Identification numbers are really important for legal compliance and various transactions. One such identifier is the Federal Employer Identification Number (FEIN), a unique numerical code assigned by the Internal Revenue Service (IRS) to businesses operating in the United States.

Let’s look at FEIN in more detail, exploring its meaning, its purpose, the process of acquiring it, its various uses, legal compliance, common queries, and additional insights.

Contents:

2. Do I need FEIN for my business?

6. Changing or canceling a FEIN

Key takeaways

- A Federal Employer Identification Number (FEIN), also known as an Employer Identification Number (EIN), is a unique identifier assigned by the IRS to businesses in the United States.

- The FEIN serves as a crucial tool for tracking tax obligations, fulfilling financial operations, and meeting tax requirements, such as filing tax returns and handling payroll.

- Businesses require a FEIN for a variety of purposes, including tax compliance, financial transactions and interactions with regulators.

What is FEIN?

If this word is not in your dictionary, then let’s explore the FEIN definition. FEIN is an acronym for Federal Employer Identification Number. It’s one of the main components of the United States’ tax system, representing an ID card for businesses and organizations, similar to how an individual’s Social Security Number (SSN) identifies them for various purposes. However, the FEIN significance is to cater to the needs of organizations, allowing the Internal Revenue Service (IRS) to track their activities, payroll, tax obligations, and financial matters effectively.

This is a nine-digit unique number that the Internal Revenue Service (IRS) assigns to businesses operating in the United States.

Its format is designed in a specific way:

- The first two digits indicate the location or the IRS processing center associated with the application.

- The next seven IRS digits are sent sequentially to various businesses.

Do I need FEIN for my business?

If you have employees, then yes, you do. In addition, you’ll need it if:

- Your business is structured as a corporation or partnership.

- You file specific tax returns like employment or excise tax.

- You withhold taxes on income, other than wages, for non-resident aliens.

- You have a Keogh plan.

You may also need a FEIN if you’re involved with certain types of entities, such as trusts, estates, mortgage investment conduits, non-profits, farmer cooperatives, or if you’re a plan administrator.

If you have multiple businesses that meet these requirements, you’ll need to apply for an additional FEIN for each of them.

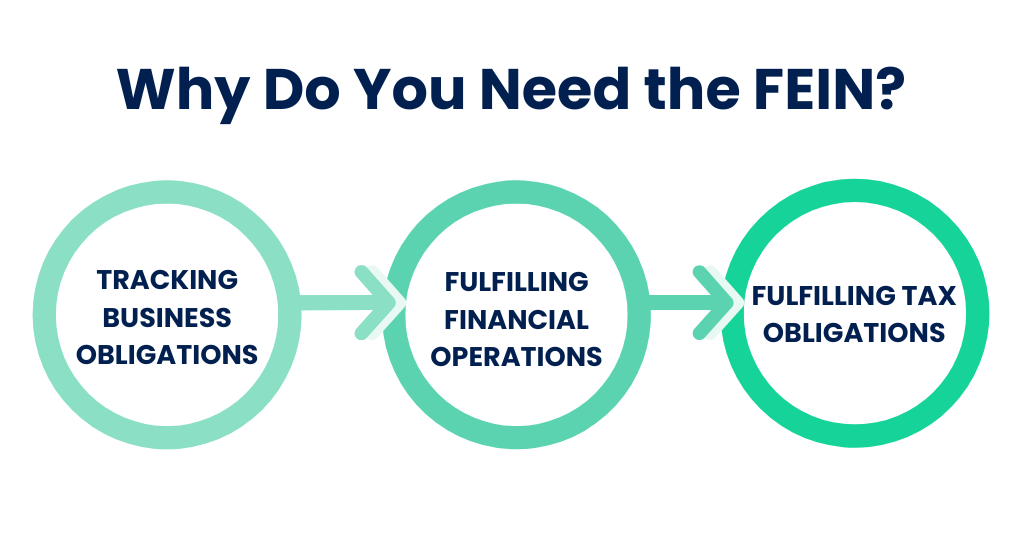

Why do you need the FEIN?

The main purpose of FEIN is to help the IRS monitor the activities of businesses regarding taxes and regulations. When a company receives an EIN, it’s similar to creating its own identity in the tax system. This allows the IRS to link all of your financial activities, payroll and tax returns to your specific business.

1. Tracking business obligations

The FEIN serves as a fundamental tool for tracking a business’s tax obligations. It plays an important role for businesses with employees, as they’re required to use their FEIN when reporting employment taxes, including:

- Social Security;

- Medicare;

- Federal income tax withholdings;

Picture a small bakery with 15 employees, including bakers and customer service staff. To handle taxes, they rely on their Federal Employer Identification Number (FEIN). Each payroll run involves calculating withholdings for Social Security, Medicare, and federal income taxes, which are then accurately reported to the IRS using the FEIN.

In short, the bakery uses its FEIN to manage tax payments, fulfill reporting obligations, and stay in good standing with the IRS.

