Restaurant bookkeeping can be intimidating even for experienced restaurant owners. There are so many things to keep in mind and so many important reports to maintain (profit and loss statement, daily sales report, cash flow report, balance sheet, and others). Many questions arise about restaurant accounting services, such as what is the difference between restaurant bookkeeping and accounting? Which software is suitable for restaurants? What does the restaurant bookkeeping cycle look like?

One thing that makes it particularly tricky is that so many pieces are in motion. You often have to hire new people, track costs and inventory such as food, beverages, items of cooking equipment, employee uniform, etc., as well as account for damages which occur from time to time. But it’s also incredibly important to maintain a healthy regular bookkeeping flow.

To help you take good care of your restaurant’s accounts and streamline the process of managing your finances, we’ve prepared a guide on the major aspects of restaurant bookkeeping. So in this article you’ll learn about:

- Restaurant bookkeeping tips: accounting methods

- The basics: bookkeeping reports required in restaurants

- Bookkeeping cycle: what does it look like?

- Automating the routine: restaurant accounting software

Contents:

1. Restaurant bookkeeping tips: Accounting methods

2. The basics: Bookkeeping reports required in restaurants

3. Bookkeeping cycle in restaurants: What does it look like?

4. Automating the routine: Restaurant accounting software

Restaurant bookkeeping tips: Accounting methods

This part will give you a comprehensive overview of restaurant accounting tips you should take into consideration when running a restaurant business. The big thing to cover right away is the accounting method which would be suitable for restaurants. According to Chron.com, restaurants under $1M per year in revenue can choose their own small business accounting method and most often it would be the cash method. Larger restaurants must use the accrual method to comply with the IRS.

Cash Method

This restaurant accounting method is used to document generated income when cash is received to pay for services or to record expenses and costs that occur. A case for recording opens up every time cash is exchanged. Since in most restaurants, cafes, and bars services are rendered and paid for simultaneously, money isn’t owed at a later stage, which makes this method so fitting.

One might consider choosing another method because a cash basis, while pretty straightforward, isn’t always the most accurate accounting method for a restaurant. The problem is that it doesn’t recognize delayed payments. For example, using the cash method you’d account for the deliveries from your restaurant’s vendors only when you pay for them. But many established restaurants have delivery accounts that allow them to pay their vendors long after the delivery has taken place.

If you follow a similar pattern, the cash method would inaccurately show that your restaurant has large sporadic delivery expenses, when in fact they might be smaller and more regular.

Accrual Method

The accrual method is mandatory for restaurants with larger revenue and can be useful for smaller-scale restaurateurs that have delivery accounts, for which they pay after the delivery has taken place. The accrual method accounts for a restaurant’s transactions as they occur. What it means is that expenses and revenue are being recorded at the time of the transaction. It doesn’t matter when cash is actually exchanged or payments are made.

Using this method will allow you to see a more accurate picture of how expenses happen and income is generated. It also demonstrates the balance between your revenue and expense spending.

Tips

It’s very important to consider the tips (separate from automatic gratuities, which fall under a different IRS category) in the accounting process. Employees are required to report their tips to the restaurant owner, as it’s considered employee income. They also have to pay taxes on them. So, while you don’t need to report the tips as a part of your restaurant revenue and it can’t be subject to withholding, they should be factored in.

