When selling products, you might be disappointed yet accepting when clients leave empty-handed because they didn’t find what they were looking for. However, when they abandon the cart at the payment stage—ohhh, that hurts!

While there are things beyond your control during the payment process, there’s a lot you can do as a seller at this point. Clients want simple, accessible, safe, and extensive payment options. And you can easily offer them.

At Synder, we work with businesses that process different online payments like PayPal, Stripe, Square, Afterpay, digital valets, debit and credit cards, and payment links, among others. So we know firsthand how to help our clients best manage their payments—as we make software for it.

That’s why today, we want to share with you our knowledge and expertise on a unique and versatile payment method that can move that needle forward on your sales, namely—payment links.

TL;DR

- Payment links simplify transactions for various businesses, from service providers to ecommerce.

- Pay links provide a secure and versatile payment option for B2B and B2C transactions.

- Creating and sharing payment links is a quick process that simplifies the payment experience for customers.

- Automating data entry into your accounting software solves the main issues in pay links bookkeeping.

Contents:

2. Is this method safe for my business?

3. How do clients pay through payment links?

4. How to share a payment link?

5. When to use this payment method?

6. How do I make a payment link?

8. How bookkeeping for payment links works with Synder

9. Which businesses use payment links?

What is a payment link?

Maybe you’re already using payment links, or quite the opposite—you’re quite weary of this method. However, a payment link is a simple and safe way to pay and accept payment.

It’s a link or URL that you—the seller sends to a buyer. The customer then clicks on this link to pay for a product or service using their preferred payment method. So, a payment link is essentially a quick way to request payment from a customer, directing them to a secure payment portal where they can complete their transaction.

Note: Links are a great choice for both B2B and B2C businesses.

Is this method safe for my business?

This needs to be clarified as a next point: Is this method even safe to use for a business in the first place?

Payment links are a feature provided by payment processors. They’re created and processed through reputable payment gateways like PayPal, Stripe, or Square, which use strong security measures to protect transactions.

Payment links generated through these services inherit the same security measures that these platforms employ for other types of transactions. These include encryption of financial data, adherence to PCI DSS standards, and other security protocols designed to protect against fraud and data breaches.

So when you offer a payment link from reputable processors, you benefit from the same level of security as you would from their other payment services.

How do clients pay through payment links?

You might think that if Stripe, for example, offers these payment services this means that at the checkout the customer will only see this method of payment. But that isn’t how it works.

Your customer will have access to a variety of payment options. Here’s what you can typically expect:

- Credit and debit cards: Stripe widely supports major credit and debit cards including Visa, MasterCard, American Express, and others.

- Digital wallets: Stripe integrates with popular digital wallets such as Apple Pay, Google Pay, and Microsoft Pay so your customers can make payments using their mobile devices through these services.

- Bank direct debits: Stripe can process payments directly from bank accounts, which is particularly useful for subscription-based services or larger transactions.

- Local payment methods: Depending on the region, Stripe supports various local payment methods. For example, it can handle Alipay in China, Bancontact in Belgium, and SEPA direct debits in the European Union.

This variety means that payment links don’t restrict your clients to a single payment method, quite the opposite—they’re a secure gateway to popular payment options. The key difference is in how the payment prompt is delivered to the customer which takes us to the next point: delivery method.

N.B. Each payment processor will have its own list of supported payments but generally, the largest gateways offer similar methods.

Payment link is a special feature in the toolbox of payment options. It covers ‘payment grounds’ that other methods usually can’t. You can share it with your customers in numerous and non-traditional ways, such as:

- Remote sales;

- Phone-based services (consultants, helplines, or any service-oriented business that operates via phone);

- Social media sales (Instagram, Facebook, TikTok, or even Twitter);

- Email marketing;

- Newsletters;

- QR codes (these can be printed or displayed digitally);

- Chat apps (WhatsApp, WeChat, Messenger, etc.);

- Text messages;

- Button-embedded on your website.

As you can see, the places where you can use a payment link are really very broad. And they open up opportunities for sales in many different situations, from in-person, digital, and phone, to printed materials.

It’s an often overlooked option that hides a lot of sales opportunities.

When to use this payment method?

We covered how to use it, so let’s look at when to use it. There are different types of transactions that companies might have, depending on the type of business they run.

Payment links can be successfully applied to:

- selling a product or a service;

- managing subscriptions;

- accepting donations.

At Synder, we work with clients who use all of the above transaction types, so we know how to couple payment links with unique bookkeeping complexities of traditional businesses, SaaS companies, and nonprofit organizations. It isn’t just about generating a link but also automating the accounting process in your books.

