Operating a business without a financial plan may cause various challenges, such as a lack of direction and focus, inefficient resource allocation, poor cash flow management, difficulties in meeting short-term obligations, increased economic risks, and setbacks that impact stability. Your business needs financial goals, realistic objectives, and strategies to implement them. A financial plan helps you make informed decisions for allocating resources and setting priorities.

You also need to identify and manage risks to ensure your company’s resilience in the face of economic challenges. A financial roadmap also facilitates investment planning and debt management and enhances stakeholder confidence. So, we consider here the most important stages and points on the way to creating a reliable roadmap for your business to promote its financial health and overall success.

Contents:

1. Assessing the current financial situation

8. Monitoring and adjusting the financial roadmap

Assessing the current financial situation

The first step on this road is assessing the current financial situation. It involves such processes as reviewing financial statements, analyzing key ratios, identifying strengths and weaknesses, evaluating the efficiency of working capital management and existing liabilities and risks, examining financial trends, and benchmarking against industry standards.

You have to consider reviewing such financial statements, such as income or profit and loss statements, balance sheets, and cash flow statements. It’ll allow you to analyze revenues, expenses, and profits over a specific period, as well as to identify their trends and patterns. Balance sheets help assess assets, liabilities, and equity, and examine liquidity ratios to understand the company’s current position. Cash flow statements help analyze the sources and uses of cash to evaluate operational efficiency and identify the further needs for operating, investing, and financing cash flows.

Analyzing key financial ratios (current and quick ones) helps assess the company’s ability to meet short-term obligations. Consider examining net profit margin, return on assets, and equity when you deal with profitability ratios. Assessing efficiency is also crucial. Efficiency ratios help evaluate inventory and receivables turnover to measure operational efficiency. Debt-to-equity and interest coverage ratios assist in understanding the company’s debt repayment capacity.

Such a thorough assessment provides valuable insights that will serve as the foundation for informed decision-making and the development of a strategic financial plan.

Prabhath Sirisena, Co-founder & CPO of Hiveage, emphasizes, “A well-crafted financial plan is not just a document; it’s a strategic roadmap that guides your business through both challenges and opportunities. It serves as the foundation for sound decision-making, risk management, and sustainable growth. In an era of economic uncertainties, incorporating SMART goals and robust strategies isn’t just advisable; it’s imperative for long-term success and resilience.”

Setting financial goals

Next, you have to set well-defined and achievable financial goals, which will align with the team’s efforts, provide a clear direction, and serve as benchmarks for success.

The goals can be short-term and long-term. Short-term goals cover a period of up to one year and focus on immediate priorities and operational efficiency. For example, you can think about ways of improving cash flow, reducing operating expenses, or increasing sales in the next quarter. Long-term goals align with the company’s strategic vision and address broader objectives, like market expansion, achieving a specific market share, or new product development. They’re set for over one year.

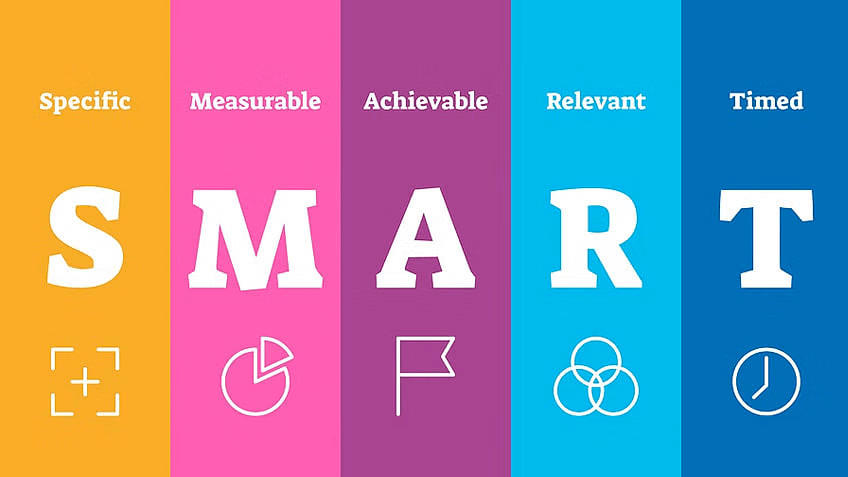

While making a financial plan, use the SMART criteria. They’re the following:

- Specific (clear definitions and needs, avoiding vague formulations);

- Measurable (using quantifiable metrics to track progress and key performance indicators (KPIs) to measure achievements);

- Achievable (realistic and attainable referring to available resources and potential obstacles);

- Relevant (aligned with overall objectives and priorities);

- Time-bound (defining a specific timeframe and deadlines for milestones).

Aligning financial goals with business objectives is important. You need to be sure that these goals are directly linked to the company’s mission, vision, and strategic plan.

Budgeting and forecasting

These are integral components of financial plans for businesses. These processes involve the systematic estimation and allocation of resources to reach specific goals and consider future challenges and changes.

The budget you create has to be detailed and comprehensive. It must cover all aspects of your business, including revenues, capital expenditures, operating and non-operating expenses.

