If you’re a frequent Walmart shopper curious about utilizing Afterpay’s BNPL service, the question of whether this financing option is available is pressing. However, despite its popularity among consumers seeking flexible payment solutions, Afterpay is not currently accepted by the marketplace as a payment method.

In this article, we’ll go into more detail, explore what Afterpay is, why Walmart doesn’t accept Afterpay, and discuss other payment options for Walmart stores.

Contents:

1. Is Walmart no longer on Afterpay?

2. Why doesn’t Walmart accept Afterpay?

3. The more you know: What is Afterpay?

4. What are the other payment options?

5. Benefits of using BNPL services

6. FAQs

Is Walmart no longer on Afterpay?

No. Right now, customers can’t make payments with Afterpay at Walmart (both in store and online). Instead, the marketplace offers other buy now, pay later financing options, including Affirm, PayPal, Klarna, and Zip (formerly QuadPay).

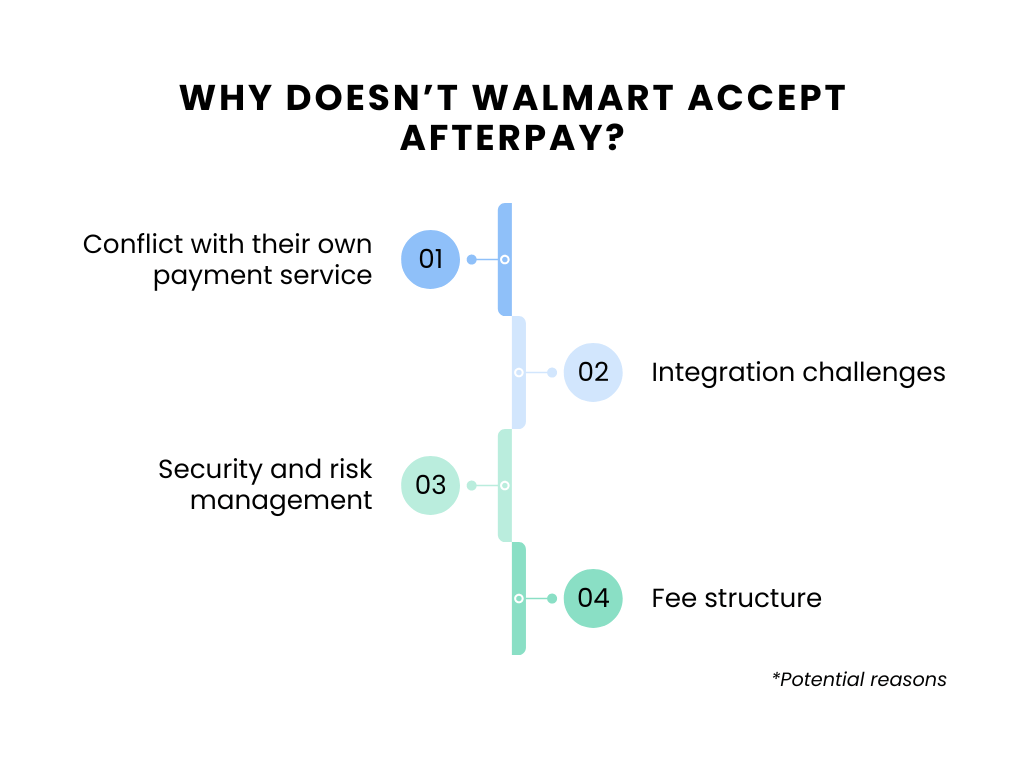

Why doesn’t Walmart accept Afterpay?

The marketplace has chosen not to accept Afterpay as a payment method, a decision that has caught the attention of many customers, especially those using Afterpay. Since we can’t say what motivated such a decision, we’ll analyze all known factors to see potential reasons.

The actual rationale could include factors not mentioned here.

