Tax forms often do feel like a maze, especially for smaller businesses. One form that frequently leaves people scratching their heads is IRS Form 1096, also known as the “Annual Summary and Transmittal of U.S. Information Returns.”

In this guide, we’ll simplify Form 1096 for you. We’ll uncover its purpose, identify who needs to tackle it, and provide a step-by-step walkthrough on how to obtain, fill out, and file an official Form 1096. Let’s unravel the mystery surrounding Form 1096 together.

Disclaimer: This article serves as a general overview and is not intended to provide personalized tax advice. Tax laws and regulations are intricate and can differ depending on individual situations. If you or your business require guidance on 1096 Form filing or have specific tax-related inquiries, it is advisable to seek the expertise of a qualified tax professional. Making tax preparations or decisions solely based on the information presented here is not recommended.

What is Form 1096?

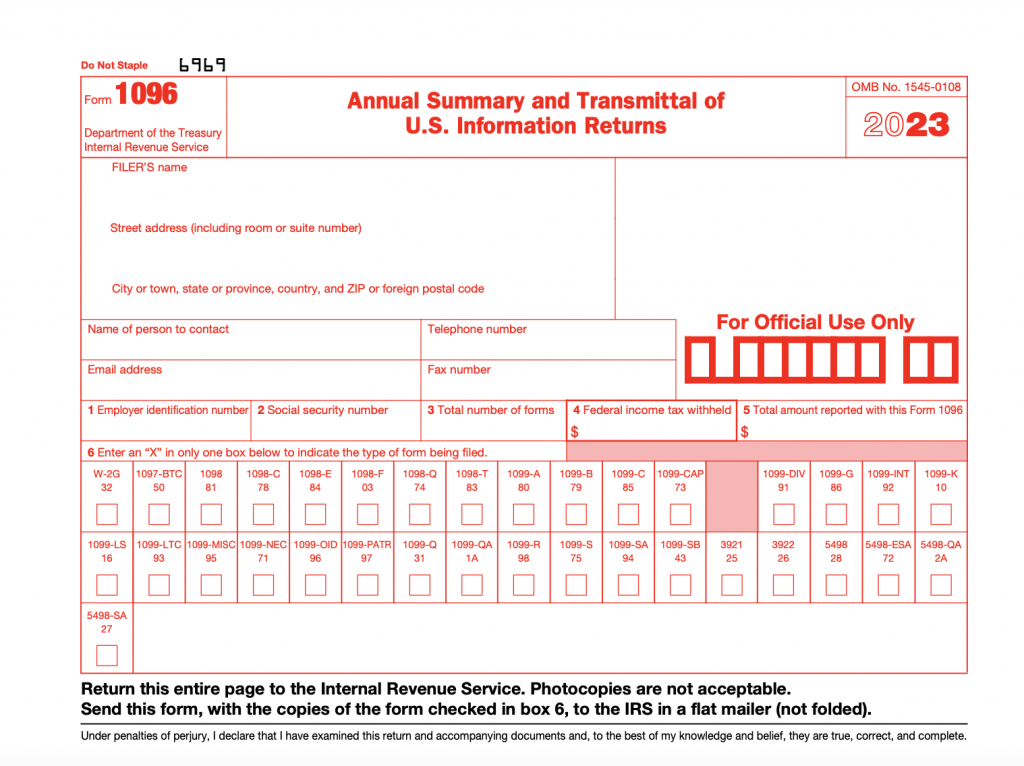

IRS Form 1096, officially known as the “Annual Summary and Transmittal of U.S. Information Returns,” is a summary document used when filing certain IRS information returns by mail. It serves as an accompanying cover sheet that provides the IRS with a quick overview of the information returns you’re submitting.

1096 Forms in details: Who is required to file Form 1096?

IRS Form 1096 plays a specific role in the tax filing process for U.S. companies that have paid contractors for their services over the past year. Importantly, it’s required only when businesses are submitting their tax returns to the IRS through the mail, rather than electronically.

The main function of Form 1096 is to serve as an accompanying document when filing certain tax forms by mail. If any of the following tax forms are being filed via mail, then Form 1096 is also required:

- Form W-2G: Used to report gambling winnings and any federal income tax withheld on those winnings.

- Form 1097: Utilized by issuers of specific tax credit bonds to report the distribution of tax credits to the IRS and credit recipients.

- Form 1098: Used to report mortgage interest of $600 or more received during the year in the course of business.

- Form 1099: A group of forms reporting various types of miscellaneous income. Note that there are multiple versions of Form 1099, and each may require its own Form 1096 when filed by mail.

- Form 3921: Employed by corporations to report transfers of stock related to an individual’s exercise of an incentive stock option.

- Form 3922: Used by corporations to report transfers of the legal title of a share of stock acquired by an employee related to the exercise of an option granted under an employee stock purchase plan.

