If you want to avoid manual work and are looking for the perfect finance software for easy cash flow management – you have come to the right place. Synder mirrors the actual money flow in your accounting system, automates and simplifies the accounting by auto-recording live data into your accounting company.

Having connected Payrix to your books, all your individual transactions along with all the information they contain (customer’s name, transaction amount, taxes, items, taxes, shipping and so on) will be automatically recorded in the Payrix (required for Synder) account (a Clearing account that represents Payrix in your books), categorized and prepared for one-click reconciliation. Be sure that the system will recognize all payment details and record them in your accounting system to keep your QuickBooks or Xero reporting accurate and up-to-date in accounting terms.

Connect your Payrix to Synder and check out how precise, detailed, and easy accounting can be with its help!

Overview:

Start the Payrix integration from scratch

1. Create an account

If you’re getting started with Synder you’ll need to create a free Trial account and connect your accounting system first. Check out this guide if you would like to integrate your payment platform with QuickBooks Online or Xero, and this article to connect your QuickBooks Desktop company.

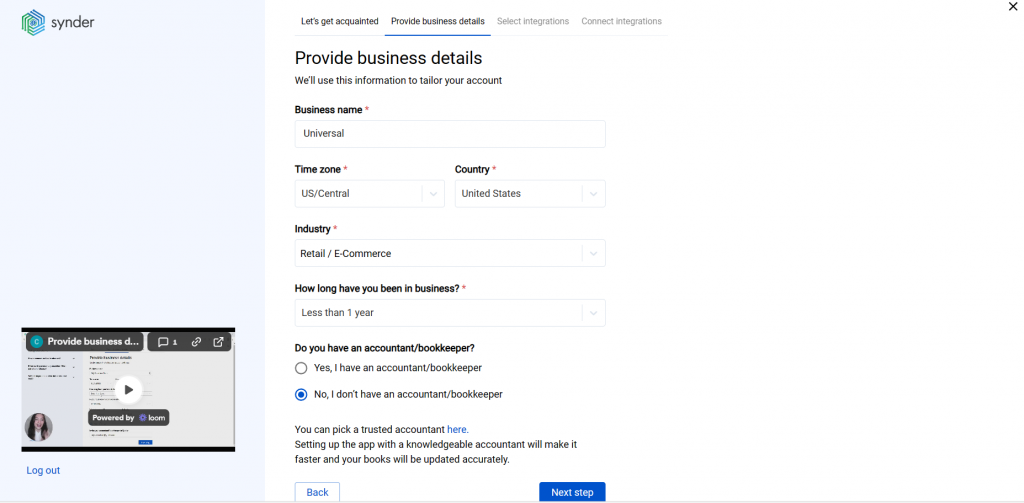

2. Provide your business details

Going through the set-up process of an Organization for your QuickBooks/Xero company, fill in the information about your business and hit the Next step button.

