You can’t directly use Klarna at Amazon’s checkout, but there’s a workaround. Amazon hasn’t integrated Klarna’s buy now, pay later service, so you’ll need to purchase Amazon gift cards through the Klarna app and use those to complete your orders.With 93 million consumers using Klarna in 2024, shoppers want to combine this payment method with Amazon purchases. This guide explains how Klarna and Amazon interact, the gift card workaround, and what it means for businesses managing multi-channel accounting.

TL;DR

- Klarna lets shoppers split payments, while merchants receive funds upfront through settlement payouts.

- Amazon doesn’t support Klarna directly, but shoppers can use Klarna by purchasing and redeeming Amazon gift cards.

- These purchases appear as gift card payments on Amazon, which limits payment visibility and complicates accounting.

- Synder automates Klarna settlement accounting by breaking out sales, refunds, and fees and accurately matching deposits at scale.

What is Klarna?

Klarna is a Swedish fintech company offering buy now, pay later services that let shoppers split purchases into smaller payments. Instead of paying the full amount upfront, customers spread costs over time while merchants receive funds immediately. This helps increase merchant conversion rates by 20%, making expensive items more accessible.

How does Klarna work?

Klarna typically offers:

- Pay in 4: Four interest-free payments

- Pay in 30 days: Full payment after one month

- Long-term financing: Extended plans with interest

The service handles approvals, repayment, and customer risk, while merchants pay a transaction fee. From an accounting perspective, this means Klarna payouts usually bundle sales, refunds, and fees into a single settlement.

How to use Klarna for Amazon purchases

Since Amazon doesn’t support Klarna natively, there’s only one practical way to combine the two, but it shows up in a few different usage scenarios.

Using Klarna to buy Amazon gift cards

The Klarna app allows shoppers to use Klarna’s payment plans to purchase Amazon gift cards, which can then be redeemed and used like cash on Amazon. While this approach involves two separate steps, it effectively recreates the Klarna experience by spreading the cost of an Amazon purchase over time.

To get started, the shopper opens the Klarna app and searches for Amazon gift cards in the shopping section. The shopper selects the gift card amount and chooses a payment plan – most commonly four interest-free installments or payment in 30 days.

Once the purchase is approved, Klarna processes the transaction and sends the Amazon gift card code by email. The code is then added to the shopper’s Amazon account under Your Account → Gift cards → Redeem a Gift Card. From that point on, the gift card balance applies automatically at checkout.

In practice, the flow looks like this:

- The shopper buys an Amazon gift card in the Klarna app.

- Klarna manages the installment payments.

- Amazon processes the order as a gift card purchase.

From Amazon’s perspective, Klarna never appears in the transaction. The order is treated as fully paid with a gift card, which is seamless for shoppers but creates a more indirect payment trail for businesses tracking customer payments and settlements in their accounting systems.

Note: Amazon’s mobile app follows the same payment rules as the desktop site. Klarna doesn’t appear as a checkout option, but any redeemed Amazon gift card balance can be used normally across devices.

What Klarna can’t do on Amazon

It’s important to understand where Klarna’s role stops when shopping on Amazon. Klarna doesn’t integrate into Amazon’s payment flow in any visible or functional way. As a result:

- Klarna never appears as a selectable payment option during checkout

- Amazon doesn’t support installment plans powered by Klarna

- Klarna isn’t stored or referenced in Amazon’s payment or wallet settings

As the gift card approach works around Amazon’s checkout rather than through it. Reviewing Amazon’s supported payment methods provides useful context for this workaround.

Amazon’s available payment methods and Klarna alternatives

Amazon supports several payment options, but Klarna isn’t one of them. Accepted methods include credit cards, debit cards, Amazon Pay, gift cards, and Amazon-branded store cards.

