As the world becomes increasingly digitized, businesses are recognizing the importance of adopting efficient and reliable digital solutions for their accounting and payroll management requirements. That’s why accounting software plays a pivotal role in streamlining financial tasks, reducing manual errors, and providing real-time insights into a company’s financial health. QuickBooks and Gusto have emerged as two of the leading contenders in this competitive domain, each offering a suite of features designed to cater to businesses of various sizes and industries.

Choosing the right accounting and payroll software is a critical decision for any business owner. While both QuickBooks and Gusto offer valuable features, their strengths lie in different areas. And to make an informed decision, businesses must assess their specific needs and consider their long-term goals.

In this article, we’ll delve deeper into the strengths and weaknesses of both QuickBooks and Gusto, compare user reviews and testimonials, provide valuable insights into the user experience and performance of each platform, helping readers identify which platform aligns best with their business requirements.

QuickBooks: Comprehensive accounting software

In today’s fast-paced business landscape, managing finances and maintaining accurate accounting records are crucial for the success of any enterprise. As businesses grow and expand, manual bookkeeping becomes increasingly cumbersome and prone to errors. To meet the evolving needs of modern businesses, accounting software solutions have emerged, streamlining financial processes and enabling businesses to make informed decisions. One such prominent and trusted name in the realm of accounting software is QuickBooks.

Overview of QuickBooks

QuickBooks, developed and marketed by Intuit, made its debut in 1992, truly revolutionizing the way small and medium-sized businesses handle their financial tasks. Over the years, QuickBooks has grown to become the most widely used accounting software for businesses of all sizes. Its user-friendly interface, comprehensive features, and robust functionalities have cemented its position as a go-to solution for entrepreneurs, accountants, and finance professionals.

Key features and functionalities of QuickBooks

Bookkeeping made easy

QuickBooks simplifies the complex task of bookkeeping, allowing businesses to track income and expenses seamlessly. Users can easily record transactions, reconcile bank accounts, and generate financial reports with just a few clicks.

Invoicing and payments

QuickBooks offers efficient invoicing features, enabling businesses to create and send customized invoices to clients. It also facilitates online payment options, making it convenient for customers to settle invoices electronically.

Financial reporting

The software provides a wide array of financial reports, including profit and loss statements, balance sheets, cash flow statements, and more. These reports offer valuable insights into a business’s financial health, helping decision-makers make informed choices.

Inventory management

QuickBooks allows businesses to monitor their inventory levels, track stock movements, and even set up automatic reorder points to ensure a seamless supply chain.

Payroll processing

With QuickBooks Online Payroll, businesses can efficiently manage employee salaries, deductions, and tax calculations. The platform ensures compliance with payroll tax regulations, making payroll processing hassle-free.

Third-party integrations

QuickBooks integrates with numerous third-party applications, such as CRM software, payment gateways, and project management tools, expanding its capabilities and customization options.

Check out how to use Synder to categorize expenses in QuickBooks , using Synder to add classes in QuickBooks, and Stripe QuickBooks integration.

