As we wrap up 2025 with tinsel, cookies, and maybe one too many holiday playlist replays, we at Synder are taking a moment to look back at what turned out to be a busy and ambitious year.

This year felt like conducting a symphony where every instrument is a different sales channel, payment processor, or accounting platform, and everyone played in perfect harmony. We reconciled millions, and saved enough business hours to binge-watch every holiday rom-com ever made (approximately 15 times).

Let’s unwrap what made 2025 the year accounting automation started being enjoyable.

The numbers that made our year

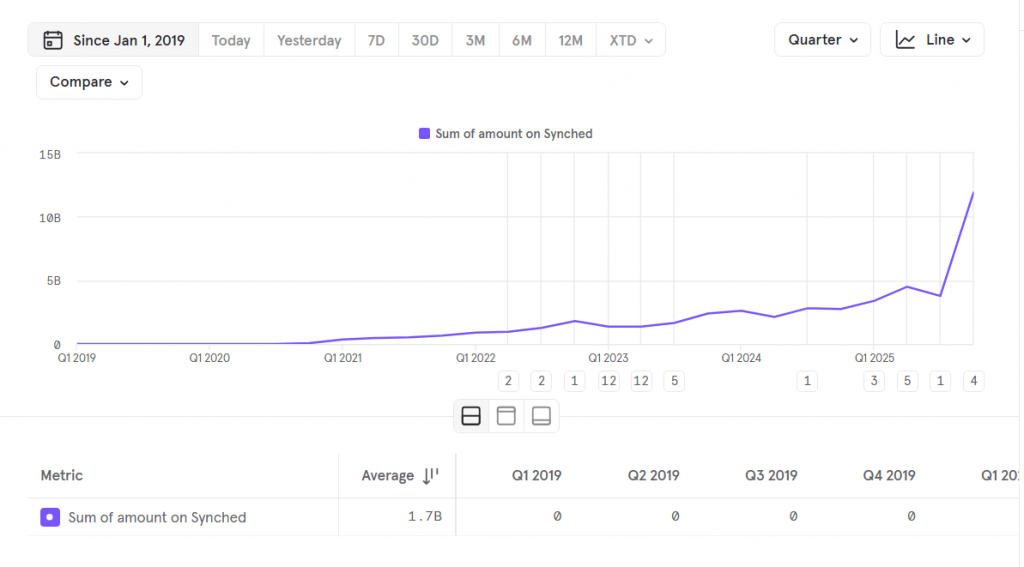

When our product team first pulled these numbers, we thought someone had accidentally added a few zeros. Nope, turns out 2025 was just that big:

$30.8 billion in amounts synced across all currencies since the day we started Synder, with the lion’s share happening this year. That’s roughly the GDP of Iceland, or about 7.7 billion lattes at your local coffee shop.

41 million transactions successfully recorded in 2025 alone. That’s 41,049,720 sales, refunds, fees, and payouts flowing seamlessly from platforms into accounting systems without manual data entry. To put that in perspective, if you tried to enter all of those at a reasonable pace manually, you’d need around 114 years. We’re guessing you have better things to do.

3 million transactions processed in a single month for one business using Summary Sync mode. That’s like manually entering a transaction every 0.86 seconds for 30 days straight. No bathroom breaks. No sleep. Just you, your keyboard, and the slow descent into bookkeeping madness. Luckily, our users chose automation instead.

These numbers aren’t just impressive because they’re big. They’re proof that businesses everywhere are ditching the spreadsheet circus and joining the automation revolution.

Our 2025 AI research: What finance leaders taught us

Speaking of revolutions, we wanted to understand how AI is actually changing accounting in the real world. Not the hype-filled, buzzword-heavy version you see in LinkedIn posts, but the messy, practical reality of finance teams trying to close faster and work smarter.

