales post on the actual transaction date and payouts link up cleanly.

- Fee categorization: Amazon charges for everything: referral fees, FBA handling, storage, ads, and so on, and each fee belongs in a different expense account. Take Dermeleve, for example: their CFO uses Synder’s Smart Rules for automated fee categorization, saving $60,000-$72,000 annually in staffing costs because every fee type goes to the right place without manual sorting.

- Marketplace facilitator tax: Amazon collects and remits sales tax in most states, so the tax shows up in your revenue even though you never receive it. Synder’s automation handles this by posting the tax collected and the tax withheld as equal offsets to a dedicated Marketplace Facilitator Tax account, keeping income and liability correct without inflating your numbers.

- Multi-marketplace operations: If you sell on Amazon, Shopify, eBay, Walmart, and Etsy, each platform sends different fees, formats, and payouts. Automation brings them into QuickBooks in a consistent way. Consider TJAYZ: they moved to Synder’s automated setup and now save over 40 hours a month because all their channels feed into one unified workflow.

- Returns and refunds: Amazon refunds aren’t simple reversals. There are return fees, inventory decisions, and refund timing differences. Automation tools track the complete return lifecycle, matching refunds to original sales, categorizing return fees, and adjusting inventory when items are restocked.

- FBA inventory and COGS: Since Amazon holds your FBA stock, QuickBooks needs accurate inventory and COGS updates whenever a sale happens. Synder, for example, reduces inventory, posts COGS, and keeps quantities in sync based on Amazon reports, with support for product mapping if your SKUs differ between systems.

- Advertising and promotional costs: Amazon PPC costs show up as negative adjustments, separate from sales. Synder identifies them in settlement reports and lets you use Smart Rules to route them to the correct advertising expense accounts without extra work.

Ready to automate your Amazon accounting? Start your 15-day free trial or schedule a demo to see how Synder handles these challenges for you.

Now that you understand why automation handles Amazon’s accounting challenges better than manual methods, let’s go over how to set up an automated integration between your Amazon Seller Central account and QuickBooks.

How to set up Amazon QuickBooks integration with Synder

Let’s look at how to set up this integration.

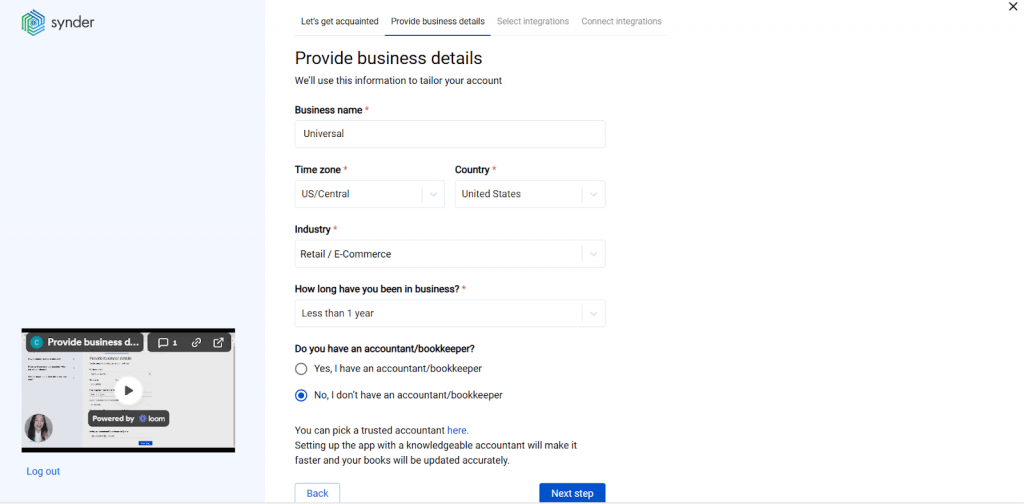

1. Create a Synder account – Sign up at synder.com and provide your business details during the organization setup process.

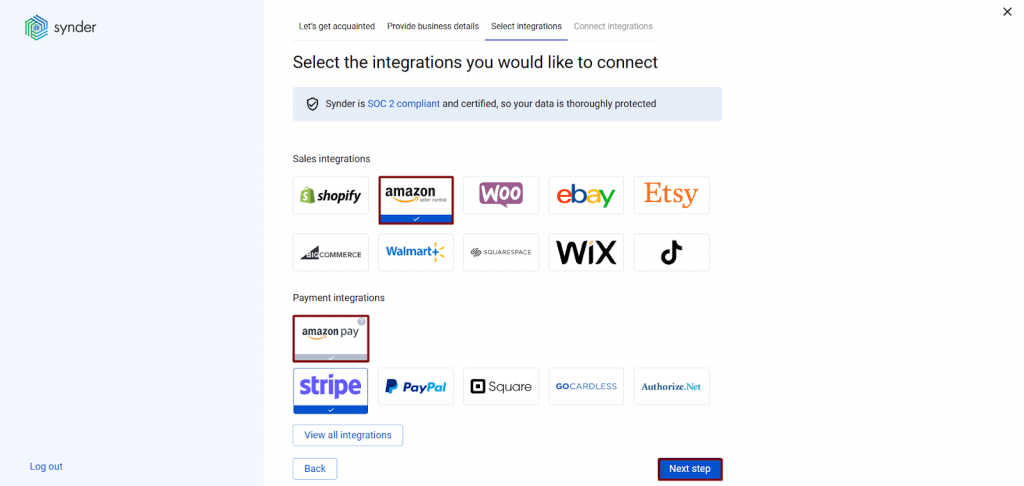

2. Select platforms to integrate – Choose which platforms you’d like to connect. You can select Amazon along with other sales channels you use, or add them later.