- Form 5498: Completed for each person for whom an IRA account is maintained.

It’s important to emphasize that employees and contractors are not responsible for filing Form 1096 alongside their tax forms; this responsibility typically falls on the entity that made the payments.

Things to keep in mind when dealing with Form 1096:

- If you’re required to file 250 or more of any one type of information return, such as the 1099-MISC form, you must file electronically and are exempt from completing IRS Form 1096. Failing to file electronically when required can result in penalties imposed by the IRS.

- If you’ve already filed one of the mentioned information returns and need to make corrections, you’ll need to file a new copy of IRS Form 1096 along with the corrected return. This ensures that the IRS has accurate and updated information regarding your tax submissions.

Read our detailed guides on payroll taxes and payroll tax forms each entrepreneur should know about.

Ensuring your business is tax season-ready

Looking to get your business in top shape for tax season? Synder has you covered! Our tool takes the hassle out of managing your ecommerce transactions and SaaS subscriptions by automating the recording and categorization of these financial activities directly into your accounting software. Say goodbye to the headache of sifting through piles of receipts and invoices; Synder keeps your financial records accurate and up-to-date, making tax preparation a breeze.

Our platform goes a step further by simplifying reconciliation and providing you with comprehensive financial reports, ensuring you have all the insights you need for tax compliance. Plus, we integrate seamlessly with popular accounting platforms like QuickBooks and Xero, minimizing manual data entry and reducing the risk of errors.

Ready to see how Synder can transform your accounting process? Sign up for our 15-day free trial and experience the benefits firsthand. Or, if you prefer a more personal touch, reserve a spot at our Weekly Product Demo to witness the magic of smart accounting software in action!

Where can I get an official 1096 Form?

Obtaining Form 1096 is easy, and here are the steps you should follow:

- Step 1. Visit the official IRS website.

- Step 2. Look for “Online Ordering for Information Returns” and click on it.

- Step 3. Specify the number of Form 1096s you require, and the IRS will mail them to you.

- Step 4. Add the forms to your order by selecting “Add to Cart.”

- Step 5. Review your order by clicking on “View Cart,” and when you’re ready, proceed to “Checkout” to complete the order.

It’s important to note that the IRS provides these forms free of charge, and they typically take about ten business days to be delivered to your address. Moreover, for proper processing, the forms must be in a scannable format. Only the official forms available on the IRS website meet these requirements. If you choose to print and mail a form that isn’t scannable, the IRS won’t be able to scan it, which potentially may result in penalties.

However, there are exceptions for certain low-volume returns. You can submit the printed-PDF Form 1096 for the following forms: 1097-BTC, 1098-C, 1098-MA, 1098-Q, 1099-CAP, 1099-H, 1099-LTC, 1099-Q, 1099-QA, 1099-SA, 3921, 5498-ESA, 5498-QA, and 5498-SA.

Can I download a 1096 Form?

When it comes to 1096 tax forms, you can’t just hop onto the IRS website and download them like you might with other tax documents. These forms have specific requirements. They need to be in a special format that’s scannable, with fields that the IRS uses to keep tabs on submissions from different entities and payees.

What’s important to know is that 1096 tax forms are meant exclusively for paper submissions. You can’t use them for electronic tax returns like you can with some other forms. So, if you’re dealing with 1096 forms, you’ll need to go the traditional route and have physical copies on hand to fill out and submit.

Understanding IRS 1096 Form: How to complete Form 1096?

Completing IRS Form 1096 may appear daunting at first, but it’s a relatively straightforward process once you grasp the required steps. Let’s review the steps that will help you to correctly fill out Form 1096.

Step 1. Business information

To begin, you’ll need to provide your business information at the top of the form. This includes your company’s name, address, and the total number of returns your business intends to file.

Step 2. Personal information

Proceed to enter your personal details in the following section. This includes your full name, contact information (phone number, email address, and fax number), home address, city, state, country, and zip code. If you have an accountant, there’s a space to include their contact details as well.

Step 3. EIN or SSN

In Box 1, you should enter your Employer Identification Number (EIN) if your business possesses one. However, if you’re a sole proprietor without an EIN, Box 2 is where you should provide your Social Security Number (SSN). Only complete either Box 1 or Box 2, depending on your business’s structure.

Step 4. Number of forms

Box 3 is designated for specifying the total number of forms you plan to submit to the IRS. For instance, if you’re submitting five 1099-MISC forms, indicate “5” in Box 3. It’s crucial to note that you’re indicating the quantity of forms, not the number of pages.

Step 5. Withheld federal income tax

Calculate the total amount of withheld federal income tax from all the forms you’re filing and record this sum in Box 4. If no federal income tax was withheld, simply write “0.”

Learn more about income tax return.

