Afterpay is an increasingly popular payment option for customers, providing an easy and flexible way to purchase products and services. As a business owner, you can offer it to your customers by setting up Afterpay through Square. Whether you are a brick-and-mortar store, an online store, or a combination of both, this step-by-step guide will show you how to set up Afterpay on Square. With this payment option, you can open up your business to more customers, increase revenue, and keep your customers happy. So let’s get started and set up Afterpay on Square!

Contents:

3. Afterpay accounting made easy

5. Benefits of setting up Afterpay on Square

6. Step-by-step guide to setting up Afterpay on Square

7. How to set up Afterpay on Square

8. Tips for Square sellers to make the most of Afterpay

What is Afterpay?

You can set up Afterpay through your Square account to offer it as an option to your customers. Afterpay is a payment plan that you and your customers can agree to at the time of purchase. Afterpay works like a debit card transaction, where you are immediately paid for the item that the customer bought. There are no long wait periods or uncertainty around payment; as soon as the customer approves the transaction, you are paid for the item.

Afterpay is a popular buy now, pay later (BNPL) service that allows consumers to make purchases and pay for them in installments over time. It was founded in Australia in 2015 and has since expanded to other countries, including the United States, Canada, the United Kingdom, and others. Afterpay has gained significant popularity, especially among younger shoppers, as it offers an alternative and more flexible payment method for online and retail purchases.

How does Afterpay work?

Afterpay is a payment option that allows customers to buy items with no upfront payment. Instead, they make equal monthly payments for the item. Afterpay lets customers with bad credit or no credit get products they want without a credit check. Afterpay works with multiple retailers, including brands such as Nike, Zara, Adidas, and many more.

Here’s how Afterpay typically works:

- Select Afterpay at checkout: When making a purchase online or in-store at a participating retailer, customers can choose Afterpay as their payment option during the checkout process.

- Split payments into installments: Afterpay allows customers to divide the total purchase amount into four equal installments. These payments are typically due every two weeks. Customers are required to pay the first installment at the time of purchase.

- Interest-free payments: If customers make all four payments on time, they won’t be charged any interest or additional fees by Afterpay. However, if a customer misses a payment, there may be late fees or penalties.

- Instant approval: Afterpay provides instant approval decisions, making it a quick and convenient payment method.

- Mobile app and account management: Afterpay users can manage their purchases, view upcoming payment schedules, and make payments through the Afterpay mobile app or their Afterpay account online.

Afterpay aims to provide a more budget-friendly and transparent way for consumers to manage their purchases by breaking them into manageable installments. However, it’s essential for users to be aware of their payment schedule and ensure they have sufficient funds in their account to cover the installments to avoid potential late fees.

Keep in mind that specific terms and conditions may vary depending on the country and retailer, so it’s always best to review Afterpay’s policies and guidelines to understand how the service works in your region.

Check out our guide on Afterpay for more information.

Afterpay fees for customers

Afterpay generally operates on a no-interest, no-fee model for consumers who make timely payments. This means that if customers make all scheduled installment payments on time, they won’t be charged any interest or additional fees by Afterpay. However, if a customer misses a payment, there may be late fees or penalties. Late fees are meant to encourage customers to make timely payments and avoid accumulating debt.

Find out about the highest Afterpay limit for shoppers.

Afterpay fees for sellers

Afterpay typically charges fees to sellers (merchants) who offer Afterpay as a payment option to their customers. These fees include a percentage-based merchant service fee on each transaction, along with a possible fixed fee, which may vary based on factors like transaction size and specific agreements.

Learn more about Afterpay fees.

Afterpay accounting made easy

Want to stay on top of your Afterpay fees and other transaction data? Enable Afterpay Synder integration – a solution that fosters accounting accuracy and impeccable data reconciliation process.

Synder is a cutting-edge accounting software that automates the process of syncing sales data from payment processors and ecommerce sales channels into the books making sure there are no errors or discrepancies. Among a multitude of useful features, Synder allows you to import historical data with no time limits and choose between two data sync modes: per transaction or daily summary records.

