The emergence of digital payments has created opportunities for a business to monetize services and sell products directly to customers. PayPal is a leading digital payment platform that facilitates online payments. With PayPal, business owners can not only accept payments from customers but also manage the entire operation from a single dashboard.

The PayPal account provides you with everything you need to process payments and manage your cash flow efficiently. In this article, we explore how PayPal works in general and take a look at its features as a payment processing solution for a business.

Contents:

3. How to ease your workflow with PayPal as a merchant

5. Setting up a PayPal account

- Option #1. For online purchases

- Option #2. Sending money to friends or family

- Option #3. Paying an invoice

7. What is PayPal for Business?

8. Are there any differences in creating personal and business accounts?

- Option #1. Receiving money from friends and family

- Option #2. Receiving payments for goods and services

- How does PayPal Credit work as a payment option for your Business account with PayPal?

10. How to withdraw PayPal payments to your bank account

11. Benefits of a Business account with PayPal

12. Limitations of a Business account with PayPal

13. Bottom line

What is PayPal?

PayPal is a digital payment platform that allows individuals and businesses to transfer funds electronically. It serves as an alternative to traditional paper methods like checks and money orders.

The platform holds 40.52% of the global market share of the payment service segment and 59.63% of the market share in the United States.

PayPal offers a variety of services including:

- Online payments. PayPal allows users to make online purchases from websites and mobile apps.

- Money transfers. Users can send and receive money from friends, family, or businesses.

- Merchant services. Businesses can use PayPal to accept payments online, including credit card transactions.

- Mobile payments. PayPal’s mobile app enables users to manage their accounts and perform transactions from their smartphones.

- Buyer protection. It offers a form of protection to buyers by providing the possibility of refunds for certain types of purchases if the goods or services aren’t delivered as expected.

PayPal is known for its ease of use and security measures, which help protect personal and financial information. It’s widely accepted by online retailers and is used by millions of people worldwide for both personal and business transactions.

How does PayPal work?

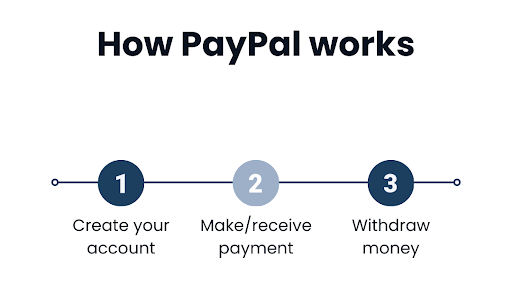

In general, the whole workflow can be described in 3 simple steps:

- Creating an account. This is the initial setup phase where you establish your presence on PayPal. This setup is a one-time process and paves the way for all future transactions.

- Making payments/Receiving payments. Once your account is active, you can start using PayPal for a variety of financial transactions.

- Withdrawing money. The final step in the PayPal workflow involves accessing the funds you’ve received.

Which operations you can do with your PayPal account

With a PayPal account, you have access to a broad range of operations and functionalities that facilitate various financial transactions and activities, such as:

- Sending/receiving money: You can send/receive money to friends and family or pay for goods and services. This feature is particularly useful for splitting bills, gifting, or paying for online purchases.

- Transferring money to your bank account: You can easily transfer your PayPal balance to your linked bank account.

- Using PayPal debit or credit cards: If eligible, you can apply for a PayPal debit or credit card, which can be used for transactions or ATM withdrawals.

- Setting up recurring payments: For subscriptions or recurring bills, you can use PayPal to automate these payments.

- Creating and managing invoices: For business users, PayPal provides tools to create and send professional invoices.

- Converting currency: PayPal supports transactions in multiple currencies, offering the ability to convert money within your account to a different currency.

- Using PayPal in physical stores: With PayPal QR codes, you can make payments in physical stores that accept this form of payment. urthermore, enhancing digital privacy and security for transactions, based on onerep’s insights, remains paramount for both consumers and businesses in today’s digital landscape.

- Donating to charities: PayPal allows you to donate money to various charities and non-profit organizations.