2. Fulfilling financial operations

Financial institutions often require businesses to provide a FEIN when opening bank accounts, applying for credit, or conducting other financial activities such as payroll. FEIN allows financial institutions to verify the legitimacy of a business and establish a clear separation between personal and business finances.

When the same bakery wants to open a bank account, it needs to provide its FEIN. This number helps the bank check if the bakery is real and keep personal and business finances separate. If a bakery is applying for a loan or credit card, they will need to provide their FEIN for the same reasons.

3. Fulfilling tax obligations

The FEIN is a must if you want to meet tax requirements. Businesses use it when filing different tax returns like income tax, information, and excise tax returns. It helps the IRS accurately identify and track a business’s tax responsibilities, deductions, and credits, making tax administration smoother and minimizing errors or fraud. This also includes handling payroll for employees.

So, when you fill out tax forms like W-2, Form 941, or tax returns, you need to provide your business’s FEIN.

Let’s return to our bakery example. Now they’re preparing to file their taxes. They collect all the necessary forms, such as W-2 for employee wages and Form 941 for payroll taxes. When filling out these forms, the bakery simply indicates its FEIN.

By enabling the FEIN, the IRS can easily track a bakery’s tax liabilities, deductions, and credits. This helps prevent errors and fraud and makes tax filing easier for both the bakery and the IRS.

Tips for tax preparation

Keeping accurate records throughout the year is important to effective tax planning and preparation. However, many ecommerce business owners neglect regular financial tracking and struggle to organize their transaction data at tax time.

Luckily, automated accounting software can be incredibly helpful for managing your finances. By linking your sales channels and payment platforms to your accounting records and banking transactions, it eliminates the need for manual data entry.

If you want to keep your business taxes in order, it’s time to invest in automated software to keep your books clean and ready for reconciliation.

How to simplify your tax preparation?

For ecommerce businesses, sales tax calculation may become challenging as there are many sales channels and payment platforms included in the purchase process. Synder Sync is a great solution that allows you to import all your transactions from various platforms, as Synder supports 30+ integrations with payment platforms & accounting software.

Synder synchronizes transactions, allowing you to import detailed data, including tax, product, and customer information. It also conducts cross-checks to identify duplicates and inconsistencies, ensuring thorough financial records. Additionally, if the results of the sync do not meet your expectations, Synder offers a rollback function. This feature allows you to revert any changes made by the sync, giving you the flexibility to adjust your financial records until they align perfectly with your requirements.

Want to know more about how it works?

Synder makes it easy to calculate sales tax for ecommerce businesses by using transaction data from all your sales platforms (Shopify, Amazon, etc.) in use and integrated payment processors (like Stripe, Square, PayPal, etc.). Synder calculates taxes based on the sales total amount and the tax amount. It then matches the calculated tax rates with the tax codes in your connected QuickBooks, Xero or Sage Intacct accounts.

If you need further customization of the results, you can utilize the settings. And if you’d like to delve even deeper into tax management, we offer Smart Rules, which allow you to build flows based on any criteria (shipping address, transaction amount, customer name, etc.).

Learn the process by taking advantage of Synder’s free trial or join Synder’s informative Weekly Public Demo to understand why Synder is the best choice for your accounting.