For shoppers looking for buy now, pay later options, Amazon offers limited alternatives:

- Affirm, available for select categories

- Afterpay, with very limited availability

- Amazon Store Card, offering promotional financing

Compared to Klarna, these options are more restricted, which is why many Klarna users rely on the gift card workaround instead.

| Payment service | Amazon integration | Payment terms | Interest rates |

| Klarna | No (gift card workaround) | 4 payments or 30 days | 0% for short-term |

| Affirm | Limited (electronics, furniture only) | 3-12 months | 0-36% APR |

| Afterpay | Very limited (selected merchants only) | 4 payments only | 0% |

| Amazon Store Card | Yes (full integration) | 6-24 months promotional | 0% promotional, 28.24% regular |

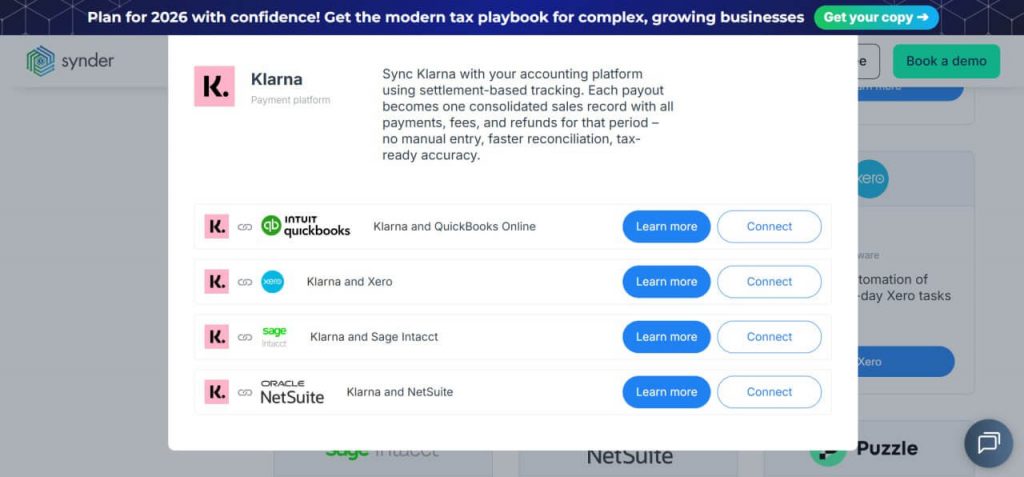

Managing Klarna payments in your accounting system

While Amazon doesn’t accept Klarna directly, many businesses still offer Klarna across their own ecommerce stores. That creates a separate challenge: making sure Klarna payments are recorded accurately once they reach the books. Klarna settlements often bundle together sales, refunds, fees, and adjustments, which all need to be reflected correctly for reporting and reconciliation.

As transaction volume grows and payments start flowing in from multiple channels, handling this manually becomes increasingly difficult. Tools like Synder help streamline this process by automatically syncing Klarna settlement data into accounting systems and organizing it into clear, reconciliation-ready records.

By connecting ecommerce platforms and payment processors with accounting software, Synder reduces the manual effort involved in categorizing transactions, tracking fees, and matching deposits, helping businesses keep their books accurate without adding complexity to day-to-day workflows.

How Synder handles Klarna payments

Synder’s Klarna integration automatically imports settlement payouts and creates detailed sales receipts in your accounting system. Each payout from Klarna becomes a properly categorized transaction showing exactly how much you earned, what fees were charged, and what the final deposit to your bank represents.

For each Klarna payout, Synder creates a sales receipt with line items breaking down:

- Klarna sales: Total amount from captured orders

- Klarna returns: Refunds issued to customers (reduces payout)

- Klarna fees: Platform and processing fees charged by Klarna

- Klarna adjustments: Chargebacks, disputes, or corrections

This structure ensures accurate revenue recognition, proper fee tracking as expenses, and bank reconciliation that matches your actual deposits. The sales receipt total matches what hits your bank account, creating a clear audit trail with each payout linked to Klarna’s payment reference.

