Overview:

Having connected your company and your accounts, you can start customizing your settings for PayPal QuickBooks integration. To access your PayPal settings, select the organization needed at the top left of the page → Settings button on the left menu of Synder → choose the PayPal integration from the dropdown. Alternatively, click on the Person icon in the upper-right corner → hit My account → click on Sync settings under PayPal.

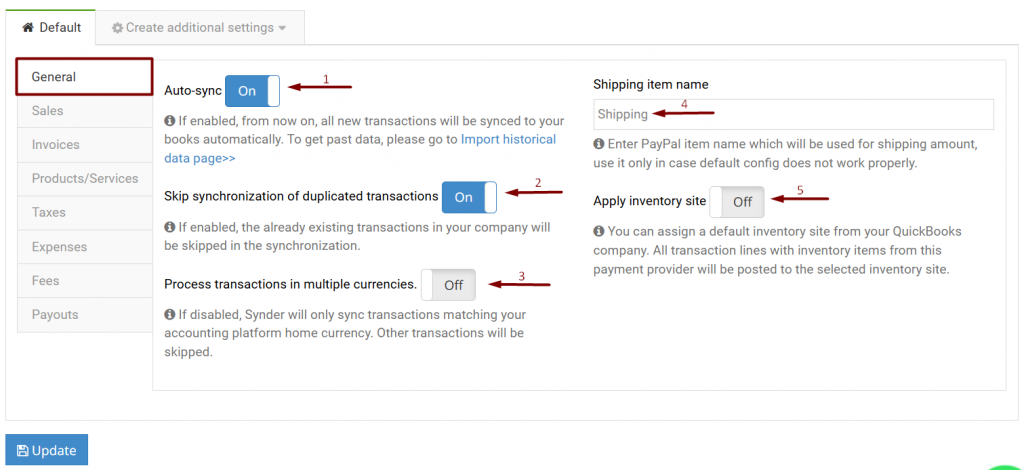

1. General settings

- Auto-sync – when “ON”, the system will automatically synchronize transactions that come into the system after the setting has been enabled. When “OFF”, you can manually choose transactions to be synced.

Learn more about auto-sync Synder mode. - Skip synchronization of duplicated transactions – when “ON”, transactions that already exist in your QuickBooks Desktop company will not be synced again.

- Process transactions in multiple currencies – when “ON”, the system will synchronize transactions not only in your home currency, but also in multi currencies. When “OFF”, the synchronization of transactions in other currencies will be skipped.

- Shipping Item name – here you can enter the PayPal item name, which stands for shipping.

Note: Use it only in case you have shipping as an item in your sales transactions, if you have it in the shipping field in PayPal, everything will work correctly by default. - Apply inventory site – assign a default inventory site from your QuickBooks company. All transaction lines with inventory items from this payment provider will be posted to the selected inventory site, ensuring accurate tracking and management.

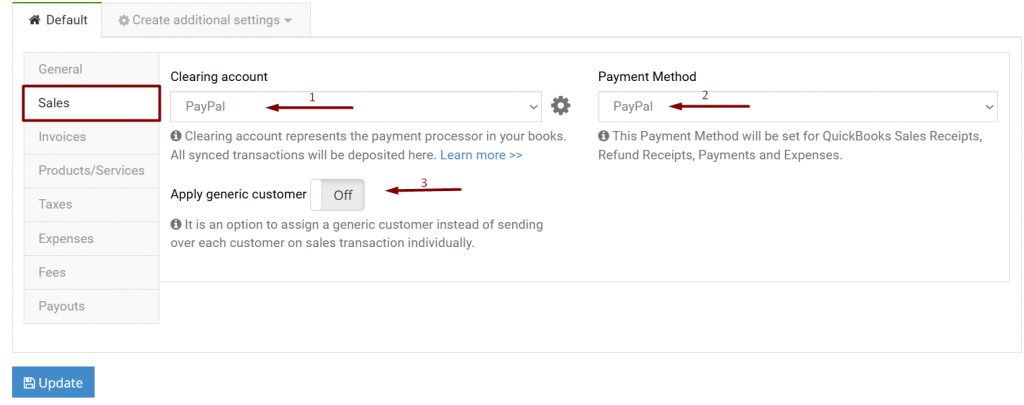

2. Sales

- Clearing account – a clearing account that QuickBooks sales receipts, fees, refund receipts and payments will be deposited into. In case you do not have an account with “PayPal” in its name, it will be auto-created in your Chart of Accounts (by default called “PayPal”).

