The relationship between PayPal and eBay shaped the way online transactions have been handled for years on this platform. But as online commerce evolved, so did the dynamics between these two giants; though that left some of us confused, asking Can you still use PayPal on eBay?

This article traces the journey of eBay and PayPal, from their integration to their eventual business separation, and how this has impacted both sellers and buyers. With the recent inclusion of Adyen, eBay’s payment landscape is set for another transformative phase.

Want to streamline your eBay bookkeeping? Learn what ecommerce financial management software can do for you!

Contents:

1. What happened to PayPal and eBay

3. How to get detailed transaction data from your eBay account to your accounting software

What happened to PayPal and eBay

PayPal and eBay had a long-standing relationship that underwent several significant changes over the years. Let’s look at the major shifts in cooperation and where those companies stand today.

Acquisition of PayPal

In 2002 eBay acquired PayPal, but at the time PayPal had already established itself as the preferred payment method for many eBay users and sellers. The acquisition aimed to streamline the buying and selling process on eBay.

For several years after the acquisition, PayPal was heavily promoted as the primary payment method on the platform. It provided a safe and efficient way for buyers and sellers to transact, especially in the early days of online commerce when trust was a significant concern.

eBay and PayPal business split

In 2015, eBay spun off PayPal into a separate publicly traded company. While they became independent companies, they maintained a close business relationship, with PayPal continuing to be a primary payment option for eBay transactions.

Transition to Adyen

eBay announced in 2020 that it would transition to a new primary payment processor, Adyen, an Amsterdam-based payment company. Adyen is a backend payment service whose portfolio includes big names like Uber, Netflix, and Spotify. Unlike PayPal, Adyen doesn’t have a distinct presence on eBay checkout. In other words, you don’t see a pay button named Adyen as they manage eBay’s payments on the backend rather than the frontend.

The transition was part of eBay’s strategy to improve user experience by intermediating payments on its platform, which would give eBay more control over the transaction process and a smoother checkout experience for the users. The transition period ended in July 2023, which means all payments are now managed on the backend by Adyen.

Does that mean there’s no PayPal on eBay anymore? We’re about to find out.

PayPal on eBay for sellers

Traditionally, if you were a seller on eBay, all your payout would be made to your PayPal account and then transferred to your bank account, but since the transition to Adyen hapenned, that’s no longer possible. What’s more, there was a button to integrate your eBay account with your PayPal account – that’s also gone, so essentially, from a seller’s point of view, a PayPal account isn’t part of business operations anymore. What you’ll find instead is eBay’s new integrated system: eBay Managed Payments.

eBay’s Managed Payments for sellers

eBay’s Managed Payments system represents the company’s shift towards handling the end-to-end payment process on its platform. Instead of relying primarily on PayPal or other external payment gateways, eBay’s Managed Payments offers a more integrated transaction experience.

A step-by-step guide to Managed Payments

Step 1. Sellers need to register for Managed Payments at the setup stage (it’s a mandatory requirement). During registration, sellers provide details like a bank account for payouts and information for identity verification. eBay provides sellers with a centralized dashboard that includes sales, fees, and payouts, making it easier to track and manage their business regardless of the payment solution chosen by the buyers – all transactions can be found on a single dashboard.

Step 2. Once registered, sellers can list items as they usually would. When a buyer makes a purchase, they choose from the payment methods provided, and eBay processes the transaction. For international sales, eBay manages currency conversion, making it easier for sellers to reach a global audience without the complexity of handling multiple currencies.

Step 3. After a successful transaction, eBay processes the payment and holds the funds. There’s no need for sellers to log into another platform (like their PayPal account) to manage or transfer their money. eBay directly deposits the funds into the seller’s bank account, typically within 2 business days of payment confirmation, depending on the seller’s payout schedule.

Additional information. Instead of paying separate eBay fees for listings and PayPal fees for payments, sellers are charged a single fee by eBay that covers both the listing and the payment processing.

With Managed Payments, refund and claim processes are handled directly within eBay, simplifying the resolution process.

Don’t have an eBay store but thinking of opening one? Read our guide on how to set up an eBay store in 4 simple steps.

How to get detailed transaction data from your eBay account to your accounting software

To transfer all your sales channels and payment processors’ data into your accounting software, you need a solution that’s tailored to ecommerce transactions. And Synder does exactly that. By utilizing a tool like Synder, you can save time and reduce errors. But above all, you can record your ecommerce operations in a detailed and accurate way.

How does Synder work?

Synder is an accounting automation solution designed to import and categorize sales, fees, and tax transactions from ecommerce platforms and online payment systems into accounting software.

It acts as a bridge between platforms like eBay, Shopify, or PayPal, and accounting systems like QuickBooks or Xero, ensuring that all financial data is accurately and seamlessly reflected in your accounting records.

Synder is renowned for a variety of features that streamline the accounting process for businesses, especially those operating in ecommerce. Let’s look at some of Synder’s best features.

Multi-platform synchronization

Synder supports a wide range of platforms (more than 25 integrations), from ecommerce sites like Amazon or Etsy to payment gateways like Stripe and PayPal. This allows businesses to integrate multiple sales channels into their accounting software.

