Many business owners wonder: how can I keep my company’s cash flow steady and its financial health on point? The answer lies at the very heart of accounting: effectively managing accounts payable (AP) and accounts receivable (AR). These two empower you to control the money flowing in and out of your business. But when do you owe money, and when are you the one waiting for payment? And what exactly are AP and AR, and how do they differ? Let’s break it down and see how getting these processes in check can give your business the financial stability it needs to thrive.

Contents

What is accounts payable?

Accounts payable represents money that your business owes to suppliers for goods or services bought on credit. Think of it as the ‘IOU’ you need to pay off – these are short-term debts to your creditors that haven’t been settled yet. Now that we’ve defined accounts payable, let’s see how this works.

How does accounts payable work?

When you buy goods or services on credit, you don’t pay right away — instead, you create an AP, which is recorded as a liability on your balance sheet. The supplier, meanwhile, sees that as an increase in accounts receivable, meaning they’re expecting payment from you.

| Let’s say, your company, “Tech Innovations”, buys $1,000 worth of computer parts from “Computer Supplies Co”. You agree to pay in 30 days. For the next 30 days, “Tech Innovations” has an accounts payable (AP) of $1,000. This means you owe the supplier $1,000 for the parts, and you need to pay it within 30 days. Once you pay, the AP balance is cleared. |

What transactions fall under accounts payable?

Here are the typical transactions that go hand-in-hand with AP:

- Purchase orders: When a company sends out a purchase order, it’s locking in what’s being bought, at what price, and on what terms. This transaction creates an accounts payable entry, tracking owed money.

- Vendor invoices: When the supplier sends an invoice for the goods or services, the company logs it into its system, creating an accounts payable entry.

- Expense reports: When employees rack up expenses for things like travel or office supplies, they submit expense reports for reimbursement. The company logs the expenses and creates an accounts payable entry to pay them back.

- Accrued expenses: When a company gets goods or services but the invoice hasn’t arrived yet, it creates accrued expenses. The company tracks these costs and creates an accounts payable entry to settle once the bill comes in.

FYI: If your AP goes up, it likely means you’re buying more on credit instead of paying in cash. If it goes down, it means you’re paying off old debts faster than you’re racking up new ones.

Why does all this matter? Managing AP is key to keeping your cash flow in check. Pay too slowly, and you might run into liquidity issues. Pay too quickly, and you might miss out on opportunities to use your cash elsewhere. Striking the right balance with AP management keeps your business running smoothly and your relationships with suppliers healthy.

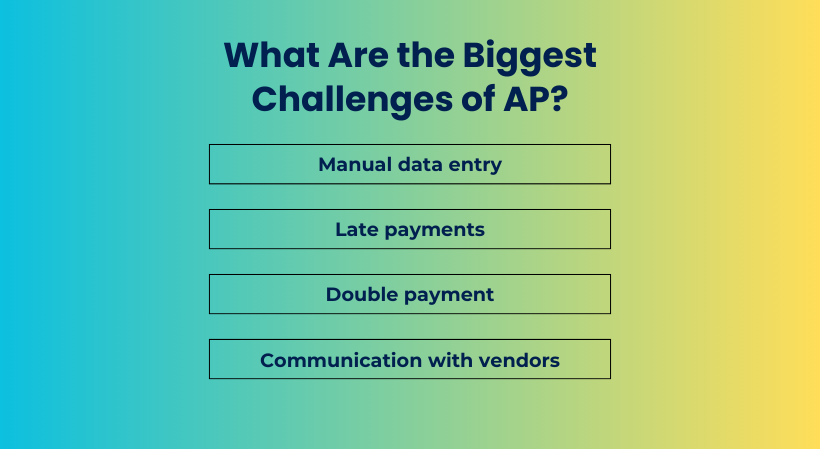

What are the biggest challenges of accounts payable?

Managing accounts payable is no walk in the park. While it’s very important for smooth operations, a few roadblocks often trip businesses up: businesses can position themselves for success and long-term growth.

Manual data entry

AP process? It’s a big deal. You’ve got to enter supplier data, get approvals, and make payments. But if you’re handling it all manually, you’re basically inviting errors to crash the party — and they’ll multiply faster than you can shout “oops”. Not only does manual entry slow everything down, but trying to find mistakes feels like a game of hide-and-seek that never ends.