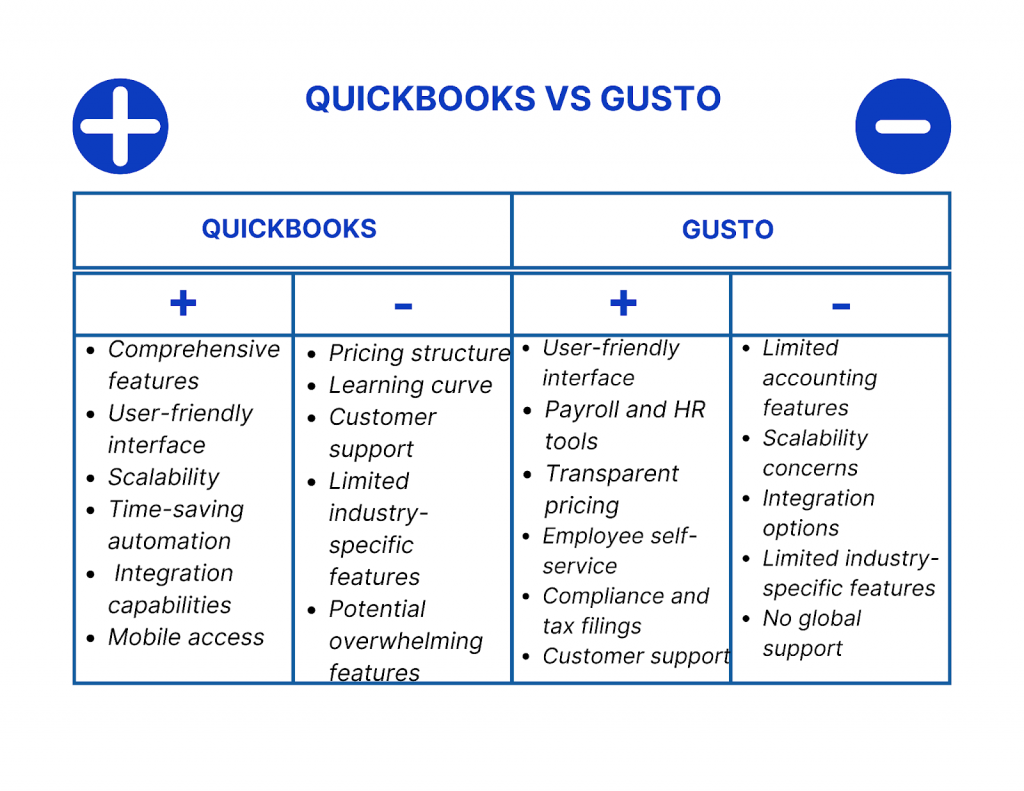

Pros of QuickBooks

1. Comprehensive features: QuickBooks offers a wide range of features, including invoicing, expense tracking, financial reporting, payroll processing, and inventory management. It provides an all-in-one solution for businesses’ accounting needs.

2. User-friendly interface: QuickBooks is known for its intuitive and user-friendly interface, making it accessible to users with varying levels of accounting expertise. The easy navigation and clear layout contribute to a smoother user experience.

3. Scalability: QuickBooks caters to businesses of all sizes, from freelancers and small startups to large enterprises. As your business grows, QuickBooks can accommodate increasing accounting complexities and transaction volumes.

4. Time-saving automation: The software automates various tasks, such as bank reconciliations, recurring invoices, and financial reporting. Automation reduces manual data entry and saves valuable time for business owners and accountants.

5. Integration capabilities: QuickBooks can seamlessly integrate with a wide range of third-party applications and services, such as payment gateways, CRM systems, and ecommerce platforms for Quickbooks. This allows businesses to enhance their accounting processes and improve overall efficiency.

6. Mobile access: QuickBooks offers mobile apps that enable users to access their financial data on the go. This feature is especially valuable for business owners who need to manage finances while away from the office.

Cons of QuickBooks

1. Pricing structure: QuickBooks has tiered pricing plans, and some users may find the costs to be relatively high, especially for advanced features or additional users. There may also be extra charges for certain add-ons or services.

2. Learning curve: While QuickBooks is user-friendly, it still has a learning curve, especially for users who are new to accounting software. Understanding all the features and functionalities may take some time.

3. Customer support concerns: Some users have reported issues with QuickBooks’ customer support, including long wait times and difficulty resolving certain problems. This can be frustrating, particularly when urgent assistance is needed.

4. Limited industry-specific features: QuickBooks caters to a broad range of industries, but some businesses with highly specialized needs may find that the software lacks certain industry-specific features.

5. Potential overwhelming features: For small businesses with relatively simple accounting needs, QuickBooks’ vast range of features may feel overwhelming. In such cases, some users might find that they don’t use all the functionalities effectively.

In short, QuickBooks is a widely used and powerful accounting software that offers numerous benefits for businesses. Its comprehensive features, user-friendly interface, and scalability make it a popular choice for managing finances effectively. However, it’s essential to consider the potential drawbacks, such as the pricing structure, learning curve, and customer support, to determine if QuickBooks aligns with your business’s specific needs and budget. For many businesses, QuickBooks remains a top choice for streamlining accounting processes and gaining valuable insights into their financial performance.

You might also be interested in reading about QuickBooks alternatives.

Gusto: A user-friendly payroll and HR platform

In the realm of payroll and human resources (HR) management, businesses seek solutions that not only streamline processes but also prioritize ease of use and accessibility. Gusto, formerly known as ZenPayroll, has emerged as a leading platform in this domain, offering businesses an intuitive and user-friendly payroll and HR solution.