Pay more attention to revenue projections and expense estimates. Projecting revenues should be based on historical data, market trends, and sales forecasts, taking into account factors that may influence the progress. To plan properly, you need to break down operating expenses into categories, such as salaries, rent, marketing, utilities, and supplies. They can be fixed and variable so that you can identify areas for potential cost savings.

You also need to develop a cash flow budget, identify capital investments, and prioritize expenditures that can potentially influence the business. Let your budget be flexible and contingent to accommodate unexpected changes. Monitor your budget’s actual performance and be prepared to adjust it as needed.

Forecasting possible market changes and new opportunities is essential. Consider analyzing historical data to identify trends, seasonality, and patterns. Get more information about market trends, economic indicators, and industry developments. A detailed sales forecast should be based on customer behavior, market demand, and collected historical data.

Try to predict future operating expenses, considering major potential changes in production costs and efficiency improvements, and conduct scenario analysis for various outcomes, including the impact of both best-case and worst-case scenarios on financial performance.

You have to update your forecasts regularly to reflect new information and changing circumstances. Financial modeling tools and technology can add to the accuracy and efficiency of forecasting because they allow for scenario testing and real-time adjustments.

Regular reviews of forecasting accuracy and using feedback from real performers will help improve forecasting processes. They can also help manage financial resources proactively and create the grounds for sustainable growth.

Risk management

This involves the identification, assessment, and mitigation of potential risks to prevent their impact on achieving goals. The risks can be market, credit, and operational. Market risks are related to fluctuations in demand, supply chain disruptions, and economic downturns. Credit risks involve the creditworthiness of customers and partners, while operational risks refer to human errors and internal processes within the company.

Insurance, diversification, and contractual protections are the key strategies for mitigating risks. Get the relevant insurance coverage for different risk categories (property, liability, and business interruption). It’s essential to diversify suppliers, revenue streams, and customer bases, as well as spread investments across different asset classes. While making contracts, include risk-mitigating clauses, for example, indemnification provisions and force majeure risks. Define all responsibilities and obligations clearly to avoid contractual risks.

It’s also crucial to establish and maintain emergency funds to provide a financial buffer during unpredicted events. Build up a reserve of financial resources that can be easily accessed in times of crisis.

All these strategies can enhance your company’s resilience, diminish the potential risk influence, and ensure a more secure financial environment in the future.

Cash flow management

Managing cash flow is critical. You have to focus on the monitoring, analysis, and optimization of cash movements into and out of the company. That will allow you to maintain operational stability, meet financial obligations, and aim for long-term success.

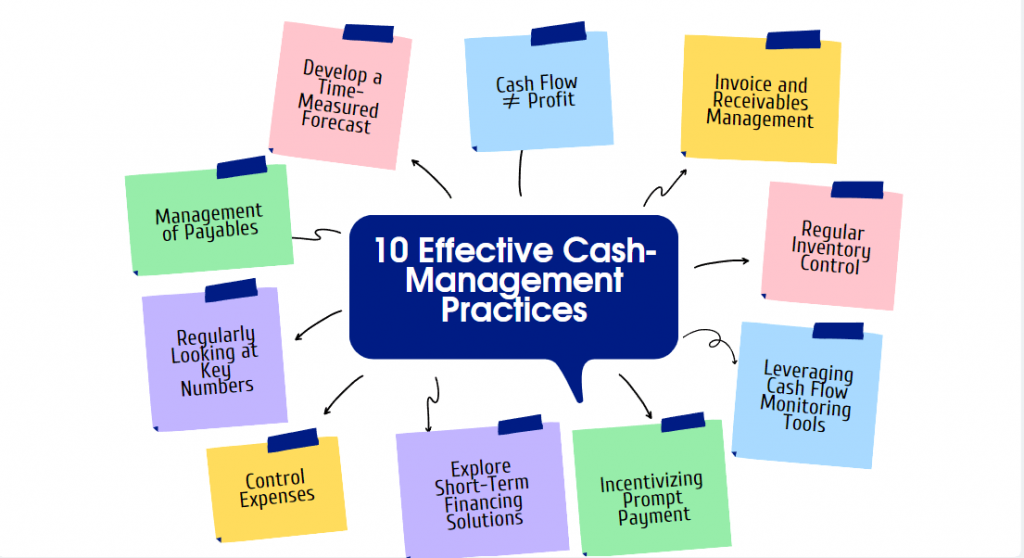

There are several effective cash-management practices, which can help you avoid potential financial problems. They include:

- Development of a detailed forecast for expected cash inflows and outflows, considering a specific period, which can be updated regularly;

- Differentiation between cash flow and profit;

- Invoice and receivables management to make invoicing processes efficient and timely;

- Management of payables based on accepted payment terms;

- Inventory control to avoid overstocking or stockouts;

- Control over discretionary expenses and identification of cost-saving opportunities;

- Utilization of short-term financing options, like credit lines or working capital loans;

- Negotiation of early payment discounts with suppliers to encourage prompt payment;

- Using cash flow monitoring tools and software to track and analyze cash movements;

- Regular financial health and key performance indicators checks.