- Payment Method – choose a payment method (cash, check, credit card, or PayPal) that will be set for QuickBooks sales receipts, refund receipts, payments, and expenses.

- Apply generic customer – by enabling this setting, all future synced transactions will be recorded with the specific name you select. When “OFF,” the original customer names will be used.

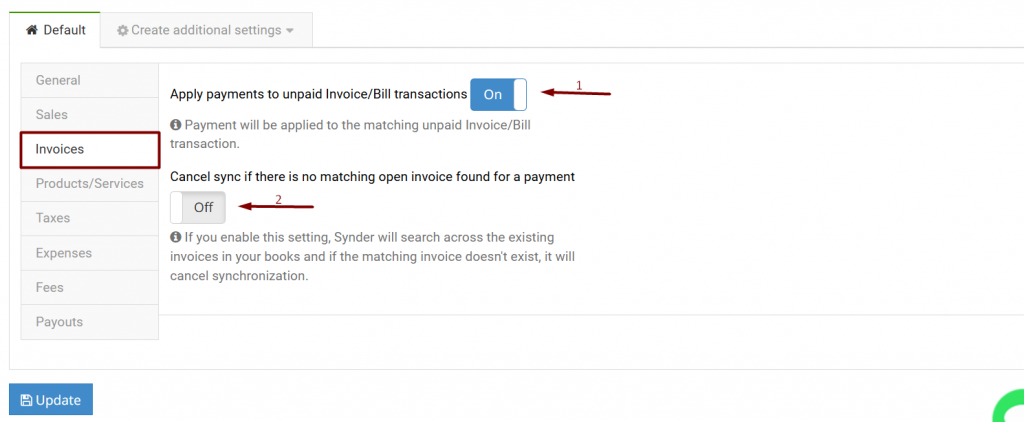

3. Invoices

- Apply payments to unpaid Invoice/Bill transactions – when “ON”, once the system encounters a payment that matches an unpaid invoice, it will be automatically applied to it.

- Cancel sync if there is no matching open invoice found for a payment – if there isn’t an open invoice that can be closed with a payment from PayPal, the system will cancel the synchronization of your payment.

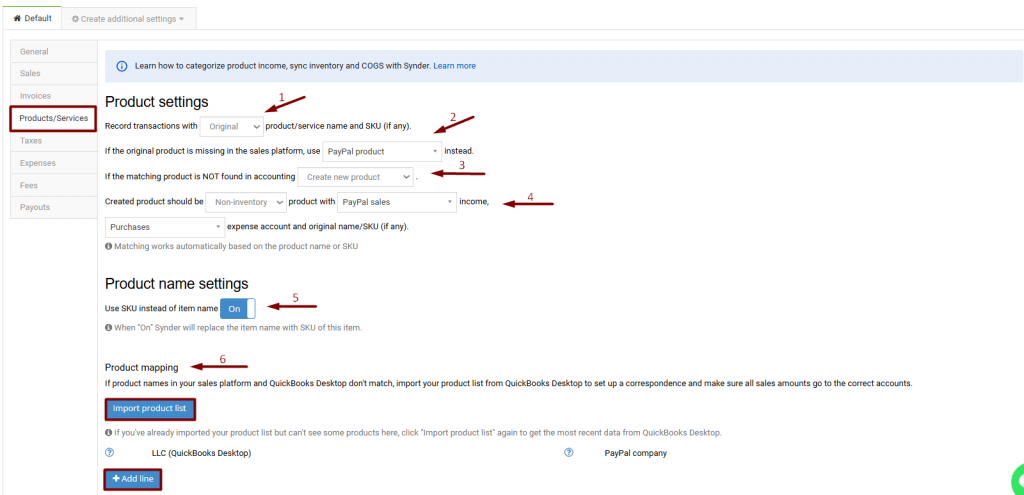

4. Products and Services tab

This setting tab is targeted at new products and services which are created during the synchronization. Product/service type can only be non-inventory or service, because when Synder creates a new product, it does not have access to its Quantity on hand. Existing inventory products will be properly updated.

The income account specified here will be used for creating new products and services only.

- Record transactions with Original/Common product/service name and SKU (if any) – choose whether you want Synder to record transactions with the original product name. This option will either map the product to an existing one by an item name or SKU, or create a new one if it doesn’t exist. Alternatively, record them with a common product name. This will log all further transactions with a specific name you can select below.