Step 6. Information return

Box 6 requires you to mark an “X” next to the type of information return you’re submitting. This step helps the IRS identify the specific return you’re sending. In case you’re filing multiple types of information returns, remember to complete a separate Form 1096 for each.

Step 7. Non-employee compensation

If you’re filing Form 1096 alongside 1099-MISC forms reporting non-employee compensation (NEC), check Box 7. This applies when you’re reporting payments made to independent contractors. If this doesn’t pertain to your situation, leave Box 7 blank.

Step 8. Review and file

After completing Boxes 6 and 7, take a careful look at your Form 1096 to ensure accuracy. Sign, date, and provide your title at the bottom of the form. Don’t forget to make copies of the form for your records.

By following these steps, you can confidently complete Form 1096, ensuring a hassle-free process for your business.

Understanding IRS 1096 Form: How to file Form 1096?

Properly filing IRS Form 1096 involves a structured process to ensure compliance with tax regulations. Here are the key steps to follow:

Step 1. Group by form number

After completing the forms, organize them by their specific form numbers. If you’re dealing with Form 1099-MISC, consider submitting it separately from other forms. Notably, even if you are required to send Form 1096 to the IRS, you do not need to include it when providing the 1099 copy to your contractor.

Step 2. Determine the mailing address

The mailing address for your completed information returns and Form 1096 depends on your business’s location. It’s crucial to cross-check the IRS Form 1096 PDF to confirm that you are sending your documents to the correct IRS address. Check the exact address where you need to file your 1096 Form at the IRS website.

Step 3. Refer to IRS instructions

The IRS provides comprehensive instructions for filing paper returns in their official 1099 instructions document. These instructions cover various aspects, including guidelines on the use of staples, print type, and other important details. Consulting these instructions before mailing your returns ensures that you adhere to IRS guidelines.

Remember that there are exceptions for specific low-volume returns. As we’ve already mentioned, if you’re dealing with any of the following IRS business forms, you have the flexibility to print the form and Form 1096 from the IRS website, complete them, and mail them according to your business’s location: 1097-BTC, 1098-C, 1098-MA, 1098-Q, 1099-CAP, 1099-H, 1099-LTC, 1099-Q, 1099-QA, 1099-SA, 3921, 5498-ESA, 5498-QA, 5498-SA. These exceptions streamline the filing process for these specific forms, offering convenience to businesses.

What is the due date for submitting Form 1096 to the IRS?

The due date for submitting Form 1096 varies based on the type of information you are reporting and the method of submission, with possible due dates falling on January 31, February 28, or March 31.

- If you’re reporting nonemployee compensation using Form 1099-NEC, the due date for both Form 1099-NEC and Form 1096 is January 31.

- For other types of 1099 vendor payments or certain information returns (e.g., Form 1097), the due date for Form 1096 is February 28 for paper filing or March 31 for electronic filing.

What is the deadline for filing IRS Form 1096 in the 2023 tax year?

In the 2023 tax year, there are important deadlines to keep in mind when it comes to the 1099 Forms:

- The deadline for providing recipients with their copies is January 31, 2025.

- If you’re opting for paper filing, mark your calendar for the deadline on February 28, 2025.

- For those planning to e-file, the cutoff date is April 1, 2025.

Additionally, it’s essential to note that the deadline for reporting 1099-MISC with non-employee compensation (NEC) is also set for January 31, 2025. Staying on top of these dates ensures compliance with tax regulations for the 2023 tax year.

Need info on other tax forms? Explore our articles on Form W-2 , Form 944 and Form 1120.

Wrapping up 1096 Forms

Becoming a pro at handling IRS Form 1096 is a significant milestone in the tax-filing journey, especially if your business deals with independent contractors or various types of income reporting. Throughout this guide, we’ve broken down the complexities of Form 1096, shedding light on its purpose and helping you identify who’s responsible for wrangling with it.

However, to be sure you do everything correctly, it’s better to consult with a tax professional. Collaborating with a tax professional is like having a trusted guide by your side throughout your tax journey. These experts are well-versed in the intricacies of tax forms and can provide you with invaluable insights. They’re your go-to source for answers to all your questions, ensuring that you not only complete the necessary forms but also do so accurately and punctually. While, yes, you’ll need to budget for their services, think of it as an investment that can save you from future headaches, excessive time consumption, and those dreaded IRS fines that might have otherwise come your way. In the end, it’s a smart move that can offer you peace of mind and smooth sailing through the tax season.

Disclaimer: This article serves as a general overview and is not intended to provide personalized tax advice. Tax laws and regulations are intricate and can differ depending on individual situations. If you or your business require guidance on 1096 Form filing or have specific tax-related inquiries, it is advisable to seek the expertise of a qualified tax professional. Making tax preparations or decisions solely based on the information presented here is not recommended.