You might have known that QuickBooks offers a possibility for businesses to accept credit card payments. This feature, available across various QuickBooks solutions, provides convenience in receiving and accounting for customer payments under the same roof. However, this convenience comes with the cost of credit card fees for payment processing, which you should factor in.

Let’s figure out how accepting payments works in QuickBooks and how much it might cost you.

Contents:

1. A look at QuickBooks Payments (part of QuickBooks Merchant Services)

2. Credit card payment fees at QuickBooks: what will payment processing cost you?

3. What are credit card processing fees?

- Why would you be charged a fee?

- How does QuickBooks Payments deside on the payment processing fee rate?

4. How do you account for payment processing fees?

5. How to save money on QuickBooks credit card processing fees

Key takeaways

- QuickBooks Payments seamlessly integrates with QuickBooks, allowing businesses to accept various payment methods directly within the platform, simplifying invoicing and receipt of payments.

- Businesses utilizing QuickBooks Payments should be mindful of processing fees, including credit card processing rates, which vary based on transaction type and payment method, to effectively manage expenses and optimize cost-effectiveness.

- QuickBooks charges different rates for credit card processing, such as 2.99% for online payments and 2.5% for in-person payments, which businesses should consider when calculating transaction costs and evaluating overall profitability.

A look at QuickBooks Payments (part of QuickBooks Merchant Services)

Before we get to the costs, let’s look at how you accept payments at QuickBooks.

QuickBooks utilizes its proprietary payment processing solution called QuickBooks Payments. This integrated system allows businesses to accept various forms of payment, including credit cards, directly within the QuickBooks platform.

QuickBooks Payments is part of QuickBooks Merchant Services, which offers a variety of payment processing solutions. QuickBooks Payments focuses on integrated payment processing within QuickBooks Online. QuickBooks Merchant Services encompasses a broader range of options, including point-of-sale systems, mobile payments, and ecommerce solutions, catering to diverse business needs.

Looking to automate your QuickBooks accounting? Let Synder work its magic and bring all your sales channels and payment processors together, and provide you with a breakdown of processing fees per each connected channel.

Get hands-on experience of using Synder during a 15-day free trial and book a seat at our Weekly Public Demo for a guided tour by our support team.

Check out the full list of integrations for QuickBooks Online and QuickBooks Desktop here and make smart data-based business decisions with Synder.

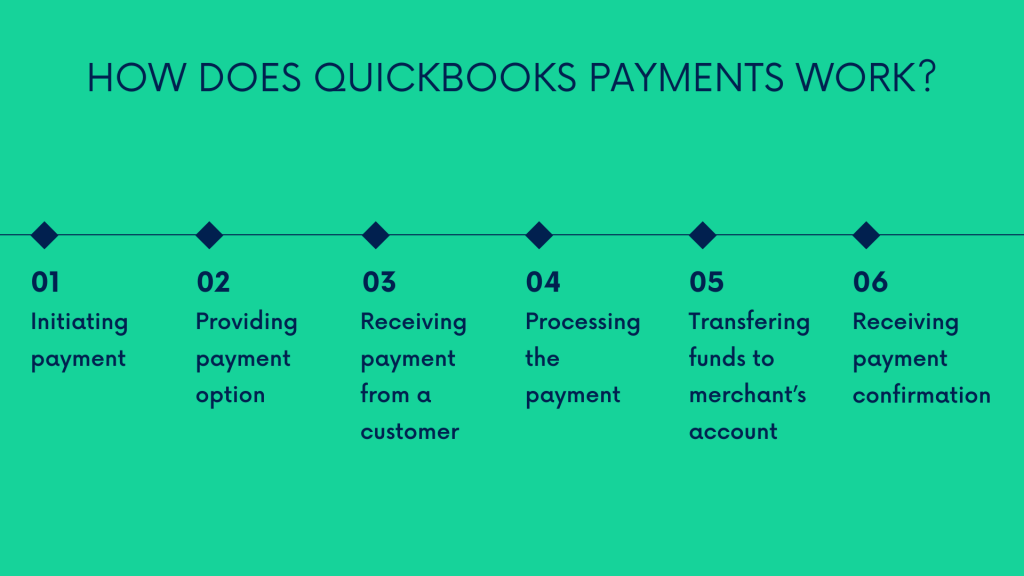

How does QuickBooks Payments work?