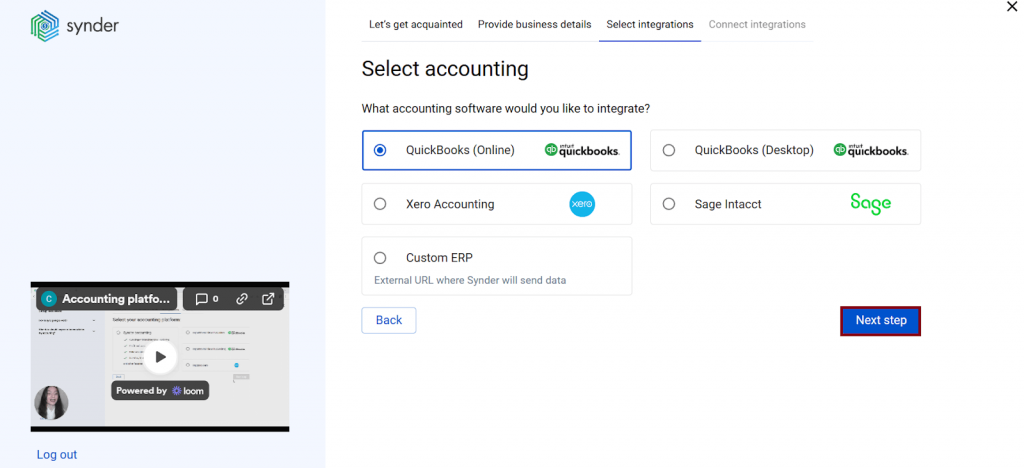

3. Connect your accounting platform – Select and connect your QuickBooks Online or Desktop account. For QuickBooks Online and Xero, you’ll be prompted to choose between Per Transaction Sync or Summary Sync mode.

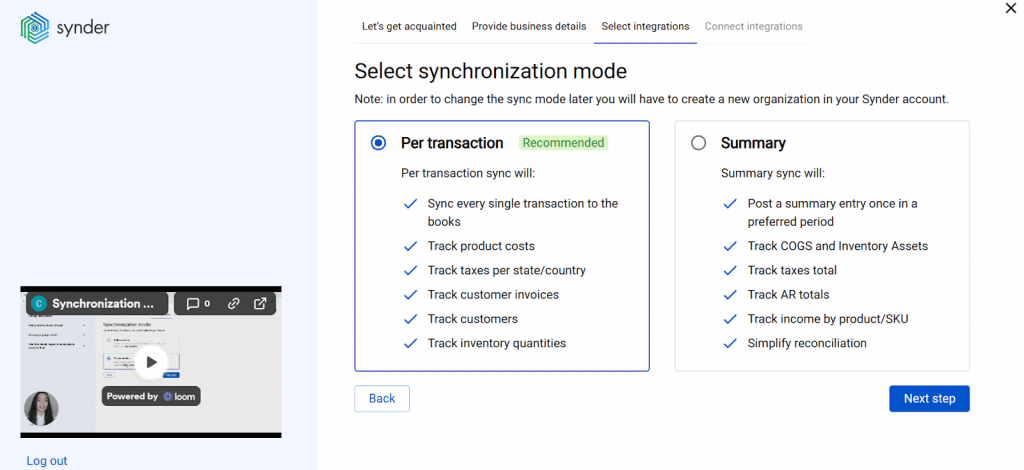

4. Choose your sync mode – You’ll be prompted to select the sync mode. Pick with the desired option: Per Transaction Sync for individual order details in QuickBooks, or Summary Sync for aggregated journal entries.

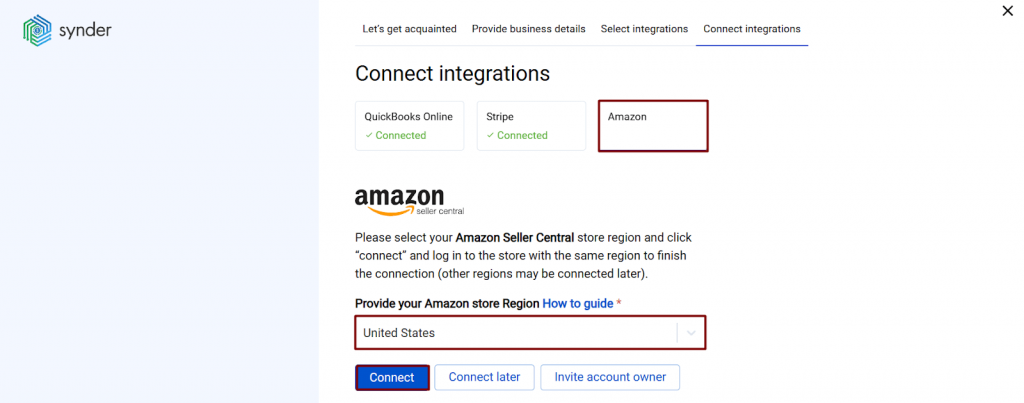

5. Connect your Amazon store – Click the Connect button for Amazon, select your marketplace region (North America, Europe, or Far East), and authorize Synder to access your Amazon Seller Central account.

