For many businesses, PayPal is a trusted platform for receiving customer payments securely and efficiently. However, when these transactions appear on a bank statement, a business owner might want to distinguish between payments from various sources to better understand their financial records and sales channel performance.

Let’s look at how PayPal transactions show up on bank statements and explore why businesses may want to differentiate these payments.

Contents:

1. How PayPal works for businesses?

- What’s a PayPal business account?

- How do you have the money from PayPal show up in a business’s bank account?

2. How can you find your PayPal transactions in a bank statements?

3. Why would you need to find your paypal transactions

- Create your marketing strategy

- Make sure your store is well-optimized

- Advertise products with Etsy Ads

- Promote listings with Off-site Ads

- Use social media marketing to promote your Etsy shop

- Regularly repost your listings

- Encourage some word-of-mouth

4. Automating your PayPal transaction management with Synder

Key takeaways

- Businesses should reconcile their PayPal transactions with their bank statements to ensure accuracy and identify discrepancies. This process is crucial for maintaining reliable financial records and detecting errors or missing payments.

- Accessing PayPal transactions in bank statements aids in tax reporting, ensuring accurate income reporting and compliance with tax regulations. By accurately documenting PayPal transactions, businesses can minimize the risk of errors or omissions in their tax filings.

- One can locate PayPal transactions in bank statements through online banking or generated bank statements. This way, businesses can control their PayPal transactions and maintain organized financial records for better decision-making and financial management.

How PayPal works for businesses

Let’s start with some basics and look at how PayPal works for businesses.

PayPal is originally a digital wallet that lets businesses and individuals send and receive money online. It’s widely used for buying and selling goods and services, sending money to friends or family, and making online payments securely.

What’s a PayPal business account?

As mentioned, PayPal works for individuals and businesses. And as a business, you’re highly likely to have a PayPal business account.

It offers features like accepting payments online, generating invoices, and accessing finance management tools. With a PayPal business account, businesses can accept customer payments using various methods like credit cards, debit cards, and PayPal balances.

How do you have the money from PayPal show up in a business’s bank account?

Once a business receives payments through PayPal, the money is securely held in their PayPal account. However, business needs them in their bank account. At this point, they need to initiate a transfer through the PayPal dashboard or app.

PayPal processes the transfer, and depending on the business’s settings and bank processing times, the money typically arrives in the bank account within a few business days. Then a business can access their funds and use them for various business needs like paying bills, purchasing inventory, or managing expenses.

Integrate your PayPal with accounting with the help of Synder and always have a comprehensive view of your PayPal transactions, neat reporting, accurate reconciliation and tax filing.

Get hands-on experience of using Synder during a 15-day free trial and book a seat at our Weekly Public Demo for a guided tour by our support team.

How can you find your PayPal transactions in a bank statement?

As mentioned, withdrawals from PayPal might take up to three working days to get to your bank account, and even longer in case of weekends or holidays.

Besides, you’re most likely to see the totals in your account balance rather than individual transactions. It can be confusing and frustrating if you need a more detailed view of your transactions or face a discrepancy during reconciliation and need to investigate.

We’ll get back to why you might want to look for your PayPal transactions on a bank statement and look at those in more detail a little further.

Meanwhile, let’s figure out the possible ways to locate PayPal transactions in your bank records. Typically, you have a couple of options. You can either look directly in your online banking or generate a bank statement for the needed period and look through it.

Locating PayPal transactions in online banking

As mentioned, one of the options is to track PayPal transactions in your bank account throughout your transaction history. You’ll be looking for transactions with the word PayPal in the description.

To do so, you might want to

- View a list of recent transactions on your PayPal account. You can do it by going to the My Account tab and selecting the History option to view the transactions. With more than one bank account linked to PayPal, you might want to verify the one to which you transferred the funds by clicking the Details link next to the relevant transaction.

- Then, you can go to your internet banking account and generate a transaction listing for the necessary period (starting from the date of the PayPal transaction and ending up to five working days after the transaction date or up to the present date, whichever you prefer).

- To narrow down your search results for transactions, try filtering them using the keyword PayPal in the description field. Typically, transactions from PayPal will be listed with the sender as PayPal, Inc. and may have keywords such as PayPal and Transfer in the description field.

- Then, you can match your banking transaction listing against that in your PayPal account withdrawal history for the amount in question.

How PayPal transactions appear in a bank statement

You can also locate your business’s PayPal transactions in a generated bank statement.

You might want to look for specific transaction details that pinpoint payments processed through PayPal. Typically, there will be a recognizable descriptor, such as PayPal or PAYPAL, followed by additional information like the recipient’s name or a transaction ID (basically, just like in online banking).

Depending on your bank, these transactions may be listed individually or grouped together under a single line item for PayPal transactions during a specific period.

So, any which way, you typically can track PayPal transactions in a bank statement.