Overview of Gusto

Founded in 2011, Gusto was created with the goal of simplifying payroll and HR tasks for small and medium-sized businesses. Since its inception, the platform has grown in popularity due to its focus on user experience, compliance with tax regulations, and comprehensive HR functionalities. Gusto aims to provide a hassle-free experience for business owners, allowing them to manage their workforce efficiently.

Key features and functionalities of Gusto

Payroll processing

Gusto offers easy robust payroll processing, automating tasks such as salary calculations, tax withholdings, and direct deposits. It simplifies payroll tax compliance by handling filings and payments on behalf of businesses.

Learn more about certified payroll.

Employee benefits

The platform allows businesses to set up and manage employee benefits, including health insurance, retirement plans, and other perks. This feature streamlines benefit administration and empowers employees with valuable offerings.

Employee onboarding

Gusto simplifies the onboarding process for new hires, providing a smooth experience for both employers and employees. It assists with necessary paperwork, compliance forms, and setting up new employee profiles.

Time tracking

Businesses can track employee hours and attendance using Gusto’s time tracking features. This streamlines payroll processing and helps ensure accurate compensation for employees.

Compliance and tax filings

Gusto keeps up with changing tax laws and regulations, ensuring businesses remain compliant with payroll and tax requirements. The platform handles tax filings and submissions, reducing the risk of penalties for non-compliance.

Pros of Gusto

1. User-friendly interface: Gusto’s intuitive and easy-to-navigate interface makes it accessible to users with limited accounting or HR experience. This user-friendliness reduces the learning curve and saves time during implementation.

2. Comprehensive payroll and HR tools: Gusto offers a broad range of features, including payroll processing, benefits management, time tracking, employee onboarding, and tax compliance. It provides a one-stop solution for businesses to handle their payroll and HR needs.

3. Transparent pricing: Gusto offers clear and straightforward pricing plans, making it easy for businesses to understand their costs and budget accordingly. You can be sure that Gusto emposes no hidden fees.

4. Employee self-service: Gusto provides employees with a self-service portal where they can access their payroll information, tax forms, and benefits details, which enhances HR’s administrative work.

5. Compliance and tax filings: Gusto keeps up with changing tax laws and regulations, ensuring that businesses remain compliant with payroll and tax requirements. The platform handles tax filings and payments on behalf of businesses, reducing the risk of errors and penalties.

6. Customer support: Gusto is known for its responsive and helpful customer support team. Businesses can rely on knowledgeable representatives to assist with inquiries and resolve issues promptly.

Cons of Gusto

1. Limited accounting features: While Gusto covers payroll and HR management well, it lacks the comprehensive accounting features present in dedicated accounting software like QuickBooks. Businesses requiring more robust accounting functionalities may need to integrate Gusto with another accounting platform.

2. Scalability concerns: As businesses grow and their HR and payroll needs become more complex, Gusto may have limitations in accommodating larger companies with more significant workforce requirements.

3. Integration options: While Gusto integrates with some third-party applications, its range of integrations may be more limited compared to other HR and payroll platforms. This can limit the software’s ability to seamlessly connect with other business tools.

4. Limited industry-specific features: While Gusto caters to a wide range of industries, businesses with highly specialized needs or unique industry requirements may find that the platform lacks certain industry-specific features.

5. No global support: Gusto primarily caters to businesses in the United States, which means it may not be an ideal choice for international businesses or those with a global presence.

On the whole, Gusto is a user-friendly and comprehensive payroll and HR platform that suits the needs of many small to medium-sized businesses. Its ease of use, transparent pricing, and focus on compliance make it an attractive choice for handling payroll and HR tasks efficiently. However, businesses should carefully consider their specific needs, including accounting requirements and scalability, before deciding if Gusto is the right fit. For companies seeking an accessible and efficient solution for managing payroll and HR, Gusto remains a strong contender with its streamlined processes and excellent customer support.

Planning to use QuickBooks or Gusto to manage your business operations? Synder Sync, a top-notch accounting solution, will help you seamlessly connect them to your sales channels and payment gateways to get automated records of the sales data. Synder will double check there are no duplicate entries or errors in your accounting software and prepare your books for a smooth and accurate reconciliation. Sign up for a 15-day free trial with or visit our public demo to check out Synder’s potential that’s bound to benefit your business.

