5% of organizations’ revenue is estimated to be lost to fraud each year. According to the Association of Certified Fraud Examiners (ACFE) and their 12th study on the costs and effects of occupational fraud, covering 133 countries and 2,110 cases which caused around $3.6 billion losses, corruption was the most common scheme globally. Among other key findings were the following:

- A typical fraud case lasted about 12 months before detection;

- 42% of cases were detected by tip, half of which came from employers;

- 23% of cases were attributed to owners or executives.

These stats alone make it clear that forensic accountant jobs are more in need than ever and they perform a really important role in today’s business world. In this article, we’re going to focus on such key moments of forensic accounting as degrees to build a career, areas of work, professional duties and skills necessary for the job.

Contents:

1. What is forensic accounting?

2. Forensic accountant duties and areas of work

3. Forensic accountant job prospects and forensic accounting careers

4. How to build a career in forensic accounting?

5. Key skills for becoming a forensic accountant

What is forensic accounting?

Forensic accounting is essentially a blend of accounting, auditing, and investigation which allows to analyze financial information and possibly identify financial crimes evidence.

Forensic accountants are CPAs (certified public accountants) who use their skills looking for evidence in the process of investigation and uncovering fraud, embezzlement, money laundering, and other types of financial crimes.

One more part of work as a forensic accountant is to quantify the financial losses caused by these crimes and to help businesses and individuals recover their losses, compile due diligence reviews, trace funds and many more.

“In the process of their work, forensic accountants leverage CPA automation tools to enhance efficiency, while also closely connecting with law enforcement agencies, government agencies, and attorneys. They might provide expert witness testimony in court, develop and implement fraud detection and prevention programs for businesses, and quantify the damages for the insurance industry.

Forensic accountant duties and areas of work

Looking closer at the areas and types of cases forensic accountants deal with helps get a better view on their duties. Let’s take a look at the most typical ones, according to accounting.com:

- Fraudulent bookkeeping investigation

Forensic accountants, especially those focused on ecommerce with accounting and financial management, analyze all the accounting records and transactions aiming to find misreported and unethical actions, which may relate to both business and personal finances. A forensic accountant’s job is to deal with the cases of business economic losses and bankruptcy and communicate with the parties involved to discover possible fraud or funds mismanagement.

Being a forensic accountant means dealing with hidden or misappropriated assets, those transferred or concealed by a business or an individual. The cases on money laundering, and other financial crimes, make a forensic accountant report to the FBI or other enforcement agencies and possibly work with them as a local partner.

- Due diligence reports

Forensic accounting specialists can help compile due diligence reports and make them more comprehensive and informative by reviewing and analyzing financial statements, conducting interviews with the key personnel, identifying the red flags (the signs of financial impropriety), giving independent valuation of assets.

Discovering and assessing financial risks helps investors and acquirers make more informed decisions about a particular business. Due diligence reports give a clear idea of a company’s financial status and can be used by the business owners to improve the situation. Forensic accountants might be asked to assess contracts and royalty agreements to identify fraud and abuse.

- Litigation discovery

Forensic accountants’ work can be a part of civil or criminal disputes. By gathering electronic data and collecting all other sorts of financial information, and preparing relevant statements, forensic accountants provide authorities and legal specialists with valuable materials for trials and hearings. For family and marital disputes forensic accountants work in close contact with attorneys and clients to investigate the cases of possible fraud or misappropriation of assets in the process of divorce and other family disputes.

- Trial testimony

In understanding the average cost of tax preparation by a CPA, forensic accountants might also be asked to provide testimony during civil or criminal proceedings, offering insights into financial discrepancies and fraudulent activities Those specialists that were taking part in gathering evidence of such financial crimes as fraud, tax evasion (presupposes work with the IRS and local governments), embezzlement and others might be asked to provide verbal confirmation of the findings.

- Insurance claim investigation

Insurance industry might be using the services of forensic accountants to get financial records related to insurance claims, which may help determine if the payments meet insurance policy conditions. The ultimate goal of insurance claim fraud detection is reached by analyzing legal documents, financial statements, and computer software related to the case.

- Securities fraud investigation

Securities fraud investigation involves working on the cases of stock or investment fraud such as trading on insider information, Ponzi schemes, pyramid schemes, late-day trading. In such cases forensic accountants follow the regulations of the Securities and Exchange Commission (SEC) and Finance Industry Regulatory Authority (FINRA).

Forensic accountant job prospects and forensic accounting careers

According to the data of the Bureau of Labor Statistics, the demand for accountant and auditor jobs (forensic accountants included) is expected to grow 4% from 2022 to 2032. The number of openings per year for accounting professionals and auditors is about 126,500, and this tendency seems to remain stable over a decade. This number of openings is believed to be the result of workers changing their occupations or retiring from accounting jobs.

