If you’ve ever tried to reconcile Stripe payments in Xero using the native integration, you already know it’s far from seamless. Missing fees, mismatched data, and lump-sum payouts that don’t tie back to your invoices can make your reconciliation process messy and time-consuming. Fortunately, there’s a smarter way.

In this guide, we’ll walk you through how to reconcile Stripe payouts in Xero accurately and efficiently using Synder, a dedicated automation tool built for clean, accurate accounting.

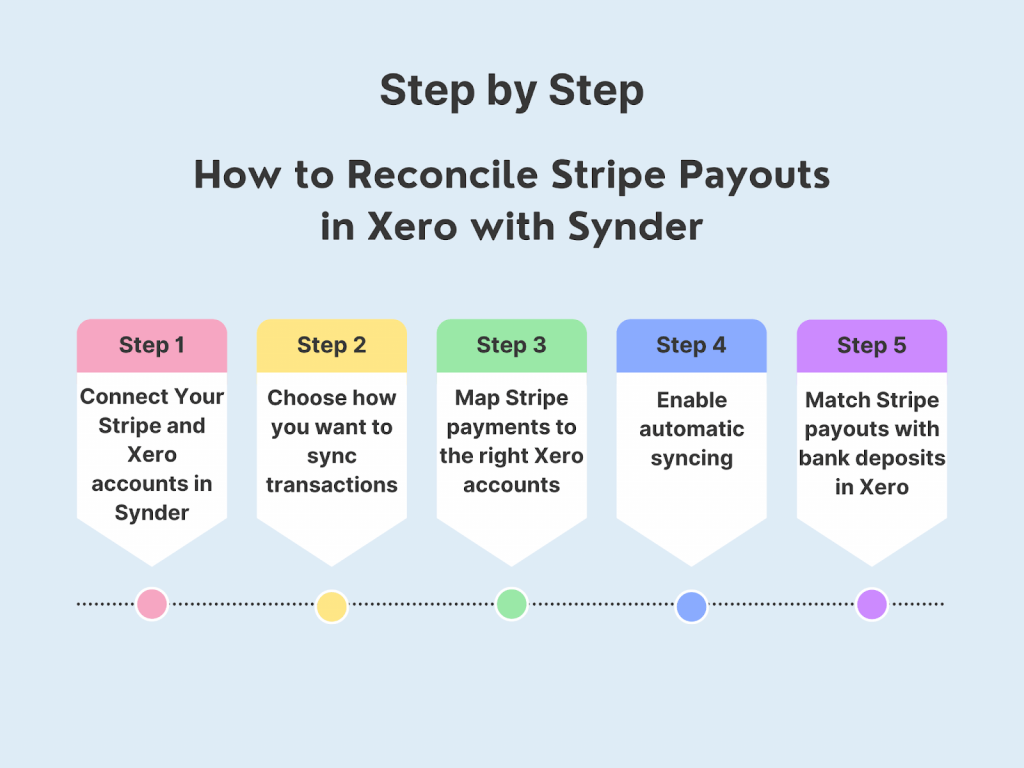

Step-by-step: Reconcile Stripe payouts in Xero with Synder

Synder integrates with Xero, as well as other leading accounting software/ERPs, and over 30 sales and payment platforms. It acts as a central hub between Stripe and your accounting system, ensuring every transaction flows through with full context. Here’s how to get started with reconciling Stripe payouts in Xero using Synder.

1. Connect Your Stripe and Xero accounts in Synder

Setting up your Synder account is the first step. From there, you can link both platforms in just a few clicks. Think of Synder as a connector between Stripe and Xero, making sure every transaction, with all the fees, refunds, and taxes, flows through completely.

2. Choose how you want to sync transactions

Synder offers two sync modes:

- Per-Transaction Sync, for businesses that want each sale itemized

- Summary Sync, for those who prefer a single daily entry

Choose what works best for your workflow. Summary Sync is great for faster reconciliations, while Per Transaction Sync offers granular detail.

3. Map Stripe payments to the right Xero accounts

Want your Stripe sales, fees, and taxes to go straight to the right place in Xero? Just set up Smart Rules. Plus, Synder’s mapping feature lets you easily assign income, fees, and refunds to the correct accounts, cutting down on manual cleanup later.

4. Enable automatic syncing

With auto-sync turned on, every time a transaction happens in Stripe, be it a sale, refund, or fee, Synder captures it and sends it to Xero, already categorized and ready to match.

5. Match Stripe payouts with bank deposits in Xero

Stripe payouts often bundle multiple transactions. Synder groups and matches them to bank deposits, so you don’t need to break them down manually. This leads to clean, one-click reconciliation right inside Xero.

Why use Synder for Stripe-Xero integration?

The built-in Stripe-Xero connection tends to skip over key details, leaving gaps in your records. Synder, on the other hand, gets the whole picture. It logs Stripe fees on their own line, automatically handles refunds, and links grouped payouts right to your Xero deposits without manual work.

That keeps your reports spot-on, so you avoid any surprises or wondering where revenue went. And if you ever need to catch up, Synder can also pull in your historical Stripe data, keeping your records clean and complete.

Basically, it covers everything the native integration lacks: all automated, accurate, and built to save you serious time.

Try Synder free for 15 days—no credit card needed, or schedule a demo to see it in action.

FAQ

Can I import historical Stripe transactions into Xero?

Yes, Synder lets you bring in and sync old Stripe transactions into Xero. This proves handy if you’re trying to catch up on your books or switching accounting platforms in the middle of the year. Just keep an eye on your Synder plan’s sync limits.

How do I handle multicurrency Stripe transactions in Xero?

To handle multicurrency Stripe transactions in Xero, Synder automatically converts and syncs them using your Xero settings. This keeps your records accurate for foreign sales, fees, and deposits.

What should I do if a Stripe transaction doesn’t match any invoices in Xero?

Synder will spot any unmatched transactions and either create the right entries in Xero, or flag them for you to review, whichever you prefer.

How can I reconcile Stripe payouts that include multiple transactions bundled together?

When you get a Stripe payout, Synder automatically bundles all those transactions together and sends them to Xero as a payout. This makes reconciling that total amount with your bank deposit a breeze. Just one click, with no need to match anything by hand.

What is the best practice for reconciling Stripe chargebacks in Xero?

The easiest way to handle Stripe chargebacks in Xero is to let Synder do this. It’ll sync them up as negative income or refunds, including any fees tied to them. This keeps your records spot-on with all the details, so reconciling and reporting your financials is simple and error-free.