The current ratio is a critical metric in accounting, telling you if your business has enough assets to cover its short-term debts. At this point, you might want to understand it, know how to calculate it, and see why it matters for investors and creditors.

Let’s go break down the current ratio.

Key takeaways

- The current ratio measures a company’s ability to cover short-term debts with its available assets, with a higher ratio indicating better liquidity. It’s calculated by dividing current assets by current liabilities.

- Investors and creditors use the current ratio to assess a company’s financial health; a ratio above 1 suggests healthy liquidity, while a ratio below 1 may indicate potential liquidity challenges, though industry norms and business cycles must also be considered.

- The current ratio doesn’t provide details on asset quality or cash flow timing and varies across industries. Complementing it with other metrics and considering industry benchmarks is crucial to analyze a company’s financial stability.

What is the current ratio in accounting?

Let’s define the current ratio first, shall we?

The current ratio, in accounting, is a financial metric used to assess a company’s short-term liquidity. It measures your business’s ability to meet its short-term liabilities when they come due

The current ratio, this way, tells about a company’s financial health, especially in the short term.

If the ratio is high, it means the company has more short-term assets compared to its short-term debts. This suggests the company is in a good position to pay off its bills and debts due soon.

If the ratio is low, the company might be struggling to cover its short-term debts with its available assets.

So, a higher current ratio generally means better financial health, while a lower one might signal some financial difficulties.

Automate your accounting with Synder and have always accurate records ready for reporting, KPI tracking, analysis, and taxation! Sign up for our all-inclusive 15-day free trial and experience the benefits firsthand. Or, if you prefer a more personal touch, reserve a spot at our Weekly Product Demo to see smart accounting automation in action.

What are liquidity ratios?

As mentioned, the current ratio is the liquidity ratio.

Liquidity ratios are financial metrics that measure a company’s ability to meet its short-term financial obligations with its available assets. They provide insight into the company’s liquidity, or its ability to quickly convert assets into cash to cover immediate liabilities.

Common liquidity ratios include the current ratio, quick ratio (or acid-test ratio), and cash ratio. These ratios help investors, creditors, and analysts assess the company’s ability to manage its short-term cash flow needs.

How do you calculate the current ratio?

Calculating the current ratio is a pretty straightforward process, involving simple arithmetic. Hower, you need to understand its components and where to find them in your financial atatements, namly, the balance sheet.

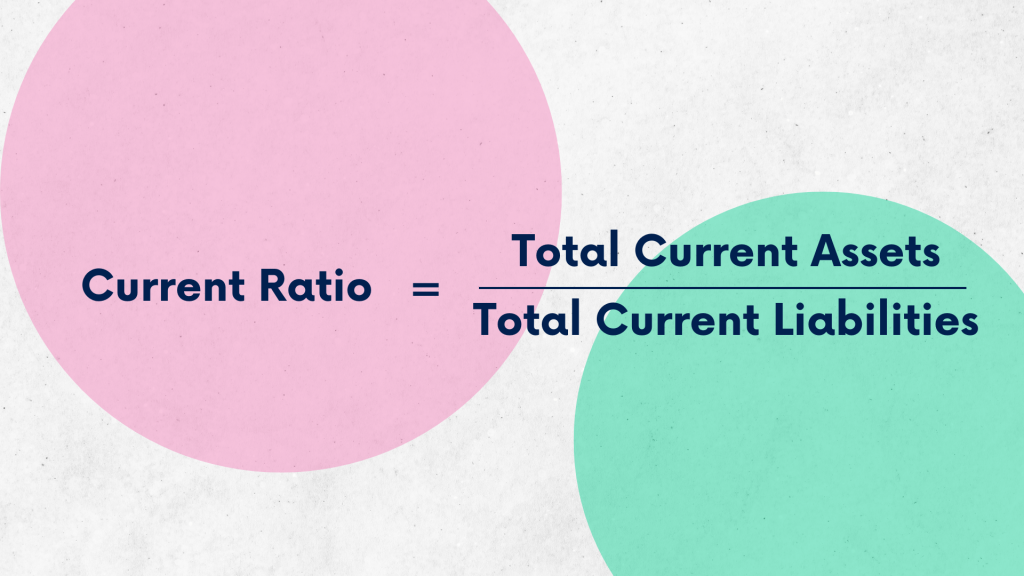

The formula for the current ratio is:

Current ratio = Total current assets / Total current liabilities

Let’s go through the calculation step by step.