We surveyed 424 senior finance leaders to understand how AI is actually changing accounting beyond the hype. The findings: 97% see measurable AI impact with faster month-end closes and better forecasting, but only 62% have implemented it at scale. Most teams are stuck battling fragmented systems and skill gaps, using AI for basic tasks while ignoring its strategic potential. The real issue isn’t technology, it’s execution. Teams winning with AI are the ones building integrated systems and training their people properly

If you’re curious about the full findings (including which tasks are worth automating and which aren’t), you can download the complete report.

Major releases

RevRec expansion: Now playing on Xero, Oracle NetSuite, and Sage Intacct

In 2025, we brought revenue recognition automation to Xero, Oracle NetSuite, and Sage Intacct users.

Now you can run RevRec alongside Summary Sync across all major accounting platforms, which is like having your cake, eating it, and still having enough left over for breakfast.

- ASC 606 and IFRS 15 compliance? Check.

- Cleaner books with lower transaction volume? Double check.

- Manual subscription tracking in Excel? Absolutely not. We’ve banished that nightmare to where it belongs – the recycling bin.

Balance Reconciliation

Month-end close used to feel like assembling IKEA furniture without instructions: frustrating, time-consuming, and nobody’s idea of fun. But now we’ve added in-app Balance Reconciliation for clearing accounts in the Summary Sync mode.

It’s like having a GPS for your finances: verify your amounts before posting to your books, catch discrepancies before they become disasters, and actually enjoy closing the month instead of dreading it like a dental appointment.

AI Insights Dashboard

Our new AI Insights Dashboard lets you ask questions in plain English. “What are the top 3 best-selling products in the region of New York?” – and get instant visual and numerical answers.

Unlike traditional reporting tools that lock you into fixed templates or manual exports, AI Dashboards generate live accounting queries on the spot, adjusting automatically to your platforms and accounting setup.

Monthly summaries

If you’re the type who color-codes their closet and keeps their desktop cleaner than a museum exhibit, you’ll love Monthly Summaries. Generate one single, beautifully organized entry for an entire calendar month instead of 30 daily entries.

Product settings

We completely rebuilt the Products/Services settings in Per Transaction sync, and the result is even more efficient than before. You can now:

- Select whether new products sync as inventory or non-inventory

- Automatically link products to specific accounts

- Auto-verify products with positive cost values for Summary Sync

Sales recording date flexibility

Want to record sales based on payment date instead of invoice date? This new setting removes accounts receivable entries from summaries when enabled, which is perfect for cash-basis operations.

Marketplace facilitator tax

If you sell on PayPal, eBay, Amazon, or TikTok, you know marketplace facilitator tax is a total nightmare.

We’ve now added a way to record withheld marketplace tax as a non-taxable line item, so your books accurately reflect reality without inflating your tax liability. And if you liked the old method better? Toggle “Track marketplace facilitator tax as your own payable” and carry on.

New integrations: Bringing everything under one roof

Oracle NetSuite ERP

Summary Sync can now post daily summaries directly into Oracle NetSuite, complete with support for subsidiaries and classifications. If you’re running a multi-entity operation and need granular control over how ecommerce data flows into your ERP, this one’s for you.

Puzzle integration

We’ve also launched new Puzzle integration. Summary Sync now posts aggregated journal entries to Puzzle, following all of Puzzle’s posting and voiding rules. No more manual data wrangling. Just automated, seamless integration that makes you wonder why this wasn’t always a thing.

Stripe Tax integration

Sales tax compliance just got easier. Synder now supports Stripe Tax, which means you can seamlessly sync sales tax data provided by Stripe directly into your books.

TikTok statement integration

Reconciling individual orders can feel like counting grains of sand on a beach. That’s why we now support settlement-level TikTok statement import, producing one beautifully summarized entry per statement. Faster reconciliation. Less manual review.

Industry recognition

QuickBooks Platinum Member status

In October 2025, we achieved Platinum status in the QuickBooks Partner Program. Platinum isn’t just a shiny badge. It’s proof that Synder meets the highest standards for integration quality, security, and customer satisfaction. It means tighter QuickBooks integration, stronger automation, and the kind of reliable performance that lets you sleep soundly knowing your books won’t explode overnight.