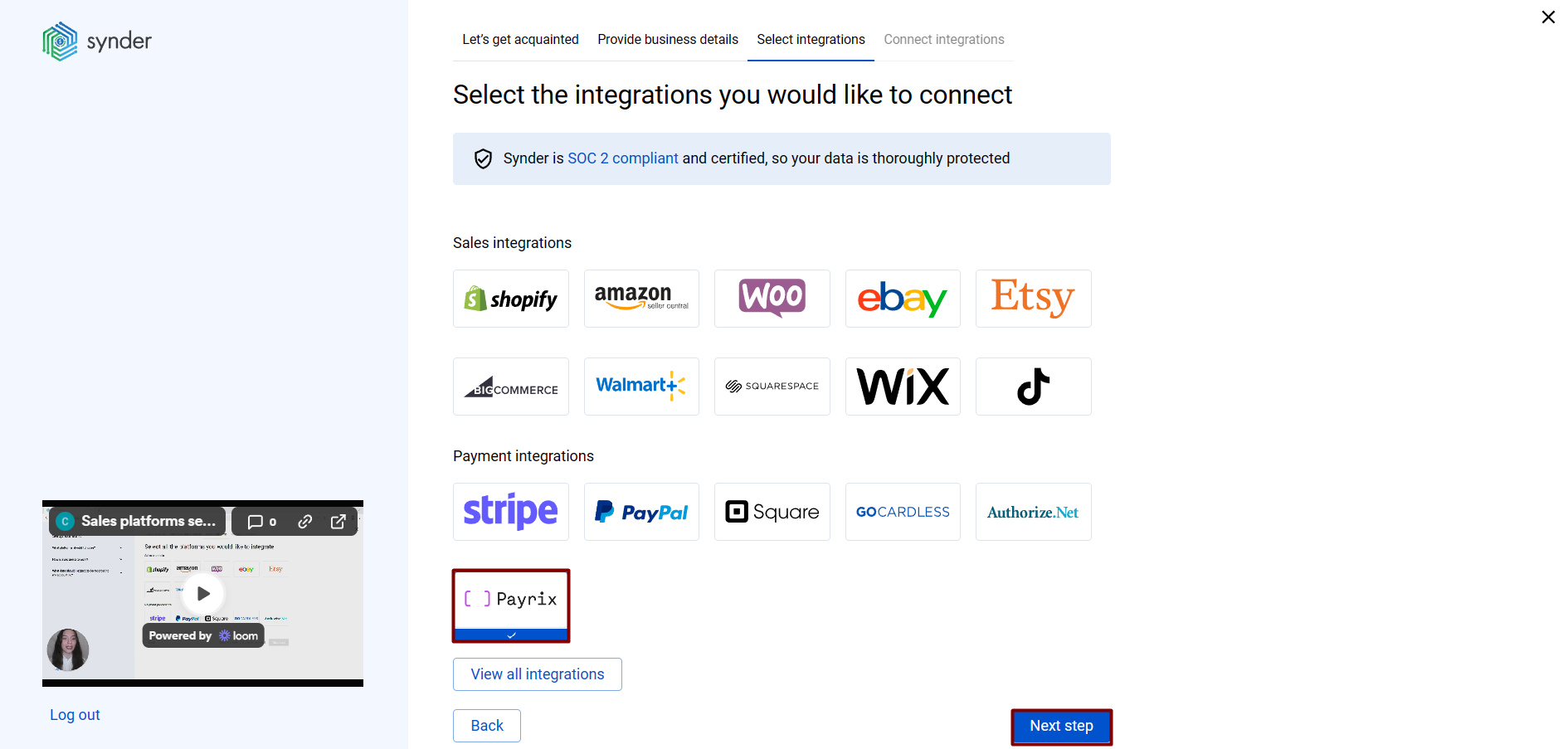

3. Select the platforms you’d like to integrate

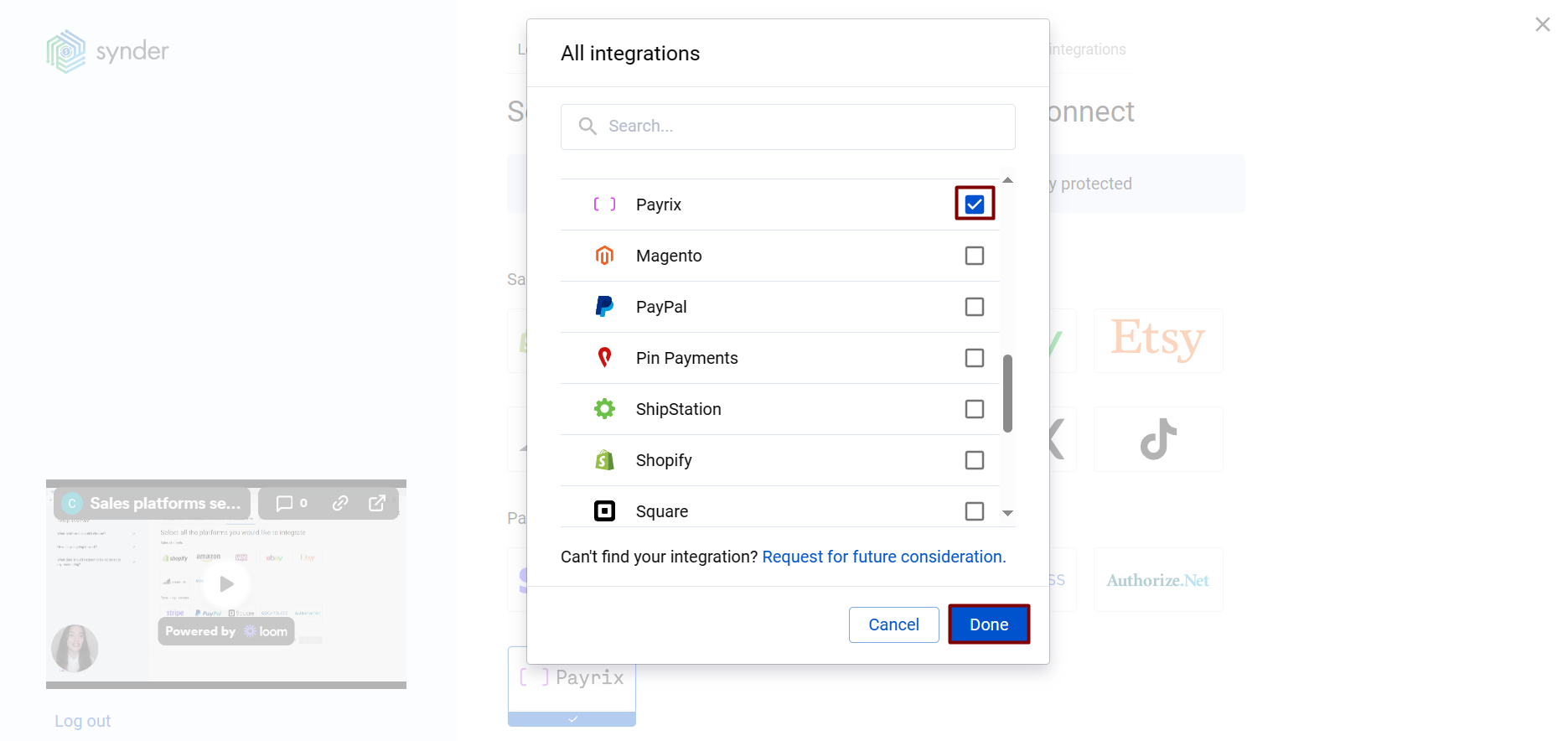

Now you need to select the platforms you would like to connect to Synder. Click View all integrations to see the list of all available platforms.

