Efficient accounting is vital in modern business management. QuickBooks provides businesses with powerful financial tools. However, to optimize its functionality, integration with other systems is necessary.

You can integrate QuickBooks directly or through third-party solutions. Anywhichway, integration empowers businesses to access real-time data, make informed decisions, and maintain a 360-degree view of their financial landscape.

This article explores QuickBooks integration possibilities. It also looks at how small businesses can leverage them to streamline their accounting processes and growth.

QuickBooks account: a foundation for financial success

As a business owner, you might know that QuickBooks is not just software. Today, it can be a cornerstone of financial success for countless small businesses. It provides a structured and efficient means of managing all financial aspects of an organization.

If you have a QuickBooks account, many tasks become simpler. Those include accounting, record-keeping, tracking income and expenses, managing payroll, and generating insightful financial reports.

QuickBooks offers two primary versions: QuickBooks Online (QBO) and QuickBooks Desktop (QBD). The choice between them depends on your business’s unique needs and preferences.

- QuickBooks Online is a cloud-based platform – a trendsetter in modern accounting. You can access financial data from anywhere through the internet, making it particularly advantageous for businesses with remote or distributed teams.

- QuickBooks Desktop is a traditional, locally installed software. It offers a comprehensive feature set for businesses that prefer to store their data on a local server for security reasons.

More and more small businesses are choosing QuickBooks Online for cloud-based accounting because it is convenient and easy to use.

How much is QuickBooks a month?

QuickBooks Online offers subscription plans ranging from approximately $30 to $200 per month, with options tailored from simple start-ups to advanced business needs.

QuickBooks Desktop, on the other hand, offers annual subscriptions for its Pro Plus and Premier Plus versions starting around $549 and $799, respectively, with Enterprise solutions beginning at about $1,922 per year.

These prices can vary based on promotions, specific business requirements, and additional services like payroll. It’s important to note that QuickBooks often updates its pricing, so checking the official website for the most current information is recommended.

Why might businesses need to integrate QuickBooks?

While QuickBooks offers comprehensive accounting capabilities, it may lack certain functionalities that businesses require for a complete financial management solution. For example, QuickBooks time tracking capabilities may be not enoughf for a companie’s HR needs. It may also lack sales tax management or extensive credit card processing capabilities. Integrating QuickBooks with specialized software can fill these gaps.

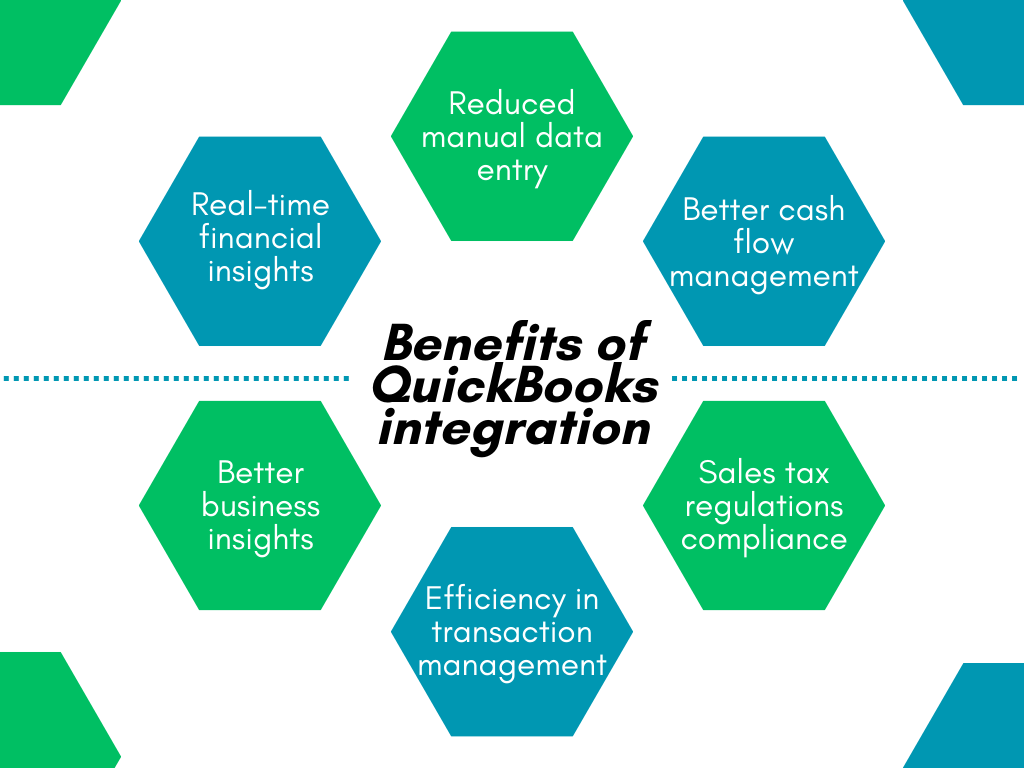

Integrating QuickBooks with other systems is essential for modern business management, providing numerous benefits.

Real-time financial insights

One of the primary advantages of integrating QuickBooks with other systems is the access to real-time financial insights. You get a live feed of transactions, expenses, sales, and other financial metrics. Compared to data updated from time to time, it’s quite a game-changer. It empowers you to make informed decisions and promptly respond to changing market conditions and trends as they happen.

