Running an ecommerce business means dealing with a steady flow of sales, refunds, and charges from multiple sources. One day, you’re champagne-popping because you’ve had a record sales week, and the next day, you’re bogged down in unmatched numbers, trying to figure out why your bank deposits don’t reconcile.

Manual recording of each transaction is tiresome and prone to mistakes. A recent Center survey shows that while many organizations still rely on manual expense reporting, it’s becoming less common as more teams move toward automation. In 2021, for example, 48% of companies used manual processes in expense reporting.

This figure has dropped to roughly a third, while the rest of companies now use payment reconciliation software to automate transaction matching, minimize errors, and have your books current.

In this guide, we’ll examine the biggest reconciliation issues, what you should look for in a solution, and give you several options of payment reconciliation tools.

Key takeaways

Looking for the quick version? Here’s your TL;DR.

- Manual reconciliation slows you down: Relying on spreadsheets is time-consuming and error-prone. Automated reconciliation software helps streamline processes and reduce mistakes.

- Multichannel selling requires smarter tools: Selling on platforms like Amazon, Shopify, and eBay with multiple payment gateways makes reconciliation complex, while automation helps tie everything together accurately.

- Look for automation, integrations, and real-time insights: The best software connects with your sales, payment, and accounting systems, supports tax compliance, and gives you up-to-date visibility into your cash flow.

- Choose a solution that fits your business needs: The right tool depends on your transaction volume, complexity, and goals.

Now we’re getting into the nitty-gritty.

Challenges in ecommerce payment reconciliation

The reconciliation process for online retailers is more complicated than that for offline retail. Following are some of the main issues faced by businesses.

1. Overseeing multichannel sales and payment gateways

The majority of ecommerce companies sell via various channels such as Amazon, Shopify, eBay, Walmart, or Etsy, and support various payment gateways such as PayPal, Stripe, or Square. For instance, an ecommerce company can get daily deposits from Shopify Payments, weekly payments from Amazon, and monthly refunds from PayPal. Reconciling all these transactions manually without automation may cause discrepancies and lost revenue.

2. Processing huge volumes of transactions

Consider an ecommerce business handling 5,000+ orders a month from various platforms. Going through this number of orders manually, reviewing bank statements, and matching payment information with orders can be daunting. Companies require a system that has the capability to automatically process transactions in real time without overlooking important details.

3. Identifying discrepancies and errors

Reconciliation is more than just matching transactions. Many ecommerce businesses deal with shipping fees, refunds, chargebacks, and processing fees that affect final payouts. For instance, a company will anticipate a $500 payout from Amazon but, through, $15 in chargebacks, and $20 in fees, will see only $465. Without a proper system, financial managers could spend hours identifying why their bank deposits don’t match their sales reports.

4. Handling manual data entry and accounting errors

AutoRek research shows 84% of payment firms still use spreadsheets, and 86% are slowed by poor data visibility. With increasing transaction volumes come increasing costs—69% of US and 63% of UK companies cite escalating expenses. Without automation, inefficiencies and compliance risks increase, making streamlined reconciliation important for ecommerce success.

5. Providing real-time insight into cash flow

Without real-time reporting, there may be inadequate financial planning. Unless a company has a clear idea of how much revenue it’s generating through channels, it can end up running into unforeseen shortfalls in cash flow.

Now that we’ve discussed the challenges, let’s jump into the most important features to look for in payment reconciliation software.

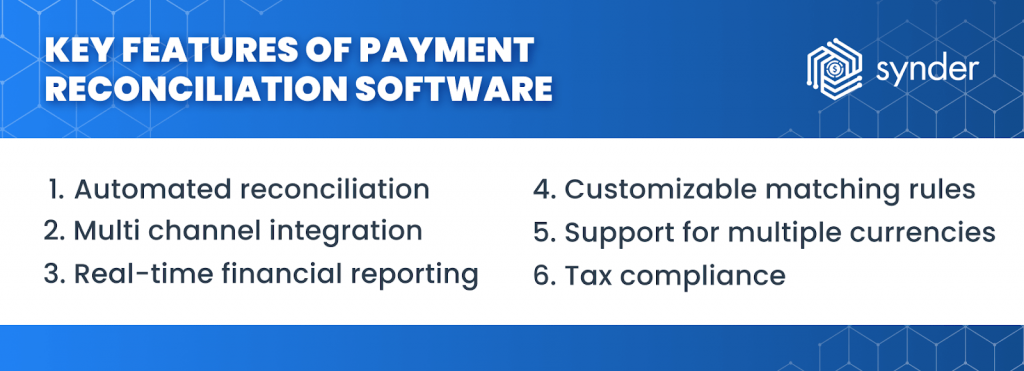

Key features to consider in payment reconciliation software

When choosing ecommerce payment reconciliation software, businesses need to search for the following functionality:

- Automated reconciliation: The software should automate the reconciliation of transactions without the need for manual bank reconciliation.

- Multi channel integration: An effective reconciliation tool supports integration with several ecommerce platforms, payment gateways and accounting systems such as Xero, QuickBooks or Sage Intacct.

- Real-time financial reporting: Businesses should have real-time visibility into revenue, expenses, and cash flow.

- Customizable matching rules: Companies require real-time visibility into expenses, revenue, and cash flow.

- Support for multiple currencies: For cross-border sales, the tool should handle transactions in various currencies, ensuring accurate pricing and conversions.

