There are multiple methods for businesses to transfer large sums of money for vendor payments, two of which are Automated Clearing House (ACH) and wire transfers, each with its advantages and drawbacks depending on the specific circumstances.

This article will explore the key differences between ACH transfers and wire transfers, breaking down how each works.

Contents:

2. How does an ACH transfer work?

4. How does a wire transfer work?

5. What are the key differences between ACH transfers and wire transfers?

6. ACH or wire transfers for payments – factors to consider when choosing between the two

7. What about Electronic Financial Transfers (EFT)?

What is an ACH transfer?

ACH is a secure funds transfer method, typically requiring an account number and routing number. It facilitates money transfers between banks, credit unions, and individuals within the United States. ACH transfers can serve various purposes including processing paychecks, one-time or recurring bill payments, person-to-person (P2P) payments (e.g. PayPal, Venmo, Zelle, etc), and more.

Payments made through ACH are usually swiftly processed and reflected in accounts within hours or days. At times, ACH transfers might experience delays due to precautionary measures aimed at preventing fraud and money laundering. Also, banks frequently process ACH payments in batches, which can result in occasional delays.

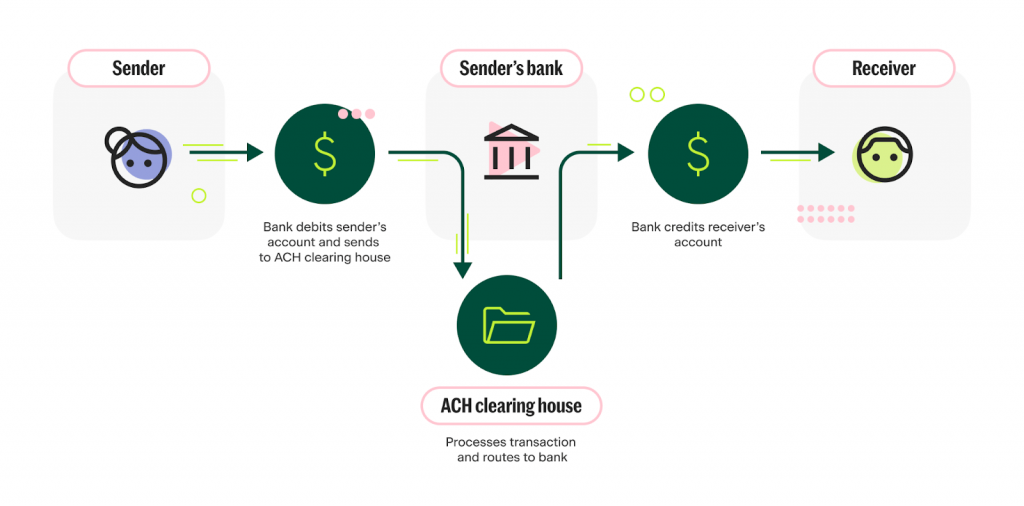

How does an ACH transfer work?

ACH transactions are initiated directly from your bank account, from which your bank bundles your transaction with others and sends them all together to a central hub (the clearing house), before getting sent to the recipient’s bank who then updates (debits or credits) the accounts.

With ACH debit, you grant permission for a specific amount to be debited from your account, while ACH credit refers to funds being added to your account.

ACH transfers are primarily designed for domestic transactions within the United States. For international vendors, it’s typically necessary to employ international wire transfers.

What is a wire transfer?

A wire transfer is often a broad term used to describe any method of electronically sending or receiving funds. However, the term is reserved for only those electronic transfers that occur from one financial institution (like a bank or credit union) to another. Wire transfers that go between the United States and a foreign country are known as remittance transfers and are usually not referred to by the same name.

In terms of wire transfer eligibility, wire transfers require the money to be available in the sender’s account before money can be sent. The sending institution will immediately remove the money before it’s cleared to be sent.

How does a wire transfer work?

When you send a payment via wire transfer, you provide your bank details related to the payment such as the amount, bank account number, and recipient’s name, address, phone number, bank account number, and routing number. The bank will then process the wire transfer by communicating with the recipient’s bank to debit (subtract) the amount from your account and credit (add) to the recipient’s account.

What are the key differences between ACH transfers and wire transfers?

1. Domestic vs International

ACH transactions are mainly used for domestic cash transfers within the U.S. or U.S. territories, meanwhile, wire transfers are more widely used around the world.

