Finance teams today operate in an environment that looks very different from even five years ago. Sales no longer flow through a single channel. You might be managing Shopify orders, Amazon settlements, Stripe subscriptions, marketplace fees, refunds, and tax adjustments all at once. At the same time, leadership expects faster reporting, tighter cash flow visibility, and clean audit trails. The workload has expanded, and the margin for error has narrowed.

Recent data highlights how significant this shift has become. According to Amazon’s published figures, third-party sellers account for more than 60 percent of total units sold, and over 55,000 independent sellers generate more than one million dollars in annual sales. That scale translates into accounting complexity: every sale, fee, reserve, and payout must be recorded accurately across multiple systems.

Can manual processes realistically keep up when transaction volumes grow into the thousands each month? This article explores the benefits of accounting automation software and explains why more finance teams are relying on it to manage growth, reduce risk, and maintain control over increasingly complex financial operations.

TL;DR

- Accounting automation embeds reconciliation logic and structured transaction handling directly into financial workflows.

- It delivers measurable time savings and direct cost reduction, supported by real ecommerce and SaaS success stories.

- Structured data improves reconciliation accuracy and strengthens GAAP and ASC 606 compliance.

- Solutions such as Synder demonstrate how multi-channel businesses can implement this depth of automation inside systems like QuickBooks Online, Xero, NetSuite, Sage Intacct, and Puzzle.

What is accounting automation software?

If you already work with accounting automation software, you understand the fundamentals. Transactions sync from sales and payment platforms, categories are applied, and reports update without manual uploads. The real distinction lies in how much responsibility the system assumes before the data reaches your ledger and how much still depends on manual intervention.

Basic integrations often push summary totals into your accounting platform, leaving your team to interpret fees, adjust for reserves, and resolve payout discrepancies. While this reduces some data entry, reconciliation and review remain largely manual. More advanced automation processes:

- Capture transaction-level detail

- Apply consistent categorization rules

- Record activity through clearing accounts

- Structure payouts to align with actual bank deposits

For finance teams managing high transaction volumes or subscription revenue, depth matters. Automation should embed:

- Reconciliation logic

- Compliance considerations

- Reporting accuracy

When that level of control is in place, the benefits become measurable in hours saved, costs reduced, and accuracy improved, which is exactly what the next section explores.

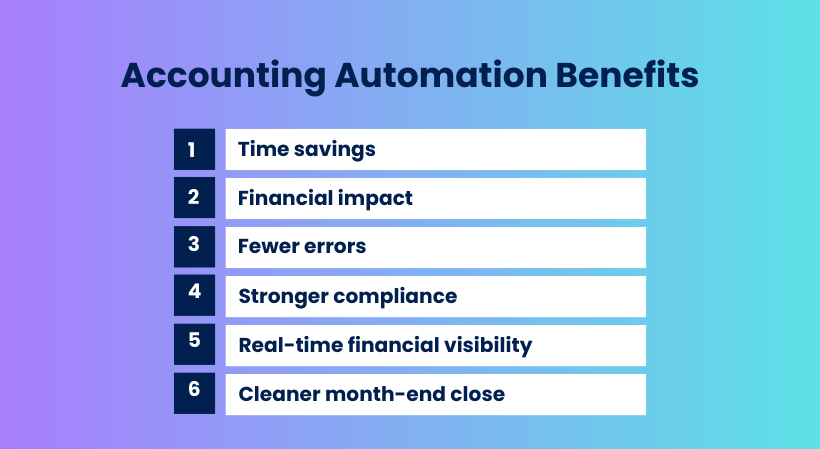

Benefits of accounting automation

See how accounting automation delivers measurable operational and financial impact across the entire finance function.

Benefit 1. Time savings that actually scale

Manual bookkeeping rarely fails all at once. It accumulates quietly in small, repetitive tasks such as exporting reports, uploading CSV files, categorizing transactions, reviewing fees, and adjusting entries. Each task might take minutes, but together they add up to days.