Note: Mark all the services you are using to receive payments, you will be able to connect all of them right away or skip the connection of particular integrations and set them up any time later.

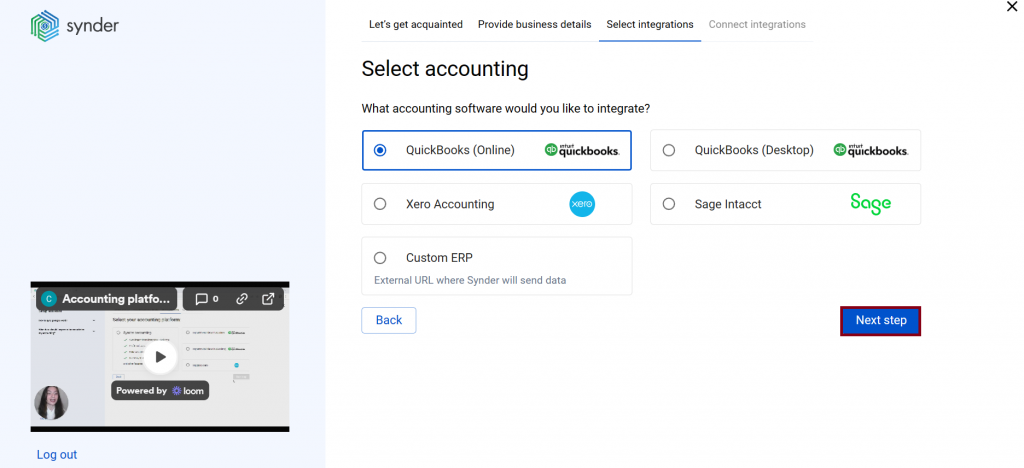

4. Connect your accounting platform

Select the accounting company you’d like to connect to Synder and click on Next step.