QuickBooks Payments essentially works as a payment gateway integrated directly within the QuickBooks platform. When a customer makes a payment, the transaction is processed securely through QuickBooks Payments.

Here’s how a credit card payment looks, simply put.

- You generate an invoice or sales receipt within QuickBooks Online for the goods or services provided to the customer.

- QuickBooks Payments allows you to include a Pay Now button or payment link on the invoice or sales receipt sent to the customer. It makes it a convenient way for customers to make payments online.

- The customer clicks the button or link and enters their credit card details through the QuickBooks Payments interface.

- QuickBooks Payments securely processes the credit card transaction in real time, communicating with the customer’s bank and the credit card network to authorize and complete the payment.

- Once the transaction is approved, the funds are transferred from the customer’s credit card account to the merchant’s bank account. QuickBooks automatically records the payment and updates the user’s (in this case, yours) financial records accordingly.

- The user and the customer receive payment confirmation, and the invoice or sales receipt is marked as paid within QuickBooks Online.

As you can see, it’s very similar to how other payment gateways work processing payments. As mentioned, but worth repeating, payments made through QuickBooks Payments are automatically recorded in QuickBooks Online. This integration simplifies the accounting process for you as a business, as it eliminates manual entry of payment records, saving time and granting you more accuracy in your books.

How else can customers pay: methods QuickBooks accepts beyond credit card payments

Another thing to mention before we go to the credit card processing fees is what payment methods you can offer your customers with QuickBooks Payments.

QuickBooks Payments offers flexible solutions for accepting payments online and on-site.

Online payments

For online payments, QuickBooks Payments enables businesses to send instantly payable invoices directly to their customers (see the example above). Customers can conveniently pay online using credit cards, debit cards, ACH bank payments, and popular digital wallets such as Apple Pay, PayPal, or Venmo. It allows customers to make payments securely using their preferred payment method. Businesses benefit from faster receivables and simplified invoicing procedures.

On-site payments

Besides, QuickBooks Payments provides options for on-site payments, utilizing the QuickBooks GoPayment mobile app and card reader to accept credit or debit card payments in person through tap, dip, or swipe. Customers can also make payments using their digital wallets directly on their mobile devices, further enhancing convenience and flexibility for both parties involved.

Find out how to add classes in QuickBooks and automatically apply them to your sales and how to categorize expenses in QuickBooks automatically with Synder.

Done with that, without much further ado, let’s go look at those payment processing fees at QuickBooks.

QuickBooks card payment fees: what will QuickBooks charge for payment processing?