Interested in learning more about Synder’s functionality? Sign up for a 15-day free trial or save a spot at our webinar.

Brief overview of Square

Square Cash App, also known simply as Cash App, is a mobile payment service developed by Square, Inc. It allows users to send and receive money to and from friends, family, or anyone with a Cash App account. The app is available for both iOS and Android devices.

Here are some key features and functionalities of Cash App:

- Square peer-to-peer payments: Users can send money to other Cash App users by entering the recipient’s $cashtag (a unique identifier) or their phone number or email associated with their Cash App account.

- Square Cash Card: Cash App offers a physical debit card called the Cash Card, which is linked to the user’s Cash App balance. Users can use the Cash Card to make purchases and withdraw money from ATMs.

- Square Direct deposit: Users can set up direct deposit with their Cash App account to receive paychecks, tax refunds, and other deposits directly into their Cash App balance.

- Square Bitcoin trading: Cash App allows users to buy, sell, and store Bitcoin within the app.

- Square Cash Boost: Cash Boost is a rewards program that offers discounts and cashback on eligible purchases when using the Cash Card.

- Square Cash App for Business: Cash App also has features designed for business owners to accept payments from customers.

Learn more facts about Square Cash App.

Benefits of setting up Afterpay on Square

Afterpay is a payment option that will attract new customers to your business, increasing your revenue. Customers who don’t have the cash up front to make a purchase might not buy from you. But with an Afterpay payment option, they have a way to make the purchase now and pay for it later.

Setting up Afterpay on Square also has benefits for your business. You can increase your revenue by bringing in customers who may not have been able to purchase from you otherwise. And you don’t have to worry about bad debt or customers who don’t pay you back. Afterpay takes on that risk for you, so your business is protected.

Afterpay also lets you offer a flexible payment option to customers who may have otherwise paid with cash. With Afterpay, they can make payments on their own time, which can be convenient for them. And because Afterpay holds the payment, you don’t have to worry about collecting from the customer who may not have the money to pay upfront.