The basics: Bookkeeping reports required in restaurants

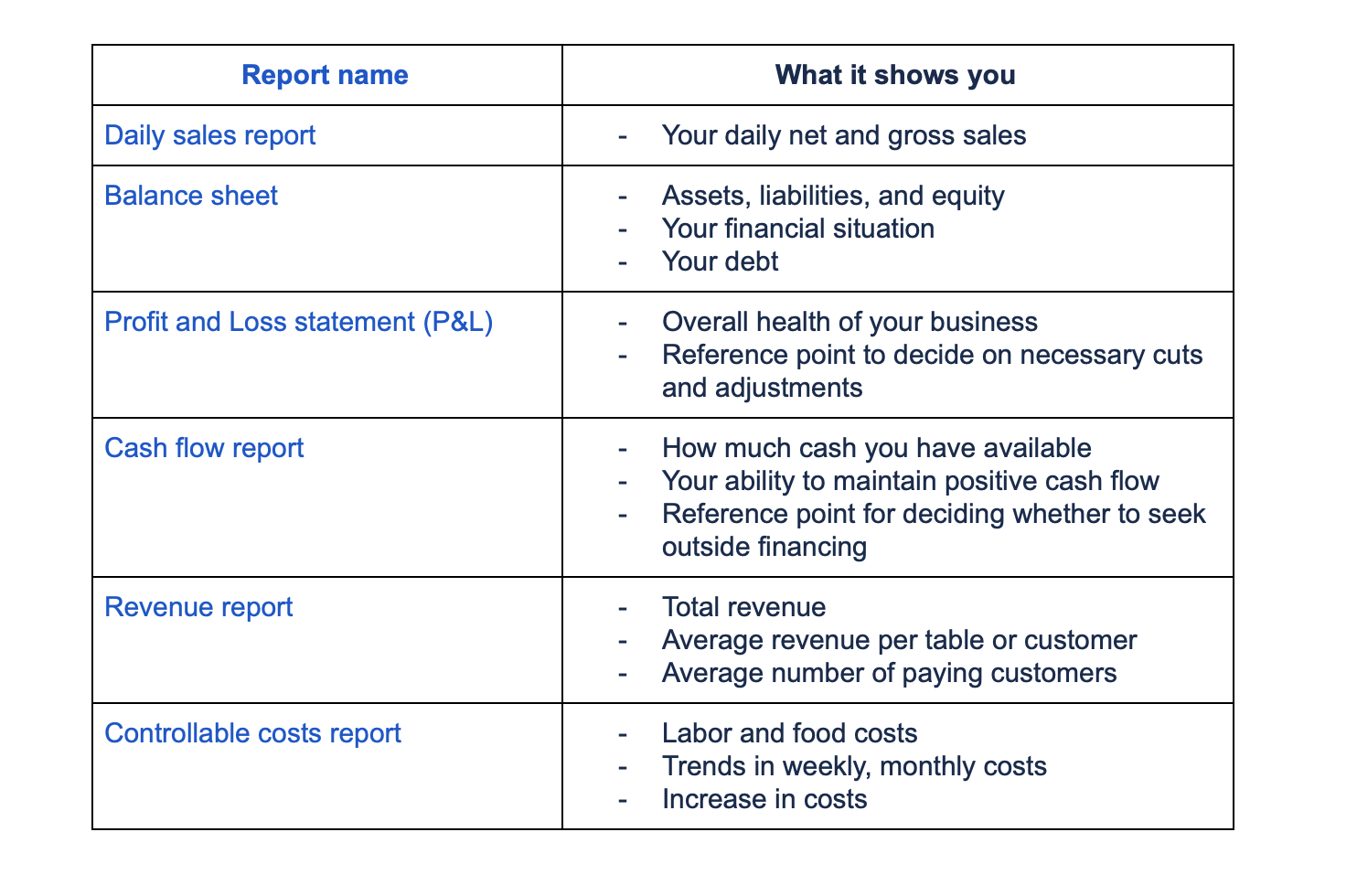

There are several reports that accompany every restaurant business as they go forward trying to maintain a positive cash flow and the overall health of their business. Here are some of the essential reports that restaurants use in their bookkeeping process with an outline of what they’re needed for.

Bookkeeping cycle in restaurants: What does it look like?

To put it simply, this is the process of preparing financial reports in which an accountant usually follows the accounting cycle of business transactions. Restaurants often use the four-week accounting period instead of a monthly one, as days of the week tend to affect how the business is doing, which creates a 13-week bookkeeping cycle.

There are several processes your bookkeeper should focus on to keep your business running smoothly. A typical bookkeeping cycle would consist of:

- Account reconciliation;

- Payroll;

- Accounts payable.