An ecommerce retailer, Sleepeh provides a clear example. Before implementing automation, the team spent 2-3 hours per week on manual data entry and QuickBooks management. Over the course of a year, that translated into 12-18 full workdays dedicated solely to maintaining accounting records. Once transaction syncing and categorization were automated, those hours were freed for higher-value financial oversight.

Two hours per week may not seem dramatic in isolation. Over a year, however, the cumulative effect becomes significant. For ecommerce and SaaS businesses with growing transaction volumes, time savings increase alongside revenue growth, without requiring additional accounting headcount.

Benefit 2. Turning time savings into financial impact

Less time on routine transaction work means more money saved for your finance team, especially when external bookkeepers or internal staff spend hours each month on repetitive transaction handling.

PlayYourCourt, a tech-driven tennis community platform, experienced this impact clearly. Automation reduced transaction categorization workload by more than 480 hours per year, leading to over 24,000 dollars saved annually on bookkeeping services. Those numbers reflect a structural shift in how financial operations are managed. Instead of paying for manual processing, resources can be redirected toward financial planning, analysis, or growth initiatives.

For businesses scaling across multiple channels, the financial impact becomes even clearer. When transaction volume doubles, manual workload often doubles as well. With automation in place, cost doesn’t increase at the same rate. That difference protects margins and supports sustainable growth.

Benefit 3. Fewer errors

As transaction volume increases, so does the probability of human error. A misclassified fee, an overlooked refund, or a payout posted to the wrong account may seem minor in isolation, but across thousands of transactions those inconsistencies distort financial reporting and complicate audits.

An OTC skincare company, Dermeleve faced exactly this challenge while operating across four sales channels. After implementing structured automation, reconciliation accuracy exceeded 99.5% across all channels. That level of consistency is difficult to achieve through manual review alone, especially when each platform applies different fee structures, payout timing, and reporting formats.

Benefit 4. Stronger compliance

Accuracy directly affects compliance. When revenue, fees, and liabilities are categorized correctly from the beginning, GAAP reporting becomes more reliable. For subscription-based businesses, alignment with ASC 606 requirements depends on correct timing and structured data. If source data is inconsistent, downstream reporting inherits that inconsistency.

Structured automation ensures that sales, refunds, fees, taxes, and reserves are recorded with defined logic. As a result, audit preparation becomes a verification process, not a reconstruction exercise. For finance teams that operate under regulatory scrutiny or investor oversight, that distinction is significant.

Benefit 5. Real-time financial visibility

Delayed reporting creates blind spots. When sales data, fees, and payouts are recorded days or weeks after activity occurs, cash flow decisions rely on partial information. For fast-growing ecommerce and SaaS businesses, that delay introduces unnecessary risk.

Synder customers highlight how automated synchronization improves visibility across channels. Instead of waiting for manual uploads or month-end adjustments, financial data reflects daily activity.

Such visibility directly affects cash management. When payout timing and clearing account balances are recorded accurately, leadership can assess available funds with greater confidence. Forecasting becomes more grounded in actual transaction behavior, not estimates compiled from separate reports.

For companies operating across multiple platforms, consolidated reporting also reduces fragmentation. Rather than reviewing disconnected dashboards from Shopify, Stripe, or marketplaces, financial performance is reflected within the accounting system itself. For instance, a properly configured Shopify QuickBooks integration automatically organizes all transactions in QuickBooks Online, removing the need to manually reconcile platform reports. That consolidation supports faster decision-making and reduces reliance on parallel spreadsheets maintained outside the ledger.

Benefit 6. Cleaner month-end close

Month-end is where structural weaknesses in accounting processes surface most clearly. Clearing accounts fail to reconcile, payout totals don’t align with bank deposits, and finance teams spend hours tracing differences back to individual transactions. When multiple sales channels and payment processors are involved, even small timing differences can create confusion that slows down the entire close cycle.