#1. Conflict with their own payment service

Firstly, the marketplace has its own financial services arm called Walmart Pay, which offers convenient payment solutions tailored to its customer base. By prioritizing its in-house payment system, it may view the integration of third-party options like Afterpay as conflicting with its business strategies. This approach enables Walmart to maintain more control over the payment process and foster loyalty to their own payment platform, not Afterpay’s.

#2. Integration challenges

Incorporating Afterpay as a new payment system into Walmart’s existing infrastructure involves logistical challenges and complexities. Successful integration of a platform like Afterpay would require synchronization with various systems, including point-of-sale terminals and online checkout processes. The technical hurdles associated with this integration might discourage the marketplace from adopting Afterpay as a viable payment method.

#3. Security and risk management

As a major retail giant, Walmart likely places significant emphasis on security and risk management in payment processing. Incorporating a third-party payment system like Afterpay could introduce additional security risks and complexities that the marketplace may hesitate to undertake.

#4. Fee structure

Yes, BNPL services, including Afterpay, typically charge a retailer a fee for each transaction processed using their service. Walmart might consider these fees too high or not justifiable based on the value they perceive from the partnership. Especially if they can negotiate more favorable terms with other providers.

→ Learn whether Amazon accepts Afterpay’s payments.

Need an app for your accounting?

Do you want to handle your finances with ease? Do you want to be prepared for tax season? Synder app offers valuable solutions for the efficient management of your accounting, providing businesses with the tools to streamline their financial processes.

By integrating with Walmart Marketplace, Synder app simplifies Walmart’s accounting by automating reconciliation, tracking expenses, and managing payments seamlessly. The app integrates with various ecommerce platforms, ensuring synchronized financial data, and offers detailed Profit and Loss reports for informed decision-making.

Give Synder a try with a 15-day free trial, or join our Weekly Public Demo to explore Synder’s capabilities with an expert. It’s all about making your work smoother and more efficient!

Before discussing Walmart’s alternative payment methods in more detail, let’s apply our focus to find out what all the fuss is about. So, why Afterpay?

The more you know: What is Afterpay?

Afterpay is a financial technology company that offers a BNPL service. This service enables consumers to buy goods and services immediately and make payments for them over time in installments. With Afterpay, you’re able to shop both online and in physical stores.

The best part about Afterpay is that you make payments for your purchases over six weeks. The good news is that Afterpay doesn’t add any extra interest to your payments. However, it’s essential to make your payments on time to avoid late fees.

These unique aspects have contributed to Afterpay’s popularity and growth, setting it apart as a leader in the BNPL industry by catering to consumer preferences for simplicity, transparency, and financial control.

→ Find out more about Afterpay’s workflow.