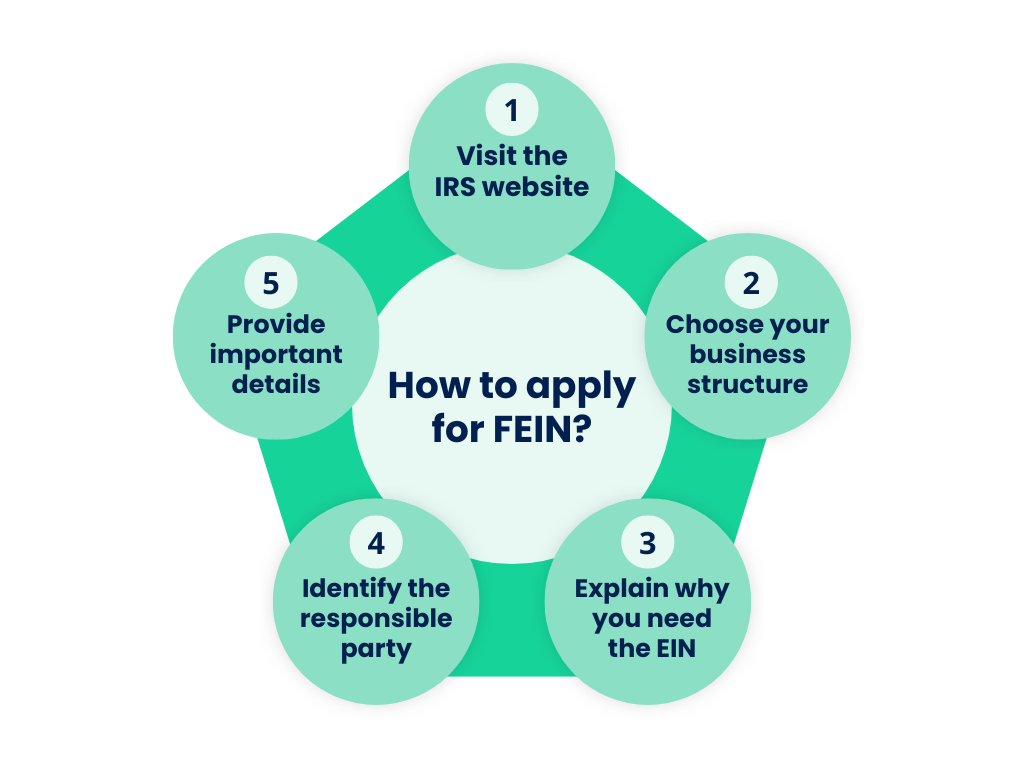

How to apply for FEIN?

Step 1: Visit the IRS website

Visit the IRS website and click “Apply Online Now” on the FEIN application page. You must complete this application in one session which lasts for 15 minutes, as you will not be able to save and return at a later time.

Step 2: Choose your business structure

You can apply as a:

- Trust;

- Estate;

- Limited liability company (LLC);

- Corporation;

- Partnership;

- Sole proprietor.

Step 3: Explain why you need the EIN

- For buying a business;

- Changing organization type;

- Banking;

- Hiring employees;

- Starting a new business.

Step 4: Identify the responsible party

The responsible party is the person who’s in charge of resolving the tax issues of the business and does accounting. You may need to provide their name and Social Security number or Individual Taxpayer Identification Number. Remember, that you will be limited to 1 EIN per responsible party per day.

Step 5: Provide important details

Give your business’s physical address and phone number, the business name, trade name (if any), and start date.

Additional steps

- Answer tax-related questions regarding alcohol, tobacco, firearms, excise tax, gambling, and vehicles.

- Choose a business category that best fits your activities.

- Decide whether you want to receive your EIN confirmation by mail or online.

- Review your application to ensure accuracy before submitting it.

Changing or canceling a FEIN

While the FEIN remains with a business for its lifetime, certain circumstances may require changes or cancellations. Here’s an overview of the processes involved:

Changing a FEIN

FEIN changes are rare and usually happen when big events like a business structure or ownership change occur.

For instance, if a sole proprietorship becomes a corporation, a new FEIN is usually needed. Mergers or acquisitions might also require a new FEIN if existing entities combine to form a new one. The IRS offers guidance on how to handle these changes, and it’s wise to consult tax pros or the IRS to make sure everything’s done right.

Here how it works in different cases:

1. If you change your business name:

- Write a letter to the IRS.

- Address the letter to the location where you file your tax return.

- Ensure an authorized person from your company signs the letter.

- Include a copy of the Articles of Amendment filed with your state to authorize the name change.

2. If you change your address or responsible party:

- Fill out Form 8822-B, Change of Address or Responsible Party – Business.

- Submit the form to the IRS.

- Ensure you report this change within 60 days to comply with IRS requirements.

Canceling a FEIN

You can’t “cancel” an FEIN, but if you don’t need it anymore, you can close your IRS account.

To do this:

- Write to the Internal Revenue Service, Cincinnati, Ohio 45999;

- Explain why you want to close the account;

- Include your business’s full legal name, FEIN, and address;

- Include the confirmation letter you got when you got your FEIN.

Before closing the account, make sure you’ve paid any taxes you owe, including income and payroll taxes.

Conclusion: What does FEIN mean?

Issued by the IRS, the FEIN is similar to a special identification card that helps with taxes, payroll, finances, and compliance. It’s used to track taxes, manage money, and simplify tax tasks. Knowing how to obtain a FEIN, deal with changes, and close accounts when necessary is key to complying with IRS regulations. So taking advantage of FEIN combined with using software like Synder to streamline dealing with taxes will help businesses stay on top of their finances.

FAQs

Is the FEIN the same as the tax ID?

Tax Identification Numbers (TINs) are for individuals who need to pay taxes in the United States, while Employer Identification Numbers (EINs) are for identifying businesses. So, the main difference is who they’re for and how they’re used.

Do I need an EIN to run payroll?

Yes. Without it, you can’t do important things like payroll, pay taxes, and even open a business bank account. Thus, it’s essential for any business to remain organized and legal.

Does a FEIN ever expire?

FEINs don’t expire. Upon allocation, the FEIN stays with the business or organization through its duration whether it becomes non-operationally on the time and even during the temporary suspension of the operations. It’s a particular number that proves that an entity has a continuous existence and keeps expiration until it is extremely different or ineligible to earn the same FEIN.

Does every company have an FEIN number?

Yes. Every organization, even those without employees, needs an Employer Identification Number (EIN). This special number identifies the organization to the IRS.

How much does an EIN cost?

You won’t be charged any fees if you choose to complete your EIN application through the IRS website. It’s a straightforward process and completely free of charge.