The global business landscape, comprising of innumerable entities, sectors, and markets, operates under an extensive framework of rules, regulations, and principles. This elaborate system is specifically designed to ensure transparency, accountability, and overall efficiency in business conduct. Accounting standards, including the Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS), are the linchpin of this system. GAAP, primarily used within the United States, and IFRS, adopted in over 140 countries globally, play instrumental roles in regulating business finances and accounting worldwide.

This article delves deep into the differences and similarities between GAAP and IFRS, offering businesses, investors, and financial professionals a greater understanding of these fundamental systems in the global financial arena.

Want to automate bookkeeping and accounting processes? Learn how Synder can help you!

Overview of GAAP

The Generally Accepted Accounting Principles (GAAP) are a set of standards, guidelines, and procedures that govern the financial reporting practices of businesses operating in the United States. These principles have evolved over time to provide transparency, consistency, and comparability in the financial reporting landscape.

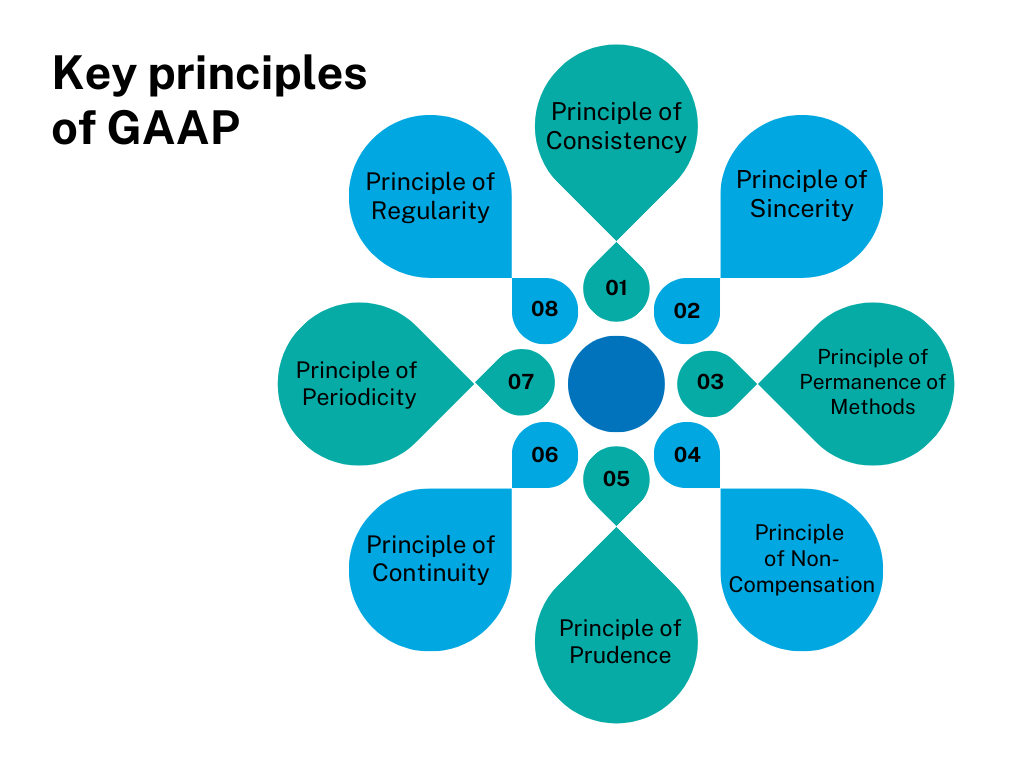

Key principles of GAAP

GAAP operates on several key principles:

- Principle of Regularity: The accountant has adhered to GAAP rules and regulations.

- Principle of Consistency: The same standards are applied throughout the financial reporting process to ensure consistency.

- Principle of Sincerity: The accountant strives to provide an accurate depiction of a company’s financial situation.

- Principle of Permanence of Methods: Procedures used in financial reporting should be consistent.

- Principle of Non-Compensation: All aspects of a business’s performance, both positive and negative, should be fully reported with transparency.

- Principle of Prudence: This emphasizes fact-based financial data representation that is not clouded by speculation.