- If the original product is missing in the sales platform, use the item name/SKU instead – this product you select will be created if there is no matching one available.

- If the matching product is NOT found in accounting, you can choose to either let Synder create a new product or cancel the synchronization of your transaction.

- Select the type of newly created product, which can be either non-inventory or service, and choose the income account that will be assigned to the newly created product.

- Use SKU instead of item name – when “ON,” Synder will replace the item name with its SKU.

- Product mapping – Synder is able to identify existing products in your accounting company and apply them to transactions. If product names in your payment system and accounting company don’t match 100%, fill in the product names from your payment platform in the right field to map it to product names from your QuickBooks in the left field. Check out an additional guide about product mapping feature.

Note: please check the plans where the product mapping feature is available by following this link.

Note 2: before mapping the products, ensure both the Synder connector and QuickBooks Desktop are running, then click “Import product list” to fetch all details.

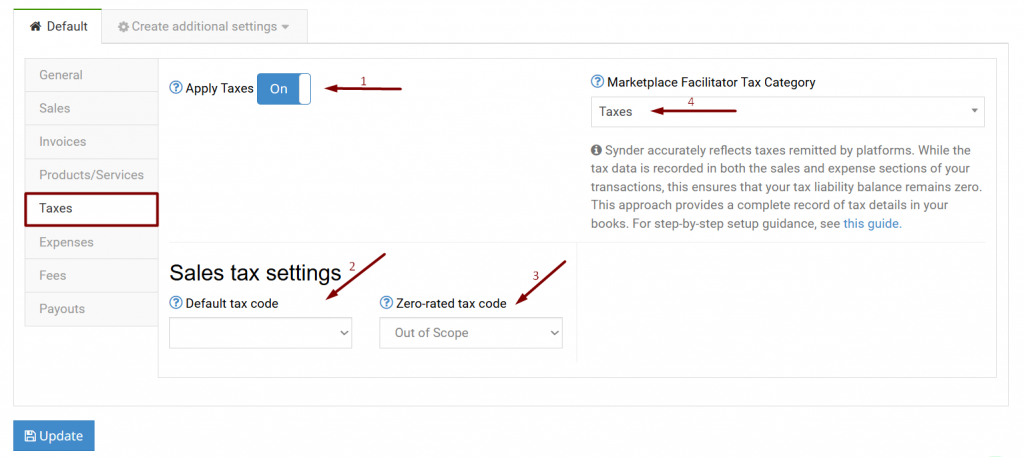

5. Taxes tab settings

Note: that taxes are recorded in a transaction as line items.

- Apply taxes – when “ON”, the system will search for a matching tax code and apply it as a line.

- Default tax code – choose the tax code Synder will apply to transactions if the calculated rate is unavailable in QuickBooks Desktop.

- Zero-rated tax code – choose a zero-rated tax code, Synder will apply to every item (line)/shipping line which doesn’t contain any other tax rate in the original transaction.

- Marketplace Facilitator Tax Category – here you can specify the category to which Marketplace Facilitator Tax will be applied (it is used only if your PayPal or your e-commerce pays taxes to the government for you).

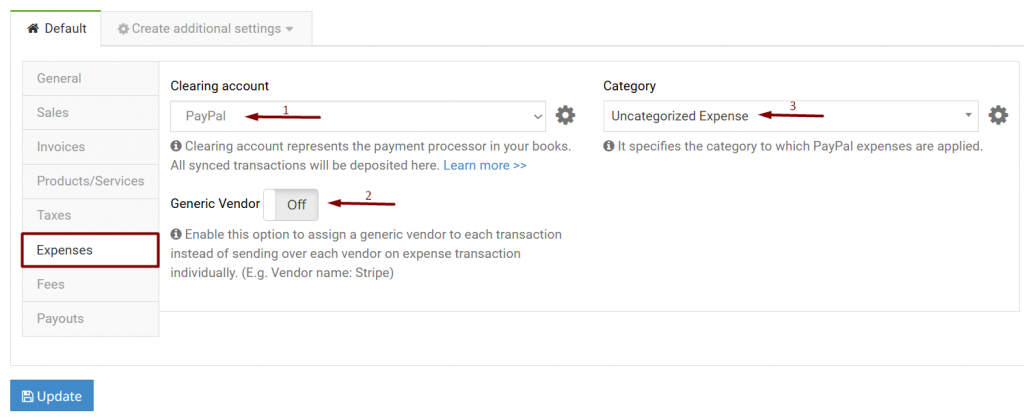

6. Expenses

- Clearing account – this setting specifies the clearing account to which the PayPal expenses are applied. We recommend using the same account as in the Sales – Clearing account.