2. Speed

ACH transfers tend to take up from one to three days since funds won’t be released until they clear the ACH systems, although sometimes same-day transfers are possible. Wire transfers, on the other hand, tend to be faster and can be processed in as little as a few hours (mostly the same business day) since a wire transfer is cleared as soon as the receiving bank confirms the incoming message.

3. Cost

Usually, your bank won’t charge you for sending or receiving ACH transfers. Even if fees are charged, they tend to be lower than wire transfers. The cost of an ACH payment can be tens of cents while wire transfers tend to cost up to $35 to send domestically and more for international wire transfers, with added currency exchange fees.

4. Reversals

ACH transfers can be reversed in the case of obvious fraud or a clear mistake such as the wrong dollar amount, wrong account number, or a duplicate transaction. This is because ACH payments are moved through the ACH network, a collection of designated ACH operators who approve, process, and carry out the transaction request.

Wire transfers can be canceled up until they’re cleared but once they are, they mostly can’t be reversed or stopped.

ACH or wire transfers for payments – factors to consider when choosing between the two

The differences between ACH transfers and wire transfers can be important considerations for business owners. While both ACH and wire transfers are workable options for businesses, the right choice for a company will depend on whether it prioritizes speed or cost.

If your business regularly needs to send funds quickly, a wire transfer could be the right choice. However, wire transfers are more expensive than ACH transfers—you pay for the convenience of same-day delivery. If your business processes a high volume of payments, you may be more interested in cost-saving than speed, in which case, ACH transfers may be ideal.

Another consideration is payment size, as some banks may impose limits on ACH transfers that are time-bound (e.g. daily, weekly, or monthly) or by transaction. Wire transfers tend to be larger: for example, Fedwire handled an average of $5.4 million per transfer in 2022.

Although ACH transfers are slightly safer than wire transfers because businesses can reverse funds in the event of fraud or errors and ACH payments must pass through clearing houses with strict regulations, both options are highly secure.

What about Electronic Financial Transfers (EFT)?

Electronic Financial Transfers (EFT) is an umbrella term for transactions that move funds electronically between financial institutions (including ACH!) and come with their own pros and cons. For example, if you’re considering a transfer from one individual to another, you might think about using alternate methods such as checks, credit transactions, direct debit, or apps like Paypal, Cash App, or Venmo.

These methods are instantaneous, but they typically come at some small cost to the party sending or receiving the funds. They’re less secure, and they’re also subject to federal limitations. Still, individuals often default to these alternative methods because of the significant delay associated with both ACH and wire transfers.

Electronic financial transfers are an excellent way to make sure that you meet the requirements for a secure transaction as banks and other financial institutions always keep an electronic record of any transfers they send or receive on behalf of others as well as themselves. An additional benefit to electronic transfers is that they’re faster than physical checks. If you were to write a check, send it in the mail, and then have the recipient deposit it, there’s a several-day turnaround time associated with that transfer.

Electronic transfers happen instantly with minimal downtime reserved for security and confirmation purposes. On the off chance that funds aren’t received or aren’t adequate, an alert is triggered back to the sender rather than an automatic overdraft penalty is delivered.

Finally, wire transfers are considered to be very similar to an electronic cashier’s check. For example, if you receive a wire transfer into an account, that money can be used immediately rather than pending for a matter of hours or days. The financial institution responsible for sending the money has already verified its existence and has cleared those funds automatically.

ACH transfer vs wire transfer: The bottom line

Both ACH transfers and wire transfers offer secure methods to transfer money, each with its distinct benefits and limitations.

ACH transfers usually take more time and are less costly compared to wire transfers. However, they provide the option for reversals in certain circumstances. Conversely, wire transfers are quicker but come at a higher cost, and once completed, can’t be reversed.

Additionally, the broader spectrum of Electronic Financial Transfers (EFT) adds another layer of options, bridging the gap between traditional bank transfers and contemporary digital payment solutions. EFTs, including services like PayPal and Cash App, provide swift transactions and convenience, though they may not always match the security standards of their traditional counterparts.

So, when choosing an adequate payment method, it’s essential to evaluate your specific requirements. For businesses looking for a comprehensive solution, there are platforms available – such as Settle – that facilitate various payment methods, from ACH transfers to wire transfers and paper checks, while enabling payment tracking at the same time.

Ultimately, the choice between these options rests on several factors such as transaction volume, urgency, cost considerations, and the geographical reach of their operations. Being aware of the nuances of each method will empower both businesses and individuals to make informed decisions that align with their financial objectives and operational requirements.