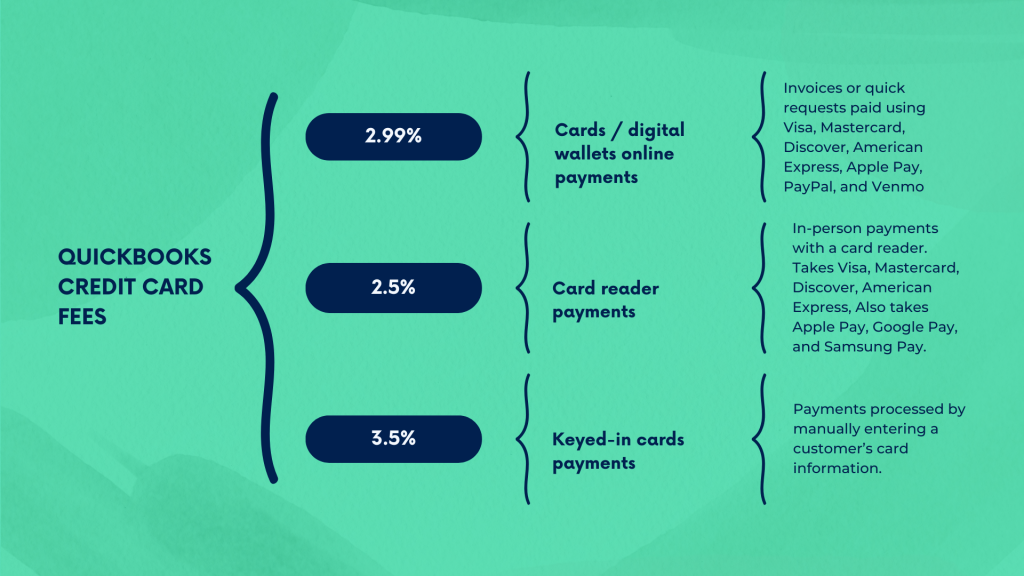

So, as mentioned, QuickBooks offers reliable, secure and affordable credit card processing solutions for businesses of any size. The fees charged by QuickBooks depend on how the credit card payment is processed.

Let’s break it down.

- For online payments made using cards by Visa, Mastercard, Discover, American Express, Apple Pay, PayPal, and Venmo, a fee of 2.99% will be charged.

- For in-person payments using a card reader with Visa, Mastercard, Discover, American Express, Apple Pay, Google Pay, or Samsung Pay, there is a 2.5% fee.

- The fee for payments processed by manually entering a customer’s card information is 3.5%.

IT worth noting that you’ll pay only 1% for AHC payments, with a maximum of $10 per transaction.

What are credit card processing fees?

Now, why would QuickBooks want to charge you for processing payments? Let’s look at what payment processing fees are and how they work.

Payment processing fees are charges merchants face when they accept electronic payments, such as credit cards, debit cards, or digital wallets, for goods or services. They are usually a small percentage of the sale amount or a flat fee per transaction (or both).

Why would you be charged for processing credit card payments?

These fees are typically charged by payment processors or acquiring banks and are necessary for several reasons.

Let’s break them down.

#1 – Service provision

Payment processors offer services for facilitating electronic transactions, including authorizing and processing payments, ensuring security and compliance with regulations (such as PCI DSS), providing customer support, and handling disputes and chargebacks.

#2 – Infrastructure costs

Payment processing requires infrastructure. Maintaining it involves significant costs, including software development, hardware maintenance, data security measures, and network connectivity.

#3 – Risk management

Payment processors assume certain risks associated with processing transactions, such as fraud, non-payment, or disputes. So, they factor risk management costs, together with providing security measures to protect merchants and consumers, into the service fees.

#4 – Interchange fees

A portion of the processing fees goes to the card networks (e.g., Visa, Mastercard) as interchange fees. These fees compensate card issuers for the cost of issuing cards, managing accounts, and assuming risks associated with card transactions.

How does QuickBooks Payments decide on the rate?

Like any other payment processor, QuickBooks Payments doesn’t get their rates for payment processing out of the blue. They calculate them based on a combination of transaction-specific factors, merchant characteristics, and market dynamics to provide competitive rates for businesses using payment processing services.

Let’s look at those factors real quick.

Transaction type

As you can observe in the example of QuickBooks, the fee rate may vary depending on the type of transaction. For example, the fee for a card-present transaction (where the card is physically present) differs from a card-not-present transaction (such as online payments).

Payment method

Various payment methods may incur different fees. It’s quite typical for credit card transactions to have a higher rate compared to debit card transactions.

Merchant profile

When setting the rate, payment processors might also consider the merchant’s business type, processing volume, and credit history. Businesses with higher sales volumes or lower risk profiles may qualify for lower rates.

Additional services

Additional services, such as next-day deposits or advanced reporting, may also come for an extra fee. At this point, the total cost may include both the base processing fee and additional service fees.

Market competition

It goes without saying that, like other payment processors, QuickBooks Payments wants to be competitive, so they might take into account market and industry standards when setting their fee rates. Competition might also influence fee adjustments over time.

