Journal entries are vital parts of your accounting journal used to record financial transactions and ensure the accuracy of financial statements. Journal entries provide a detailed record of each transaction, including the date, description, and amount, which can be used for financial analysis and auditing purposes.

This article guides you through the process of making journal entries, provides some journal entries examples and gives advice on how to streamline this process.

What are Journal Entries?

A journal entry is a record of financial transactions made by a business or an individual in an accounting journal. It’s used to keep track of the business financial transactions, including income, expenses, assets, and liabilities. Usually, journal entries include the following components:

- Date: There’s a record of the date of a transaction in the journal entry.

- Description: A brief description of the transaction is recorded.

- Debit account: The amount debited from the account is recorded.

- Credit account: The amount credited to the account is recorded.

Benefits of Keeping Journal Entries

Journal entries have several benefits, including:

1. Accuracy: Journal entries help to maintain accurate financial records.

2. Organization: Journal entries provide an organized record of all financial transactions.

3. Analysis: Journal entries can be used for financial analysis, including cash flow analysis and balance sheet analysis.

4. Auditing: Journal entries are useful for auditing purposes.

Journal entry examples

Here are examples of journal entries of a sales transaction with and without the sales tax:

Journal entry example of debit and credit accounts: sales transaction without sales tax

Assume that ABC company sold a treadmill for $1,000 on credit to a customer. The journal entry for this transaction may be like this:

Date: April 1, 2023

Description: Sold treadmill on credit to customer

Account Debit Credit

Accounts Receivable $1,000

Sales Revenue $1,000

Explanation:

- The date of the transaction is recorded as April 1, 2023.

- The description of the transaction is recorded as “Sold treadmill on credit to customer.”

- The accounts receivable account is debited with $1,000, representing the amount owed by the customer for the products sold.

- The sales revenue account is credited with $1,000, representing the revenue earned from the sale of the products.

Example of entries in an account journal with sales tax

If you need to include the sales tax, the journal entry for this transaction would look like that:

Date: April 1, 2023

Description: Sold treadmill on credit to customer

Account Debit Credit

Accounts Receivable $1,070

Sales Revenue $1,000

Sales Tax Payable $70

Explanation:

- The date of the transaction is recorded as April 1, 2023.

- The description of the transaction is recorded as “Sold treadmill on credit to customer.”

- The accounts receivable account is debited with $1,070, representing the total amount owed by the customer, including the sales tax.

- The sales revenue account is credited with $1,000, representing the revenue earned from the sale of the product.

- The sales tax payable account is credited with $70, representing the sales tax of 7% collected from the customer on behalf of the government.

Example of entries in a general ledger

When your business needs to account for inventory and keep a general ledger – an account of all your financial transactions including debits and credits in such area assets,liabilities, revenue, and expenses, so your entries may become somewhat more intricate than just entries in general journals. They have to include two more accounts to reflect your inventory changes. Whenever you sell a product to a client, you’re reducing your inventory and increasing your Cost of Goods Sold (COGS) expense account. COGS shows how much the item costs a business.

Entries in your journals might look this way:

Date: April 1, 2023

Description: Sold treadmill on credit to customer

Account Debit Credit

Accounts Receivable $1,070

Sales Revenue $1,000

COGS $700

Sales Tax Payable $70

Inventory $700

Explanation:

- The date of the transaction is recorded as April 1, 2023.

- The description of the transaction is recorded as “Sold treadmill on credit to customer.”

- The accounts receivable account is debited with $1,070, representing the asset increase as the total amount owed by the customer, including the sales tax.

- The sales revenue account is credited with $1,000, representing your business’s revenue from the sale of the product.

- The treadmill cost your business $700, so you debit their COGS account with this amount.

- The sales tax payable account is credited with $70, representing the sales tax of 7% collected from the customer on behalf of the government.

- Your inventory account is credited with $700 once the product is off your inventory list.

Learn more about keeping entries in journals and managing accounting from our articles “Accounting Basics for Small Business: A Simple Guide” and “Basic Accounting for a Small Business: Bookkeeping and Accounting Basics”.

On the whole, the most essential thing about making journal entries is to ensure that such entries are accurate and reflect the correct amounts owed or earned by the company. It’s quite a challenge to keep error-free entries in journals manually. Luckily, advances in modern technology enabled us to automate this demanding routine.

