- Working with Per-Transaction Sync

- How to check that Per Transaction Sync is working right

- Important details to know

- Troubleshooting

- FAQ

This guide explains the process of Per-Transaction Sync in Synder and how to use it correctly. We’ll help you understand what data is created and to confirm your setup is working as expected.

Use this guide if:

- You are using Per Transaction Sync

- You want transaction‑level detail in your accounting platform

Don’t use this guide if:

- You are using Summary Sync and/or want to know more about it

Working with Per-Transaction Sync

Per Transaction Sync posts each sale, refund, fee, and payment as a separate record in your accounting platform.

Step 1: Make sure your platforms are connected

Per Transaction Sync works once your sales platforms and accounting platform are connected to your Synder organization.

- Open your Synder organization.

- Connect your sales payment platforms.

- Connect your accounting platform.

Integrate Stripe to QuickBooks for data sync and reconciliation

Step 2: Import historical data

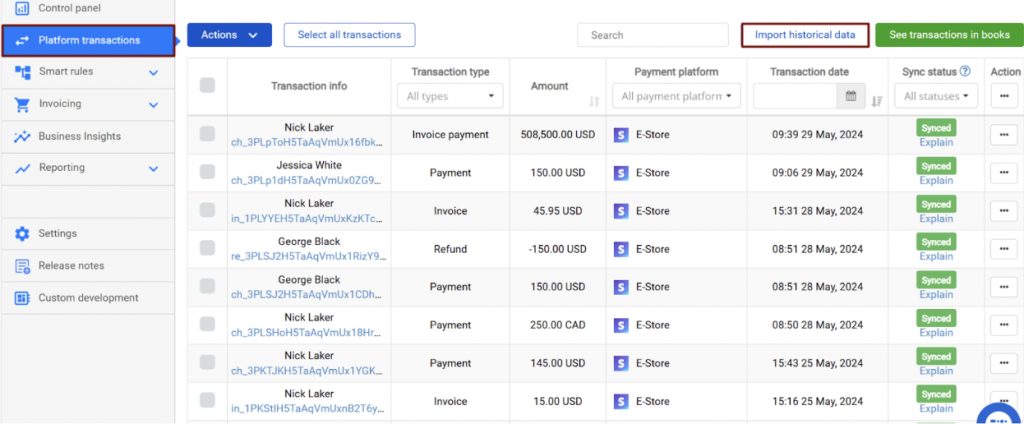

- Open Platform transactions from the left‑hand menu.

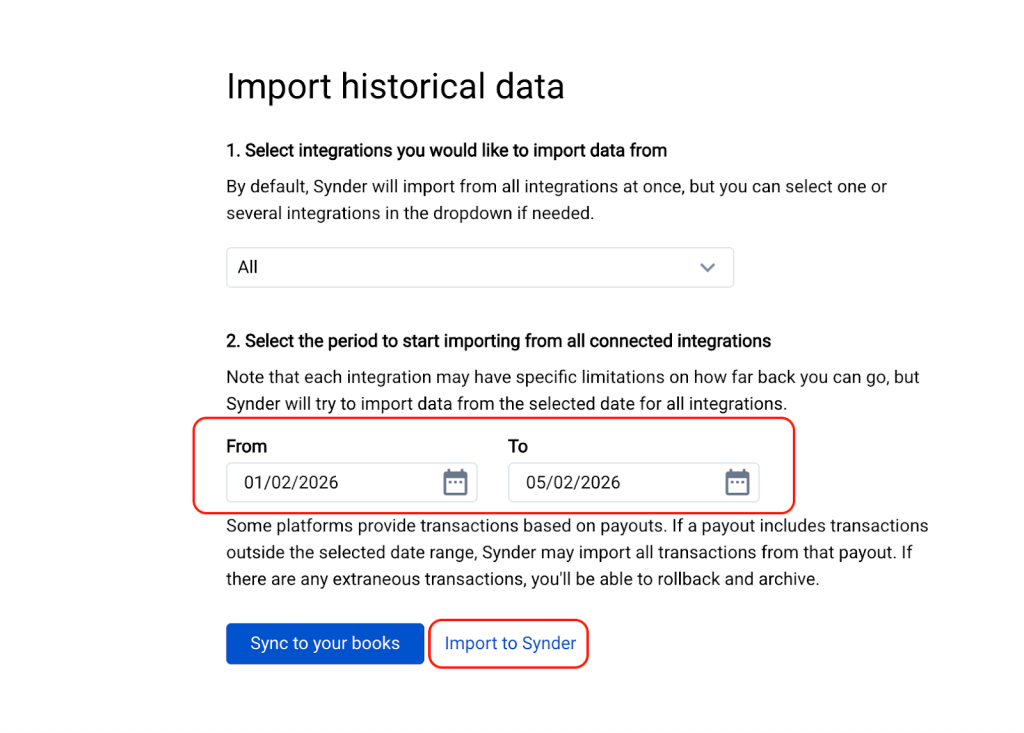

- Click Import historical data.