Reduced manual data entry

Manual data entry is a time-consuming and error-prone process that QuickBooks integration eliminates. Integrating with payment processors, ecommerce platforms, or CRM software helps automatically bring financial records to QuickBooks. It saves you countless hours of manual data input and minimizes the risk of human error. At this point, your financial records remain accurate and up to date.

Improved cash flow management

The integration allows for significantly improved cash flow management. Having access to accurate and timely information helps you monitor incoming and outgoing funds more effectively. In turn, it helps you optimize your cash reserves, pay bills on time, and make sound financial decisions.

Streamlined compliance with sales tax regulations

QuickBooks can automatically generate and file sales tax reports. It helps reduce the risk of costly penalties and audits and saving you the hassle of manual calculations. Still, managing sales tax can be complex, especially if you sell across different states or abroad. At this point, integrating with systems that can handle complex sales tax calculations and reporting ensures that your business stays compliant.

Enhanced efficiency in transaction management

Integrating QuickBooks with payment processors and ecommerce platforms simplifies transaction management. You can easily reconcile credit card transactions, monitor invoice payments, and track customer orders, all within QuickBooks. It saves time and provides a clear and accurate picture of your financial transactions, making it easier to identify discrepancies.

Better business insights

By integrating QuickBooks with customer relationship management (CRM) systems, you gain a deeper understanding of your customers. It helps you tailor your business strategies, marketing campaigns, and customer service to their specific needs. QuickBooks integration with CRM tools helps connect your financial and customer data. It provides a holistic view of your customer interactions and their impact on your business.

Types of QuickBooks integration

As mentioned earlier, QuickBooks can integrate with many other business software and systems, depending on a company’s needs. Here, we will explore some of the most popular QuickBooks integrations. They are the integration with payment processors and ecommerce platforms (and marketplaces). And they are the most frequently used systems when running a business.

These systems can integrate with QuickBooks directly or through third-party solutions, and we’ll look at both.

Payment processors integration

One of the most popular forms of QuickBooks integration is connecting payment processors. Payment processors, such as PayPal, Square, and Stripe, are essential for businesses that accept online payments. Integrating these payment processors with QuickBooks streamlines financial balancing by automatically recording transactions in your accounting software.

The advantages of payment processor integration with QuickBooks are manifold.

First, it reduces the need for manual data entry, minimizing the risk of errors and saving precious time. Also, a real-time view of sales can help track income, manage cash flow, and stay compliant with sales tax regulations.

Besides, this real-time data empowers businesses to make informed financial decisions promptly. It also simplifies the accounts balancing, helping you keep a tight grip on your financial records.

Ecommerce platforms integration

For businesses engaged in online retail, ecommerce platform integration with QuickBooks is a critical step.

Platforms like Shopify, WooCommerce, and BigCommerce allow businesses to sell products or services online. Integrating them with QuickBooks ensures you can consistently update your financial records.

Ecommerce platform integration offers numerous benefits.

First, it eliminates the need for manual data entry, reducing errors and saving time. This seamless integration provides real-time insights into your sales. So you can monitor revenue, manage inventory, and calculate sales tax more efficiently.

It also streamlines customer and product data tracking. So, businesses can analyze sales trends and optimize their product offerings based on the data gathered.

You can integrate QuickBooks with other business management systems directly or through third-party solutions. Direct integration is simple but may result in duplicate data. Third-party integration offers more flexibility and can automate tasks, resulting in more accurate books and reporting. It may require an additional fee, but the benefits are worth it.

Enhancing financial management through QuickBooks integration

Integrating multiple sales and payment channels with QuickBooks accounting through third-party solutions brings many significant benefits. From creating a unified view of multi-channel data to automating data integration – the advantages are game-changing. Let’s look at these benefits, using Synder as an example.

- Unified view of multi-channel data

Synder consolidates data from various sales platforms, simplifying decision-making by offering a unified, comprehensive financial snapshot. - Automated data integration and analytics

Automation streamlines data entry and enhances accuracy, empowering businesses to derive actionable insights and make data-driven decisions. - Insights via a comprehensive dashboard

Synder’s dashboard provides a centralized platform to monitor financial performance, preventing the need to juggle spreadsheets or log into multiple systems. - Complex tax calculations simplified

Businesses can set up intricate tax calculations based on customer location or shipping address, ensuring compliance without manual complexity. - Simplified operations

The integration eliminates the requirement to log in to multiple systems. This provides a time-saving and efficient solution for businesses. It allows them to focus on growth and success.

Conclusion

QuickBooks is a strong accounting solution, but it may not meet the specific needs of every business. However, integrating QuickBooks with other business tools, can become the ultimate source of truth for a business’s performance and financial health. Businesses can make data-driven decisions by using real-time data, streamlined operations, and automation. These decisions are crucial for sustainable growth in today’s business world.

It’s important to note that QuickBooks integration capabilities may not cover all the systems and platforms a business uses. Third-party integration solutions, such as Synder, can bridge these gaps, ensuring that no data or transaction goes missing.

%20(1).png)