How to automate the process of journal entries recording

Manual data entry is a tiresome, time-consuming and highly error prone process of keeping accounts of financial transactions. It might be especially painful for e-commerce businesses due to a larger volume of business transactions that need to be recorded, as well as the complexity of the e-commerce model that involves multi-channel sales. This can make it difficult to control so many accounts and sources of transactions and identify errors, and may result in inaccuracies in financial statements and challenges during tax filing and further reconciliation with your bank account. Luckily, there’s a high-tech pill to relieve this pain.

Synder Sync is a top-notch accounting app that has a great number of integrations with the most popular sales and payment channels like Shopify, Etsy, eBay, Amazon, PayPal, Stripe, and many more, as well as with accounting software like QuickBooks or Xero. The app acts like a bridge between them, synchronizing the details of sales transactions from all sales channels you’re selling on, and all payment gateways you’re using, and transferring this data into your accounting software.

To facilitate this process for e-commerce businesses with a big number of sales transactions happening daily, Synder offers the Daily Summary feature that allows users to import summarized totals of the day’s transactions instead of importing each transaction individually.

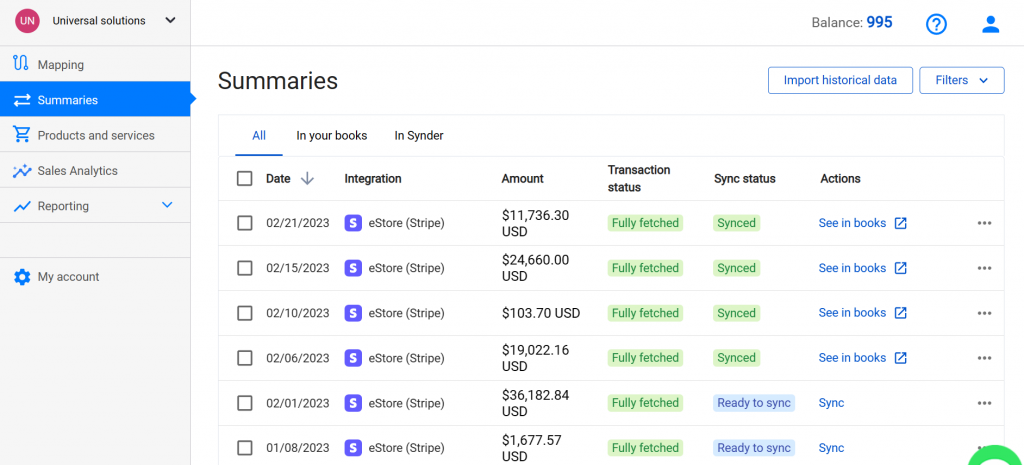

When this feature is enabled, Synder batches the daily amount of transactions into a single journal entry, automatically categorizing transaction details to ensure all incomes, expenses, fees, and taxes are accurately synced with your accounting software. This is what Synder’s summary looks like:

However, you can also view what exactly is included in each journal entry. Here’s an example:

Synder’s Daily Summary feature helps prevent the system from being overloaded with unnecessary details, speeds up data import, and ensures accurate categorization of transactions. It also provides mapping functionality for accurate categorization, and automation settings that allow users to select totally automated data import or manually check created journal entries before posting them in the books. By using this feature, business owners can record financial data in the books accurately and efficiently, while providing accountants with the necessary financial data for analysis.

To experience all benefits of the Daily Summary sync mode first hand, sign up for a 15-day free trial. Or if you prefer a specialist to talk you through the process via a live chat, book office hours with the Synder support team.

For more information on the Daily Summary Sync, check out our article “E-commerce Accounting Simplified with Daily Summary: A Short Feature Overview”.

Conclusion

In conclusion, journal entries are a really helpful tool for maintaining accurate financial records. They provide an organized record of all financial transactions including debits and credits, like expenses, the generated revenue, COGS and inventory (if needed), which can be used for financial analysis and auditing purposes. The examples of a journal entry provided in this article illustrate how to record a financial transaction accurately. By automating the process of recording journal entries, companies and entrepreneurs can ensure the accuracy of their financial statements, answer essential questions about the financial health of their business, make informed financial decisions and eventually earn more money.