Naturally, everyone would like their invoices to be paid promptly, right? However, as a small business owner, you may have experienced difficulties when dealing with open invoices. How does it all work? What’s the difference between open and closed invoices? What types of open invoices are there? To fully understand these things, let’s look at the topic of open invoices in more detail.

Contents:

3. What is an open invoice cycle?

4. Simplify your business invoicing automation with Synder

Key takeaways

- An open invoice is an invoice that has been sent by the merchant but hasn’t yet been paid by the customer.

- There are 4 types of open invoices: online and offline pending payments, bills and incomplete payments.

- The open invoice cycle includes issuing the invoice, receiving and reviewing it, waiting for payment, processing the payment, marking overdue invoices, and following up on unpaid invoices.

What is an open invoice?

As you may already know, an invoice is a document that a seller sends to a customer to receive payment for goods or services. But what is the definition of an open invoice? An open or outstanding invoice is an invoice that has been issued but not yet paid by the client. This means the payment is still pending, and the seller is still waiting for the funds to hit the bank. An open invoice is simply a type of a regular invoice, which you’ve probably dealt with before.

Open invoice components

Overall, the components of regular and open invoices are the same. As we’ve learned, an open invoice is just a part of the invoicing process, so there’s no surprise. But it’s still important to know this information to navigate through these documents. So open invoices include the following information:

- Unique invoice number and PO number;

- Personal info of the payer and payee (e.g. name, address, credit card);

- Product details;

- Invoice date;

- Total amount of goods or services;

- Payment terms and directions.

Which types of businesses can use open invoices?

Open invoices are used by businesses that offer credit-based transactions, like wholesalers, service providers, and manufacturers. For example, a wholesale distributor might send open invoices to retailers, a marketing agency might use them for client projects, and a manufacturer could issue them to suppliers.

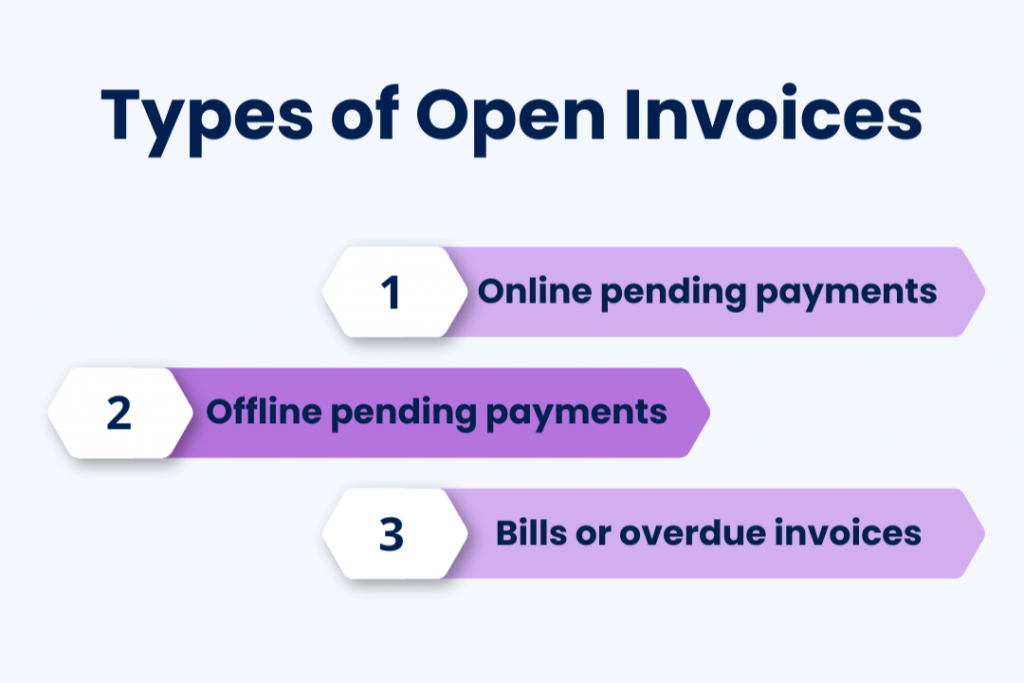

Types of open invoices

1. Online pending payments

This type of open invoice appears when using payment processors. When an invoice is created automatically, any delays or issues with the money transfer result in an “online pending” invoice. Since the automation is involved, this type of open invoice differs from those sent manually.

2. Offline pending payments

Offline pending payments refer to transactions involving cash, checks, or bank transfers from a customer’s bank account that are awaiting processing. This type of payment is in the pending stage and is part of the payment process, but it can sometimes take longer to complete the transaction. Offline and online pending payments are similar, but the difference lies in the manual and automated parts of the process.

3. Bills or overdue invoices

If the client hasn’t paid the invoice and the payment deadline has passed, the open invoice will be considered overdue. In this case, an open invoice can be compared to a regular bill. For example, this could be due to translation problems.