A wellness company, Betr Health provides a strong illustration of how automation changes that dynamic. Operating across several platforms, the company previously relied on manual reconciliation to match sales activity with payouts and bank deposits. After implementing automated transaction sync and structured payout handling, sales, refunds, and fees were recorded consistently through clearing accounts, and net transfers reflected actual deposits. Reconciliation shifted from troubleshooting discrepancies to verifying alignment.

When payouts are recorded with the correct structure and timing, and when clearing account balances correspond to platform activity, month-end becomes far more predictable. Automated matching between recorded transfers and bank deposits reduces review time, while structured summaries preserve accuracy without overwhelming the ledger with unnecessary noise.

Accounting automation in practice: How Synder operationalizes it

Synder is an accounting automation software built for businesses that sell online and process payments through multiple platforms. It records detailed transaction data directly into the accounting system with a predefined structure. Sales, refunds, fees, taxes, and payouts are posted according to mapping rules that reflect how finance teams actually manage their books.

Key standout points include:

- Integration with 30+ sales and payments platforms such as Shopify, Amazon, Stripe, etc.

- Flexible sync modes, including Per Transaction mode for detailed posting and Summary Sync mode for batch journal entries

- Clearing account logic that prepares payouts to match real bank deposits

- Customizable mapping for fees, discounts, taxes, and reserves

- Data structure that supports GAAP reporting and ASC 606-aligned revenue recognition

- Direct integration with accounting systems including QuickBooks Online, Xero, NetSuite, Sage Intacct, and Puzzle

Across the success stories discussed earlier, the measurable outcomes are consistent: fewer manual hours, lower bookkeeping expenses, reconciliation accuracy above 99 percent, and a close cycle that no longer depends on reconstructing platform activity.

For finance teams evaluating automation seriously, Synder demonstrates how integration depth and reconciliation logic can translate into operational reliability.

Considering upgrading your accounting automation setup? Start a free Synder account or book a demo to see how sales and payment data are recorded in your accounting system with structured reconciliation and full visibility.

Conclusion: From survival to strategic finance

Strong financial operations depend on how reliably data moves from sales platforms into the general ledger and how much correction is required after it arrives. When categorization, reconciliation, and payout handling are structured from the start, reporting becomes more consistent and month-end review becomes more predictable. Accounting automation addresses these structural requirements by embedding logic directly into the workflow instead of relying on manual adjustments later.

For finance professionals, the real value lies in control and confidence. When financial records reflect actual platform activity without constant intervention, leadership discussions shift toward performance, margins, and growth strategy. Tools such as Synder demonstrate how this level of structured automation can operate in practice, supporting businesses that require accuracy, scalability, and disciplined financial reporting.

FAQ

What are the main benefits of accounting automation software?

Accounting automation software reduces manual data entry, improves reconciliation accuracy, lowers bookkeeping costs, and provides more reliable financial reporting. It helps finance teams maintain control as transaction volume and operational complexity increase.

How does accounting automation improve reconciliation?

Automation records sales, fees, refunds, and payouts using structured logic, often through clearing accounts. This ensures that recorded transfers align with actual bank deposits, which reduces discrepancies and shortens the reconciliation process.

Can accounting automation support GAAP and ASC 606 compliance?

Yes. Advanced accounting automation tools preserve transaction-level detail, payment timing, and customer data. This structured information supports GAAP-compliant reporting and revenue recognition requirements such as ASC 606.

Is accounting automation suitable for ecommerce and SaaS businesses?

Accounting automation is particularly valuable for ecommerce and SaaS companies that process high volumes of transactions across multiple platforms. It helps consolidate financial data and maintain accurate records across sales channels and payment processors.

How do I choose the right accounting automation solution?

Evaluate integration depth, reconciliation logic, scalability, compliance support, and compatibility with your accounting system. A solution such as Synder is designed to handle multi-channel sales and structured reconciliation within platforms like QuickBooks Online, Xero, NetSuite, Sage Intacct, and Puzzle.