Forensic accounting might provide drastically different career options, depending on the clients and area of work, but one thing we need to underline is that jobs related to forensic accounting aren’t entry-level positions that students can think of getting right after graduation.

Government positions

Such government agencies like the IRS, the Department of the Treasury, the FBI, and the Drug Enforcement Agency as well as local government departments employ forensic accounting specialists to reveal the cases of criminal activity. The job titles are often forensic auditor, forensic accountant, investigative auditor. To build a career with government agencies, one should be able to meet specific entry requirements for the position. For example, the FBI has the following requirement for the position of a forensic accountant:

- Be a U.S. citizen;

- Be able to obtain a Top Secret Sensitive Compartmented Information (SCI) Clearance;

- Be in compliance with the FBI Employment Drug Policy;

- Possess a valid driver’s license;

- Possess a bachelor’s degree or higher from a U.S.-accredited college/university in accounting or a related field, such as Business Administration, Finance, or Public Administration that included or was supplemented by 24 semester hours in accounting, which may include up to six hours in Business Law.

Positions at accounting firms and financial institutions

Forensic accounting professionals are employed by the advisory departments of such institutions. With larger firms there can be the whole forensic accounting department. In other cases, you may hire a smaller firm that specializes in forensic accounting, audit or financial investigations.

Positions with law firms, insurance companies, banks, risk consultant firms

Law firms might require the expertise of a forensic accounting specialist or their testimony for criminal or civil cases they’re working on. Banks and insurance companies might hire their own financial forensics or use the services of forensic accounting firms to discover the cases of fraud, assess claims or insure that their documents are compliant with the law.

There’s a variety of job titles related to forensic accounting:

- Forensic auditor

- Financial investigator

- Fraud examiner

- Fraud investigator

- Senior forensic accountant

- Forensic accounting senior associate

- Chartered financial analyst

- Chartered alternative investment analyst

- Certified financial planner

- Asset recovery specialist

- Financial risk manager

According to glassdoor.com, the estimated total pay for the job of a forensic auditor is $89,309 per year in the United States, with an average salary of $79,379 per year. The estimated additional pay (including cash bonus, commission, tips, and profit sharing) is $9,930 per year.

How to build a career in forensic accounting?

If you are interested in a career in forensic accounting, there are some things to consider and be prepared to:

- Bachelor’s degree and CPA

The first requirement is to get a bachelor’s degree in accounting or a related field and earn a Certified Public Accountant (CPA) license. The procedure of getting a CPA varies depending on the state, but most often involves passing a CPA exam to prove that you’ve mastered technical skills in accounting. Getting this professional certificate is a must to build a career in accounting and then possibly in forensic accounting.

- Master’s degree

Getting a master’s in forensic accounting or just accounting is an optional step, but many forensic accountants have it to build a career in the field.

- CFE credential (certified fraud examiner)

Getting CFE credentials isn’t necessary but it can surely enhance your resume, show your commitment to this profession and promote your career. The Certified Fraud Examiner or CFE credential is recognized around the globe. To become a CFE, you’ll need to be an associate member of the Association of Certified Fraud Examiners (ACFE), have at least two years of professional experience, and pass an exam administered by the Association of Certified Fraud Examiners.

This four-part exam covers the major disciplines that comprise the fraud examination body of knowledge: Financial Transactions and Fraud Schemes, Law, Investigation and Fraud Prevention and Deterrence. Academic and professional requirements include a specific point system that determines a person’s eligibility for the credentials. The ACFE provides programs and courses to prepare for the exam.