Late payments

Just for you to know: a third of B2B invoices take over 90 days to be settled beyond their initial deadline. Late payments can really mess with your cash flow – piling on extra interest and leaving you with less for things like payroll. It also makes it harder to jump on new opportunities when they come up.

Level up your accounts payable (AP) process. Streamline your invoice management, automate where you can, and keep the lines of communication open with your suppliers.

Double payment

You’ve got to be extra sharp here because suppliers often send a second statement if the first one isn’t paid on time. And if you’re not careful, you might not catch it — next thing you know, you’ve paid twice for the same product or service. And if you’ve got multiple locations, it’s easy to get lost in the shuffle about which one is actually paying the invoice.

Pay that invoice twice and forget to request a chargeback from the supplier? You will lose money — and that’s never a win.

Communication with vendors

Inefficient communication and messy vendor records are a recipe for missed payments and awkward supplier relationships. You need to keep all your vendor info in one easy-to-access place. Make sure everyone’s on the same page by setting clear expectations for communication, like how often you need updates and which channels to use. Regularly check in on vendor performance to avoid costly mix-ups down the road.

Learn more about AP via our How to Calculate Accounts Payable for Your Business article.

What is accounts receivable?

Accounts receivable (AR) is basically the flip side of accounts payable (AP). It’s the money your customers owe you. Now it’s not your ‘IOU,’ but your customer’s – the money you’re waiting to receive for goods or services you’ve already provided.

How does accounts receivable work?

When you let customers pay later, those unpaid bills turn into AR, which shows up as an asset on your balance sheet. For your customer, it’s their accounts payable, meaning they owe you within an agreed timeframe.

| Imagine you run a furniture store, and a customer buys a sofa for $1,000. Instead of paying upfront, they agree to pay within 30 days. That unpaid bill becomes your accounts receivable. You’ll expect to receive the $1,000 from the customer within the 30-day deadline. |

What transactions fall under accounts receivable?

- Invoiced sales: When a company sells products or services with payment terms, it creates accounts receivable. The customer now owes for what they’ve received and is expected to pay up within the agreed timeframe.

- Deferred payment agreements: A business may allow customers to pay for goods or services later by providing deferred payment options.

- Installment sales: When the customer splits their payment into multiple chunks over time it creates installment sales.

- Accrued revenue: Accrued revenue is money a business has earned but which hasn’t been paid yet. This usually happens when a company provides a service over time and invoices the customer at the end of the service period.

FYI: If your AR goes up, it’s likely because you’re giving more credit and waiting on payments. If it goes down, it means you’re collecting payments faster than you’re extending credit, which is a good sign.

Why does this matter? Like with AP, managing your AR well is essential for keeping cash flowing smoothly. If you wait too long to collect, your finances could hit a standstill. Finding that balance in AR management keeps everything running like clockwork and your relationships with customers in check.

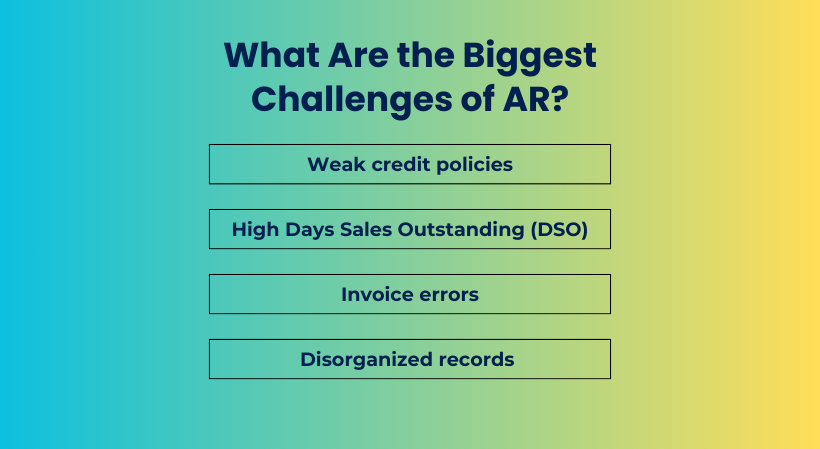

What are the biggest challenges of accounts receivable?

Like accounts payable, accounts receivable has its own challenges. You might think that if you’re not the one owing money, everything is fine, but it’s not that simple.