How do I make a payment link?

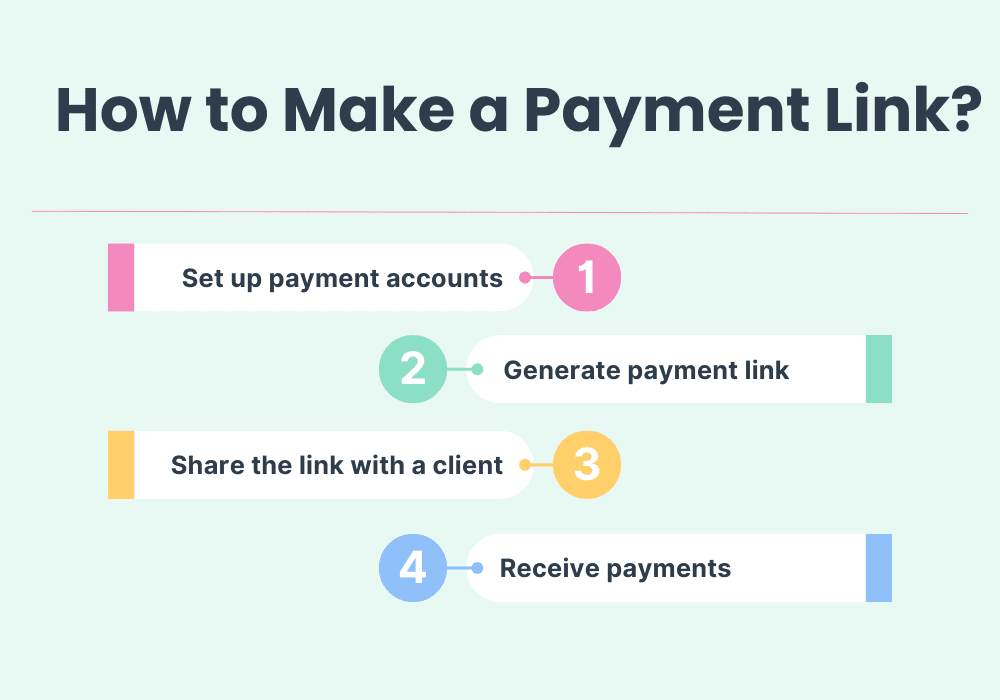

As you’ll see, creating a payment link is very simple. Though every payment processor will have its own exact path to generating the link, they all follow a short set of straightforward steps.

Step 1. Set up accounts

First, you need to sign up and configure your account with your payment processor, verify your business information, and connect your bank account to receive money from your customers.

At this stage, you should also integrate this process with your accounting software, so that all incoming payments are automatically recorded in your accounts, eliminating the need for manual data entry.

The setup for using payment links is a one-time process. Once completed, the below steps outline the routine you’ll follow each time you need to generate a new link.

Step 2. Generate payment link

To create the link, you fill out the details such as the payment amount, currency, and a description of the product or service being sold. Depending on the payment processor, you might be able to input other types of info.

Step 3. Share the link with your customer

Here, you distribute the payment link through your preferred communication channels. This can include email, social media, SMS, or you can even make a QR code that customers can scan.

Once the buyer receives the link, it takes them to a payment page where they can finalize the purchase, subscription, or donation.

Step 4. Receive payments

Once your customer pays you, the money will be sent to your account. Depending on the payment processor you use, there will be different payment schedules that the money will be transferred to your account.

You’ll be able to monitor this from the dashboard of the payment processor of your choice.

A few words about fees

You must know that each payment processor will charge fees (different types to be precise). This isn’t just for payment links—fees are almost everywhere now.

This is the reality: the money you get ≠ the money your customer paid. What does this mean? The money you get into your bank account through the payment processor won’t be equal to the money your customer paid for the goods or services as the payment provider will charge fees (and any other types of payments it needs to take out at this stage).

This is important for bookkeeping as you need all 3 numbers in your books:

- sales revenue (what the customer paid);

- fees (what payment processor charged and deducted);

- payout (what you actually received in your bank account).

There can also be other fees, taxes, shipping costs, discounts, and more. This is a headache for any business owner dealing with payment processors. At Synder, we solve all these problems for our clients by automatically breaking down and syncing the above types of transactions into your books.

You can calculate fees using a PayPal fee calculator, Stripe fee calculator, or other tools if you want to compare the fees.