- Principle of Continuity: It is assumed that the business will continue to operate in the foreseeable future.

- Principle of Periodicity: Entries should be distributed across the appropriate periods of time.

Read our article about Basic Accounting Principles to learn more details about each principle.

GAAP in practice

GAAP covers a broad array of topics, including revenue recognition, balance sheet item classification, and materiality. Under GAAP, companies are required to report earnings, financial position, and cash flows. Furthermore, certified public accountants must audit these financial statements.

GAAP serves to guide the users of financial statements by creating uniformity in the manner financial statements are presented, thereby enabling users to understand and compare the financial health of businesses easily.

The role of FASB

The Financial Accounting Standards Board (FASB) is the body that currently establishes and improves GAAP. It’s an independent, private-sector organization that operates only in the interest of serving the public and meeting the needs of investors, lenders, and other users of financial reports. It operates to address the constantly changing financial and business environment and adapt the GAAP guidelines to meet these changes.

Despite the widespread use of GAAP, one of its main criticisms is that its detailed focus on rules can result in “check the box” accounting, where the economic substance of a transaction may be obscured by an overemphasis on its form. However, GAAP’s commitment to detail, accuracy, and consistency has helped maintain trust and transparency in the American business environment.

Overview of IFRS

IFRS stands for International Financial Reporting Standards and is a set of accounting rules and standards established by the International Accounting Standards Board (IASB). As the name implies, these standards have been accepted and adopted in more than 140 countries worldwide, which is why they’re deemed “international” in nature.

Key principles of IFRS

Unlike rule-based GAAP, IFRS is primarily a principles-based system, meaning it sets broad rules along with specific guidance. The principles of IFRS revolve around a fair presentation and full disclosure perspective. This approach allows for more flexibility than GAAP and relies more heavily on professional judgement to interpret and implement the principles.

IFRS in practice

Under IFRS, financial statements aim to provide a faithful representation of an entity’s financial position, performance, and changes in financial position. They consist of a statement of financial position, a statement of profit or loss and other comprehensive income, a statement of changes in equity, a statement of cash flows, and notes comprising a summary of significant accounting policies and other explanatory information.

The role of IASB

The IASB is an independent, privately-funded accounting standard-setter based in London, UK. It consists of a diverse group of experts with an array of professional backgrounds from different geographical regions. The IASB aims to develop a single set of globally accepted accounting standards, striving for the worldwide acceptance and observance of these standards.

The adoption of IFRS across various countries has been gradual due to differences in local legal systems, culture, and domestic accounting standards. However, as international trade and business continue to grow, the adoption and influence of IFRS are also likely to increase, promoting transparency, accountability, and efficiency in the global financial market.

One of the main criticisms of IFRS is its reliance on professional judgement, which can lead to inconsistencies and interpretation variances. However, the flexibility provided by this approach can also allow for more meaningful and relevant reporting in certain situations, as it can better reflect the economic substance of transactions.

The purpose of GAAP and IFRS in financial reporting

The principles underlying financial reporting, such as those found in IFRS and GAAP, serve several essential purposes for business strategy:

Transparency

These principles ensure that financial reporting is clear, concise, and easily understood. It promotes transparency by requiring businesses to disclose accurate and complete financial information to all stakeholders, including investors, creditors, and regulators.

Comparability

Financial reporting principles make it possible to compare the financial health and performance of different companies. This is particularly important for investors and creditors who need to make informed decisions about where to allocate resources.

Consistency

Consistency in financial reporting allows for the comparison of a company’s financial performance over time. This is crucial for stakeholders to understand the company’s financial trends and make predictions about its future performance.

Accountability

These principles hold businesses accountable by requiring them to present an accurate depiction of their financial position. They deter fraudulent or deceptive practices and can lead to better overall corporate governance.

Reliability

By adhering to established principles, financial reports are more reliable. Stakeholders can trust the information presented and use it to make informed decisions.

Understandability

The principles ensure that financial reports are prepared in a manner that is understandable to people with a reasonable knowledge of business and economic activities.

