In the ever-evolving digital world, business transactions have gone through revolutionary changes. Among the pioneers of this change is Square. It has simplified the financial transactions landscape, enabling businesses to accept credit card payments through various means, such as mobile devices and dedicated point-of-sale (POS) hardware.

As with all such services, Square’s offerings come at a cost. To be able to use the platform wisely, you need to know exactly what Square fees are and understand their implications for the business. This comprehensive guide aims to give insights into the structure of Square fees, their potential impact on businesses of different sizes, and how to manage Square fees properly.

Contents:

1. How much does Square cost per month

2. Deep dive into different Square fees and costs

4. How to get a report of the Square fees

5. Can I charge a customer processing fee on Square?

How much does Square cost per month

Square’s monthly cost depends on the specific services and products you choose to utilize for your business. Here’s a general breakdown:

- Transaction fees: These are charged per transaction rather than monthly. The exact fee depends on the type of transaction;

- Hardware costs: Square offers a range of hardware products with one-time costs, not monthly charges.

- Software fees: Square provides various software solutions with different monthly costs.

- Additional fees: Other fees may apply in certain circumstances.

Let’s go through each of them in detail.

Deep dive into different Square fees and costs

Transaction fees

Transaction fees are costs associated with the processing of credit or debit card payments. They’re a standard part of doing business in a world where credit and debit cards are common forms of payment. Like other payment processors, Square charges these fees to cover the costs they incur when facilitating these transactions.

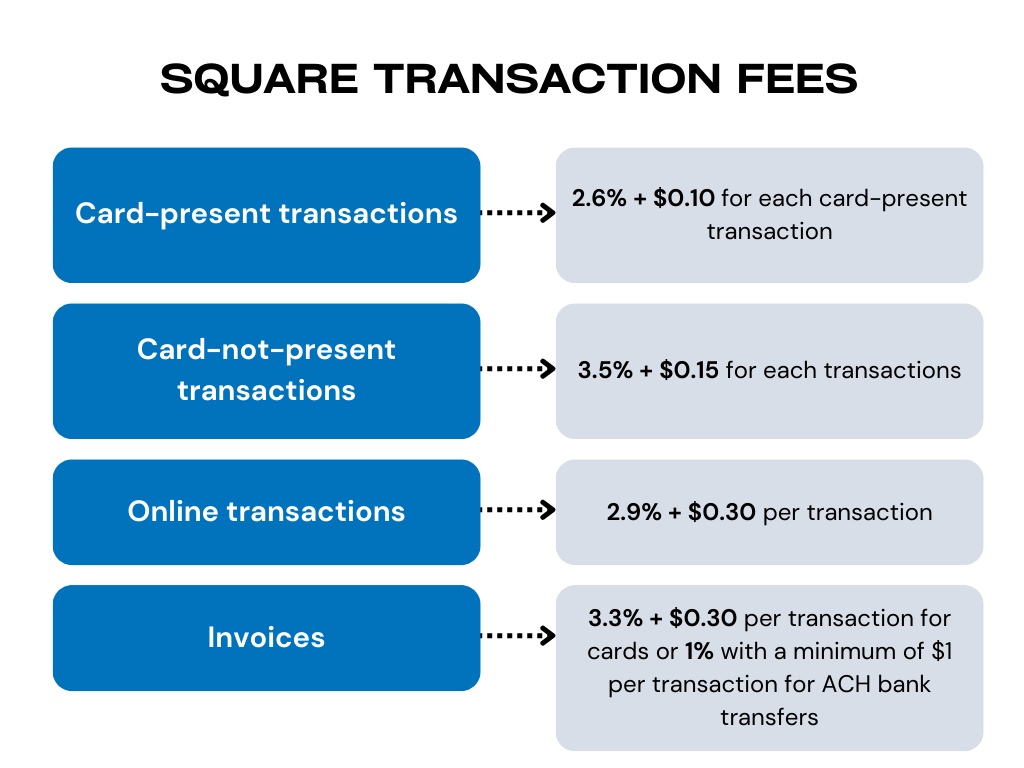

In the context of Square, there are different types of transaction fees based on how the transaction is carried out:

- Card-present transactions: These transactions occur when a customer’s card is physically read by a Square device, either by dipping a chip card, swiping a magstripe, or tapping a contactless card or mobile wallet. Square charges 2.6% + $0.10 for each card-present transaction. These transactions are considered less risky because the cardholder is physically present.

- Card-not-present transactions: These transactions occur when the customer’s card isn’t physically present. They include situations where card details are manually keyed in. These transactions have a higher fee due to the increased risk of fraud. Square charges 3.5% + $0.15 for each of these transactions.

- Online transactions: For online transactions, such as those made through Square’s Online Store or using online payment APIs, Square charges 2.9% + $0.30 per transaction.

- Invoices: If you’re using Square’s invoicing features to send an invoice to a customer, the fee is 3.3% + $0.30 per transaction for cards or 1% with a minimum of $1 per transaction for ACH bank transfers.