QuickBooks vs Gusto: Comparison of key features

QuickBooks and Gusto stand as two prominent players in the realm of accounting and payroll software, each excelling in different areas. Let’s take a closer look at the key features of both platforms to better understand their strengths and how they cater to different business needs.

QuickBooks, being a comprehensive accounting solution, boasts a wide array of features that make it a go-to choice for businesses seeking a holistic financial management tool. Its robust accounting capabilities encompass everything from basic bookkeeping to advanced financial reporting. Users can efficiently track income and expenses, create and send customized invoices, reconcile bank accounts, and gain valuable insights into their financial performance. Moreover, QuickBooks offers powerful inventory management tools, enabling businesses to optimize supply chain operations and keep track of their products in real-time. The software’s flexibility allows it to cater to businesses of all sizes, accommodating the complexities of larger enterprises and supporting the financial growth of smaller startups.

On the other hand, Gusto’s key focus lies in simplifying payroll and HR management, making it an attractive option for businesses that prioritize streamlined HR processes. Its user-friendly interface and intuitive design enable business owners and HR personnel to efficiently handle payroll processing, tax calculations, and direct deposits with ease. Gusto also offers a range of benefits administration tools, helping businesses manage employee health insurance, retirement plans, and other perks, fostering employee satisfaction and retention. The platform’s emphasis on compliance ensures that businesses stay up-to-date with payroll tax regulations and avoid potential penalties. Gusto’s time tracking feature further enhances efficiency by accurately recording employee hours, simplifying the process of calculating pay and attendance.

When it comes to accounting capabilities, QuickBooks undoubtedly offers a more comprehensive suite of tools compared to Gusto. However, if your primary concern revolves around payroll and HR management, Gusto shines with its straightforward and efficient platform.

QuickBooks and Gusto pricing comparison

QuickBooks Pricing

QuickBooks offers various pricing tiers to cater to different business needs:

- QuickBooks Simple Start: This basic plan is designed for solopreneurs operating one sales channel and as of July 2023 costs $15 per month. It includes basic features like free setup, income and expense tracking, invoicing, receipt management, basic reporting.

- QuickBooks Plus: The Plus plan, starting at around $42.50 per month, is designed for growing businesses. It includes up to 5 users, all sales channels, inventory tracking, comprehensive reporting capabilities, and more.

- QuickBooks Advanced: This plan is suitable for more established businesses with more extensive accounting needs. Pricing for the Advanced plan is $100 per month and includes up to 25 users, all sales channels, advanced features like accelerated invoicing, custom user permissions, and enhanced support.

Gusto Pricing

Gusto’s pricing is based on the number of employees, and it offers different plans to accommodate various business sizes:

- Simple plan: Gusto’s Simple plan, at around $40 per month, which is $6 a month per employee, includes full-service payroll, and employee benefits.

- Plus plan: The Plus plan, at around $80 per month, which is $12 per employee, includes comprehensive payroll features, employee benefits, and HR tools.

- Premium plan: The Premium plan is Gusto’s most comprehensive offering with scalable payroll and benefits features, expert HR tools and priority support – all these for exclusive pricing negotiated with Gusto’s team.

It’s worth noting that both QuickBooks and Gusto may offer occasional promotions or discounts, and their pricing structures might evolve over time. Additionally, the number of employees and users on the platform can impact the total cost for businesses. Therefore, it’s essential to evaluate your specific business needs and the features offered in each plan to determine which platform provides the best value for your organization. Before making a decision, consider taking advantage of free trials or contacting the sales teams of both QuickBooks and Gusto to explore pricing options and ensure they meet your business requirements.

QuickBooks and Gusto: User experience comparison

User experience is a critical aspect to consider when choosing accounting or payroll software, as it directly impacts how smoothly and efficiently you can manage your financial tasks. Both QuickBooks and Gusto strive to offer user-friendly experiences, but there are differences in their interfaces and functionalities. Here’s a comparison of the user experience for QuickBooks and Gusto:

QuickBooks user experience

- Interface: QuickBooks has a clean and organized interface, with a dashboard that provides an overview of your financial data. The navigation is straightforward, and the layout is designed to be intuitive.