Xero Finalists

Being selected as finalists in Xero’s partner awards felt like getting nominated for an Academy Award – except instead of a golden statue, we got validation that we’re genuinely helping accountants work smarter. Considering how many incredible apps live in the Xero ecosystem, this was a proud moment for the entire team.

SOC 2 Type 2

We’ve been SOC 2 Type 2 certified for a while now – the gold standard for data security that proves we handle your financial data with enterprise-grade protection. But in 2025, we got something new: our own personalized compliance badge from Insight Assurance. The certification means your data stays encrypted, secure, and protected by audited controls.

Events: Where we traded Zoom calls for real conversations

2025 was the year we got out from behind our screens and met the actual people from the industry. You’re all delightful, and we hit the road to prove it. Here are some of our favorite stops:

BDO Evolve 2025 – May 5–7, Las Vegas

BDO Alliance USA’s EVOLVE 2025: 90+ sessions on accounting, tax, and AI for firm leaders and BDO Alliance members. We demoed Synder’s multichannel sync, and the conversations with firm leaders navigating messy client data showed us exactly where automation needs to step in. We left with a clearer picture of what accounting firms actually need to simplify their workflows.

Stripe Sessions – May 6–8, San Francisco

Stripe’s flagship conference brought together fintech innovators, product leaders, and business builders to explore the future of payments and commerce. We came for the insights, stayed for the conversations, and left with approximately new feature ideas.

Intuit Connect 2025 – October 27–29, Las Vegas

Our team spent a few incredible days in Vegas connecting with accountants, bookkeepers, and QuickBooks users. At our booth, we had great conversations, learning firsthand about the challenges accountants face and how Synder fits into their daily workflows. We also took the stage at the Intuit Theatre to share what’s coming next for Synder and how we’re continuing to simplify reconciliation.

SynderHacks Wrocław – November 8–9

We hosted our first-ever AI hackathon in Wrocław, Poland, challenging developers and students to build AI-powered tools that automate the retail back office: orders, payments, payouts, expenses, returns, and disputes. Over 24 hours, teams worked with Replit Pro and Claude Code, learned from mentors, and competed for prizes while tackling the repetitive, error-prone tasks that steal time from merchants every day. The best projects showed real paths to making life easier for small business owners drowning in back-office busywork.

Digital CPA – December 7–11, Washington D.C.

DCPA brought together accounting professionals and firm leaders to talk about innovation, technology adoption, and the future of the CPA profession. This year’s main theme was AI in accounting and finance, which felt especially relevant for our company. The industry is moving fast, and we’re thrilled to be part of that momentum.

Beyond the numbers

2025 wasn’t only about hitting milestones. It was proving that automation can actually work the way people need it to.

“We learned a ton this year,” says Michael Astreiko, founder and CEO of Synder. “Expanding RevRec across platforms was harder than we expected. Building AI that actually helps instead of just sounding impressive took even more work. But the payoff made it all worth it: watching customers get reconciliation done before their coffee gets cold. Those moments are what matter. Our users show us where we need to go next. Every conversation, every feature request shapes what we build. We’ve got big plans for 2026. And we’re ready to face what this adventure is bringing up next and continue growing and serving more customers.”

Before we close the books on 2025

To everyone who helped make this year happen – thank you. Whether you’ve been doing bookkeeping with us since the early days or just discovered Synder last month, you’re part of the reason we keep pushing forward. Every business that trusts us with their transactions, every accountant who recommends us to clients, every team member shipping features and squashing bugs – this year belongs to all of you. As 2025 winds down, we’re wishing you a holiday season filled with joy, perfectly balanced books, and maybe a little less screen time than usual. May your 2026 bring growth, success, and the work-life balance that doesn’t require a vacation to achieve. Here’s to a great year ahead! 🎄✨