It’s important to note that these fees are automatically deducted from the transaction, so the amount deposited into a business’s bank account is the total transaction amount minus Square’s fees. This fee structure is consistent regardless of the card issuer or the card’s issuing bank.

Hardware costs

Square provides a range of hardware products that businesses can use to process payments. Each of these hardware products comes at a different price point.

- Square Reader for magstripe: This is the most basic hardware that Square offers. It plugs into a smartphone or tablet, allowing businesses to swipe magnetic stripe cards. The cost is $10.

- Square Reader for contactless and chip: This is a step up from the magstripe reader. It allows businesses to accept chip cards and contactless payments from mobile wallets like Apple Pay and Google Pay. The cost is $59.

- Square terminal: This is an all-in-one card processing terminal that can accept all types of card payments and print receipts. It’s a standalone device, which means it doesn’t need to be connected to a smartphone or tablet to work. The Terminal is priced at $299.

- Square register: This is the most complete and also the most expensive of Square’s hardware offerings. The Register is a fully integrated point-of-sale system that comes with a customer display. It accepts all forms of card payments. At the time of writing this article, the Register was priced at $799.

Learn more about How Square Point Of Sale works and How to set up Afterpay On Square.

Software fees

In addition to transaction and hardware fees, Square also offers several software solutions that come with their own costs. These fees are typically charged on a monthly subscription basis and vary depending on the software product.

- Square Point of Sale (POS): This is Square’s basic POS software, which provides a suite of tools to help businesses manage their sales, inventory, and customer information. This software integrates with all of Square’s hardware products. A free version is available, which is often sufficient for many small businesses.

- Square for Retail: This is a more advanced POS software that’s designed specifically for retail businesses. It offers additional features tailored to the retail industry, such as multi-location inventory management, vendor management, and more detailed sales reports. This software comes with a free version (Square for Retail Free) and a more advanced version (Square for Retail Plus), costing $60 per location per month.

- Square for Restaurants: This is Square’s POS software for the restaurant industry. It offers features like table mapping, menu management, and order management. This software also comes with a free version (Square for Restaurants Free), a more advanced version (Square for Restaurants Plus) that costs $60 per location per month, and a premium version if you process more than $250k a year.

- Square Appointments: This software is designed for service businesses that rely on appointments, like salons or fitness studios. It offers online booking, calendar management, and reminders. The cost of Square Appointments depends on its plan: Free for a single location, Plus is $29 per month per location, and Premium is $69 per month per location.

Additional fees

In addition to the core fees mentioned above, Square sometimes charges additional fees under specific circumstances.

- Non-compliance fees: If your business violates the Payment Card Industry Data Security Standard (PCI DSS), you may be assessed non-compliance fees. The PCI DSS are standards all businesses that process card payments are required to follow. They’re designed to ensure that businesses handle card information securely.

- Refund fees: Unlike many payment processors, Square doesn’t charge a fee to process refunds. However, the original transaction fees aren’t returned when you issue a refund.

- Instant transfer fees: Square generally transfers money to your linked bank account on a schedule (like next-day transfers), but if you need the money immediately, Square offers an instant transfer service for a fee. Square charges a 1.75% fee per transfer.

Learn more about Square fee rates.

How to reduce Square fees

While the rate for Square’s processing fees is generally non-negotiable, there are a few strategies you can use to reduce the impact of these fees on your business effectively.

Encourage cash or debit card payments

Since Square charges a fee for each credit card transaction, you can potentially save on fees by encouraging your customers to use cash or debit cards, which typically have lower processing fees than credit cards. This could include offering small discounts for cash payments or clearly communicating that debit cards are a preferred payment method.

Increase your average transaction value

Because each transaction incurs a fixed fee in addition to the percentage rate, you can make your fees more cost-effective by increasing the average value of your transactions. This could involve strategies like bundling products or services together, upselling, or setting a minimum transaction amount for card payments.

Use Square’s POS system

Using Square’s POS system for in-person transactions results in lower fees than manually entered or online transactions. So, whenever possible, opt for in-person card transactions.

Select the right Square software for your business

Square offers various software with different costs. Some are free, while others come with a monthly fee. Ensure you’re using the one that best suits your business needs, as paying for features you don’t need can unnecessarily increase costs.

Negotiate your fees (for high-volume businesses)

If your business processes a high volume of transactions, it may be possible to negotiate lower rates with Square. While not always possible, it’s worth reaching out to Square’s customer service to discuss.

Before implementing any of these strategies, consider the potential impacts on your business and customer experience. Some strategies may save on fees but could potentially affect sales if not carefully managed. As always, it’s crucial to keep an eye on your business’s overall financial health rather than focusing solely on minimizing fees.

How to get a report of the Square fees

Through Square

Square offers comprehensive reporting features through its dashboard, which can provide a detailed report of your Square fees. Here’s how you can access this:

- Log into your Square dashboard. Use your Square account credentials to log into your Dashboard from a web browser.

