Want to grow your accounting firm but don’t know where to start?

In today’s online world, competition is fiercer than ever. You’re well aware of your tax and financial services that will improve your clients’ lives and businesses. But how do you keep a competitive edge over other firms in the market that appear everywhere—from Google search results to YouTube ads?

This comprehensive guide will walk you through 12 digital marketing techniques for accountants.

1. Grow an email list and start email marketing

Email marketing is an increasingly popular strategy for accountants. It has one of the highest potential ROI—$42 for every $1 spent.

Here’s how to get started growing an email list:

- Choose an email service provider. Invest in a reliable email service provider (ESP) to streamline your processes. They come with email templates, automation, analytics, and more. An ESP can greatly simplify sending and tracking email campaigns. Popular options for accountants include Mailchimp, Constant Contact, and Campaign Monitor.

- Grow your email list. Find email addresses of your existing clients and potential leads. Consider incorporating lead generation techniques. These could be techniques like creating content offers or embedding lead generation ads on networks like Linkedin or other platforms where your ideal client spends time.

- Segment your email list. Once you’ve built your email list, segment it based on relevant criteria. These include customer type, industry, or interests. This lets you ensure your emails resonate with the right people in your audience.

- Create engaging email content. As an accountant, you can share industry news, financial tips, and tax updates. Plus, promote special offers and events. Personalize your emails and use a conversational tone to connect with your recipients. Including images, infographics, or videos can also captivate your audience and improve engagement.

- Set a consistent sending schedule. Consistency is vital when it comes to email marketing. Establish a sending schedule that works for your business and your audience. Whether you send monthly newsletters, weekly updates, or periodic promotions, ensure that you stick to it. This will help establish trust with your recipients and keep them engaged with your brand.

2. Start a blog and optimize it for search engines

Blogging can be a powerful way for accountants to demonstrate their expertise, share valuable insights, and connect with potential clients.

This is because it lets you improve your website pages’ positions on the search engine results pages (The most common search engine being Google.) By abiding by as many Google ranking factors as possible, you’ll be discovered by more potential clients.

Here are three steps to help you get blogging fast:

1. Choose a platform. There are a lot of platforms to choose from. Popular options include WordPress, Squarespace, Wix, and more. Each platform has strengths and weaknesses, so research to find one that aligns with your goals and technical abilities. WordPress is a popular choice for bloggers due to its versatility, user-friendliness, and a wide range of plugins and themes.

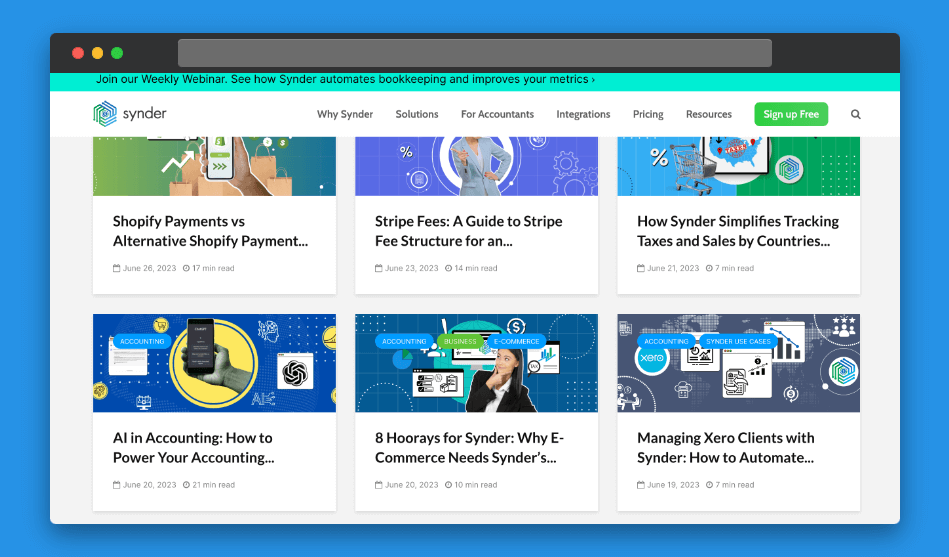

2. Write valuable blog post content. Your content must be relevant, engaging, and valuable to generate leads. Create a list of topics that align with your niche and your audience’s pain points. These could include how-to guides, industry news, tax tips, or case studies. Use a conversational tone and avoid jargon that may confuse your readers. Including images, infographics, or videos can also enhance the visual appeal of your blog and improve engagement. For example, here’s a glimpse of the content we offer on our blog at Synder:

3. Track meaningful metrics and KPIs. To measure the success of your blog, it’s important to monitor and analyze your results. Use Google Analytics to gain insights on key metrics such as page views, bounce rate, and time on site. This will help you identify what types of content resonate best with your audience. Plus, you can optimize your future blog posts accordingly.