Reconciliation

Reconciling in accounting means that you need to compare two sets of documents, usually a financial account statement and your company’s financial spreadsheet, in order to make sure they’re in agreement. It allows you to be aware of any incorrect deposits or discrepancies in data recording.

Payroll

Payroll is the compensation you need to pay to your employees for a set period on the agreed date. It tends to be quite complicated and time-consuming, and you might find yourself needing a professional to keep track of different salaries or hourly pay, hours, tips, taxes, and deductions. Using employee time-tracking software specifically for restaurants will make the payment process fairer.

Accounts payable

Accounts payable is about short-term obligations you owe to your suppliers. Paying attention to accounts payable and paying the bills on time is what helps you keep long-lasting working relationships with your vendors.

Automating the routine: Restaurant accounting software

Managing a restaurant often requires the business owner to constantly attend to challenging tasks. You need to marshall all your resources in order to increase restaurant sales, boost your customer and employee retention rate, streamline restaurant operations, focus on inventory tracking, optimize the menu, etc. Hence, automating repetitive bookkeeping processes is crucial in order to free up as much expert time as possible for things that truly need your attention. Together with your bookkeeper, you can optimize this tedious labor by outsourcing it to business accounting software.

Restaurant accounting software generates most essential reports. Among the most popular software solutions is QuickBooks Online, which is a reliable easy-to-use software solution mainly for small and medium-sized businesses offering accounting applications that accept business payments, manage and pay bills, and payroll functions.

Pro-tip:

Entering revenue transactions into an accounting system, as well as recording your expenses can be tiresome, that’s why it’s always better to automate. A lot of small businesses use a POS (point of sale) system which facilitates transactions in a retail company, be it in the food, clothes or restaurant industry. But even if you use a POS system like Toast in your restaurant business, or Clover for online orders for delivery, the payments might come in from different sources, such as Stripe, PayPal or Square.

To ease up the process of recording all transactions, you can enhance your QuickBooks experience with expert cloud-based software that fits small business, such as Synder, which is a top-notch solution that brings automation to your accounting and saves you tons of time to focus on restaurant sales, upscaling your business, and increasing profit. If you connect your POS like Square or Clover, etc., or payment platforms like Stripe, Paypal, etc. to Synder directly, it’ll automatically bring all data from POS and payment platforms to Quickbooks Online. Moreover, Synder features advanced settings and categorization rules that’ll enable you to optimize the transferred data according to your particular accounting needs.

Here’s a short how-to guide to setup the background automation of data recording:

- Connect your QuickBooks to Synder;

- Connect your POS system and/or payment platform (check out the list of available integrations);

- Have an overview of your incoming and outgoing online transactions and auto-sync them to QuickBooks in the background.

You can also accept online payments in seconds via Synder (a useful option for restaurants would be creating an instant checkout on your website for deliveries and your e-shop without needing any coding skills).

Check out our use case to find out what Synder can do to streamline restaurant bookkeeping.

Closing thoughts

The life of a restaurateur can be quite hectic. You need to keep track of so many different things to get your business running smoothly. Staying on top of all bookkeeping issues is time-consuming and takes a lot of effort, so why not automate some tedious bookkeeping tasks? With Synder working for you in the background, you get all your transactions auto synced to your QuickBooks, which saves you a bunch of time for other restaurant operations that require your ultimate attention. Synder has tons of useful features and is bound to be the perfect fit for your restaurant business. Get a free trial or book a demo to make sure Synder is just what you’ve been looking for.

Hungry for more? (pun intended) Check out additional automation options. We hope that by using these guidelines you can clarify your bookkeeping strategy and focus on sales and other things that contribute to the growth of your business.

.png)

I do consider all the ideas you have introduced to your article. It’s really convincing and will certainly work. Still, the article is very brief for novices. Thank you for the post.

This post was fantastic. Accounting gives me crazy anxiety even with a having a CPA!