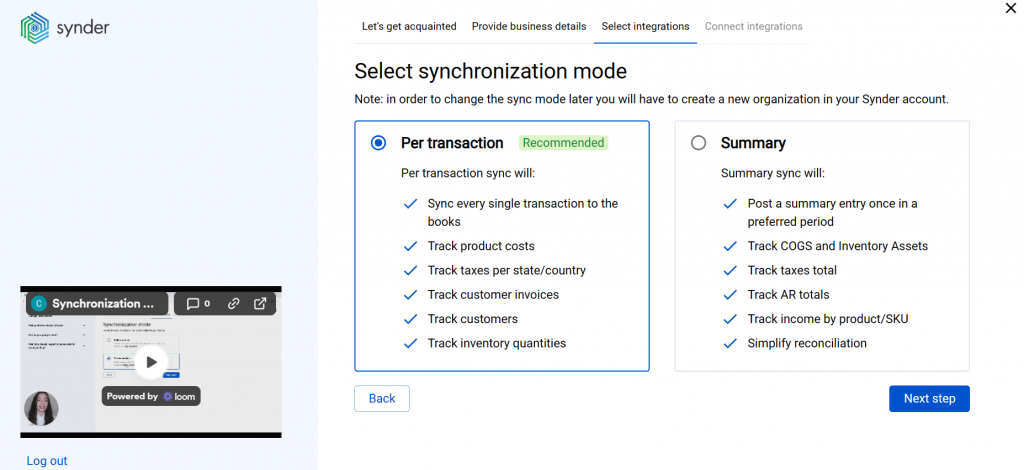

Note: If you are connecting QuickBooks Online or Xero, you will be prompted to select the sync mode. Proceed with the desired option.

Click on Connect to connect your accounting company.

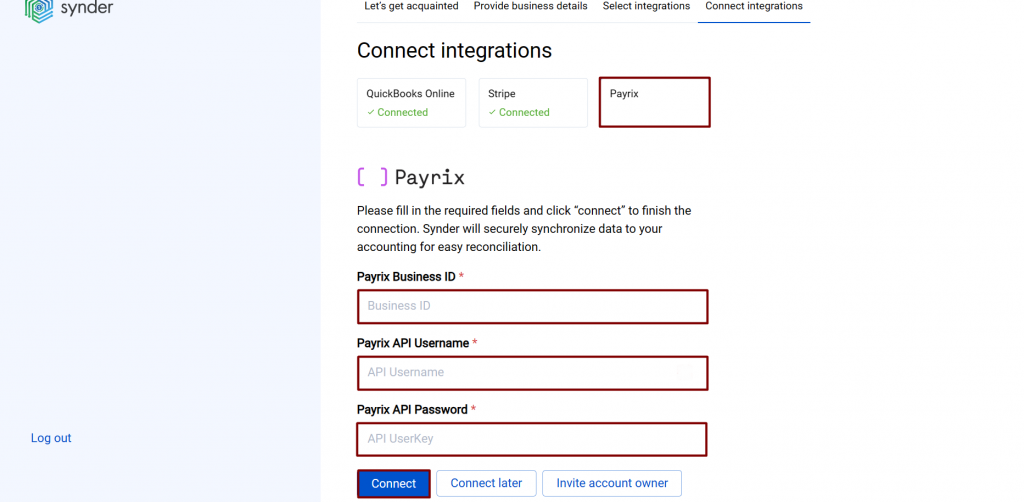

5. Connect your Payrix account

Almost there! To complete the setup, you just need to connect your Payrix and other sales platforms to Synder.

