Retained profit, often referred to as retained earnings, is the amount a small business retains after paying shareholder dividends and expenses. It serves as a financial safety cushion or savings that can be reinvested into the company.

Curious to learn more? We’ll take a closer look at what it means, how to calculate it, and why it’s critical to business growth.

Let’s dive in!

Contents:

2. How to figure out retained earnings

3. Why is retained profit important for companies?

4. Pros of retained earnings for small companies

5. Cons of retained earnings for small companies

6. How retained profit can influence your business

What is retained profit?

Are you in ecommerce and looking to grow your business? If so, it’s crucial to grasp what retained earnings are and why they matter to you. Retained earnings represent the portion of a company’s profits that it chooses to reinvest in its operations rather than pay out as dividends to shareholders. Accumulated over time, they have a significant impact on the trajectory of the company. As the saying goes, saving is as valuable as earning.

To understand retained earnings better and faster, picture having money at your disposal that you don’t have to share with anyone. This is the money you have left over after paying dividends, taxes, and other obligations. Retained earnings, also known as retained profits, are part of your equity.

You may be wondering about companies that don’t pay dividends. Do retained earnings matter to them? Absolutely. Both big companies and individual business owners depend on retained earnings. These earnings are essentially the extra profits they have after expenses, which they can then reinvest into their businesses to help them grow. Reinvestment options include internal research, expanding operations, acquiring assets, and debt repayment, all of which create lasting value for shareholders.

Retained earnings, reflected as equity on your balance sheet, indicate your business’s health, influenced by gains and losses. While not synonymous with net income, they demonstrate stability and overall business well-being, unlike net income, which can fluctuate drastically. Understanding this distinction is crucial to avoid future confusion.

Retained earnings: What does it include?

Understanding retained earnings might seem challenging, but it’s not overly complicated.

Let’s break down what it includes:

- Dividends: These are portions of a company’s profits paid out to shareholders. Instead of distributing these profits immediately, retaining them allows for reinvestment in the business. This reinvestment can include enhancing infrastructure, expanding operations, or modernizing the business, ultimately boosting profitability for shareholders.

- Debts: Retained earnings can serve as a safety net, helping a company avoid bankruptcy by using these funds to repay debts and improve its creditworthiness.

- Reinvestment: By keeping funds within the business, you’re investing in its future. This money can fuel growth initiatives such as opening new locations, purchasing equipment, hiring employees, or implementing automation, contributing to the long-term success of companies.

How to figure out retained earnings

Before delving into the formula, you might wonder: Why should I bother with determining retained earnings?

Knowing how to measure retained earnings is crucial for evaluating a company’s potential to grow sustainably. Since they’re derived from a company’s net income, managing them effectively is crucial, especially when shareholders are involved.

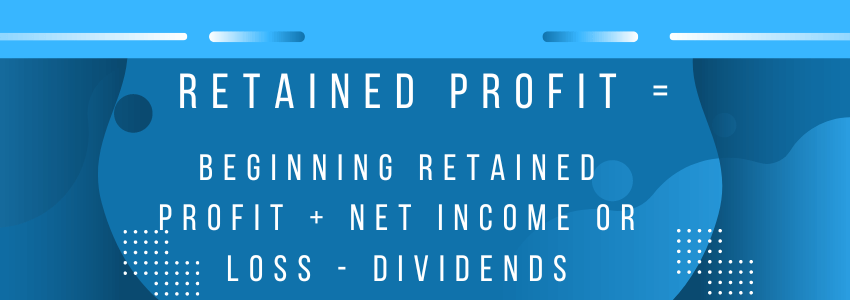

Here’s how to turn simple numbers into a clear understanding of your finances:

Let’s break down each part:

- Beginning retained profit: This is the balance of retained earnings carried forward from the previous reporting period and represents the accumulated surplus of retained earnings.

- Net income: Calculated by subtracting all expenses (operating, tax, interest) from total revenue.

- Dividends: The portion of earnings distributed to shareholders as a return on their investment, if applicable to your situation.

You can find all this information in a statement providing a clear overview of how profits have been kept and utilized within the business.

What to consider when calculating retained profit

When determining retained earnings, remember these key points:

- Adjust for special events: Consider any unusual or one-time expenses, such as asset sales or legal fees, that could affect the calculation. Make adjustments to ensure your retained earnings accurately reflect ongoing business operations.

- Know the tax implications: Understand how retained earnings affect your taxes. Since they’re part of your taxable income, you need to know how much of your profits will be subject to corporate taxes. This helps in planning for the long-term period ahead and tax compliance.

- Consider your dividend policy: This determines how much of your profits are paid out to shareholders versus reinvested in the business. Understanding this policy will help you decide how to effectively use and balance your retained earnings.

Why is retained profit important for companies?

Retained earnings serve as a valuable asset for attracting investors and partners, showcasing a company’s potential for growth. However, their importance goes beyond attracting investors.

Successful companies view retained earnings as a catalyst for future expansion. Yet, it’s not enough to have retained earnings; effective management of retained earnings is critical to ongoing success.

According to surveys, companies are investing heavily in business growth, placing a quarter of their annual revenue into fast-growing opportunities. This strategic allocation of resources, alongside sound human resource strategies and prudent digital investments, is predicted to be pivotal for success in the coming years, as highlighted in the Gartner survey.