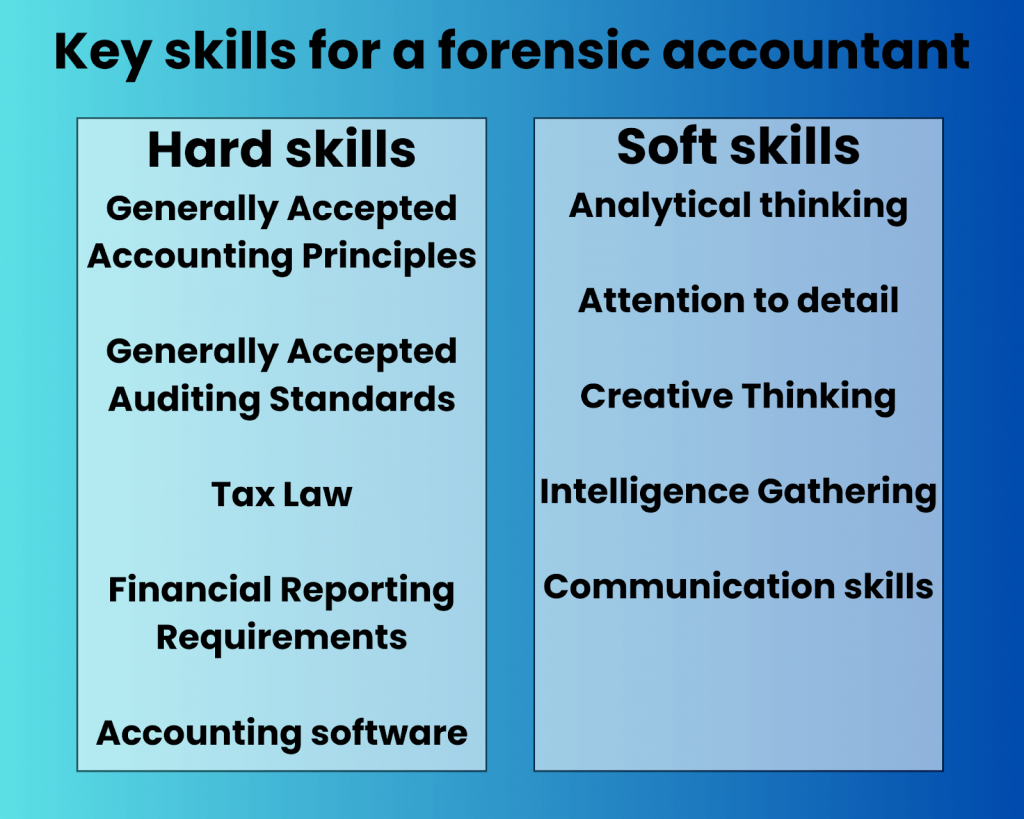

Key skills for becoming a forensic accountant

A forensic accounting career is both challenging and rewarding. Based on the variety of spheres forensic accountants can work in, they have to possess a set of soft and hard skills to help them cope with the tasks.

Referring to hard skills forensic accountants should have, it’s necessary to mention the firm knowledge of:

- Generally Accepted Accounting Principles

Being familiar with GAAP standards helps a forensic accountant detect the cases of their intentional misuse.

- Generally Accepted Auditing Standards

Applying GAAS principles that cover best practices for auditing financial records, is the way to detect tax evasion, fraud, misappropriation, embezzlement, and other financial crimes.

- Tax law

Forensic accountants working with the cases of corporate and individual tax evasion should have deep knowledge of tax laws relevant for the particular case, as taxes that an ecommerce business files differ from the ones filed by a corporation or an individual.

- Financial reporting requirements

The knowledge of financial reporting standards is an inseparable part of working on due diligence reports and cases of accounting fraud, as it helps define the misreported, unethical actions and unusual reporting practices.

- Accounting software and applications

As accounting software is getting more and more widespread, forensic accountants need to have the knowledge and skills to be able to analyze the data provided by such software.

When it comes to soft skills needed to become a forensic accountant, the most relevant would be:

- Analytical thinking

Using logic and critical thinking is the pillar of analyzing various types of data, including the information that comes from the interviews of the suspects on the case.

- Attention to detail

Focusing on small details and the ability to see what doesn’t add up is one of the key skills of a forensic accountant.

- Creative thinking

Stepping into the world of fraud swarming with “creative” cybercriminals, for example, forensic accountants must be prepared to match their creativity to that of criminals in the process of finding evidence.

- Intelligence gathering

Much like police, financial accountants should obtain intelligence-gathering skills, such as identifying, collecting, analyzing and organizing data and evidence. One more task to keep in mind is that the evidence should be admissible in court.

- Communication skills

Interview is one of the ways to get evidence and get into the case. Thus, it’s vital that a forensic accountant is able to talk to people involved in the case in the way that brings the best results.

Bottom line

Forensic accounting career is a challenging and rewarding one, requiring those who choose to work in it to have strong accounting and auditing skills, as well as investigative and communicative skills, and the ability to communicate complex financial information to both technical and non-technical audiences. Building a career in forensic accounting involves not only getting professional degrees, but also gaining a CPA license and possibly CFE credentials together with a lot of experience in the field.

The noble mission of the job is to reduce and prevent the incidence of fraud and white-collar crime and to assist the authorities and businesses in fraud detection and deterrence.

.png)

Thank you for sharing such unique and useful information, and great article.

Thank you for giving such a feedback!

Forensic Advisory Services

Forensic Advisory Services encompass a comprehensive range of specialized expertise aimed at uncovering, analyzing, and mitigating risks associated with financial irregularities, legal disputes, and regulatory compliance issues within businesses and organizations. These services integrate forensic accounting, investigative techniques, and strategic advisory to provide clients with insights and solutions tailored to their unique challenges.