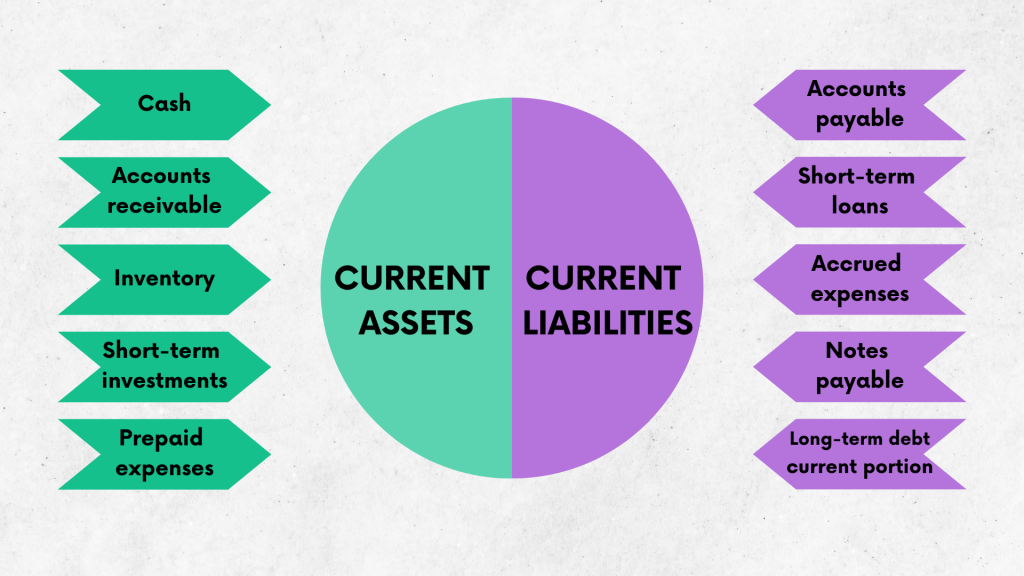

Step #1 – Gathering current assets

Start by identifying all the current assets on the company’s balance sheet. These assets are those that are expected to be converted into cash or used up within one year. Examples include cash, accounts receivable, inventory, and short-term investments.

Step #2 – Totaling current liabilities

Next, gather all the current liabilities listed on the balance sheet. Current liabilities are obligations due within one year, such as accounts payable, short-term loans, and accrued expenses.

Step #3 – Performing the division

Once you have the total current assets and total current liabilities, divide the total current assets by the total current liabilities.

The resulting ratio indicates how many times the company’s current assets can cover its current liabilities.

For instance, if a company has $500,000 in current assets and $250,000 in current liabilities, the current ratio would be 2. This means the company has $2 in current assets for every $1 in current liabilities, which is a healthy liquidity position.

The typical components of current assets and current liabilities included in the current ratio calculation

Meanwhile, let’s take a closer look at current assets and liabilities, included in the current ratio calculation and figure out all the components they inlcude. This way, you’ll get the full picture the data you need to out together before you can calculate the current ratio.

Current assets

We’ll start with the current assets. As mentioned, they are the assets (you company’s possessions) you plan to turn into cash within a year.

Here’s the breakdown.

- Cash includes physical cash on hand and cash equivalents, such as money in checking accounts or highly liquid investments that can be readily converted into cash.

- Accounts receivable are amounts owed to the company by customers or clients for goods or services that have been provided but not yet paid for.

- Inventory is the value of goods held by the company for sale or raw materials and supplies used in the production process.

- Short-term investments are those you can easily convert into cash within one year, such as marketable securities or certificates of deposit.

- Prepaid expenses are payments made in advance for goods or services that will be used or consumed within the next year, such as prepaid insurance or rent.

Current liabilities

Current liabilities, let’s recall, are you company’s obligations due within the upcomming year. Here’s what they typically include.

- Accounts payable are amounts owed by the company to suppliers or vendors for goods or services purchased on credit.

- Short-term loans represent borrowings that are due to be repaid within one year, including lines of credit, bank overdrafts, and other short-term loans.

- Accrued expenses are expenses that have been incurred but not yet paid, such as wages and salaries, utilities, and taxes.

- Notes payable mean promissory notes or loans that are due to be repaid within the next year.

- Current portion of long-term debt is the portion of long-term debt that is due to be repaid within one year.

The limitations of using the current ratio as a standalone metric

While the current ratio is a valuable tool for assessing a company’s short-term liquidity, it possesses some limitations when evaluating overall financial health.

Let’s break them down.

It ignores asset quality

he current ratio doesn’t distinguish between different types of current assets. For example, cash is highly liquid and readily available, while inventory may take time to sell and may not fetch its full value. Therefore, a high current ratio may overstate liquidity if it includes a significant portion of illiquid assets.

It doesn’t consider timing of cash flows

The current ratio doesn’t account for the timing of cash inflows and outflows. Even if a company has a high current ratio, it may face cash flow problems if its accounts receivable are not collected promptly or if it has large upcoming expenses.

