As payment methods evolve, buyers and sellers seek more convenient ways to transact. Major marketplaces like Amazon regularly update their payment options to meet this demand, which includes Afterpay and other buy now, pay later options. As disappointing as it might be, Amazon doesn’t currently support the Afterpay payment method. However, there’s a workaround available.

So, let’s look at how Afterpay functions and learn some tips on successfully using it for Amazon purchases. We’ll also review alternative ‘buy now, pay later’ payment options accepted on Amazon as a bonus (because, why not?).

There’s also a bonus for sellers, as you can learn how to integrate both Amazon and Afterpay into your QuickBooks Online. So, hop on reading.

Make the most of Afterpay Amazon integration – book a seat at Synder’s Weekly Public Demo to learn more.

Key Takeaways

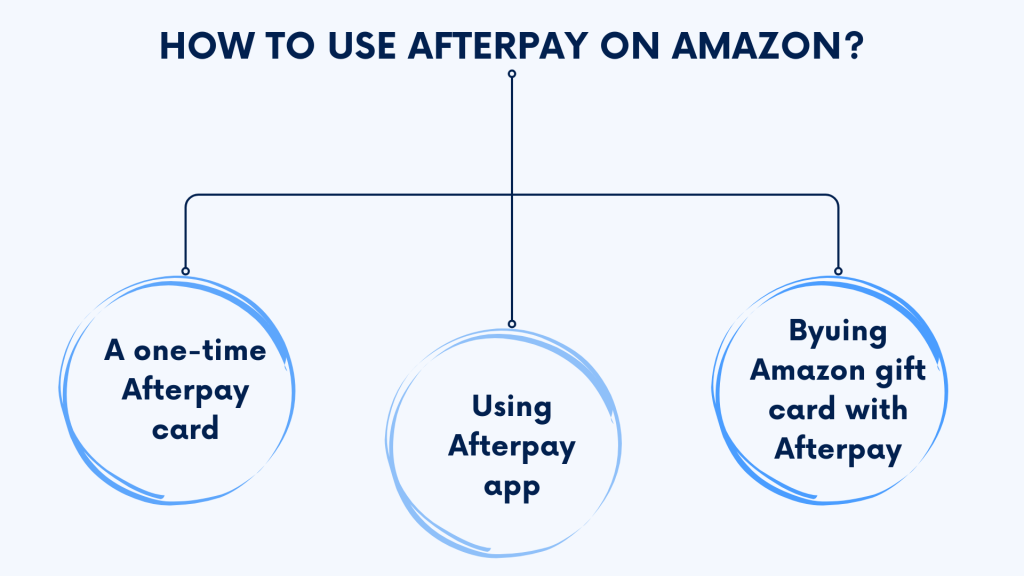

- You can use Afterpay on Amazon even though it’s not directly available at Amazon checkout. You can do it with a single-payment Afterpay credit card, purchase Amazon gift cards through Afterpay, or utilize the Afterpay app for Amazon purchases.

- Amazon offers other buy now, pay later options, such as its Amazon Monthly Payments system and integration with payment processors like Affirm and Klarna, providing flexibility for shoppers.

- Sellers can easily consolidate transactions from Amazon, Afterpay, and other sales channels into accounting software like QuickBooks Online to have all their numbers in one place for simplified bookkeeping.

How does Afterpay work?

Afterpay is a payment gateway based on a buy now, pay later financing model. In other words, with this option, you can instantly purchase a product or service and make repayments at a later date.

Afterpay lets you avail of its services when you shop online and in-store. For online purchases, you need to create an Afterpay account. For brick-and-mortar stores, you need to additionally install the Afterpay app on your mobile phone, where you set up an Afterpay card to use either with Apple Pay or Google Pay at the checkout.

While Afterpay doesn’t perform a typical credit check when you first sign up, it conducts a soft credit check. It helps them understand your financial situation before approving a new application. The soft credit check doesn’t affect your credit score. Once approved, using the Afterpay buy now, pay later payment option won’t affect your credit score either.

So, what options does it offer?

Afterpay provides two services, Afterpay Pay-in-4 and Afterpay Pay Monthly.

The Pay Monthly model applies to orders valued over $400 with payments spread over 6 or 12 months. However, this offer includes the annual percentage rate. It’s a peculiar offering different from the standard Afterpay payments of Pay-in-4. It’s worth noting that, in this article, we’ll concentrate on the Pay-in-4 option only.

Find out how to increase your Afterpay limit and what the highest limit is.

Afterpay lets you split payment totals into smaller, more manageable installments and pay them back over time according to the agreed payment schedule.

At the point of purchase, your order gets an instant approval decision. It’s important to note that not all orders are approved. It depends on several factors, some of them being:

- Sufficient funds on your card to cover the first installment, usually made at the point of purchase;

- How long you use Afterpay;

- The amount of money you need to repay;

- The amount of the purchase you’re trying to make;

- The number of open Afterpay orders you currently have.

