Recent research shows that 42% of business tasks, including inventory management, simple record-keeping, and financial tasks, can be automated, smoothing out workflows across the board. But where do CFOs fit within the automation equation? While much of a CFO’s role requires a personal touch, a great deal of time is spent on mundane tasks. And here lies the beauty of automation tools: speeding up workflows and increasing productivity.

But how do you pick the right ones? Don’t worry — we’ve gathered the top digital software solutions to help you navigate the huge world of automation.

Contents

Cloud CFO software for accounting needs

For a long time, Excel has been a reliable tool for handling a wide range of bookkeeping and accounting tasks. It sounds convenient to have everything in one place, but it quickly becomes overwhelming when you realize the amount of data and tabs you need to manage manually.

Here are the best accounting solutions for the CFO that can streamline your workflow.

Synder

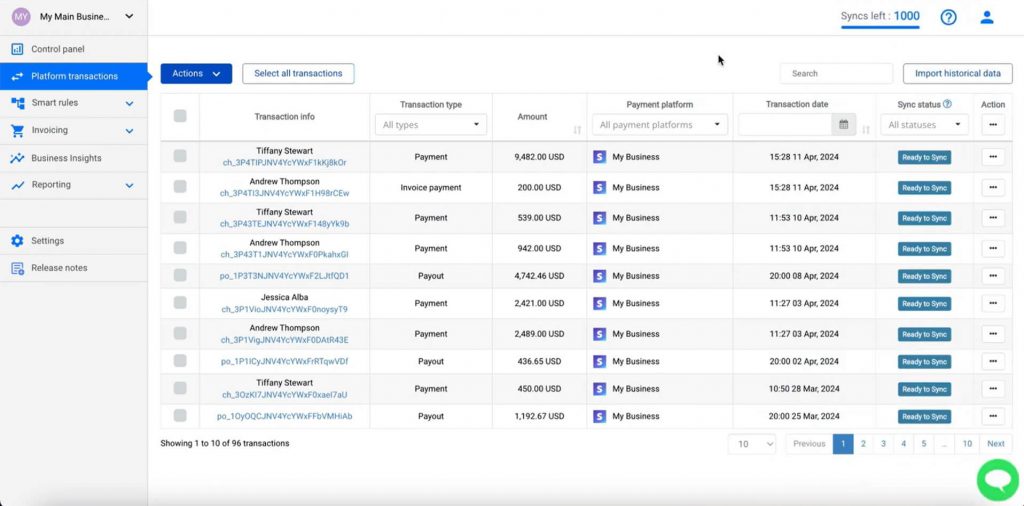

Source: Synder

Synder is a top-tier accounting automation software that seamlessly connects sales channels like Shopify and Amazon and/or payment platforms like Stripe and PayPal to the accounting systems, including QuickBooks Online and QuickBooks Desktop, Xero, and Sage Intacct. Overall, the software integrates with over 30 platforms, simplifying the bookkeeping and accounting processes and eliminating the need for extra apps. As a CFO, you’ll be most likely interested in the two main powerful tools the software provides: Synder Sync and Synder RevRec. Let’s take a close look at their distinctive features.

Key features

| Synder Sync | Synder RevRec |

| Multichannel financial data sync | GAAP-compliant revenue recognition for subscription-based businesses |

| Month-end reconciliation | Multicurrency support |

| Accurate, up-to-date P&L reports | Automatic tracking of subscription changes in QuickBooks Online |

| COGS tracking | Invoices processing with extended payment terms (Net 30, Net 60, etc.) |

| Tax data recording | Discounts recognition |

And that’s not all! To learn more, you can try Synder with a 15-day free trial (no credit card required) or explore its features on a Weekly Public Demo.

Xero

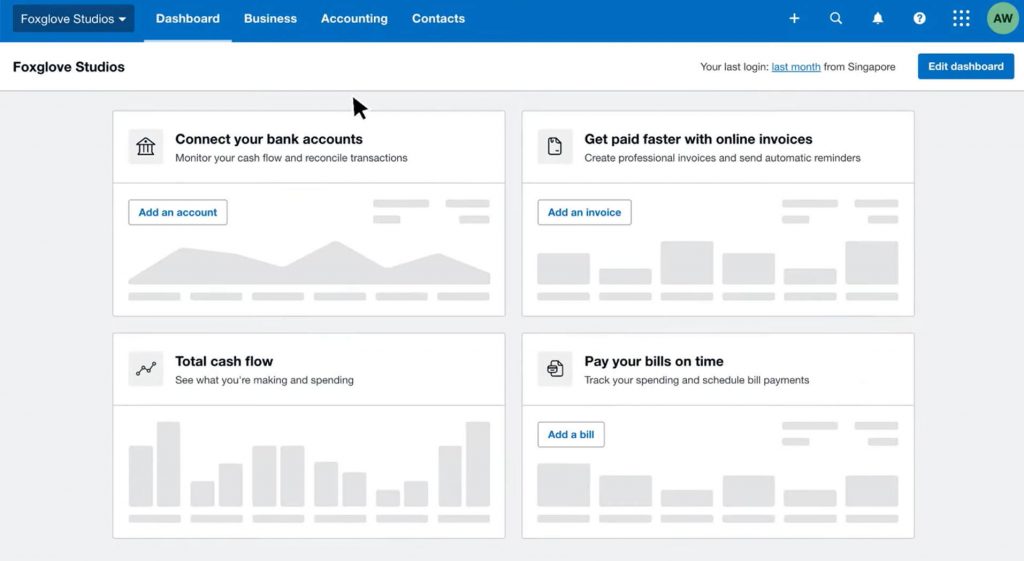

Source: Xero Accounting Software – YouTube channel

Xero is a top-rated cloud-based accounting software perfect for small business owners and accountants, accessible from any device. With the ability to connect to multiple bank accounts, Xero makes daily transaction reconciliation quick and easy. In short, as a CFO you might find Xero useful because it boosts efficiency in accounting tasks and enhances financial control.