- Generic Vendor – the system will use the QuickBooks Vendor you select to store your expenses. Select available, or type in a custom one.

- Category – this setting specifies the category to which the PayPal expenses are applied.

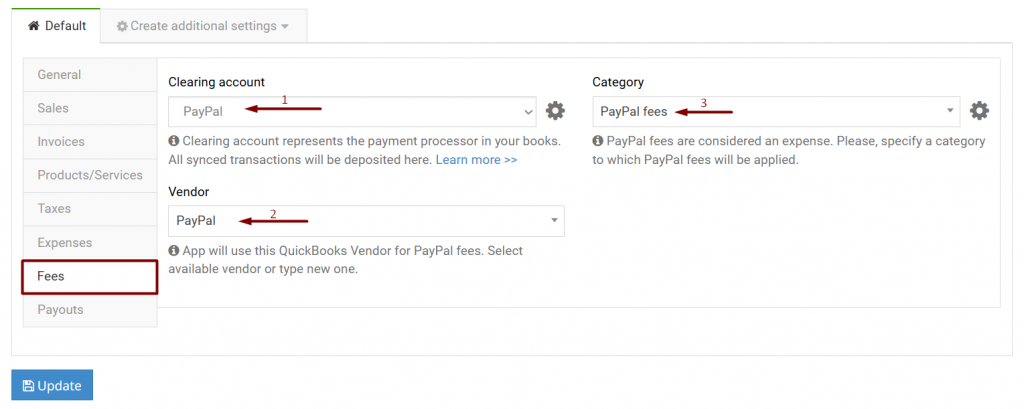

7. Fees

- Clearing account – this setting specifies the bank to which the expenses are applied. We recommend using the same account as in the Sales – Clearing account.

- Vendor – the system will use this QuickBooks Vendor to store your PayPal fees. Select available, or type in a custom one.

- Category – this setting specifies the category to which the fees are applied.

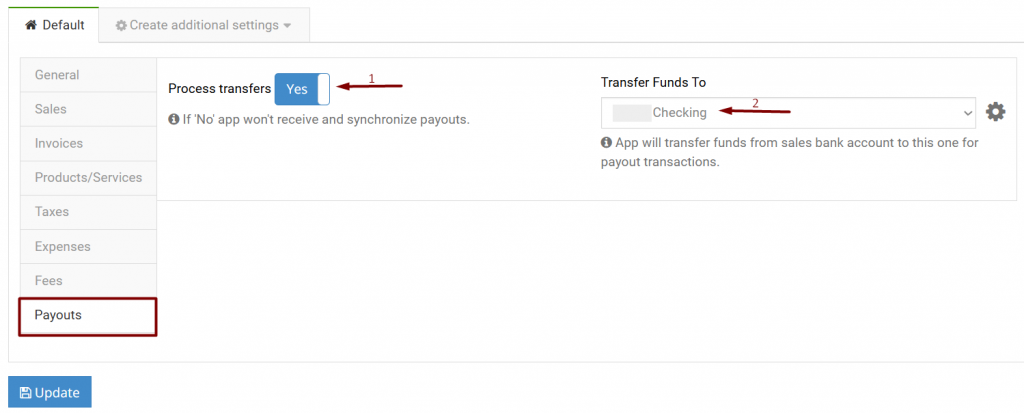

8. Payouts tab settings

This tab allows you to track Payouts that PayPal deposits to your checking account. Synder will record them in QuickBooks, allowing for a simple matching of your actual deposits from PayPal to payouts that you have received in PayPal and synced using Synder.

It is matched in the QuickBooks Bank Feeds Center.

- Process transfers – when “ON”, the system will track and create deposit receipts reflecting PayPal payouts to your checking account.

Note: if this feature is “OFF”, Synder will not show you any payouts under the transactions tab. - Transfer Funds To – Choose the checking account that you deposit the funds from PayPal to.

Reach out to the Synder team via online support chat, phone, or email with any questions you have – we’re always happy to help you!