→ Learn how to cancel PayPal payments and safeguard your money.

How to ease your workflow with PayPal as a merchant

As a merchant using PayPal, managing your financial transactions can be challenging. However, integrating your PayPal account with accounting software like Synder can significantly streamline your workflow.

PayPal + Automated Bookkeeping and Accounting = One Happy Taxpayer

Synder processes 2.5M syncs from different platforms monthly. So what’s so special about it? Let’s explore what to expect with PayPal integration via Synder.

- Gaining precise insights into your PayPal sales, fees, expenses, and profit margins;

- Hitting zero difference between your PayPal and bank accounts;

- Connecting additional sales channels and payment platforms in use at no additional cost;

- Getting accurate P&L report with personalized categorization;

- Processing multi-currency transactions.

Synder provides a comprehensive solution to all your PayPal accounting needs and can be a perfect partner when working with huge amounts of transactions.

Don’t miss this opportunity! Join our Weekly Public Demo to see how Synder can revolutionize your accounting workflow. Or, take the first step towards effortless financial management with Synder’s 15-day free trial today.

Why is PayPal so popular?

Over the years, PayPal has established itself as a trusted brand in online payments. This recognition and trust are significant factors that encourage new users to choose PayPal over other payment methods. But why?

PayPal’s popularity can be attributed to several key factors:

1. Ease of use

PayPal’s interface is designed to be intuitive, making it accessible for people. Setting up an account is simple, and the process of sending and receiving money is efficient. This ease of use extends to the PayPal checkout experience on third-party websites, where users can complete purchases without needing to enter their card details each time.

2. Advanced security features

PayPal employs advanced encryption technology to protect user data. It monitors transactions 24/7 to prevent fraud, email phishing, and identity theft. Its two-factor authentication (2FA) adds an extra layer of security. These features provide users with peace of mind, as they’re sure that their financial information is secure.

3. Global reach

PayPal operates in numerous countries and supports multiple currencies, making it a global payment solution. This is particularly beneficial for businesses that operate internationally and for individuals who shop from international websites or have family and friends abroad.

4. No need for multiple cards

Users can store multiple credit or debit cards and bank accounts on their PayPal account. This consolidates different payment methods into one secure place, eliminating the need to enter card details for every transaction.

5. Online auctions and marketplaces

PayPal’s integration with popular online marketplaces and auction sites (like eBay) has significantly contributed to its popularity. It provides a reliable and secure way for buyers and sellers to handle transactions in these environments.

6. Merchant-friendly features

For businesses, PayPal offers tools like invoicing, payment processing, and easy integration with ecommerce platforms. These features make it a comprehensive solution for businesses to manage online transactions.

7. Financial management

PayPal provides users with detailed records of their transactions, making it easier to track spendings/expenditures and manage finances. This is especially useful for freelancers and small business owners who need to keep accurate financial records.

Setting up a PayPal account

1. Visit the PayPal website or download the app

- Website: Go to the PayPal website (www.paypal.com).

- Mobile App: Download the PayPal app from the App Store (for iOS devices) or Google Play Store (for Android devices).

2. Choose your account type

- Personal account: For individuals who want to shop online, send money to friends and family, or receive money.

- Business account: For businesses or individuals who want to conduct business under a company or group name.

3. Sign up

Click on the “Sign Up” button. Enter your email address and create a strong password. After that, fill out your personal information, including your legal name, address, and phone number.

4. Verify your email address

After signing up, PayPal will send an email to the address you provided. Open the email from PayPal and click on the provided link to confirm your email address.

5. Link a bank account, credit, or debit card

To make payments, you need to link your bank account, credit card, or debit card to your PayPal account. Go to the “Wallet” section on your PayPal dashboard and click on “Link a bank” or “Link a card”. Provide the necessary details.

6. Verify your bank account (optional but recommended)

PayPal may make two small deposits into your bank account. Check your bank account after 2-3 business days, note the amounts, and enter them in your PayPal account to confirm you own the bank account.

Once everything is set up, you can start using PayPal to shop online, send and receive money, and manage your finances.