Afterpay Pay-in-4 payments, as the name suggests, are split into four installments.

Usually, you pay the first installment at the time of purchase. If you’re placing an order that exceeds the Afterpay’s allowance, you might have to pay a larger amount when you order. In other words, your first installment charged to your card or bank account will be bigger than the remaining ones.

The usual payment schedule offers installments every two weeks, which closes the entire repayment in six weeks. You can always choose to repay earlier than the scheduled due date. Otherwise, Afterpay automatically debits the money from your bank account, credit card, or debit card on the due dates.

Mind late repayments fee

You don’t pay any interest on the Afterpay Pay-in-4 financing service. It means you can keep using the Afterpay payment method and pay 0% additional interest and fees until you make payments on time.

Otherwise – when you’re late to repay – you’ll have to pay a late fee. Usually, it’s one late fee per installment, and the total late fees per order won’t exceed 25% of the initial order amount (this capping applies to the US).

Learn what are the benefits of Amazon Afterpay combination.

Using Afterpay on Amazon: Can I use Afterpay on Amazon?

Amazon is the largest global online marketplace, so it’s reasonable for consumers to expect Afterpay-supported payments on Amazon. So, does Amazon accept Afterpay?

As mentioned at the beginning, there isn’t an option to pay directly with Afterpay at the Amazon checkout. Still, you can go with a couple of clever workarounds to use your Afterpay Pay-in-4 orders on Amazon.

Want to know the trick?

Users can open a one-time credit card with Afterpay, which works like any other card when shopping online. So you check out like you usually do with a card, and the purchase goes to your Afterpay account. Nice and elegant. Others (yes, there’s more) include using Amazon from the Afterpay mobile app or buying Amazon gift e-card with Afterpay.

Find out if you can buy groceries with Afterpay.

How does the Afterpay’s single-use payment work?

Now let’s look at how Afterpay single-use payments work in detail and see what steps you need to make to purchase products on Amazon with Afterpay:

- Open your Afterpay app, and click on Amazon in the Shop tab.

- Pick your products and add them to your cart.

- Enter your shipping and account details.

- When you reach the payments page, select Add a Payment Method.

- Choose Add a Credit or Debit Card.

- The button at the bottom of the app screen labeled Buy now. Pay later will activate.

- Untick Set as default payment method and click the Buy Now button.

- Afterpay will fill out the credit card fields, and you can place your order.

Because it’s a single-use payment, you need to be careful not to set your Afterpay credit card as a default. Otherwise, Amazon will attempt to charge future orders to the same card, which will be declined.

It’s a neat workaround and means that while Amazon doesn’t officially offer Afterpay, you can safely use your Afterpay account for Amazon purchases.

The above method is what Afterpay itself provides. So, you can be confident that your Amazon payments with Afterpay will pass safely and securely according to Afterpay’s policies.

How to buy an Amazon’s gift card with Afterpay?

Another option you can use to purchase on Amazon with Afterpay is buying an Amazon’s gift e-card (you can buy it for yourself, because, frankly, who’s our most loved one if it’s not us?). Let’s look at how it works. The process is pretty straightforward, but there are a couple of nuances you might want to know about.

First, gift cards are available to purchase in the Afterpay app, so before you can use this method, you might want to install and sign up with the app (see below).

Another little trick is that you’re not 100% guaranteed that your gift card order will be approved. Though Afterpay offers an extensive choice of gift cards, access to them depends on several factors, namely the history of timely repayments and the period of you being an Afterpay user. You might have access to some cards and be not eligible for others, so you need to consider this little side-effect.

But if everything is bright and shining for you, you’ll see the Amazon gift card in the Afterpay app. From there, it takes you literally three steps to get the card.

- Select the card, choose the amount and the person to send the card to. Remember, this happy one can be you or any other significant one.

- Get an order confirmation from Afterpay on your email (and confirm it, obviously).

- Get another email with your e-card sent by Prezzee, Afterpay’s chosen gift card supplier.

Then, you can use the gift card to purchase on Amazon like you usually do.

Afterpay app: How to use Afterpay mobile app to purchase from Amazon?

That’s probably the easiest way to buy on Amazon with Afterpay.

Afterpay offers a mobile app that makes your shopping experience even more convenient with plenty of stores and brands to purchase from, including Amazon. So, you can use this option to pay on Amazon with Afterpay. All you need to do is:

- Download the Afterpay app – it’s available on the website, as well as on Google Play and Apple’s App Store.

- Search for Amazon.

- Open the Amazon store and start shopping.

- Check out with Afterpay and choose how to pay.

Does Amazon offer other buy now, pay later payment methods?