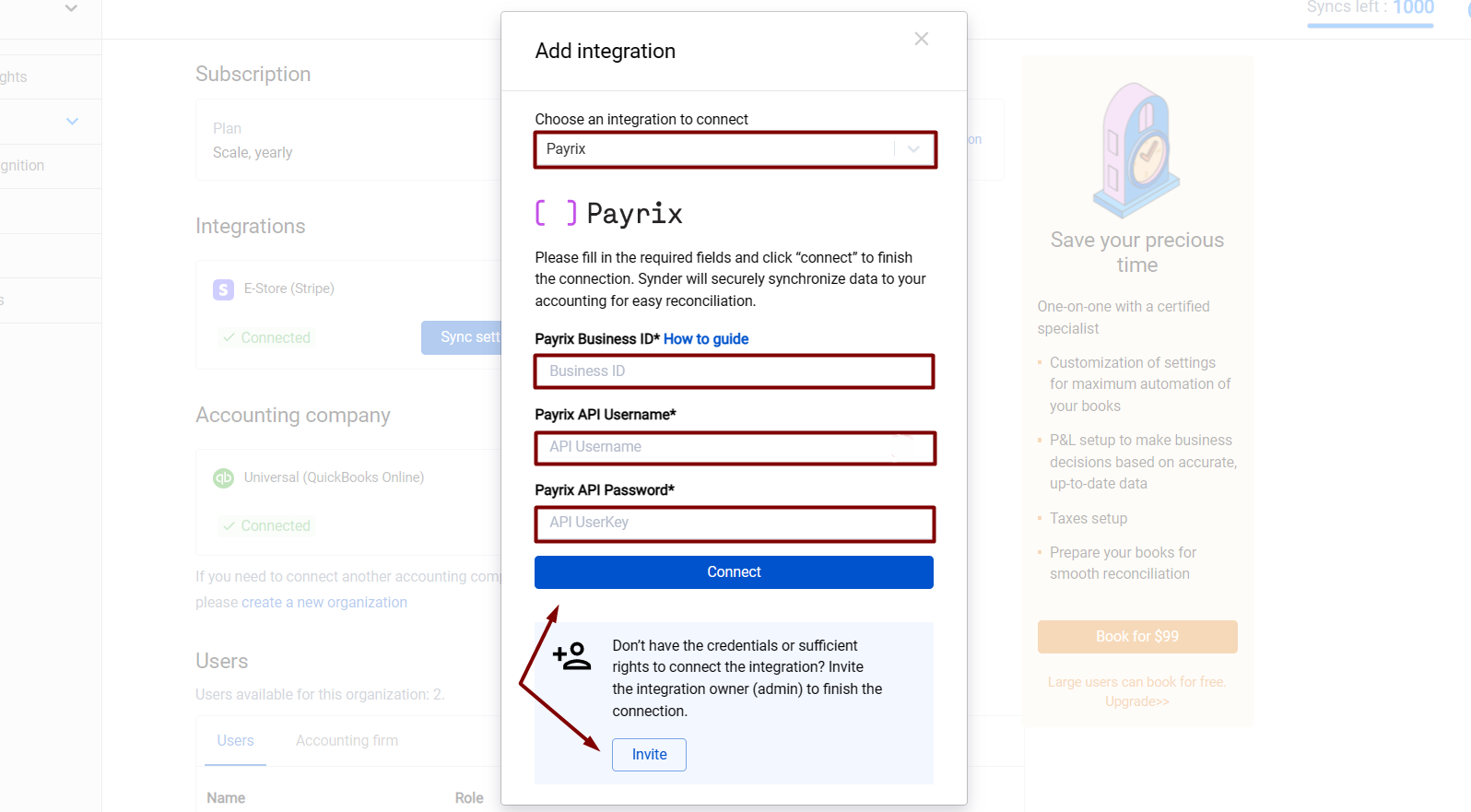

You will be prompted to fill in yourBusiness ID, API Username, and API password to let Synder see and synchronize your transactions.

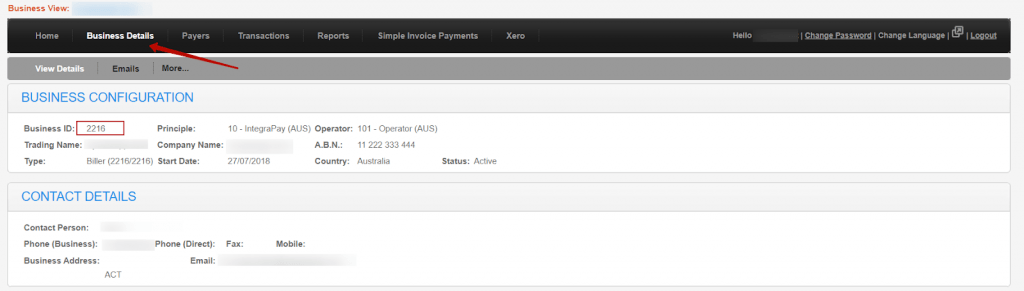

You can find your Business ID in the Business Details section of your Payrix website.

Please, reach out to the Payrix support team to obtain the API Username and API password. Once you receive all the details needed – enter the data into the corresponding fields and continue the setup.

Click on Connect if you are an admin, or Invite account owner if you do not have admin access in Payrix.