How bookkeeping for payment links works with Synder

Generating payment links isn’t a pain point as you can see, but bookkeeping for this payment method can be. We solve this problem by directly integrating with both online payment systems and accounting solutions (and sales channels too). This integration means that all the information that flows from payments will automatically end up in your bookkeeping system.

In a nutshell, the process looks as follows:

- You generate a link using a payment processor and share it with a customer.

- A customer pays via the payment link.

- The transaction immediately appears in your payment processor account (Stripe, Square, etc.).

- Synder takes this transaction with all the details and imports it into your QuickBooks Online, QuickBooks Desktop, Xero, or Sage Intacct automatically placing all the bits of the transaction (such as processor fees, taxes, etc.) in the right categories, classes, and accounts.

And all this happens in the background, with no need for any further manual action from you.

2 ways to streamline your bookkeeping

With Synder, you can manage your payment links in two ways:

- Generate payment links directly through Synder and automatically sync transactions to your accounting books.

- Use your existing payment processors to generate links, then sync these transactions into your books using Synder.

Either way, you don’t have to worry about the hard part—bookkeeping. We help our clients:

- automate data entry;

- ensure real-time updates;

- provide detailed transaction breakdowns;

- enable business-specific customization ;

- simplify reconciliation;

- save time.

Want to see these and other Synder’s functionality? Book a seat at our Weekly Public Demo and find out how the software can help with your business bookkeeping.

How to generate a link using Synder

If you want to use Synder for generating payment links, follow these step-by-step instructions, complete with screenshots, to guide you through the process.

N.B. Synder offers a straightforward checkout page powered by Square or Stripe, where your customers can pay using credit or debit cards. Each transaction automatically generates a sales receipt and payment processor fee in QuickBooks Online.

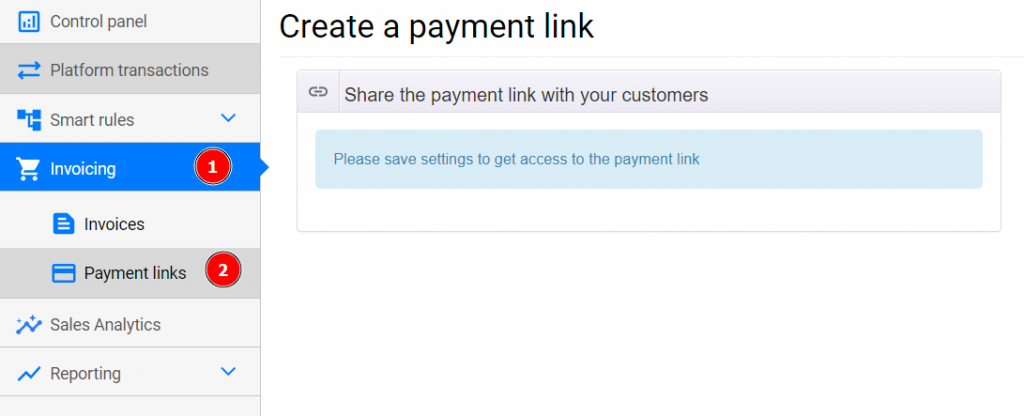

1. Go to the Invoicing tab and choose Payment Links:

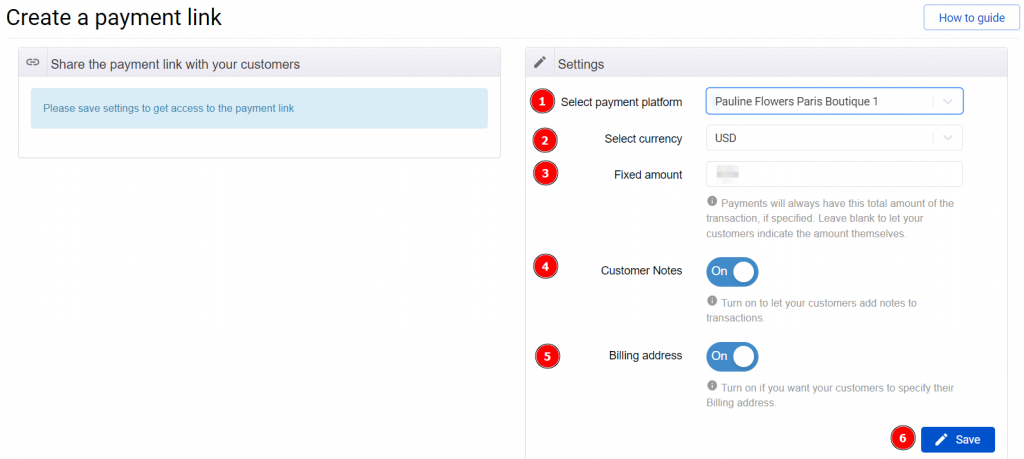

2. Customize your payment link by choosing the settings that work best for you. Select your payment platform, currency, and the amount to be paid. You can also choose to allow customers to add notes and their billing address if necessary.