Now that we know how to pay on Amazon with Afterpay, does Amazon offer anything like installment payments or other buy now, pay later options? Let’s find out.

First, Amazon offers its native plan called Amazon Monthly Payments, which is available upon eligibility and only for selected items on Amazon. Amazon also supports some buy now, pay later options integrated at the checkout, like Affirm.

Besides, several payment processors that give you an option of a single-use credit card can work on Amazon, and they avail deferred payments such as Afterpay (the one we’re talking about) or Klarna.

Amazon Monthly Payments

So, as mentioned, Amazon offers its own Amazon Monthly Payments system for selected products only. You can check which items qualify for this financing on the product detail page. You’ll also be able to see it at the checkout.

The plan comprises four payments, with the initial down payment and the remaining three installments, over 90 days. There’s no interest or any other financial charges for Amazon Monthly Payments.

This offer is available only for selected buyers at Amazon’s discretion. While it considers your purchase history with Amazon and the item price, there’s no guarantee on who will or won’t be approved by Amazon for its Monthly Payments system for a specific order.

Paying with Affirm on Amazon

Amazon does offer the Affirm payment option at the checkout, so there’s no need to look for workarounds – you click Affirm when placing an order on Amazon.

Affirm gives you a flexible payment schedule with installments ranging from 3 to 48 months. You can pay in four installments and don’t attract any fees with this financing plan.

If you prefer to go with monthly payments (other than four installments), a simple interest (up to 36%) applies. It means that at the checkout, you’ll be able to see your order total with all the interest clearly stated upfront.

Paying with Klarna on Amazon

Making online payments with Klarna on Amazon follows the same concept as using Afterpay on Amazon.

First, you need to log into your Klarna app, and from there, you choose Amazon as an online shopping option. Once you add your items to the cart, go to the Amazon checkout page and click Pay with K. This will allow you to make purchases on Amazon using your Klarna account, splitting your payments into four installments.

Amazon and Afterpay in QuickBooks Online

As a retailer, you might want to handle as many sales channels and payment gateways that make sense for your business and provide a flexible choice to your customers. That’s why having Amazon and Afterpay as parts of your offering is quite logical, especially for ecommerce stores.

Integrating Amazon and Afterpay can be done by two separate software solutions. However, if you keep expanding the channels, the best strategy is to employ a single tool that acts as a bridge for all your platforms.

Synder Sync provides a large number of integrations between your chosen accounting software, such as QuickBooks Online/Desktop, Sage Intacct, or Xero, and more than 25 sales channels and payment gateways, including Amazon and Afterpay.

Synder Sync gives a competitive advantage to syncing your transactional data by using smart rules, categorization, product mapping, rollback, duplicate detection, and many more features that make bookkeeping easier. On top of that, it offers two sync modes – per transaction or sync daily summaries – so you can tailor your software to your accounting style, not the other way around.

Curious? Sign up for Synder’s 15-day free trial to see its features in action.

TL;DR

Although Amazon doesn’t directly support Afterpay payments, there are ways to use Afterpay for purchases on the platform. Users can opt for alternative methods, such as obtaining a one-time Afterpay credit card or buying Amazon gift cards through Afterpay, to facilitate their transactions. Additionally, Amazon offers its native installment payment option called Amazon Monthly Payments, along with integration with other buy now, pay later services like Affirm and Klarna, providing shoppers with various payment choices.

For sellers, managing transactions across different sales channels, including Amazon and Afterpay, can be simplified through integration with accounting software like QuickBooks Online. Solutions like Synder Sync enable sellers to consolidate transactions from various platforms into one centralized system, streamlining their financial management processes. This integration ensures sellers can track and reconcile their revenue and expenses across different channels, enhancing overall accounting efficiency.

Closing thoughts

As you can see, Afterpay and Amazon not having a straightforward integration doesn’t seem like so much trouble. There are several workarounds to help you use Afterpay to purchase from Amazon, like leveraging the app for the single-payment card option and others described above. So, you can easily browse Amazon and avail of Afterpay’s split payment option confidently and securely since processing your payments is Afterpay-supported.

As an Amazon seller, you might want to inform your customers of these ways they can use Afterpay on Amazon. It might be nice of you to give them even more flexibility in how they want to purchase from you.

At the back end, you can adequately sync Amazon and Afterpay transactional data into QuickBooks Online using Synder, helping you treat your business as one ecosystem, bringing all the transactions into one place.

Share your thoughts

Sharing is caring! We appreciate your opinion and will be glad to read your thoughts in the comments section.

![How to Use Afterpay on Amazon: Can You Use Afterpay on Amazon [A Using Afterpay Guide]](https://synder.com/blog/wp-content/uploads/sites/5/2023/05/how-to-use-afterpay-on-amazon-800x500.png)

Thanks. Im going to try it.