Benefits businesses see with Synder

Businesses using automated transaction sync and reconciliation consistently report meaningful operational gains. By removing manual posting and review work, teams are able to manage multiple sales channels without adding headcount.

Common results include:

- 99.5%+ reconciliation accuracy achieved across multiple sales and payment channels

- 40+ hours of manual work eliminated per month, freeing teams to focus on analysis instead of data entry

- 150,000+ transactions processed automatically without manual intervention

What previously required several hours of weekly bookkeeping now runs in the background, even for businesses operating across platforms like Amazon and Shopify. Automated data flows replace spreadsheets and settlement reports, keeping books accurate at scale while reducing ongoing operational overhead.

Ready to automate your multi-channel accounting? Start your free trial of Synder or book a demo to see how automated transaction sync works for your business.

Common issues when using Klarna on Amazon and how to solve them

Using Klarna with Amazon works, but it isn’t seamless. Because the process relies on gift cards rather than a direct checkout option, shoppers can run into a few predictable issues. Understanding these ahead of time makes the workaround easier to use and helps avoid last-minute surprises.

Problem 1: Klarna doesn’t appear at checkout

Shoppers who regularly use Klarna on other ecommerce sites often expect to see it as a payment option on Amazon. When it’s missing, this can be confusing and lead to abandoned purchases.

Solution: Amazon doesn’t support Klarna directly. Using Klarna requires purchasing Amazon gift cards through the Klarna app and redeeming them before checkout.

Problem 2: Delays in gift card delivery

Most Amazon gift cards purchased through Klarna are delivered quickly, but in some cases, the code can take several hours to arrive. This creates friction if a purchase is time-sensitive.

Solution: Plan ahead by purchasing and redeeming gift cards before you’re ready to place the Amazon order, rather than during checkout.

Problem 3: Klarna payment limits

Klarna sets transaction limits that vary by user, typically between $500 and $1,500 per purchase. For larger Amazon orders, a single gift card may not cover the full amount.

Solution: Split the purchase across multiple gift cards or combine a Klarna-funded gift card with another Amazon-supported payment method.

Final thoughts on using Klarna with Amazon

Amazon doesn’t support Klarna at checkout, but the gift card workaround makes buy now, pay later possible for planned purchases. While it isn’t as seamless as a direct integration, it gives shoppers flexibility where Amazon’s payment options fall short.

For businesses, the bigger challenge is handling Klarna settlements once payments start flowing in. Tools like Synder help keep Klarna payouts, fees, and deposits organized automatically, so indirect payment setups don’t create accounting headaches later on.

FAQ

What is Klarna?

Klarna is a Swedish buy now, pay later service that lets shoppers split purchases into installments or pay in full within 30 days. The service offers flexible payment options with no interest for short-term plans.

Can I use Klarna on Amazon?

Not directly. Amazon doesn’t support Klarna at checkout. Klarna can only be used for purchasing Amazon gift cards through the Klarna app.

Can you use Klarna in Amazon’s mobile app?

No, the Amazon mobile app has the same payment limitations as the desktop website. However, the gift card workaround works by purchasing Amazon gift cards in the Klarna app and redeeming them in your Amazon account.

How do you use Klarna at checkout on other websites?

On websites that accept Klarna directly, select Klarna as your payment method during checkout and choose your payment plan (4 payments, 30 days, or financing). Klarna processes instant approval, and you complete your first payment immediately.

Is Klarna safe to use?

Yes, Klarna maintains bank-level security and is regulated by the Swedish Financial Supervisory Authority. The service uses encryption to protect your information. However, missing payments can result in late fees and credit score impacts.

Hi Basma, thanks for commenting. We’d recommend you turning directly to the Amazon or Klarna support if you’re experiencing any troubles with the services.

You didn’t mention how to do financing for 1 year. It just shows the one time card payment option on Amazon in the klarna app..

Thanks for the heads-up, Donna! We’ll update the article shortly.