3. Create a social media marketing strategy

Social media lets you engage with clients, build brand awareness, and establish thought leadership in the industry. Let’s look at some tips to get you started.

- Focus on 1-2 social media sites. Selecting the right platforms will maximize your reach and impact. Platforms like LinkedIn and Twitter are popular for accountants. This is because they allow for professional networking, sharing valuable insights, and engaging with industry peers. Facebook and Instagram can also showcase your brand personality and expand your audience.

- Develop a consistent content strategy. Creating a content calendar outlining what content you will share and when. Consider sharing educational articles, industry news, tax tips, case studies, or even behind-the-scenes glimpses into your accounting practice. Use a mix of images, videos, and written content to keep your audience engaged. And remember to stay consistent with your brand voice across all platforms.

- Interact with your audience. Respond to comments, answer questions, and participate in industry conversations. Actively seek opportunities to connect with potential clients, influencers, and partners. Engaging with your audience can build trust, strengthen relationships, and establish yourself as a go-to expert.

- Monitor your account’s performance. Knowing how your social media strategy is performing is essential for continuous improvement. Use analytics tools that come with the platform to track important metrics. Such metrics include reach, engagement, and click-through rates. Analyze which types of content are performing well and adjust your approach accordingly. And experiment with techniques to optimize your results, such as running targeted ads or partnering with influencers.

4. Start a podcast about finances and accounting

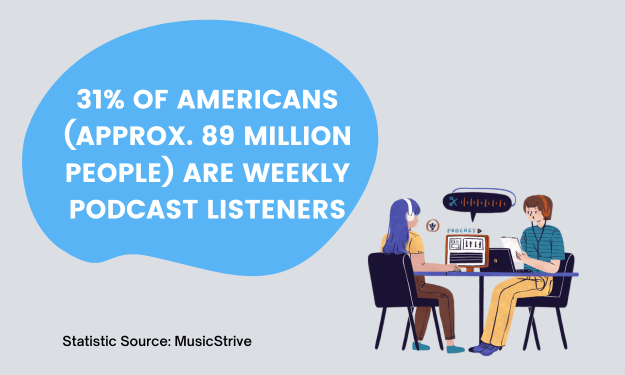

Podcasting has gained tremendous popularity recently. It offers a unique platform for accountants to share their expertise, connect with a bigger audience, and establish themselves as thought leaders.

You can follow these steps:

1. Define your podcast’s focus. Determine the specific topic or niche you want to focus on in your podcast. Consider areas where you have expertise or a unique perspective to share. Accounting is a broad term, so try to narrow it down.

2. Choose your format and structure. Will your podcast consist of solo episodes? Interviews with industry experts? A combination of both?

3. Invest in quality equipment. To produce a professional-sounding podcast, invest in a quality microphone, headphones, and audio editing software. Clear audio is essential for an engaging listening experience.

4. Create compelling content. Develop a content plan with episode topics and outlines. Consider addressing common accounting challenges, sharing industry insights, discussing emerging trends, or offering practical tips for business owners.