6. Set up the Amazon integration – Choose an account for payouts (typically your Checking account) to enable smooth reconciliation of your Amazon transactions.

Handling ongoing sync

Once configured, Synder runs automatically. The system checks for new Amazon transactions hourly, syncs new sales, fees, refunds, and other transactions, posts data to QuickBooks in your chosen format (transaction or summary), updates clearing account balances, and creates bank transfers when Amazon makes deposits.

Importing historical Amazon transactions

If you need to import historical Amazon transactions, Synder lets you pull past data into your accounting system. You can manually import transactions from your payment platform by going to Platform Transactions and clicking Import Historical Data. Select your desired start date and choose whether to import to Synder first (to review before syncing) or sync directly to your books.

Keep in mind that you can import up to 6 months to 1 year of historical sales and up to 2 years of historical payouts due to Amazon’s API limitations. Also note that Amazon payouts can only be synced into your accounting software 14 days after they were imported to Synder due to Amazon API restrictions. During this time, payouts will show a “Pending” status in Synder, then sync automatically once the waiting period ends.

Best practices for maintaining accurate Amazon QuickBooks integration

Think you can set it up and forget? Not quite. A few regular checks keep your integration running smoothly and catch issues before they mess up month-end. Where are some regular routines:

Weekly tasks:

- Match bank deposits to clearing account transfers in QuickBooks

- Verify clearing account balance roughly equals Amazon Seller Central balance

- Check the integration dashboard for sync errors

Monthly tasks:

- Complete bank reconciliation

- Review P&L for anomalies (referral fees should stay 13-15% of sales, FBA fees proportional to units)

- Verify sales tax liability equals tax collected minus tax withheld

- Run inventory report and compare it to Amazon’s Inventory Age report

This is what helps handle Amazon fee changes when Amazon announces fee structure updates:

- Subscribe to Seller Central announcements

- Check if new fees are categorized correctly (not under “Other Fees”)

- Update integration mappings if needed for granular tracking

Don’t forget to monitor integration health:

- Set up email alerts for sync failures

- Check last sync time weekly

- Never manually import Amazon CSVs while integration is active

Key takeaways: Amazon QuickBooks integration that actually works

Manual Amazon accounting eats hours you could spend optimizing ads, sourcing better products, or negotiating with suppliers. Every settlement you manually enter, every fee you categorize by hand, every bank reconciliation you puzzle through – that’s work a computer handles in seconds. Millions of U.S. Amazon sellers face this same grind, and automation costs less than hiring help for the job. Your payoff will be time back to actually move your business forward instead of just documenting what already happened.

If you want to automate your Amazon accounting, Synder connects Amazon to QuickBooks with different sync modes, handles various fee types and marketplace facilitator tax automatically, supports multi-marketplace operations, and stops wasting your time on manual bookkeeping.

FAQ

How much does Amazon QuickBooks integration cost?

Integration tools typically range from $20 to $200 monthly, depending on features and transaction volume. Synder starts at $52/month with unlimited transactions and includes all core features. Compare this to 10-40 hours monthly on manual data entry, and the ROI is immediate. Most tools offer a free trial so you can test functionality before committing.

Can I connect multiple Amazon marketplaces to one QuickBooks account?

Yes. For example, Synder supports Amazon marketplaces worldwide and syncs all your Amazon regions (US, Canada, Mexico, European countries, etc.) to a single QuickBooks company file. If you sell on multiple Amazon marketplaces, each marketplace manages its own reserve balance separately, and Synder handles this automatically. When selling internationally with multiple currencies, you can set up separate clearing accounts for each currency in Synder settings, or use a single clearing account with automatic currency conversion to your home currency.

Does integration work with QuickBooks Desktop or only QuickBooks Online?

Most tools support QuickBooks Online, with fewer supporting QuickBooks Desktop. Synder supports both QuickBooks Online and Desktop, giving flexibility if you prefer desktop software. Note that QuickBooks Desktop requires additional setup (desktop connector software) compared to the seamless cloud-to-cloud connection with QuickBooks Online. If you’re choosing between platforms specifically for Amazon integration, Online offers simpler setup and maintenance.

What happens if I have historical Amazon data to import?

Automation tools typically import 30-90 days of historical data during initial setup, with options to extend further back if needed. Synder supports historical import back to the beginning of your Amazon selling history, though processing large data volumes (years of transactions) takes time.

How does integration handle Amazon’s marketplace facilitator tax?

Automation tools record tax collected as revenue, then post tax withheld as an offsetting expense or directly to a tax liability account that balances to zero. This treatment shows tax flowed through your business without inflating actual taxable income.