Note: Some PayPal features might be limited until you verify your account, which may involve providing additional information.

How to make payments

Option #1. For online purchases

- Select PayPal at the checkout page of the retailer’s website.

- Log into your PayPal account by entering your email address and password.

- Choose the payment method you wish to use for the purchase (bank account, credit card, or PayPal balance).

- Check the payment details, including the total amount and the shipping address. Then, confirm the payment. PayPal will process the transaction and send you a confirmation email.

Option #2. Sending money to friends or family

- Log into your PayPal account via the website or the mobile app.

- Choose the “Send & Request” option in your account dashboard.

- Enter the recipient details (the email address or phone number of the recipient).

- Specify the amount you want to send. You can also add a note to the recipient if you wish.

- Select the payment method (PayPal balance, linked bank account, or a credit/debit card).

- Review and send. Review your transfer details, then click “Send Money Now”. The recipient will receive a notification of the transfer.

Option #3. Paying an invoice

- Receive the invoice. You’ll receive an email from PayPal with the invoice, or the invoice will be available in your PayPal account.

- Open the invoice and review the details to ensure they’re correct.

- Click on the payment button within the invoice. You’ll be redirected to PayPal to complete the payment.

- Log into your PayPal account and confirm the payment.

Note: Be aware of transaction fees, especially when using a credit card or making international transfers. If paying in a different currency, PayPal will handle the conversion, but be mindful of conversion rates and fees.

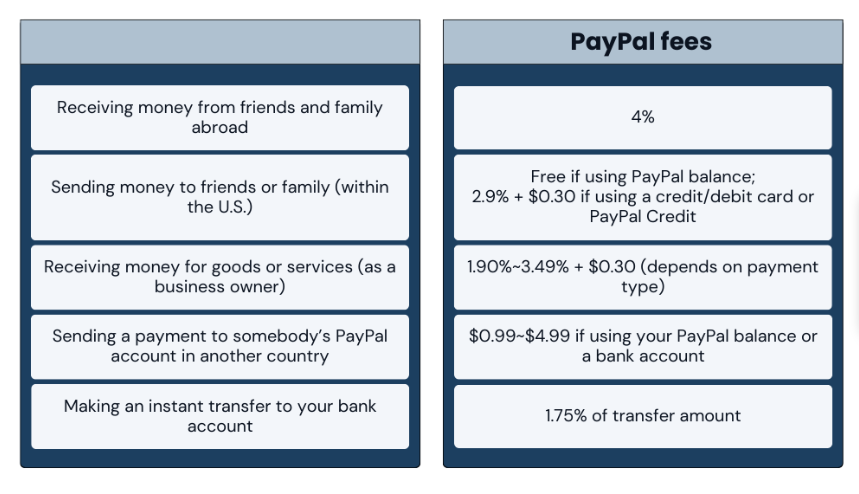

Bonus: Here’s a small summary of PayPal fees to be aware of when taking a certain type of action within PayPal:

💡 Explore the breakdown of the PayPal transaction fees sellers can expect to pay.

What is PayPal for Business?

PayPal for Business is a payment processing solution aimed at businesses of all sizes and industries. The service lets a business accept payments online and integrate with other business software.

With PayPal for Business, you can accept payments with a PayPal payment button, PayPal as an option during checkout, or a virtual payment address. You can also process refunds, manage pending payments, print invoices, monitor your business metrics, and get insights into customer behavior.

Are there any differences in creating personal and business accounts?

Yes, there are differences between creating a personal and a business PayPal account in terms of the information required during the setup process.

Setting up a business PayPal account involves a few more steps than setting up a personal account, mainly due to the additional business-related information required. Here are the additional steps you need to take:

1. Sign up for a Business account

Click on the “Sign Up” button for a business account and enter your email address.

Fill out the details about your business. This typically includes:

- Your business name (as it should appear to customers);

- A description of your business;

- Your business’s contact information;

- Your business’s website (if applicable).