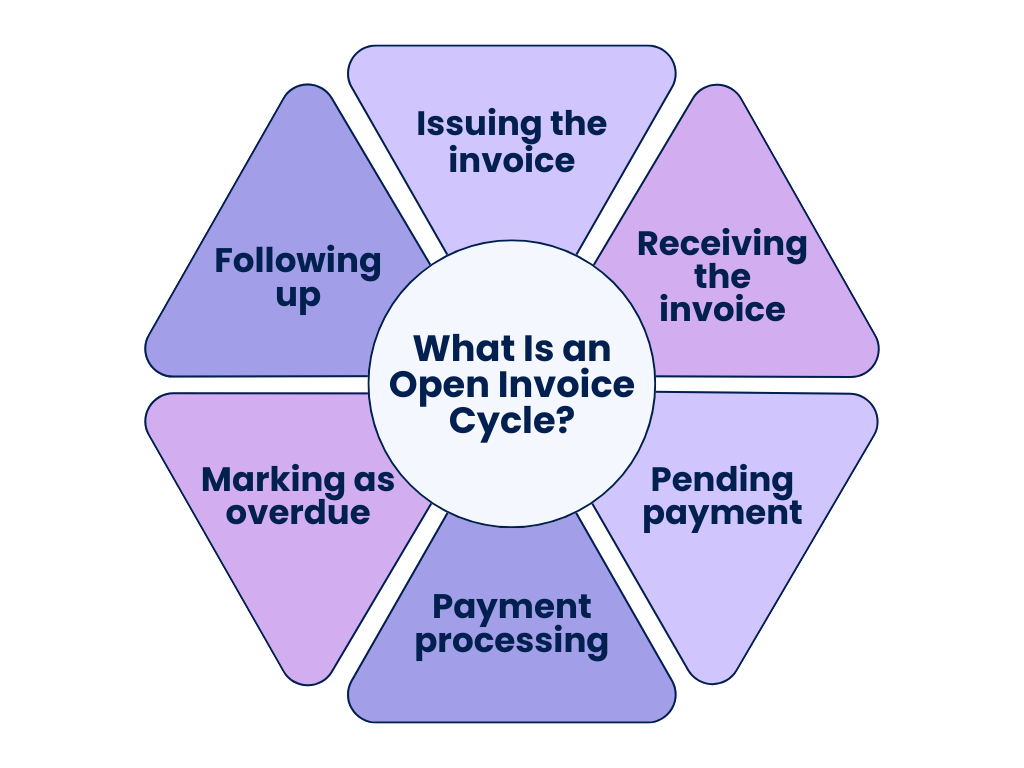

What is an open invoice cycle?

Now that we know what an open invoice is, let’s look at how it works. Like any process, the open invoice cycle involves several steps, specifically six, and each of them is important for successful transactions. Here’s how it works:

- Issuing the invoice: The seller prepares an invoice in which the items sold, the total cost and other terms of payment are stated. This document is forwarded to the buyer.

- Receiving the invoice: The buyer receives the invoice and reviews the details to check if everything is accurate.

- Pending payment: Until the buyer makes the payment, the invoice remains open. The payment might be pending if there are some processing issues or there are problems with the invoice items.

- Payment processing: The buyer initiates the payment. In case of using payment processing software, it automatically handles the transaction and updates the invoice status.

- Marking as overdue: If the buyer fails to pay by the specified deadline, the open invoice becomes overdue. This past due invoice can be treated like a regular bill that requires follow-up for payment.

- Following up: The seller may connect with the buyer to remind them of the overdue invoices or to resolve any issues preventing payment, such as translation problems or discrepancies.

Simplify your business invoicing automation with Synder

Synder is an accounting software that connects over 30+ platforms with QuickBooks, Xero, and Sage Intacct, records transactions on an accrual basis, keeps your records accurate, simplifies invoice management and makes reconciliation easy. And there is more:

- Creating and sending invoices to customers.

- Tracking which invoices are paid and which are overdue.

- Sending reminders for unpaid invoices to create healthy cash flow.

- Accepting payments through payment links.

Note: The Synder Invoicing feature works only with QuickBooks Online and Stripe or Square as payment methods.

Let’s dive deeper into Synder’s invoicing functionality.

Creating invoices

When you create an invoice in QuickBooks, it syncs across all systems, and your customers get a payment link. Once paid, Synder automatically updates your books.

Synder pulls info from QuickBooks to create invoices, so you don’t need to enter them manually. This lets you receive payments directly through Synder and keeps your accounting books updated in real-time.

Note: You can also send one-time or recurring invoices (weekly, monthly, or yearly), making invoicing easier and keeping all your customer communications in one place.