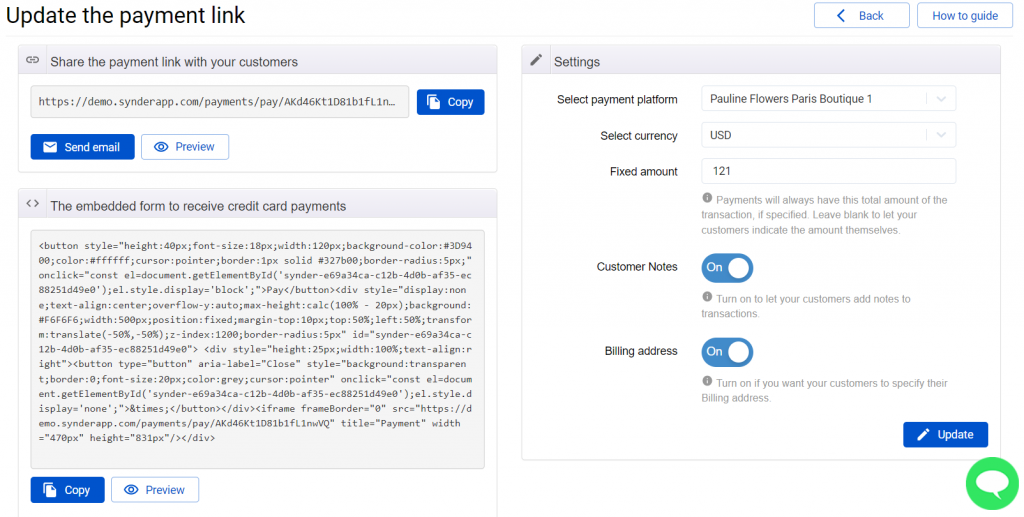

3. Make sure everything is correct, then either copy the payment link to share as you choose or send it directly via email.

Generate your first payment link with Synder by creating a 15-day free trial.

Which businesses use payment links?

If you’re still unsure whether payment links can be of use to your company, below, we’ve compiled a tailored list of businesses that are ideal for adopting this method.

This doesn’t mean the list is exhaustive. We just want to highlight those types of industries where payment links can really enhance sales.

1. Service providers

Payment links are a handy tool for consultants, freelancers, and contractors who need to bill for their services. They’re particularly useful for jobs requiring payment upon completion or when an advance payment or deposit is needed.

For example, if you’re a contractor, once you’ve done the job, even while speaking to your customer, you can send them a link via a text message and they can pay you online – on the spot. No need for a card reader or POS system to make a payment.

2. Retail and ecommerce

Ecommerce businesses can offer quick payment options via their social media or direct marketing. It’s especially true for small businesses that might lack the in-house technical resources needed to launch a full-body online store and implement a payment gateway there. Also, for temporary retail events or pop-up stores where setting up traditional payment systems might be impractical, payment links can be a great choice.

3. Hospitality and leisure

Companies that organize events such as concerts, exhibitions, workshops, or sports events can use payment links for direct ticket sales to consumers. This can be equally good for businesses in the tourism sector, which handle bookings for tours, accommodations, and other travel-related services.

4. Educational and non-profit organizations

Educational institutions like schools and universities, as well as providers of online courses, can use payment links to collect fees for courses, seminars, webinars, and other educational offerings. Similarly, charities and non-profit organizations can utilize payment links effectively in donations.

5. Professional services

Firms offering professional services such as legal and financial advice often require payments for consultations or ongoing retainer fees, while real estate agencies can streamline the collection of rental payments, lease applications, and deposits.

Closing thoughts

Payment links can be a great way to widen your payment options and attract new customers. This method reaches places that other ways usually can’t. And that’s precisely where its power lies.

What’s more, you don’t have to worry about setting up complicated payment gateways. All you need to do is create a payment link and share it with your customers.

While payment links might not suit every business, they’re an opportunity for those who operate in diverse sales channels.

Share your experience

Have you tried implementing payment links into your business? What was your experience? Feel free to share your opinion in the comments.

Excellent article!

Thank you so much, David!