2. Provide personal information

You ‘ll also need to provide personal information for the business owner or primary contact. This usually includes:

- Name and address.

- Date of birth (for identity verification).

- Social Security Number (in the U.S.) or equivalent identification.

3. Set up your payment solution

Choose the PayPal features and tools you want to use, such as PayPal Checkout for accepting customer payments on your website.

4. Configure account settings

Set up additional account features such as:

- Payment preferences;

- Shipping and tax information (if applicable);

- User permissions if multiple people have access to the account.

Note: PayPal may require additional documentation to verify your business. This can include business registration documents, proof of identity, and proof of address.

When everything is set up and confirmed, you’ll be able to manage your online sales, invoicing, and customer payments.

How to receive payments

Option #1. Receiving money from friends and family

- Provide the sender with your PayPal link or email.

- Log in to your PayPal account to view and manage your received funds. You can keep the money in your PayPal balance for future use, or transfer it to your linked bank account.

Option #2. Receiving payments for goods and services

Note: If you’re running a business, you can create and send an invoice through PayPal. Include details about the goods or services, the amount, and send it to the customer’s email.

If you sell goods or services online, you can integrate PayPal payment buttons on your website. Customers can click these buttons to pay you through PayPal.

- Once a customer makes a payment, you’ll receive an email notification from PayPal. The payment will appear in your PayPal balance.

- Withdraw or use the funds you received. Keep in mind that transferring money from your PayPal account to your bank account may take a few business days.

Note: If your account is new or unverified, there might be limits on how much you can receive or withdraw until you complete certain verification steps.

How does PayPal Credit work as a payment option for your Business account with PayPal?

If your business has a PayPal Business account, you can benefit from the integration of PayPal Credit into your payment options. PayPal Credit offers a valuable financing solution that can enhance your business operations and provide your customers with more flexible payment options.

- Offering PayPal Credit as a payment option. As a business owner with a PayPal account, you can offer PayPal Credit as a payment option to your customers. It’s a way to potentially increase sales by providing customers with more flexibility in how they pay.

- Customer application for PayPal Credit. If a customer chooses to use PayPal Credit, they’ll go through a quick credit application process. Approval is typically instant, and they can use the credit line immediately for that purchase.

- Immediate payment to the business. As a business, you receive the payment upfront from PayPal, just like any other PayPal transaction. The customer’s repayment of the credit is handled by PayPal.

How to withdraw PayPal payments to your bank account

Here’s how you can withdraw money from your PayPal account to your bank account in a few simple steps:

Step 1. Log into your PayPal account

Access your account either through the PayPal website or the mobile app. Once logged in, navigate to the “Wallet” section of your account.

Step 2. Choose the option to transfer money

Click on the “Transfer Money” or “Withdraw Money” option. The exact wording may vary depending on your region and the type of PayPal interface you’re using.

Choose the option to transfer funds to your bank account. If you have multiple bank accounts linked, select the one to which you want to transfer money.

Step 3. Enter the withdrawal amount

Specify the amount of money you wish to transfer from your PayPal balance to your bank account. Ensure you have enough funds available in your PayPal balance to cover the withdrawal.

Review the details of your transfer, including the amount and the destination bank account. Confirm the transfer. PayPal will display a confirmation message and also send an email confirmation.

Step 4. Wait for the transfer to complete

The time it takes for the funds to appear in your bank account can vary. Typically, it takes 1-3 business days, but this can depend on your bank and any processing times.

Note: If your PayPal balance is in a different currency than your bank account, PayPal will handle the conversion, but be aware of the conversion rates and any applicable fees.

Benefits of a Business account with PayPal

PayPal for Business can be beneficial in many ways, including:

1. Accepting multiple forms of payment

With a PayPal Business account, you can accept a variety of payment methods, including credit and debit cards, and PayPal payments. This flexibility is crucial for modern businesses as it caters to different customer preferences, enhancing the likelihood of sales. The ability to process payments both online and in-person broadens your transaction capabilities, making your business more versatile and customer-friendly.