Weak credit policies

The last thing you want is to unknowingly hurt your business with weak accounts receivable policies. It often starts innocently enough—offering credit perks or adding new payment options without fully thinking through how they’ll impact your AR process. But here’s the truth: not every customer is a perfect match for your product or service. Without solid credit policies in place, you might end up giving credit to customers who can’t deliver—leading to unpaid debts and lost revenue.

High Days Sales Outstanding (DSO)

High Days Sales Outstanding (DSO) means your payments are taking longer than they should, and that’s like hitting the brakes on your business growth and cash flow. When accounts receivable (AR) drags on, it ties up finance you could be using to cover expenses or chase new opportunities.

If collections are dragging, it might be time to check your AR process—maybe your systems are outdated or payment terms need a refresh. High DSO could also be a sign that customers are dragging their feet on payments.

Invoice errors

Invoice errors, whether it’s a wrong number or a missing detail, can quickly lead to disputes, delayed payments, and a hit to your professional reputation. These small mistakes snowball into misunderstandings and payment holdups, throwing off your cash flow and straining customer relationships. Inaccurate invoices can leave your customers confused and questioning your credibility.

Disorganized records

Disorganized records are a straight path to confusion, turning tracking who owes what into a guessing game and leaving unpaid invoices to slip through the cracks. Without clear, tidy records, keeping tabs on payments is hard, which can mess with your cash flow and leave money on the table. A solid accounts receivable system is your best friend here—keeping everything in order and ensuring those payments roll in on time.

Check our Accounts Receivable Best Practices article for more insights.

How can Synder help manage AR?

Synder is an automation accounting software that streamlines accounts receivable (AR) management by automating key processes and ensuring accurate and timely tracking of outstanding invoices and payments. With Synder Sync, you’ll be able to process invoices, track payments, send reminders to your clients, and more. But what else can Synder Sync offer?

- Real-time data sync: Synder integrates with over 30 sales channels and payment gateways, automatically syncing transaction data to provide real-time visibility into your AR, ensuring every invoice and payment is tracked without delay. See the full integrations list.

- Automatic invoice sync: Synder syncs open invoices directly from platforms like Stripe, Shopify, and more into your accounting software, eliminating manual entry and ensuring accuracy.

- Seamless payment tracking: It automatically updates payment statuses, so you always know which invoices are paid, outstanding, or overdue, without the need for constant manual checks.

- Accurate P&L reporting: Synder will give you access to your profit and loss statements, balance sheets, and cash flow reports, giving you crystal-clear financial insights whenever you need them.

- Multicurrency support: Synder tracks payments in multiple currencies for global businesses, ensuring your AR remains accurate regardless of the currency used.

With Synder, AR management becomes faster, more accurate, and less stressful, so you can stay on top of your finances with minimal effort.

Interested in Synder? Join our Weekly Public Demo to see its capabilities in action, or start a 15-day free trial to experience it firsthand.

What is the difference between accounts receivable and accounts payable?

As we explored accounts receivable and accounts payable, as you might have noticed that the main difference between the two boils down to who’s paying who:

- Accounts payable (AP) is the money your business owes to vendors for products or services you’ve bought on credit. It’s a short-term debt you need to settle.

- Accounts receivable (AR) is the money customers owe you for what you’ve already provided. It’s an asset, waiting to come in.

In short:

- AP is your “to-pay” list;

- AR is your “to-receive” list.

And because of this, other differences in accounts payable vs. receivables emerged:

| Accounts Receivable | Accounts Payable |

| Includes trade and non-trade receivables | Includes trade payables, income taxes, interest, and sales taxes |

| Is an asset | Is a liability |

| Boosts cash flow when payments come in | Involves outgoing payments to maintain supplier relationships and credit standing |

| May have an allowance for doubtful accounts | Doesn’t typically have offsets |

Conclusion: Accounts payable vs accounts receivable

So, what is the difference between accounts receivable and accounts payable? With accounts payable, you’ll know exactly what you owe, and with accounts receivable, you’ll ensure payments come in on time. Together, they’re the fundamentals of your business that keep your financial engine running smoothly. Getting the balance right is crucial to avoiding cash flow hiccups and building solid relationships with your partners.

Can you truly manage your finances without a solid strategy for AP and AR? Not a chance. The key to making it all work? Automation software like Synder will make your financial processes seamless.

Commenting on a blog is an art. Good comments create relations. You’re doing great work. Keep it up