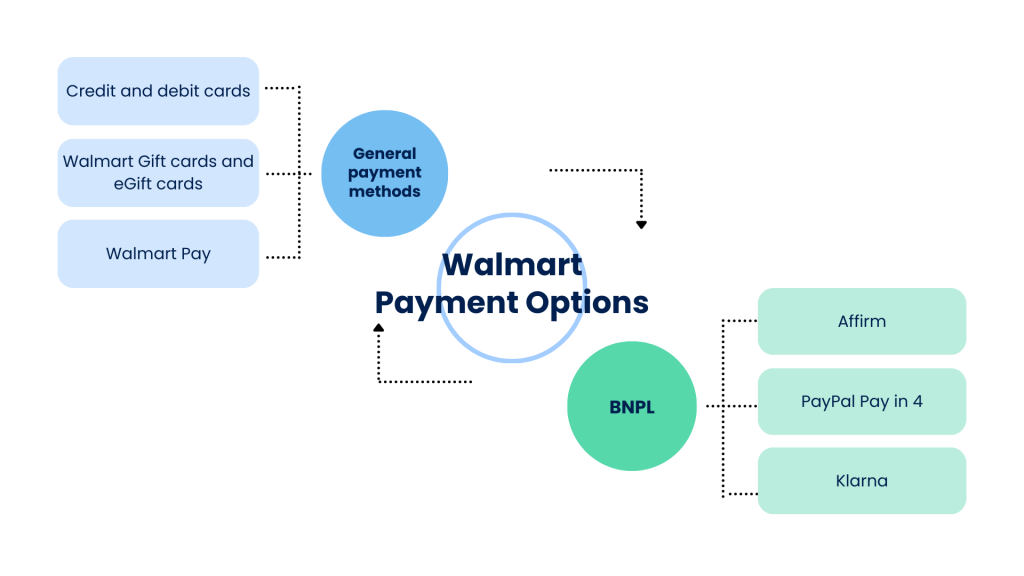

What are the other payment options?

Even without Afterpay, Walmart offers a variety of payment options to accommodate the diverse needs of its customers, both in stores and online. This flexibility ensures that shoppers will be able to choose the payment method that best suits their preferences or financial situation.

How to pay with general payment methods (Credit and debit cards, gift card, Walmart Pay)

1. Credit and debit cards

The retail marketplace accepts most major credit and debit cards, including Visa, MasterCard, Discover, and American Express. These options are available both online and in physical stores. Credit and debit cards are favored for their straightforwardness and the added benefits some cards offer (cash back rewards, travel points, or payment protection).

2. Walmart Gift cards and eGift cards

Such cards are available in various designs and denominations, catering to occasions such as birthdays, holidays, and graduations or simply as a way to say thank you. The eGift Cards are sent electronically and can be used immediately upon receipt, making them a quick and eco-friendly gifting option.

Both types of cards are used to buy a wide range of products from different categories, from groceries and household essentials to electronics and apparel.

3. Walmart Pay

Walmart Pay is a contactless payment solution. It allows customers to link their credit, debit, or Walmart cards and make payments through their smartphones for checkout in stores and online. By scanning a QR code at the register with their mobile device, customers complete transactions without physically handling cards or cash

→ Check our articles on How to Sell on Walmart and Walmart Seller Center.

How to pay with BNPL payment methods (Affirm, PayPal Pay in 4, Klarna)

1. Affirm

Affirm provides a transparent and flexible BNPL option, enabling customers to apply for immediate purchases and spread their payments over time. It conducts a soft credit check and works by giving customers a loan for their payment amount and then charging interest over a fixed term. Customers have the option to apply for repayment terms of 3, 6, or 12 months, with interest rates ranging from 0% to 30%.

It’s important to note that Walmart’s usage of Affirm (for both a retailer and a customer) has some limitations.

- Affirm is used for purchases between $144 and $2,000;

- Customers must be at least 18 years old;

- The service may not apply to specific product categories like groceries and pharmacy items.

2. PayPal Pay in 4

PayPal Pay in 4 is a financing option available to shoppers and integrated into PayPal’s existing payment system. It enables customers to split their purchases into four equal payments made every two weeks.

The service requires no additional sign-up for current PayPal users. Late fees may be applied if payments are missed, but PayPal provides clear communication on payment due dates and amounts, helping customers manage their installment payments effectively.

Note: This option is not available for certain merchants and goods.

3. Klarna

Another option is BNPL with Klarna. With Klarna, shoppers split their payment into four interest-free payments, due every two weeks, or opt for monthly financing options extending up to 36 months, depending on the payment details.

For those who prefer an even simpler approach, the pay-in-4 option requires minimal effort. Automatic payments ensure that installments are never missed. By integrating directly with Walmart’s online and in-store payment systems, Klarna facilitates a smooth and secure transaction process.

Benefits of using BNPL services

#1. Increased affordability

The installment of BNPL services for Walmart stores effectively mitigates the immediate financial burden of large purchases by dividing the total cost into smaller, manageable payments. This approach allows consumers to plan and manage their finances without compromising on their needs or desires.

For consumers disciplined about their payments, BNPL schemes like those from Klarna or PayPal offer a way to avoid the extra costs typically associated with borrowings, such as interest or finance charges, provided the installments are paid on time.