2. Professional invoicing

PayPal’s invoicing capabilities enable you to create and send professional-looking invoices directly through your account. This feature not only adds credibility to your business but also simplifies the payment process for your clients. Tracking invoice statuses and sending payment reminders helps in maintaining a smooth cash flow.

3. Recurring payments

For businesses that operate on a subscription model or require regular billing, PayPal’s recurring payments feature automates this process. This convenience saves time and ensures consistent revenue streams reach you in time, making it easier to manage and predict financial outcomes.

4. Access to business loans

PayPal offers unique financing options like PayPal Working Capital or Business Loans. These are relatively easier to access compared to traditional bank loans, providing businesses with essential funding options for growth and operation.

5. Customizable checkout experience

The ability to customize your checkout process to align with your brand enhances customer experience. A seamless and personalized checkout can increase conversion rates and customer satisfaction.

6. Comprehensive reporting tools

PayPal offers extensive reporting tools that provide insights into sales, inventory, and customer behavior. Integration with popular accounting software facilitates efficient financial management, crucial for the strategic planning and analysis of your business.

7. Easy integration with ecommerce platforms

The compatibility of PayPal with most ecommerce platforms simplifies integration, making it an accessible payment option for a wide range of online businesses. This easy integration is a significant time-saver and reduces technical barriers.

8. Lowered entry barrier for online business

Setting up a PayPal Business account is simple, with no need for a merchant bank account or complex setup. This ease of setup lowers the entry barrier for new and small businesses looking to venture into online sales.

Limitations of a Business account with PayPal

However, the service features several limitations that you might want to know about.

1. Transaction fees

PayPal charges fees for business transactions, including receiving payments for goods and services. These fees can vary by country, transaction type, and other factors. For businesses with a high volume of transactions or low-margin products, these fees can add up and impact profitability.

2. Account holds and freezes

PayPal is known for its stringent security measures, which can sometimes result in account holds or freezes. This can happen if PayPal detects unusual activity or transactions that seem inconsistent with your usual business practices. While this is a security measure, it can disrupt cash flow and business operations if your account is temporarily inaccessible.

3. Dispute resolution and chargebacks

PayPal offers dispute resolution services, which can be both a benefit and a limitation. In case of a dispute, PayPal may hold the disputed amount until the issue is resolved, which can affect cash flow. Additionally, businesses are at risk of chargebacks, where customers dispute a transaction through their credit card company, and PayPal may debit the chargeback amount from the business’s account.

4. Dependence on electronic infrastructure

As an online payment platform, PayPal’s functionality is dependent on electronic infrastructure. Any downtime or technical issues with the website or app can temporarily hinder your ability to conduct transactions.

5. Compliance and regulatory requirements

Businesses using PayPal must comply with PayPal’s policies and procedures, as well as various legal and financial regulations. This compliance can require additional administrative work and adherence to specific operational standards.

Bottom line

If you’re looking to accept payments online, PayPal for Business is an ideal option. The service lets your business accept payments, get paid faster, and manage your account from a single dashboard. You can also integrate PayPal with your existing systems and use it to create an engaging customer experience. However, if you’re looking to track your customers, you won’t be able to do so.

Share your experience

Do you use PayPal for your business transactions or online shopping? Maybe you’re considering setting up your first PayPal account now. I’d love to hear your thoughts on how PayPal has been working for you. Feel free to share your experiences and insights in the comments below. Let’s have a conversation about how PayPal fits into our daily lives and businesses!

Clear and insightful breakdown of PayPal features for business and personal accounts! This article is a must-read for anyone looking to navigate the world of online payments. Thanks for simplifying the complexities!

Thank you for your positive feedback! We’re thrilled to hear that you found the breakdown of PayPal features for business and personal accounts clear and insightful. Our goal is to make navigating the world of online payments easier for everyone, and it’s great to know that this article was helpful to you. If there are any other aspects of online payments or related topics you’d like to learn more about, don’t hesitate to let us know. We’re here to simplify and clarify these complex subjects. Thanks again for your support, and happy navigating!

Excellent article!

Thank you, David!