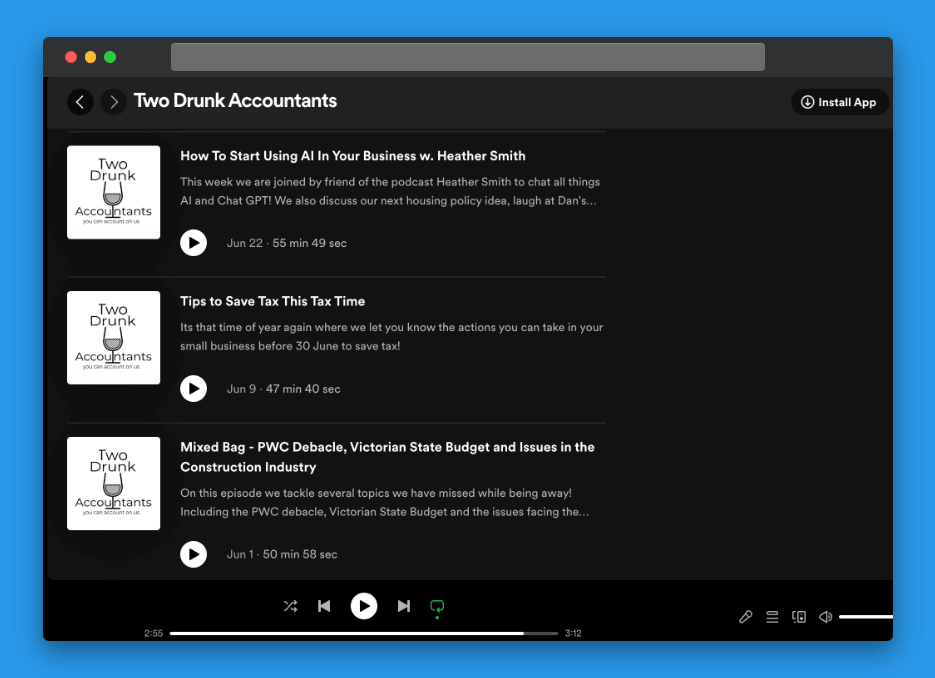

5. Record and edit your episodes. Set up a quiet recording space and start recording your podcast episodes. After recording, use audio editing software to edit out any mistakes, enhance audio quality, and add intros, outros, or background music if desired. Don’t forget to be engaging with your audience. Make your episodes fun and easy to listen to, and make your topics as interesting as possible. A good example of this is the Two Drunk Accountants podcast on Spotify. Their episodes are informative, but also entertaining. And they frequently bring on podcast guests.

6. Choose a podcast hosting platform. Popular options include Libsyn, Podbean, or Buzzsprout. This is where you’ll upload and distribute your podcast episodes on major platforms like Apple Podcasts, Spotify, and Google Podcasts.

7. Launch and promote your podcast. Once you have a few episodes ready, launch your podcast by submitting it to various podcast directories. Then, promote it through your website, social media channels, and industry networks. Engage with your listeners by encouraging feedback and reviews.

5. Create a lead magnet your audience can download for free

As an accountant, generating leads is crucial for growing your business. A powerful lead magnet can help attract potential clients, establish trust, and drive conversions.

A lead magnet is something you offer for free. And in exchange, you get a lead’s contact information. Usually, their email address.

Here’s how we suggest you create a powerful lead magnet:

- Identify your target audience and pain points. Determine what challenges they face financially and how you can help solve their problems.

- Choose your lead magnet type. Decide on the type of lead magnet that aligns with your ideal client and area of expertise. Popular options include e-books, whitepapers, checklists, webinars, presentation backgrounds and templates. You can even offer a free tool you’ve created, like a dividend calculator or business expenses spreadsheet.

- Create an eye-catching design. An attractive design captures your audience’s attention and enhances the lead magnet’s perceived value. Consider hiring a graphic designer or using tools like Canva to create customized designs.

- Provide clear and actionable next steps. Make sure your audience knows how to get your lead magnet. Provide a call-to-action (CTA) that prompts them to take action, and make your lead capture form clear and trustworthy.

- Distribute your lead magnet. Make your lead magnet easily accessible on your website, social media platforms, and other relevant channels.

6. Run paid ads to your landing pages

While organic marketing efforts are crucial, paid advertising can also significantly drive growth for your accounting firm. It’s a more traditional way to market your services, but effective when done right.

They let you target specific audiences, promote your services, and increase your online visibility. Here are some tips to help you run them successfully:

- Identify your objectives. Before running ads, determine what you hope to achieve through your advertising efforts. Are you looking to generate leads, promote a new service, or increase brand awareness? Define your objectives to help you create targeted and effective ad campaigns.

- Choose the right platform. LinkedIn Ads and Google Ads are popular for accounting firms, as they provide targeted advertising options for B2B audiences. Facebook Ads and Instagram Ads can also help you reach a wider audience.

- Craft compelling ad copy. Create ad copy highlighting your unique value proposition and addressing your target audience’s pain points. It should be concise, engaging, and offer a clear call to action.

- Be strategic with ad placement. Consider where your audience will likely see and engage with your ads. Target your placements to relevant websites, social media pages, or search engine results pages.

- Track and analyze results. Use analytics tools to track ad performance and adjust your strategy accordingly. Review key metrics such as cost per click, conversion rates, and return on ad spend to optimize your ads and improve overall performance.

7. Collaborate with thought leaders in the accounting industry

Collaborating with industry thought leaders can provide valuable opportunities for accountants looking to expand their network and establish themselves as experts in their field.

By partnering with influential voices, you can gain insights, credibility, and access to a bigger audience.

You can do so through methods like:

- Guest blog posts

- Podcast interviews

- Webinars

- Joint research projects

- And more

Leverage their expertise and build meaningful connections. By showcasing your knowledge and collaborating with others, you can elevate your professional profile, attract new clients, and stay ahead of the curve in the ever-evolving accounting field.

8. Create a referral program for existing accounting clients

A referral program lets you tap into your current network and benefit from positive word-of-mouth marketing. This is because it incentivizes existing clients and contacts to refer to your services.

Here’s a step-by-step guide to help you create a program that brings you consistent client referrals:

- Define your objectives. Determine what you hope to achieve with your referral program. Is it to increase client acquisition? Boost revenue? Expand your network? Clarifying your objectives will help shape the structure and incentives of your program.