- Comprehensive features: QuickBooks offers a wide range of accounting features, which can be advantageous for businesses with complex financial needs. However, the abundance of features may feel overwhelming for some users who only require basic accounting functionalities.

- Customization: QuickBooks allows some level of customization to tailor the software to your business’s specific needs. You can customize invoices, reports, and other elements to reflect your brand.

Gusto user experience

- Interface: Gusto boasts a simple and clean interface that emphasizes ease of use. The platform aims to simplify payroll and HR tasks, which is reflected in its straightforward design.

- Focus on payroll and HR: Gusto’s focus is primarily on payroll and HR management, making it ideal for businesses seeking a user-friendly solution for those specific tasks.

- Compliance: Gusto prioritizes compliance with tax regulations and handles tax filings and payments on behalf of businesses, simplifying the process for users.

Overall, QuickBooks is suitable for businesses looking for a comprehensive accounting solution, while Gusto is an excellent choice for those primarily focused on payroll and HR management. QuickBooks may be a better fit for larger businesses with complex accounting needs, while Gusto is ideal for small to medium-sized businesses seeking a user-friendly HR and payroll platform. Ultimately, the best user experience will depend on your business’s specific requirements and preferences. Before making a decision, consider trying out free trials of both platforms to see which one aligns better with your needs and workflow.

QuickBooks and Gusto user reviews and testimonials compared

User feedback is invaluable in understanding the real-world experiences of using both platforms. QuickBooks’ large user base has resulted in a significant amount of feedback, while Gusto’s users praise its ease of use and customer support.

QuickBooks reviews

Users appreciate QuickBooks’ extensive range of accounting tools, including invoicing, expense tracking, financial reporting, and inventory management. Additionally, many users find QuickBooks to be easy to navigate, even for those without an accounting background, which helps save time and reduce frustration. QuickBooks users also value that the platform caters to businesses of all sizes, allowing them to start with a basic plan and upgrade as their needs as they grow their business.

However, some users find QuickBooks’ pricing structure confusing, with potential hidden costs or higher fees for additional users and advanced features. They also comment on the learning curve for new QuickBooks users, especially when navigating more complex features and reporting options. And there’s a common concern among users about the quality of customer support, with some experiencing longer wait times or difficulty resolving issues.

Gusto reviews

Most of all, users praise Gusto’s intuitive interface and easy-to-use payroll and HR features, especially for businesses with limited HR expertise. Users also appreciate Gusto’s straightforward pricing structure, which makes it easier to understand costs and budget accordingly. What else is highly valued is Gusto’s compliance support, including tax filings and payments as it reduces the burden of regulatory responsibilities. And the employee self-service portal in Gusto is often cited as a useful feature that empowers employees and reduces HR administrative tasks.

On the other hand, some users may find Gusto’s accounting features too basic, requiring integration with another accounting software for more advanced functionalities. So larger businesses or those with more complex HR needs might feel limited by Gusto’s capabilities.As well, users may find the range of integrations more limited compared to other HR platforms.

Closing thoughts: How QuickBooks and Gusto compare and which software to choose for your business needs

In conclusion, choosing between QuickBooks and Gusto ultimately comes down to understanding your business’s specific needs and priorities. Both platforms offer valuable features and functionalities, but they excel in different areas.

If your business requires comprehensive accounting capabilities, QuickBooks is the better choice. With its wide range of features and extensive reporting options, it is suitable for businesses of all sizes, especially those with complex accounting requirements.

On the other hand, if your primary focus is on efficient payroll and HR management, Gusto is an excellent option. Its user-friendly interface, compliance support, and employee self-service portal make it ideal for small to medium-sized businesses seeking a streamlined HR solution.

To make an informed decision, take advantage of free trials offered by both platforms. This will allow you to explore their functionalities, test their ease of use, and assess how well they align with your business processes.

Additionally, consider reading user reviews and testimonials from businesses similar to yours. Real-world experiences from other users can provide valuable insights into the pros and cons of each platform and help you understand how well they perform in different scenarios.

Ultimately, the right accounting software can significantly impact your business’s financial management and overall success. By carefully evaluating your requirements and comparing the strengths of QuickBooks and Gusto, you can choose the platform that best fits your business needs, ensuring efficient and effective financial and HR management in the long run.

Read more about Ecommerce as a Service and our guide How to undo reconciliation in Quickbooks Online.