- Tax compliance: It must also support VAT, sales tax, and other regional tax rules to stay compliant with local regulations.

Learn why manual reconciliation is holding you back.

Overview of top 5 ecommerce payment reconciliation software

Below are five standout solutions, each offering specialized capabilities to support different stages of growth and operational complexity.

1. Synder

Synder simplifies payment reconciliation by automatically syncing transactions from Shopify, Amazon, Stripe, PayPal, and more into QuickBooks, Xero, Sage Intacct, and soon Oracle NetSuite. It eliminates manual data entry, ensuring clean, accurate records across all your sales channels and payment gateways.

With custom transaction mapping and deep QuickBooks/Xero integration, Synder offers the flexibility to match your unique workflows. Smart matching rules help you categorize transactions fast, while multicurrency support, VAT tracking, and tax filing make cross-border compliance easy.

It also handles COGS calculations and delivers automated profit and loss reports, so you always know where your margins stand. Real-time financial reporting keeps you on top of cash flow, empowering confident, data-driven decisions as your business grows. Plus, Synder offers flexible customization, allowing you to tailor the tool to suit your complex multi-channel bookkeeping workflows.

Curious to see Synder in action? Start your 15-day free trial today! Want expert guidance? Join our Weekly Public Demo for a live walkthrough.

2.Taxilla

Taxilla is a customizable platform built for enterprises with intricate reconciliation and compliance requirements. It offers multi-payment processor integration and can be smoothly integrated into ERP and accounting systems to align financial data between departments.

Taxilla automates payment, receipt, return, and ecommerce order reconciliation for businesses, saving them from manual effort and loss of revenue. With built-in alerts, mismatch reports, and configurable workflows, it ensures financial accuracy and compliance across jurisdictions.

3. eShopBox

eShopBox is a centralized ecommerce platform designed for medium to large brands selling across online marketplaces. The solution integrates 20+ sales channels, enabling companies to monitor inventory, fulfillment, and payment reconciliation on one dashboard.

The tool automates reconciliation of payouts, highlights overcharges, and supports claims recovery to minimize revenue loss. With real-time tracking, barcode-based inventory management, and a nationwide fulfillment network, eShopBox streamlines ecommerce operations while improving financial accuracy and visibility.

4. Vinculum

Vinculum is a cloud solution designed for omnichannel retailers and provides payment reconciliation, product information management, and inventory management. Its payment reconciliation gives real-time tracking of transactions for unpaid, paid, reconciled, disputed, and returned merchandise, enabling companies to detect and resolve financial discrepancies.

Vinculum’s inventory management offers centralized visibility and control, making it possible to manage stock effectively across multiple locations. Its product information management system also delivers consistent and accurate product information across channels, enhancing the customer experience.

5. Nolan

Nolan provides end-to-end financial and operational solutions for companies using Microsoft Dynamics and NetSuite. Its software gives greater visibility into accounts, automates the reconciliation process, and makes payment processing easier for suppliers, employees, and vendors.

Nolan also supports ecommerce operations, allowing users to manage multiple storefronts, currencies, and tax jurisdictions from one central system. With capabilities for cross-border transactions and multi-entity management, it provides the scalability needed for growing businesses and ensures consistent performance across global operations.

Comparison of the ecommerce payment reconciliation software

| Software | Best For | Key Features |

| Synder | Multi-source data reconciliation for medium to enterprise businesses with complex bookkeeping needs | Automated transaction syncing with 30+ platforms (Shopify, Amazon, Stripe, PayPal, QuickBooks, Xero, Sage Intacct, Oracle NetSuite, as well as custom ERP), custom transaction mapping, smart matching rules, multicurrency support, VAT tracking, tax filing, COGS calculation, automated profit and loss reporting, real-time financial reporting, detailed tax and fee breakdowns, flexible categorization. |

| Taxilla | Enterprises and multinational corporations in high-risk sectors | Custom payment reconciliation workflows, ERP and accounting integration, multi-payment processor support, and compliance-focused financial reporting tailored for complex regulatory environments. |

| eShopBox | Medium to large ecommerce brands selling through online marketplaces | Reconciliation, invoice/refund tracking, real-time overcharge detection, centralized inventory management, fulfillment optimization, and ecommerce conversion tools (e.g., express delivery, free shipping). |

| Vinculum | Omnichannel ecommerce brands | Payment reconciliation across sales, shipping, and commissions; overcharge and incomplete transaction detection; real-time inventory sync; automated product catalog listing; and intelligent warehouse fulfillment routing. |

| Nolan | Business management across growing or multi-entity organizations | Automatic bank reconciliation using custom rules, electronic payments in multiple formats/currencies, ecommerce support for B2B/B2C sellers (multi-site management, tax/localization tools), and integration with Microsoft Dynamics and NetSuite. |

| Pro tip: The best reconciliation tool for your business depends on your sales channels, accounting setup, and financial needs. To identify your best option, think about the level of automation, integration, and financial insights you require. The best tool will help you save time, minimize errors, and provide greater visibility into cash flow so that you can concentrate on business development. |

Conclusion

Picture this: your ecommerce sales are booming, but your bank deposits don’t match your reports. Instead of drowning in spreadsheets and manual checks, the right payment reconciliation software can automatically match transactions, sync data, and identify discrepancies—saving you time and stress.

Software like Synder automates the process, providing you with precise records, real-time visibility, and complete control over your cash flow across multiple chnnels. The correct tool doesn’t merely clean up your finances, it empowers you to scale.