- Identify target referral sources. Identify key sources for potential referrals, such as satisfied clients, professional contacts, or industry organizations. These sources should already have a network of individuals who may benefit from your accounting services.

- Create incentives. Develop attractive incentives for the referrer and the new client. Consider offering discounts on services, cash rewards, or additional perks. The value of the incentive should be enticing enough to motivate referrals.

- Promote your program. Use various channels to communicate your referral program to your existing clients and contacts. This can include email newsletters, social media posts, website banners, and in-person conversations.

- Track and reward referrals. Implement a system to track and monitor referrals. Ensure that both the referrer and the new client are properly rewarded. You can do this manually or by using referral management software.

- Thank and engage the referrers. Always remember to show gratitude to anyone who helps grow your business. Send personalized thank you notes, offer exclusive benefits, or invite them to special events. Engaging with referrers helps strengthen your relationship and encourages continued referrals.

- Evaluate and adjust. Regularly evaluate the results of your referral program. Measure the number of referrals, conversion rate, and return on investment (ROI). Finally, make necessary adjustments based on feedback and insights to continually optimize your program.

9. Publish a book about taxes, finances, and other accounting topics

If you’re a seasoned professional, publishing a book highlights your expertise and knowledge. It also establishes you as a thought leader in your field.

A book is a tangible asset that can attract new clients, increase your credibility, and differentiate you from competitors.

Whether it’s a comprehensive guide, a case study collection, or a niche-specific book, publishing can boost your professional reputation, open doors to speaking engagements, and, ultimately, fuel business growth.

10. Host a webinar

Hosting a webinar as an accountant can be a dynamic way to share your expertise, educate your audience, and build thought leadership. Webinars offer a cost-effective way to engage with potential clients and convey value.

Whether a live presentation on tax law changes, how to file an income tax return, or a Q&A session on business finances, webinars allow you to demonstrate your knowledge and connect with your audience in a more interactive setting.

Offering valuable insights and personalized advice also lets you increase engagement and establish yourself as a trusted expert.

11. Start a YouTube channel to give financial advice

YouTube is a platform for visual content, allowing you to engage with viewers through educational videos, tutorials, and expert insights.

Here’s how you should plan working with YouTube:

1. Define your channel’s focus. Determine the specific niche or topics you want to cover on your channel. Focus on areas where you have expertise, such as tax planning, budgeting, or small business finance.

2. Plan your content. Develop a content strategy that addresses the needs of your target audience. Plan video topics, outlines, and scripts to ensure your content is informative, engaging, and valuable to viewers. For example, check out these videos accountants have made explaining tax deductions:

3. Invest in quality equipment. Purchase the necessary equipment for producing high-quality videos. This includes a good camera, microphone, lighting, and video editing software.

4. Create engaging videos. Create and upload videos that align with your channel’s focus. Make sure to craft attention-grabbing titles, incorporate visual aids, and speak confidently to engage and educate your audience.

5. Optimize your videos. Use relevant keywords in your places like video titles, descriptions, and tags. Create eye-catching thumbnails and engage with your audience in the comments section to foster interaction.

6. Promote your channel. Share your videos on other social media platforms, websites, and professional networks to grow your subscriber base. Plus, collaborate with other YouTubers or industry influencers to increase exposure.

7. Engage and interact. You can build a loyal community by responding to comments, answering questions, and engaging with your audience. And of course, always remind viewers to like your videos and subscribe to your channel.

12. Consistently follow up with leads

Following up with leads is crucial for growing your business and converting potential clients into loyal clients.

Here are some effective strategies to help you follow up with leads:

- Respond promptly. Respond to leads promptly—preferably within 24 hours—to show your commitment and interest in their needs.

- Personalize communication. Tailor your follow-up messages to each lead’s needs and interests. Personalized communication makes a lasting impression and shows that you value their consideration in your business.

- Be persistent but respectful. Send follow up emails consistently but avoid being pushy. Find the balance between staying in touch and respecting their time and preferences.

- Track and organize. Use a CRM (customer relationship management) system to track and organize lead information. This allows you to keep essential details and conversations in one place for easy reference.

You can also use these tips to reach out to previous clients. You never know when they might need your services again. Or if they want to refer someone to you.

Also consider asking leads, current, and previous clients for feedback. You can do this easily through your email list and feedback surveys. Make it 1-2 minutes to fill out maximum, and use a QR code generator to make finding the survey easy for participants.

Wrapping up: Grow your firm by using tips on marketing for accountants

There you have it—twelve practical, effective tips to market and grow your accounting firm fast.

With these digital marketing tips, you’ll be filling up your calendar with potential client consultations in no time. And converting them into long-term clients will be a cinch.