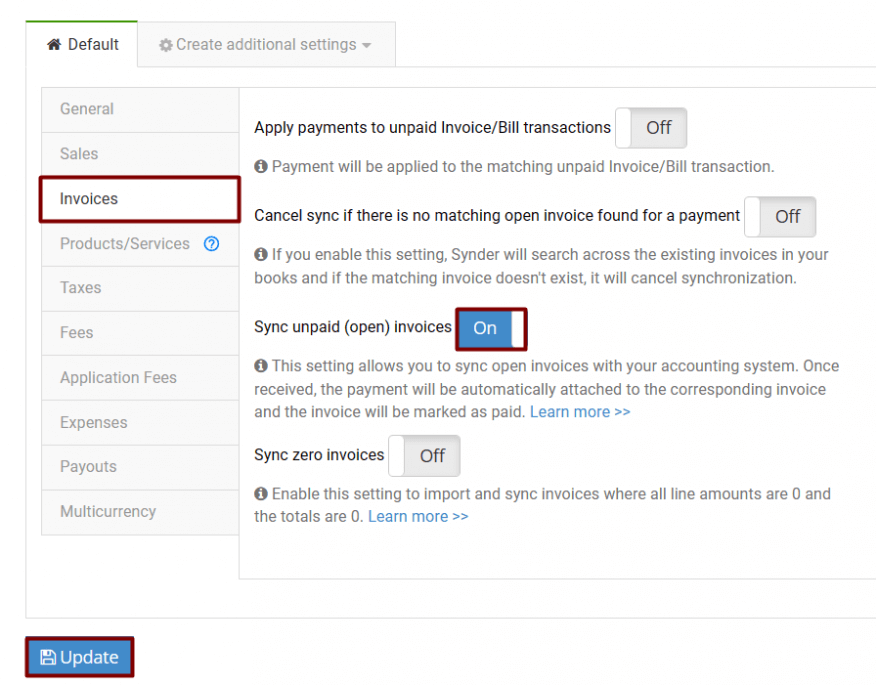

Syncing unpaid invoices

Synder offers another convenient feature for invoicing: the Sync Unpaid Invoices feature for Stripe. This option allows you to smoothly sync open invoices with your accounting system. How does it work?

1. Creating invoices in Stripe: Synder’s accounting tool lets you customize your invoices in Stripe and Square to match your brand. You can easily edit the invoice email content and add your business logo or company info to each invoice.

2. Syncing to QBO/Xero:

- If the “Sync Unpaid Invoices” feature is enabled in Synder, an open invoice will be synced, for example, to QuickBooks Online within an hour as a regular transaction (using 1 sync).

- Such invoices will also be available for historical import.

3. Labeling transactions: In Synder, the transaction type for these invoices will be labeled as “Invoice”.

4. Canceling or marking as paid:

- If the invoice is voided or marked as paid outside of Stripe, it won’t be synced to avoid conflicts with QBO invoices.

5. Applying payment:

- If the invoice is paid, the payment will be applied to this specific invoice (requiring another sync).

- The new setting in Synder searches for synced unpaid invoices in its database to avoid conflicts with the “Apply payments to unpaid invoices” setting, which checks for existing invoices in QBO/Xero.

Check out all Synder features by visiting our Weekly Public Demo or sign up for a 15-day free trial and explore Synder yourself. Take the stress out of invoicing with Synder!

Conclusion

Since open invoices are common, business owners have to be aware of how to work with them. This is really important for financial stability and smooth payment processes. With the help of special software you can optimize your work, although knowing the basics: what open invoices are, their types and how to work with them – is a must. Tracking unpaid invoices will improve cash flow management and ensure timely follow-ups on outstanding amounts. Keep your invoices in check!

Share your opinion

Share your thoughts with us! Have you experienced any difficulties with open invoices? Maybe you’d like to share your experience of using special software that helped you? Feel free to tell us everything below!

FAQs

What is an open and closed invoice?

In SAP (Systems, Applications, and Products in Data Processing) an open invoice is an invoice that has been issued but not yet paid by the customer. A closed invoice, on the other hand, is an invoice for which the payment has been received and the transaction is complete.

How long can an invoice remain open?

The length of time an invoice can remain open depends on the payment terms set by the seller, which can range from a few days to several months. If the payment deadline passes without receipt of payment, the invoice becomes overdue.

What is 3 way invoicing?

Three-way invoicing is an accounting process that checks an invoice by comparing three documents: the purchase order (what was ordered), the receipt (what was delivered), and the supplier’s invoice. This process helps reduce mistakes and keep the books accurate.

What happens if an open invoice isn’t paid?

If an open invoice isn’t paid, it becomes overdue and may have late fees or interest added. The seller might send reminders, use a collections agency, or take legal action to get the payment.

What issues canopen invoices cause?

Although open invoices aren’t that complicated, they can cause some problems, for example:

- Cash flow issues;

- Administrative burden;

- Customer relationship strain;

- Financial uncertainty;

- Risk of bad debt.

Thanks for explaining the concept of open invoice. This will help me better manage my expert financial advice UK business.

Thank you for your feedback, David!