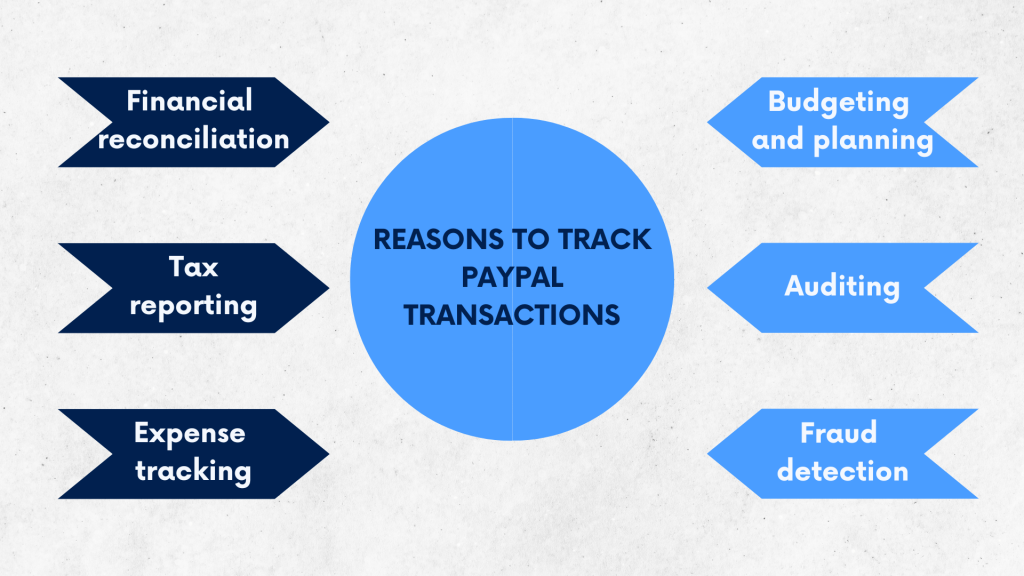

Why would you need to find your paypal transactions?

I promised to look at why one might need to identify and look through their PayPal transactions in more detail. As already mentioned, there are several reasons, reconciliation being just one of those.

So, let’s go take a look.

Reason #1 – Financial reconciliation

Checking PayPal transactions on your bank statement helps reconcile your financial records. It ensures that all transactions recorded in PayPal match those appearing in your bank account, helping to identify any discrepancies or missing payments.

Reason #2 – Tax reporting

Accessing PayPal transactions in your bank statement aids in tax reporting. You can accurately report income received through PayPal for tax purposes, ensuring compliance with tax regulations and minimizing the risk of errors or omissions in your tax filings.

Reason #3 – Expense tracking

Monitoring PayPal transactions on your bank statement facilitates expense tracking. You can categorize payments made through PayPal, such as purchases, fees, or refunds, to gain insights into your business’s spending patterns and effectively manage your budget.

Reason #4 – Budgeting and planning for business operations

Reviewing PayPal transactions in your bank statement supports budgeting and planning efforts. By understanding how much revenue is generated through PayPal and tracking related expenses, you can make informed decisions about resource allocation and financial goals.

Reason #5 – Auditing and compliance

Having PayPal transactions documented in your bank statement aids in auditing and compliance processes. It provides a clear record of financial activities, which can be crucial for internal audits, regulatory compliance, or external reviews by stakeholders or authorities.

Reason #6 – Fraud detection

Monitoring PayPal transactions on your bank statement helps detect fraudulent or unauthorized activities. By regularly reviewing transaction details, you can promptly identify any suspicious transactions and take appropriate measures to safeguard your business’s finances and security.

Automating your PayPal transaction management with Synder

As you can see, PayPal provides you tools to track back PayPal transaction history and compare it against your bank account. However, as you could get, often, the information on your PayPal transactions found in the bank statement might lack the details you need for a better understanding and analysis of your sales.

That’s where Synder can step up and integrate your PayPal with accounting (be it QuickBooks or Xero) to automatically bring all your transactions (including payouts) to your books and neatly organize them there. So you can always have an accurate outline of your PayPal payments ready for reporting, taxation, and business analysis.

Let’s look at what I mean in a bit more detail.

Instant sync of PayPal’s current and historical data with accounting

Synder helps you easily synchronize your PayPal transactions with QuickBooks and import historical data. This way, all your PayPal sales and transactions are accurately recorded in your accounting software without manual data entry.

Automated categorization for your PayPal transactions

Enjoy automated categorization of your PayPal transactions within QuickBooks (or other accounting software), saving you time and effort in manually sorting and assigning categories. This feature helps streamline your accounting process and ensures consistency in financial reporting.

Fast and accurate reconciliation

Synder allows you to effortlessly reconcile your PayPal transactions thanks to accurate syncing and categorization, minimizing discrepancies and ensuring the integrity of your financial records.

Sales tax management

Synder can calculate and account for your PayPal sales taxes. So, whenever you get a sale and receive a payment through PayPal, Synder helps you easily track and manage sales tax obligations, ensuring compliance with tax regulations and facilitating accurate reporting and remittance of taxes.

Multicurrency management

You can manage your PayPal multicurrency transactions and automatically account for them. If you sell abroad, it makes it so much easier to keep your books accurate, as Synder handles tracking and applying correct exchange rates. At this point, you can keep your business expansion with more confidence and maintain accurate financial records.

Detailed transaction data, allowing you to track sales, products, and customer behavior trends

Access to detailed data for your PayPal transactions allows you to analyze sales, products, and customer behavior trends to gain insights into your business performance and make informed decisions for growth and optimization. Synder fetches all these necessary details, providing a solid base for decisions made with real numbers.

Wrapping it up

As a business receiving payments with PayPal, handling PayPal transactions is vital for keeping your finances in check. Comparing them against bank statements allows you to spot errors, track your money flow, and stay on top of tax obligations. At this point, knowing how to spot PayPal transactions in bank statements ensures easy access to financial details, helping better planning and decision-making.

Using tools like Synder can make life easier by automating tasks of syncing PayPal data with accounting software and sorting transactions automatically. With these tools and approaches, businesses can streamline their financial processes, cut down on mistakes, and focus more on growth.

Read our article to learn about possible PayPal alternatives.

Share your thoughts

Share your thoughts and experience in the comments section below. We’re fond of good stories!

bookmarked!! I really like your website!

Thank you so much! Happy to hear that.