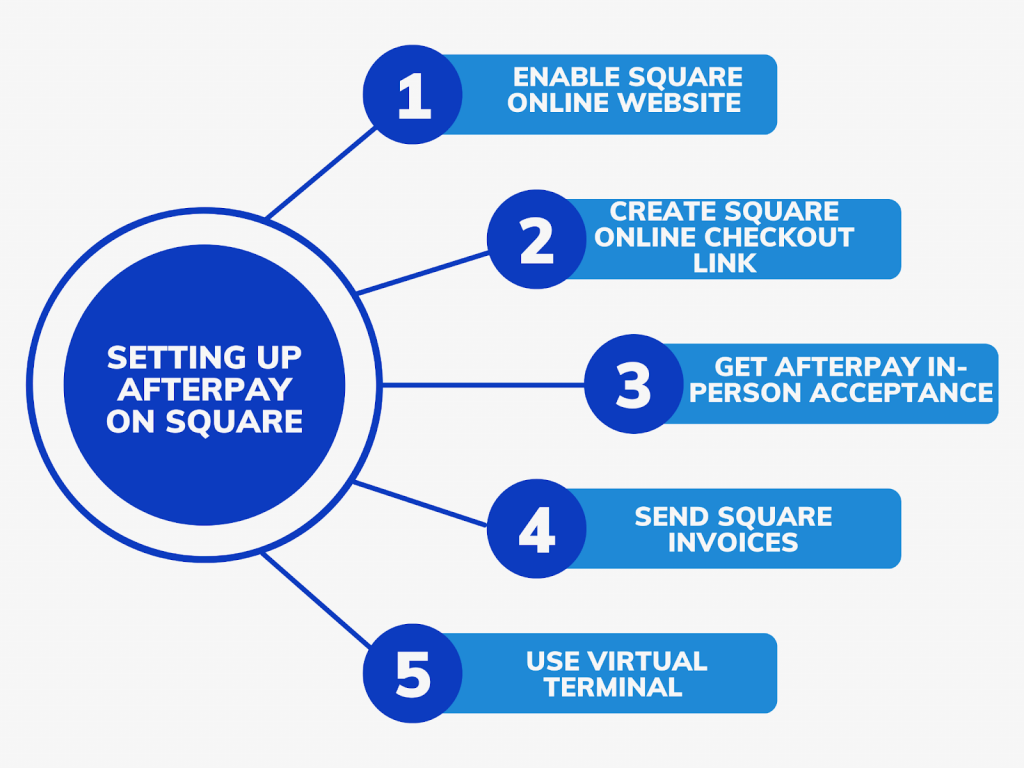

Step-by-step guide to setting up Afterpay on Square

Once you’re eligible to use Afterpay with your Square, you might want to know how to set it up. Here are some ways you can use Afterpay with Square:

Square Online website

Your Square Online website will be automatically enabled for Afterpay transactions between $1 to $2,000. Accepting Afterpay will enable you to boost online sales, increase average cart size and attract new customers. No additional integration is required.

Square Online Checkout

You can create payment links with Square Online Checkout, allowing customers to select Afterpay as a payment method for transactions between $1 to $2,000.

Afterpay in-person acceptance

Afterpay in-person acceptance is available straight away—no additional integration is required.

Square Invoices

With Square Invoices, you can enable Afterpay acceptance when sending digital invoices and estimates via your online Square Dashboard, Square POS app, or Square Invoices app.

Virtual Terminal

With Virtual Terminal, you can send payment links directly to your customers via text message. Customers can open the link to checkout via Afterpay.

As you can see, you might not even bother about implementing Afterpay to Square. Still, you might need to enable it to make it available to your customers as a payment method (you can later disable it if you’d want to do it for some reason).

How to set up Afterpay on Square

From Square dashboard

- Find Account & Settings in your online Square Dashboard.

- Tap on Business information > and choose Payment methods.

- Find ••• next to Afterpay, click on it and then select Edit settings.

- Switch the In-Person toggle on/off.

Note: Once you’ve enabled Afterpay in-person, customers can pay via their Afterpay Card on Square, Appointments, Retail, Invoices, and Restaurants POS.

From Square App

- Click on More > Settings > Checkout > Payment.

- In all types of payment, select Configure Afterpay.

- Switch the In-person toggle on/off.

Tips for Square sellers to make the most of Afterpay

As you start using Afterpay on Square, here are a few tips for making the most of it:

- Offer different payment options to customers. If you have only one payment option, certain customers may not be able – or willing – to use it. But offering a variety of payment options can open your business to a wider customer base.

- Make sure you understand the terms. Afterpay is a payment option that you can offer to your customers, but you are responsible for the money. So make sure you understand the terms of the agreement and how to handle Afterpay transactions.

- Communicate with your customers. Because Afterpay is a flexible payment option, you may have customers who are making payments on their own time. Make sure to communicate with those customers and give them reminders about the payments.

- Let customers know that Afterpay is available. While Afterpay is a great payment option for customers, they may not know it is an option. Make sure that you are advertising that After-pay is available at your business.

- Keep your customers informed. As part of keeping customers informed, be sure to let them know what terms are associated with Afterpay.

- Check your Square Dashboard for payment information. As you receive payments from Afterpay customers, those amounts will show up on your Square Dashboard.

- Stay up to date. Afterpay regularly releases updates and new features, so make sure to stay up to date with what’s new.

Conclusion

Afterpay is a revolutionary payment option that allows customers to make purchases without upfront payments, making it highly popular among consumers. By integrating Afterpay into your Square account, you can take advantage of its benefits for your business as it attracts a broader audience, including those who prefer installment-based payments as offering diverse payment options.

Overall, integrating Afterpay into your Square account can be a game-changer for your business. Embrace this payment option, communicate its benefits, diversify payment choices, and stay informed to attract more customers, boost revenue, and cultivate a loyal customer base, making Afterpay a valuable tool in your business growth strategy.