“Investment leads to long-term success. We’ve thrived in the software development market for 16 years in a row thanks to investments in skills, people, software, and overall business growth.” Says Oleksiy Kutsenko, CMO of DDI Development

As we can see, retained earnings help a company stay independent and avoid the need to borrow or invest under pressure. As an investment in and of themselves, they provide a solid foundation for future business endeavors, whether it’s expansion, research, talent acquisition, or navigating economic downturns.

Additionally, retained earnings serve as a vital safety net, offering a valuable reserve to effectively navigate unexpected challenges.

While the benefits of retained earnings are clear, it’s important to consider the potential downsides for your business.

Let’s break it down in more detail to get the full picture.

Pros of retained earnings for small companies

As a business owner, having extra cash can be a powerful asset for you, right? After all, having capital that can be reinvested into the business opens up many growth opportunities and eliminates the need to rely solely on savings or debt.

Here are some compelling benefits of retained earnings:

- Financial safety net: Retained earnings act as your business’s airbag, offering crucial support during economic downturns or unexpected expenses.

- Focus on growth: With retained earnings, you can quietly work on launching new products, innovating, and scaling your operations, without the pressure of seeking external funding to survive.

- Reduced dependency on external funding: You save time and effort by not having to seek external funding, as you can rely on your own capital.

- Enhanced return on equity (ROE): Reinvesting profits into the business can lead to a higher return on equity (ROE) over time, attracting investors interested in companies with promising growth prospects.

- Cash flexibility: Unlike debt financing, retained earnings provide flexibility with funds. This allows companies to allocate resources to research, marketing, or other strategic initiatives, rather than focusing primarily on debt repayment.

- Effective fund management: Retained earnings showcase your business’s capability to generate steady profits, resulting in improved borrowing terms and reduced interest rates.

Cons of retained earnings for small companies

Now, let’s explore the potential drawbacks of retained earnings for ecommerce businesses:

- Limited business funding: Trying to generate retained earnings can draw funds away from your core business, limiting your available capital.

- Missed learning opportunities: By relying solely on internal funding, you miss out on valuable experiences that external funding could provide for both personal and business development.

- Delayed innovation: Some critical processes, such as implementing ecommerce automation solutions, could be expedited with investor support. However, relying solely on retained earnings means waiting for profits to accumulate before initiating such initiatives.

- Risk of inefficient reinvestment: While reinvesting profits is beneficial, careless allocation of funds can lead to diminishing returns or losses, undermining shareholder value.

- Strained investor relations: Accumulating retained earnings without distributing dividends may strain relations with investors reliant on dividend income, impacting investor trust.

- Questionable strategic direction: Excessive accumulation of retained earnings without clear plans for their use can raise doubts among stakeholders regarding the company’s strategic vision and resource management.

How retained profit can influence your business

Now that you’re aware of the pros and cons of retained earnings, you can better understand their impact on your business.

Here’s why you should consider retained earnings alongside other types of income, such as net income and gross income if you’re aiming to expand and scale your business further:

- With retained profit, you can grow your business, not just cover expenses

Instead of focusing solely on net or gross profit, prioritize what you’re setting aside to reinvest in your business. Think of it as allocating funds to fuel business growth, not just to cover expenses.

- You will gain more freedom with the money you earn

Unlike net income, which disappears as bills are paid, and gross profit, which provides limited insight after expenses, retained earnings provide a buffer. It’s the surplus left over after all obligations have been met that allows you to reinvest, expand, or tackle tough challenges.

- Full control in your hands

With retained earnings, you’re in control. Instead of focusing on short-term profits or immediate expenses, you’re thinking long-term. You decide how to use these funds to move your business forward, whether through innovation, website enhancements, or building reserves for unforeseen challenges.

- With retained earnings, you can make a difference

Prioritizing retained earnings sets you apart in the business world. It shows investors and partners that you’re committed to long-term sustainability, not just short-term profits. It’s like saying, “I’m not just about making money; I want to build something great that lasts”.

Retained profit: FAQ

Looking for clear and concise answers to your burning questions about retained earnings? Look no further, we’ve got you covered.

What Is Retained Profit?

Retained profit, also called retained earnings, is the part of a company’s earnings that it keeps for itself instead of giving to shareholders as dividends. It’s the total profits saved up over time.

Why does retained profit matter?

Keeping money aside helps the company grow and stay secure. By reinvesting profits into the business, companies can expand operations, invest in research and development, pay off debts, or create reserves for unexpected expenses.

How do you find retained profit?

To calculate retained profit, subtract the dividends paid to shareholders from the company’s net income. This shows how much the company retains for reinvestment. Then, add the opening balance of retained earnings from the previous period to get the total retained profit for the current period.

What does retained profit show?

Retained earnings demonstrate a company’s ability to generate and retain earnings over a long period. It shows that a portion of earnings is being used to grow the business, make the company stronger, and increase shareholder value. High levels of retained profit may signal the company’s potential for future growth and sustainability.

Conclusion

Now that we’ve covered the basics of retained earnings, you understand their definition, how they are calculated, and what they mean to your business. Retained earnings provide opportunities for reinvestment that can fuel business growth. However, there’s a trade-off, as shareholders may not always agree with your decision to retain earnings rather than pay dividends. Deciding how best to use retained earnings is ultimately up to you, but ensure it aligns with your business objectives.

Excellent article1

Thank you!