Instead of generic entries, Synder provides a detailed breakdown of every transaction, including sales, fees, taxes, and more.

As soon as a transaction occurs on a connected platform, Synder can sync it to your accounting software in real time. For businesses with high transaction volumes, Synder can consolidate multiple transactions into a single sales receipt (a daily summary), making accounting records more manageable.

Want to find out how to record PayPal fees easily? Read our quick guide on entering your fees from PayPal into QuickBooks.

Daily bookkeeping streamlined

You can set custom rules for how transactions are categorized, giving you control over how data is imported into your accounting software. Synder automatically categorizes and tracks expenses, like payment processing fees, ensuring they’re accounted for correctly.

For businesses that need to monitor stock levels, Synder can sync sales data with inventory counts in your accounting software. If you deal with international sales, Synder supports multicurrency transactions, handling currency conversion seamlessly.

The software also automates the reconciliation process, matching transactions in your accounting software with bank statements. All you need to do is approve these matches to reconcile your accounts.

Embark on a seamless financial journey with Synder. Test it out for free, no credit card needed! Want to see it in action? Join our Weekly Public Demo. Dive in now and revolutionize your accounting game!

PayPal on eBay for buyers

If you’re a buyer, you might be surprised by all the talks about the PayPal and eBay split, as for you nothing much has changed. You can still easily pay with PayPal or PayPal Credit for goods purchased on eBay. And that’s absolutely correct – the major shift to Adyen doesn’t delete PayPal as a payment option for buyers.

What payment methods does eBay offer buyers?

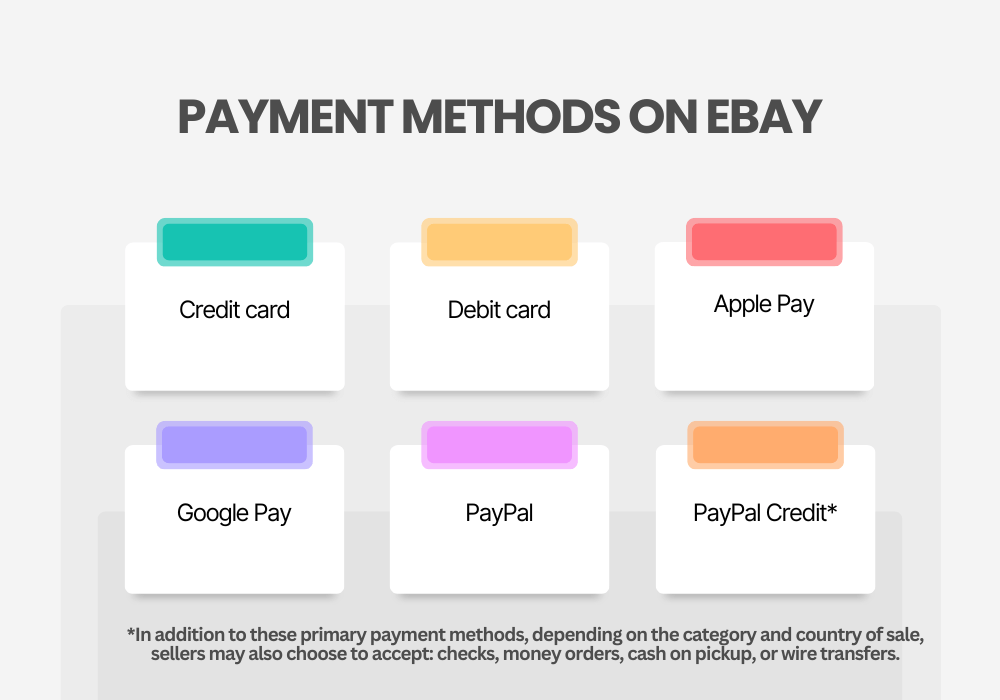

Adyen, as a backend payment software, can support over 300 different payment methods (PayPal included). eBay selected the payment solutions that they wish to offer to their customers, and they include:

- Credit card;

- Debit card;

- Apple Pay;

- Google Pay;

- PayPal;

- PayPal Credit.

In addition to these primary payment methods, depending on the category and country of sale, sellers may also choose to accept:

- Checks;

- Money orders;

- Cash on pickup;

- Wire transfer.

eBay PayPal dilemma: Closing thoughts

The eBay-PayPal saga is a testament to how business relationships can evolve in the face of changing market dynamics and user preferences. While PayPal was once synonymous with eBay transactions, the shift towards Adyen indicates eBay’s push for a more streamlined, in-house payment process. However, the continued presence of PayPal as an option for buyers ensures that familiar payment methods remain, even as the platform adopts new strategies.

As the ecommerce world continues to change, the adaptability and forward-thinking approach of platforms like eBay will undoubtedly shape the future of online transactions.

Barbara – seems that paypal credit is no longer accepted if you choose to negotiate price. And who wouldn’t. Using paypal credit to spread large purchases over 6 months at 0% interest is very attractive and enables larger purchases.

Unfortunately ebay’s switch to Ayden has thrown out the baby with the bathwater.