Alternatively, you can skip the connection and set it up later in the Settings:

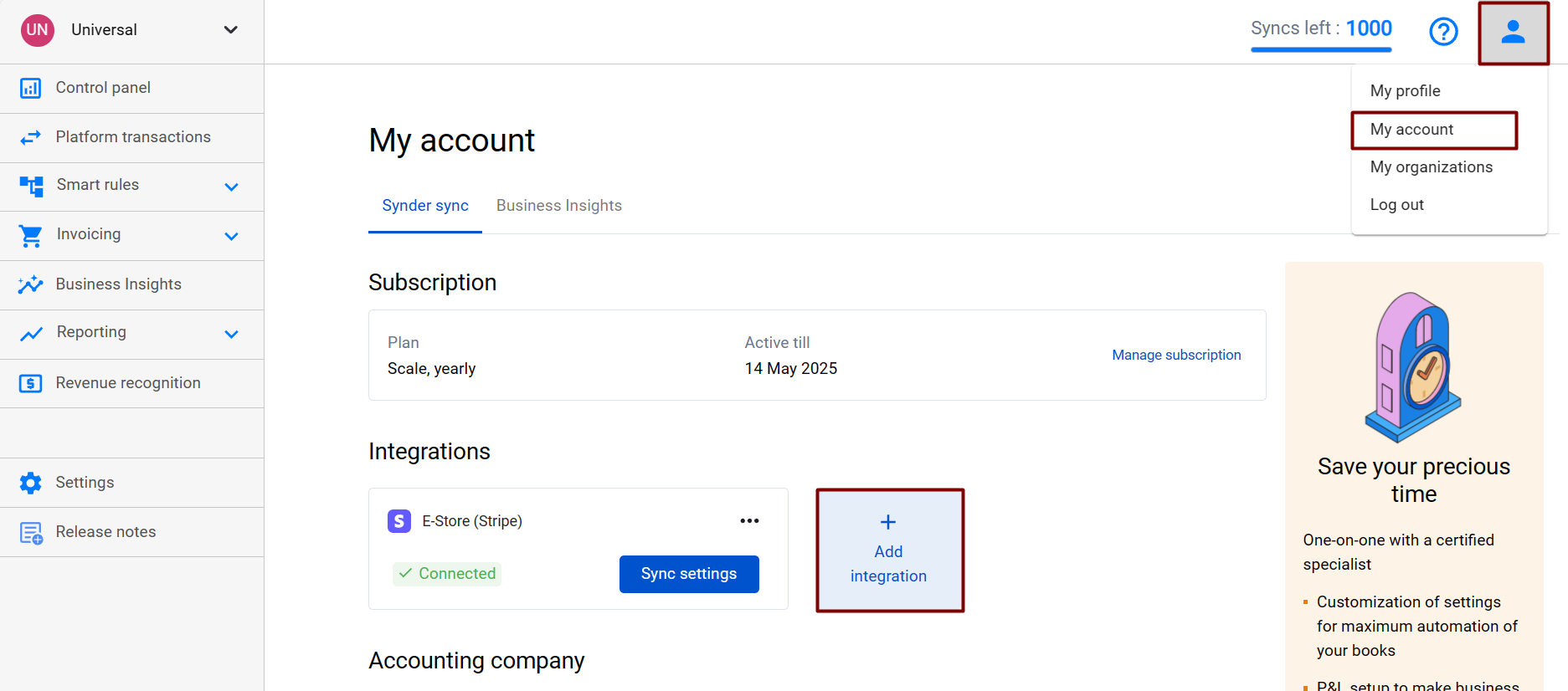

a. Click on the Person icon in the upper-right corner and select My account.

b. In the Integrations section, click Add integration.

c. Select Payrix and click Connect. If you don’t have admin rights, send an invitation to the account owner.

Note: You can find our detailed guides on how to connect your sales channels and payment providers to Synder accounting/QuickBooks /Xero via Synder in our Help center.

6. Set up the Payrix integration

To complete the setup for the Payrix integration, choose an account for payouts (usually, your Checking account) that will allow smooth reconciliation of your Payrix transactions in one click. Hit Continue to finish the configuration.

Tips and tricks on the Payrix integration

Note 1. Import and synchronization of transactions into the accounting platform will be performed only when the corresponding settlement (payout), which includes net summaries of transactions, is generated in Payrix.

Note 2. Synder records Payrix fees as separate Expense transactions and Payrix sales as Sales Receipts in your books.

Note 3: Check out our 3 Must-Watch beginner guides to find out how Synder can help you automate your bookkeeping.

Reach out to the Synder team via online support chat, phone, or email with any questions you have – we’re always happy to help you!