- Navigate to the reports section. Once you’re in the Dashboard, look for the “Reports” section in the main menu on the left side of the screen.

- Access the Transaction report. In the “Reports” section, you’ll find a variety of reports. You’ll need to access the “Transaction” report to get details on your Square fees.

- Customize the report. The “Transactions” report can be customized to suit your needs. Choose a date range and choose what information to include in the report. Select “Fees” to have this information included in the report.

- Export or print the report. Once you’ve customized the report to your satisfaction, you can export it as a CSV file or print it directly from the Dashboard. This will give you a hard copy or digital record of your Square fees.

Through a third-party solution

Another option is implementing a third-party solution to your bookkeeping and accounting workflow. An example of such a solution is Synder Sync – a bridge between a Square account and your accounting software (QuickBooks Online/Desktop or Xero).

By connecting all the platforms to Synder, you can synchronize real-time data between them and get any type of Square transactions, such as Square processing fees, payments, refunds, settlements and more. All you need to do is to choose the type of data sync that best fits the needs of your business: per transaction sync, if you want highly detailed data, or daily summary sync records per each connected platform with high-level info only.

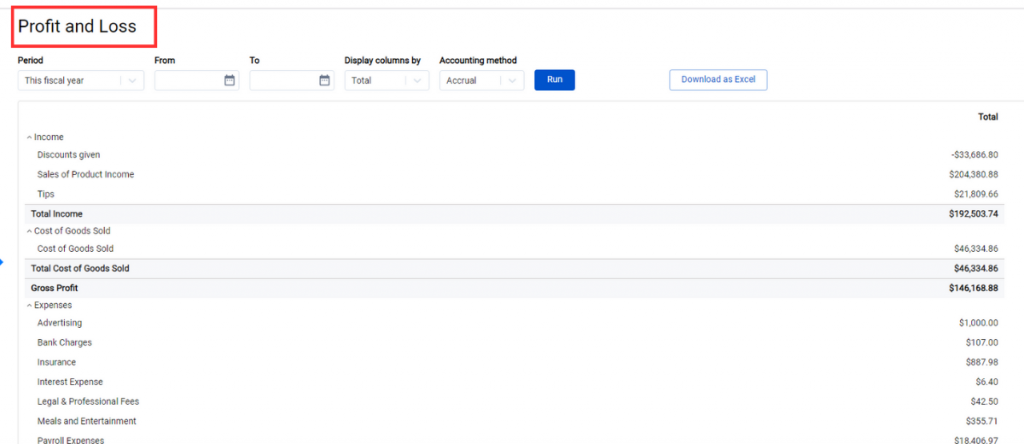

Once all the details are recorded and stored in one system, you can generate a comprehensive P&L report which includes not only the info about Square fees in particular but the records about your income and expenses in general.

With this method, you have complete financial information in one report and can check the account that interests you the most at the moment. Plus, you can connect more than one business unit to the accounting software and track the business performance across all channels.

Moreover, if you use Synder and QuickBooks Online, you can create and schedule both one-time and recurring invoices and send them to your clients through Synder. The invoices will be reflected inside the two platforms, your Synder and QuickBooks Online accounts, and once the payments for them are received, Synder will automatically close these invoices.

Connect your Square to Synder by creating a free account or book a seat at our webinar to get acquainted with all the features in more detail and ask any questions about the workflow, which will be answered by Synder specialists.

Can I charge a customer processing fee on Square?

Square doesn’t natively support adding a processing fee directly to a transaction. However, some businesses choose to incorporate the cost of processing fees into their prices or add a general service charge to orders.

If you decide to add a service charge or increase your prices to cover the cost of processing fees, here’s how you can do it:

- Adjusting prices: You can calculate your average processing cost and adjust your product or service prices accordingly. This way, the prices listed already include the processing fee.

- Adding a service charge: With Square, you can add a service charge to an entire sale or individual items.

To add a service charge to a sale, go to your Square POS app → “Current Sale” →”Discounts” → “Add a Discount” or select an existing one → enter the name and amount of the service charge → “Save“.

To add a service charge to individual items, you must create a new item representing the service charge. Then, you can add this item to the sale along with the other items the customer is purchasing.

Before implementing any of these strategies, it’s essential to be aware of local laws and regulations. In some jurisdictions, charging customers an additional fee for using a credit card is prohibited or restricted. Be transparent with your customers about any added charges, and ensure your business remains compliant with all relevant laws and regulations.

If you need more specific guidance, it’s always a good idea to consult with a legal advisor or reach out to Square’s customer support for up-to-date information.

Summing up: Is Square worth the cost?

While being a critical consideration, Square fees need to be evaluated in the light of the comprehensive benefits provided by the service. For many businesses, the convenience, simplicity, and value offered by Square’s integrated payment processing, hardware, and software solutions can outweigh the cost implications. However, every business is unique, and a thorough understanding of the implications of Square fees is essential to make an informed decision.