You have to hold regular cash flow reviews to assess the effectiveness of these strategies and make adjustments based on changing conditions and lessons learned from past experiences.

Investment strategies

Make thoughtful decisions on investments to achieve long-term financial objectives. You have to consider how each investment contributes to revenue growth, operational efficiency, and cost savings.

Balance risk and return thoroughly. Considering the potential rewards against the level of risk related to each investment will increase the tolerance of your business and retain stakeholders.

Consider diversification of investments across different asset classes, avoiding over-concentration in a single industry. That will minimize the impact of adverse market conditions.

Analyze net present value (NPV), payback period, and internal rates of return (IRR) to assess the financial viability of projects. Review the investment portfolio to get it aligned with your business goals and changes in the business environment.

Never make long-term investments before getting a detailed assessment of the liquidity needs. Think about covering short-term obligations and unforeseen expenses first.

If you want to stay competitive and enhance operational efficiency, invest in technology and innovation. Incorporate ESG (environmental, social, and governance) factors into your investment decisions.

Economic indicators and trends can influence investments. Such factors as interest rates, geopolitical events, and inflation can matter a lot. Financial ratios, for example, return on investment (ROI) and profitability help compare the performance of different investments and identify the top performers.

While planning any investments, consider their tax implications. That can minimize liabilities and maximize after-tax returns. Be adaptable and ready to adjust your investment strategies according to the changes in the business environment.

Debt management

Think about your business’s ability to take on debt. Determine the appropriate debt-to-equity ratio to ensure its correspondence to industry standards.

Business debt may involve term loans, lines of credit, and commercial mortgages. There can be short-term and long-term debt, which requires different strategies. Creating a straightforward debt repayment policy can follow such recommendations as:

- Borrow funds with a clear purpose, be it funding expansions, managing cash flow, or purchasing equipment.

- Negotiate favorable terms with lenders, including interest rates, repayment schedules, and covenants.

- Develop a well-structured repayment plan, which aligns with your cash flow and financial projections.

- Monitor your credit profile and try to maintain its health by timely payments to creditors.

- Use debt for strategic investments that can generate a good return only.

- Explore all the opportunities to refinance existing debt at lower interest rates or extended terms and conditions.

- Ensure the availability of emergency funds for covering debt obligations during challenging times.

- Correct your action accurately if your company is about to break covenants.

- Consider the balance between debt and equity and avoid excessive reliance on debt.

- Maintain open communication with lenders to inform them about any anticipated challenges.

- Obtain credit or business interruption insurance to minimize the risks associated with debt repayment.

You can use debt as a strategic tool that will help you ensure long-term financial health for your company.

Monitoring and adjusting the financial roadmap

Even if you’ve already completed your financial roadmap and implemented it, consider adjusting it to respond to changing conditions. Review your company’s financial performance regularly to assess progress. Analyze all statements, cash flow reports, and key performance indicators. Monitor KPIs, such as revenue growth, profitability ratios, and liquidity metrics to ensure that your financial strategies are successful.

Analyze significant variances to compare actual results with the forecast figures. Keeping a close eye on cash flow is also essential. Consider the timing of inflows and outflows to understand how well liquidity needs are met.

You have to take into account adherence to the budget and identify the areas where the actual spending deviates from it. Collect all the information about the external factors that may influence your business, like changes in the market, industry trends, and economic conditions. Customer feedback and insights can help a lot to adapt your projects and services and make good use of emerging opportunities.

You also need to adjust your financial goals that are no longer realistic to changing conditions and external factors. The scenario analysis has a huge potential for anticipating these changes and ensuring flexibility.

Your company’s priorities need some adjustment, too. Consider reallocation of resources and reprioritizing projects due to their impact on the overall financial plan. Take into account new or evolving risks to add additional mitigation strategies to your roadmap.

Other areas involved in your adjustment considerations are the following:

- Using new opportunities;

- Developing updated debt management strategies;

- Exploring refinancing options;

- Embracing technological advancements and process optimization opportunities;

- Communicating changes to stakeholders, including investors, partners, and employees;

- Providing ongoing training for employees.

Invite financial advisors or consultants to help you make significant adjustments to your roadmap. Their external expertise will be pretty helpful for making your strategic decisions more informed.

Final thoughts: How Financial Roadmap Could Help Your Business

Overall, there are several essential steps to ensure that your financial roadmap will be effective. They involve defining business goals and objectives, assessing the current financial situation, setting specific and measurable financial (SMART) goals , developing a comprehensive budget, evaluating external factors and risks, and assessing the debt capacity of the company. Implementing cash flow management strategies and setting up emergency funds are also crucial.

Remember that financial planning isn’t a one-time event. It’s a continuous process that requires commitment and adaptability. The business environment is dynamic, and it’s constantly changing. Market conditions, consumer behaviors, and regulatory landscapes evolve, so your plans should evolve, too. They must be based on real-time data and flexible.

If you conduct scenario analysis regularly and develop contingency plans for changing environments, you’ll be prepared for unexpected events and economic fluctuations. With an appropriate financial roadmap, your business will build resilience and position itself to thrive in a rapidly changing business landscape.