How do you account for payment processing fees?

In accounting, payment processing fees are categorized as operating expenses. What does that mean?

Typically, you record payment processing fees in the company’s financial records under expense accounts, usually found in the operating expenses section of the chart of accounts. You do so because the fees represent the costs you pay when running a business, being a part of your business’s operation.

Let’s say your business sells a product for $100, and the payment processor charges a 3% fee for processing credit card transactions. This means that for every $100 sale, you’ll incur a $3 processing fee.

Let’s look at how it happens step by step.

- When you make a sale, you record the total amount received from the customer as revenue. In this example, you would record $100 as revenue.

- However, you’ll receive only $97 in your bank account as the $3 processing fee is deducted from the $100 sale by the payment processor.

- At this point, you need to reflect it in your accounting. So, you create an expense account in your chart of accounts, such as Payment Processing Fees or Merchant Fees.

- Thus, you record the $3 processing fee as an expense in your accounting records by debiting the Payment Processing Fees account for $3. This reduces your net income and reflects the cost of processing the sale.

- To balance the transaction, you credit your bank account for the amount received after deducting the processing fee, which is $97 in this example.

Why should you track processing fees separately?

Having a separate account for tracking processing fees is utterly important, as it provides businesses with valuable insights into their financial operations, enhances decision-making capabilities, and ensures compliance with tax regulations. Let’s look at how it works in various aspects.

Financial reporting

Separating processing fees enables precise financial reporting, allowing businesses to calculate net revenue and expenses accurately and provide a clear financial performance picture.

Cost analysis

Businesses can directly analyze the costs of payment processing and assess the efficiency of payment methods, evaluate the impact of processing fees on profitability, and identify areas for cost optimization.

Budgeting and forecasting

Understanding how much a company spends on fees might help better budgeting and forecasting, and thus, allocate resources more effectively and make better decisions about future financial strategies.

Tax deductions

Processing fees are typically tax-deductible business expenses. At this point, you might want to track them separately to identify and claim them as deductions on your tax returns, reducing their taxable income and potentially lowering their tax liability.

Vendor management

Last but not least, tracking processing fees helps businesses monitor and manage relationships with payment processors more confidently. They can compare fee structures across different providers, negotiate better rates, and ensure they’re getting the best value for their money.

How to save money on Intuit QuickBooks credit card fees

Now that you understand what QuickBooks credit card processing fees are and how much they cost, let’s take a look at how you can save money on these fees.

The first step is to shop around for the best payment processing service for your business. Different payment processing services have different fees, so make sure you compare different services to find the one that offers the lowest fees for your business.

In addition to shopping around for the best payment processing service, you can also save money on QuickBooks credit card processing fees by using the right payment methods. For example, if you want to accept payments via PayPal, you can save money by using the PayPal Express Checkout feature, which charges a lower fee than the standard PayPal processing fee. Similarly, if you want to accept payments via ACH, you can save money by using the ACH Direct feature, which also charges a lower fee.

Finally, you can also save money on QuickBooks credit card processing fees by taking advantage of the payment processing services that QuickBooks offers. For example, if you are processing invoices or recurring payments, you can save money by taking advantage of the specialized services that QuickBooks offers for these types of payments.

QuickBooks fees for payments: Conclusion

Let’s wrap it up.

QuickBooks Payments is a payment processing solution that enables businesses to receive payments directly within the QuickBooks platform. This feature can improve efficiency, but one might want to consider the processing fees associated with different transaction types and payment methods. As a business, you should track these fees separately and categorize them as operating expenses. It might help you gain insight into your business’s performance, optimize cost-effectiveness, have more financial clarity, improve efficiency, and make the most of your financial resources.

Want to read more about QuickBooks basics? Check out our articles on QuickBooks accounts receivable, QuickBooks trial balance.

Share your thoughts

Share your thoughts and experience in the comments section below. We’re fond of good stories!