There are industry variations

Different industries have varying norms for current ratios. For instance, industries with rapid inventory turnover may have lower current ratios compared to those with slower inventory turnover. Therefore, comparing the current ratio of a company to industry benchmarks is crucial for accurate interpretation.

It excludes future obligations

The current ratio only considers short-term obligations due within one year. It doesn’t account for long-term liabilities or future financial commitments, which are essential for assessing overall financial health and solvency.

It’s affected by economic cycle

Economic conditions can significantly impact the current ratio. During economic downturns, companies may struggle to convert current assets into cash, leading to a lower ratio even if the company is otherwise healthy.

Considering all these limitations, the current ratio can’t be solely used to asses a company’s liquidity. Insted, you might want to analyze it alongside other liquidity ratios, such as the quick rqtio, for instance.

Current ratio vs. quick ratio, and when might one be more appropriate to use than the other?

Both the current ratio and the quick ratio (also known as the acid-test ratio) are essential tools for assessing a company’s liquidity. Serving similar purposes, they still differ, and knowing the difference and when to use each is crucial for a comprehensive analysis.

Let’s break them down then.

The current ratio, as mentioned, measures a company’s ability to cover its short-term liabilities with its current assets. The current ratio formula is as follows:

Current ratio = Total current assets / Total current liabilities

In its turn, the quick ratio focuses on a company’s most liquid assets that can be quickly converted into cash to cover immediate liabilities. It excludes inventory from current assets. The formula for the quick ratio is:

Quick ratio = (Cash + Cash equivalents + Marketable securities + Accounts receivable) / Total current liabilities

So, when should you use which ratio?

The current ratio provides a broader view of a company’s liquidity, including both its most liquid assets and inventory. It’s suitable for assessing a company’s overall ability to meet its short-term obligations. Use the current ratio when evaluating a company’s liquidity in a general sense or when comparing it to industry benchmarks.

The quick ratio offers a more conservative measure of liquidity, focusing only on assets that can be quickly converted into cash. It’s particularly useful in situations where immediate cash flow concerns come to the scene, such as during economic downturns or when assessing companies with slow-moving inventory. The quick ratio is also valuable for industries where inventory turnover is slow, as it provides a clearer picture of short-term liquidity.

Ensuring accuracy of you finances with Synder

Synder is an intelligent accounting automation solution designed to help businesses automate a good chunk of bookkeeping and accounting tasks. It fetches transactions from their various sales and payment channels (like payment processors, ecommerce platforms, and marketplaces) and brings and categorizes them in accounting, allowing for a 360-degree view of a business’s finances and performance across channels under one roof.

As mentioned above, understanding liquidity ratios is crucial for making sound business decisions, ensuring financial stability, and gaining investor confidence. Synder can help you with it in several ways.

- Multi-channel integration with accounting software

Synder integrates with major accounting platforms like QuickBooks, Xero, and Sage Intacct on one end and 30+ ecommerce and payment systems and platforms on the other, allowing you to consolidate all your financial data in one place. Having your financial information comprehensive and accurate simplifies the monitoring of your financial health, including the calculation and tracking of important business metrics and ratios. - Real-time data syncing

Accurate calculation of liquidity ratios depends on the most current information about your assets and liabilities. Synder’s ability to sync transactions in real time ensures your financial data is always up-to-date. This helps maintain the accuracy of your liquidity ratios at any given moment, providing a reliable snapshot of your financial health. - Comprehensive reporting

Synder provides comprehensive financial reports, which can be vital for understanding various business metrics, including liquidity ratios. These reports show your cash, outstanding liabilities, and overall financial position in detail. - Cash flow management

Speaking of cash, cash flow is integral to liquidity because it reflects how money moves in and out of your business. Synder helps cash flow management, as you can track cash flow in real time. This ongoing visibility ensures you have a clear and current view of your liquidity position, helping to prevent potential cash shortages and financial crises.

Stating with Synder is easy, and there’s a 15-day free trial available, so you can see it in action and figure out if you click. Should you have any questions, there’s always someone from the Support Team to have them answered, so don’t hesitate to contact them.

Final word

As you can see, understanding the current ratio and its implications is vital for assessing a company’s financial health. It displays a company’s short-term liquidity, helping investors and creditors gauge its ability to meet immediate financial obligations.

However, it’s essential to recognize the limitations of the current ratio as a standalone measure and to complement its analysis with other financial metrics and qualitative considerations.

Additionally, comparing the current ratio to industry benchmarks and understanding when to use other liquidity ratios, such as the quick ratio, provides a more comprehensive view of a company’s liquidity position.

Learn how bank reconciliation allows you to ensure accurace of your records, based on which you calculate your important financial rations.

Share your thoughts

Feel free to share your thoughts in the comment section below. What business metrics do you believe to be the most useful?