- Choose the start date for the import.

Note: We recommend importing transactions into Synder first so you can review them before posting anything to your books.

Run the import and wait until transactions appear in the list.

Step 3: Test syncing a small set of transactions

Before syncing a large number of transactions, we recommend running a test sync.

- Open Platform transactions.

- Select a small number of transactions.

- Click Sync.

- Check your accounting platform to confirm that the results look correct for your accounting needs.

- If yes, sync the remaining transactions. You can do so either by selecting them individually or in bulk.

Step 4: Adjust the settings (optional)

- If needed, review or adjust your settings in the Settings section.

- If you are unsure which settings to use, contact the Synder support team — we can help review your setup and suggest adjustments.

How to check that Per Transaction Sync is working correctly

This section helps you confirm that Per Transaction Sync is functioning correctly and that data is flowing from Synder to your accounting system as expected.

Then keep your checklist:

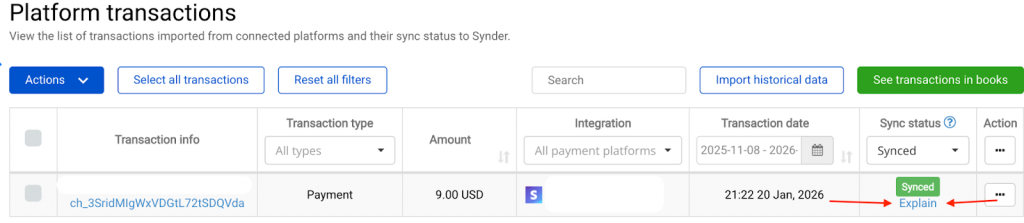

- You see transactions listed in the Transactions tab in Synder.

- When you click Sync, transactions successfully change their status to Synced in Synder.

- New transactions appear on your books, inside the clearing account.

Important details to know

Per Transaction Sync posts each financial event to your accounting system as a separate record. The notes below explain how this behavior affects reporting, data structure, and switching between sync modes.

- Per Transaction Sync creates multiple individual records in your accounting platform, such as separate sales, refunds, expenses, payments, and related customers or products created as part of those transactions.

- This mode is best suited for detailed reporting and transaction‑level review.

- Data synced using Per Transaction Sync cannot be converted into summaries inside the same organization. To use Summary Sync, you must create a new organization, and the change applies only to future data.

Troubleshooting

Use the steps below to diagnose common Per Transaction Sync issues and verify how transactions are posted in your accounting platform before making any configuration changes.

Problem: If you synced transactions, but don’t see them in your accounting platform.

What to do:

- Check the sync status in the Transactions list and confirm that the transaction is in status Synced. If not, please see this guide with the detailed explanation of each sync status: Sync Statuses and What They Mean. If yes, follow the next step.

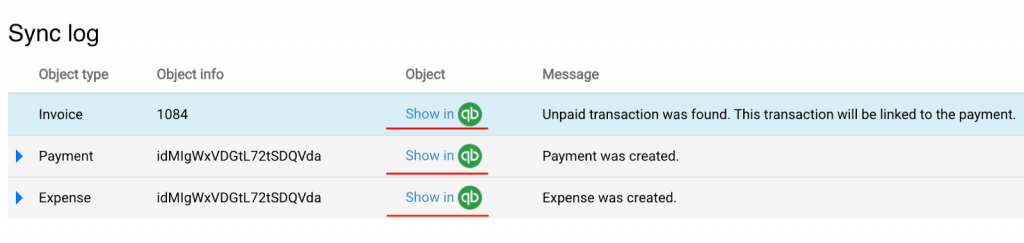

- Locate the transaction and click Explain under Sync Status. Scroll down until you see the documents Synder created in your accounting software. Click Show in QBO to open the document in your books.

Problem: I am not satisfied with how the transactions are presented in my accounting records.

What to do:

- Remove the synced transactions from your accounting platform by clicking Rollback next to the transaction.

- Open Settings, reconfigure the posting style, and click Update.

- Return to the Platform Transactions tab, locate the transaction, and click Sync. It will be posted with the new settings applied.

FAQ

What kind of data does Per Transaction Sync post?

Each sale, refund, fee, and payment is posted as a separate accounting record. You can review the exact types of transactions supported for each integration in this guide: Transaction Types Supported From Synder.

When is Per Transaction Sync a good choice?

Per Transaction Sync works well if you need detailed transaction-level visibility, want to review individual entries, or rely on transaction-based reporting.

Can I switch from Per Transaction Sync to Summary Sync later?

Yes, but this requires creating a new organization and does not affect past data.