Relevance

The information provided in the financial reports should be relevant to the decision-making needs of the users. It should have the ability to influence the economic decisions of users.

In essence, both IFRS and GAAP guide the preparation and presentation of financial statements, ensuring they provide useful information to stakeholders for decision-making purposes. They are integral to the functioning of global financial markets and the broader economy.

Detailed comparison of GAAP vs IFRS

The Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS) are both comprehensive frameworks established for standardizing financial reporting, but there are significant differences between them.

Here are some of the key differences between GAAP and IFRS:

1. Approach

GAAP is generally more rules-based, with specific guidelines and procedures to follow in numerous scenarios. On the other hand, IFRS is more principles-based and allows for more interpretation, relying on the substance of the transaction rather than strict definitions.

2. Inventory costs

GAAP allows for two methods of accounting for inventory costs: Last-In, First-Out (LIFO) and First-In, First-Out (FIFO). Conversely, IFRS only permits the FIFO method.

3. Revenue recognition

While both GAAP and IFRS have converged significantly on revenue recognition principles in recent years, differences still exist. For instance, GAAP provides more industry-specific guidance.

4. Write-downs and reversals

Under GAAP, once inventory has been written down, it cannot be reversed. IFRS, however, allows for the reversal of an inventory write-down if specific criteria are met.

5. Development costs

GAAP mandates that costs associated with research and development are expensed as incurred. However, under IFRS, certain development costs can be capitalized and amortized over multiple periods.

6. Fixed assets revaluation

IFRS allows fixed assets to be reported at fair value, while GAAP allows only for the reporting of historical costs.

7. Intangible assets

IFRS has a more stringent approach to intangible asset recognition and allows for the revaluation of certain intangibles. GAAP, on the other hand, has more specific rules and does not allow for revaluation.

8. Presentation of financial statements

There are some differences in the order of specific items on the balance sheet and income statement. For example, under GAAP, the balance sheet order is: assets, liabilities, and equity. Under IFRS, it is: assets, equity, and liabilities.

9. Consolidation

GAAP and IFRS use different models for determining when an entity should be consolidated. GAAP uses a variable-interest entity model, which is more focused on control, while IFRS uses a voting-interest model, which considers voting rights and potential voting rights.

10. Leases

GAAP distinguishes between operating leases and capital leases, while IFRS classifies all leases with a lease term of more than 12 months as finance leases unless the asset is of low value.

The future of accounting standards

The global trend towards standardization and convergence of accounting standards is gaining momentum and is not an innovation. IFRS and GAAP aim to streamline the financial reporting process, enhancing its efficiency and effectiveness.

The convergence of GAAP and IFRS, though a complex and challenging task, could yield numerous benefits. For businesses, convergence could reduce the complexity and costs of financial reporting, particularly for those operating internationally. For investors and other stakeholders, it could increase the comparability of financial statements worldwide, aiding in better decision-making.

However, challenges to convergence remain, including differences in national tax laws, regulatory practices, and business cultures. Despite these hurdles, progress towards convergence has been steady, albeit slow. This suggests a gradual shift towards a unified global accounting standard in the future.

Conclusion

In the debate of “GAAP vs IFRS,” the key issue is not about superiority, but about understanding their differences, how they impact various stakeholders, and how the landscape may evolve in the future. GAAP, with its detailed and prescriptive approach, promotes consistency and reduces ambiguity, which can be advantageous in maintaining confidence in financial reporting. Conversely, IFRS, with its principles-based approach, allows for more flexibility, accommodating the diverse business practices seen globally.

The ongoing evolution of the accounting standards (IFRS and GAAP) and the gradual convergence towards a universal standard is reflective of the increasingly interconnected global economy. As many organizations continue to expand beyond borders, understanding the dynamics of GAAP and IFRS becomes more essential than ever.

Fantastic comparative analysis! Your blog on GAAP vs IFRS provides a comprehensive overview of the key differences between these accounting standards. This is valuable information for those navigating the complexities of financial reporting. Thanks for breaking down the nuances and offering insights into the distinctive features of each framework.

It’s so great you find it helpful. Thanks for your feedback!