#2. Flexible payment schedules

The adaptability of BNPL payment plans means that the stores consumers are able to align their payment schedules with their income cycles, such as aligning installment dates with paychecks, which helps avoid late payments and additional fees.

By providing options for customization, BNPL services cater to a broader audience, including those with variable income streams, by allowing them to choose a payment plan in a marketplace store that best fits their financial situation.

#3. No impact on credit score

BNPL services provide an alternative financing option for the unbanked or those with limited access to traditional credit, thereby promoting financial inclusion.

For some stores, younger shoppers, or those looking to build their credit history, BNPL services offer a pathway to demonstrate fiscal responsibility without the potential pitfalls of traditional credit cards debt.

#4. Promotions and discounts

When using BNPL services in stores, consumers potentially benefit from exclusive deals, discounts, or cashback offers, which leads to significant savings and add value beyond basic payment flexibility.

These promotions benefit the consumer, foster loyalty, and encourage repeat business, benefiting both the retailer and the BNPL service provider.

#5. Consumer protection

Applying standard consumer protection laws to purchases made with BNPL services provides peace of mind, ensuring that consumers are not at a disadvantage when choosing this payment method in a store they shop.

Most BNPL providers offer straightforward dispute resolution processes, ensuring that consumers have a clear path to address any issues with their purchases. This further enhances consumer confidence in these services.

Conclusion: Is it possible to pay with Afterpay at Walmart?

While Afterpay is not a payment option at Walmart, the marketplace compensates by providing alternative payment solutions such as Walmart Pay, credit and debit cards, PayPal, Klarna, and Affirm. The decision not to add Afterpay reflects the strategic choice to prioritize its proprietary payment system and partnerships with other leading BNPL services. This approach might stem from considerations around integration challenges, maintaining high security standards, and ensuring alignment with the payment preferences of its users. Shoppers looking for flexible payment options might be interested in exploring these alternatives when making purchases at the marketplace.

FAQs

Is it possible to use Afterpay when shopping at the Walmart store?

No, it doesn’t currently accept Afterpay’s in-store or online purchases. However, it offers a variety of other financing options.

What are the alternative payment methods available?

Even though Afterpay is not accepted, the marketplace provides several BNPL alternatives, including Affirm, PayPal, Klarna, and Zip (formerly QuadPay), along with their own payment service, Walmart Pay, and traditional payment methods like credit and debit cards.

What’s the workflow of PayPal Pay in 4?

PayPal Pay in 4 lets you split your payments into four equal payments due every two weeks. It is integrated into PayPal’s system. Late fees may apply for missed payments.

Are there any fees or interest associated with using BNPL services?

The specific BNPL services like Klarna offer interest-free payments if paid on time, but late fees may apply. If we take Affirm as an example, the situation is slightly different. Affirm may charge interest based on the term and creditworthiness but provides upfront terms with no hidden fees.

Does Amazon take Afterpay?

There’s no direct integration between Amazon and Afterpay as a payment option in the platform. Amazon customers looking for BNPL options have an option to utilize Amazon’s own payment services available.

I have used Afterpay for making purchases at Walmart as recently as December 26, 2023. I have decided to stop just recently as I have been overcharged by Afterpay and Walmart on every purchase I have made to the tune of $100.00 cumulative.

Hi Michelle, I’m sorry to hear about the overcharging issues you’ve experienced with your Afterpay purchases at Walmart. Based on the information from Afterpay’s website, it seems that they sometimes add a small buffer to the amount charged during checkout. This is to cover potential extra costs like tax or shipping that the store might add. However, once the final total from the merchant is confirmed, Afterpay should adjust this amount and only charge you for the actual cost of your purchase. If you’ve noticed a discrepancy where you’ve been consistently overcharged and the buffer amount has not been adjusted back, it would be advisable to contact Afterpay’s customer service directly. They should be able to review your transactions and rectify any discrepancies. They will be best positioned to resolve this issue and ensure you’re only charged for what you’ve actually purchased.