Key features

- Provides real-time reports like cash flow statements and balance sheets;

- Handles over 160 currencies;

- Automatically imports bank transactions and matches them to the right accounts;

- Allows you to track company expenses effortlessly;

- Connects with CRM, eсommerce, and other tools to simplify workflows.

QuickBooks Online

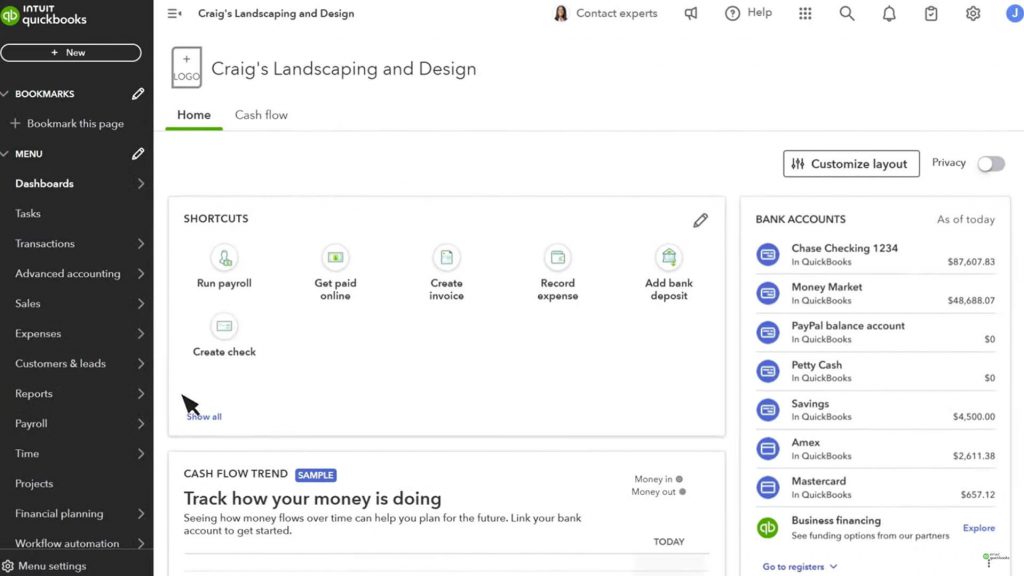

Source: Intuit QuickBooks – YouTube channel

QuickBooks Online is an accounting software and app that empowers CFOs to manage their business finances anytime, anywhere. It combines powerful tools with user-friendly features for financial process optimization and time saving. The software enables additional features that go beyond basic accounting and bookkeeping, such as inventory tracking.

Key features

- Provides custom financial reports to track key business metrics like revenue, expenses, and profitability;

- Automates tasks like invoicing and payment reminders, saving time and reducing manual work;

- Provides multi-user access with up to 25 users, ensuring secure access to financial data across teams;

- Helps with tracking stock levels and monitoring project profitability in real-time.

NetSuite

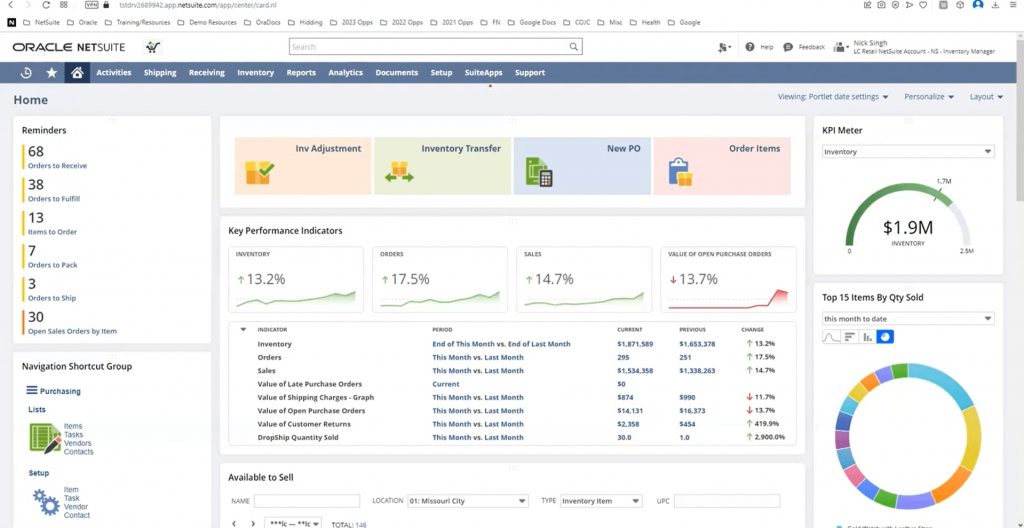

Source: NetSuite – YouTube channel

NetSuite is a cloud accounting software designed to help CFOs manage data efficiently and speed up the financial close process. By automating tasks, it reduces data inefficiencies and minimizes the risk of errors. NetSuite supports multiple currencies and compliance standards, ensuring secure global data access.

Key features

- Provides real-time financial metrics, cash flow, and reports, helping with making quick adjustments;

- Automates tasks like invoicing, billing, and reporting;

- Handles multiple currencies and compliance, making it easy for CFOs to manage international operations;

- Has customizable dashboards and reports to track the metrics that matter most.

- Grows with the business, adapting to the user’s needs.

Sage Intacct

Source: Sage Intacct, Inc. – YouTube channel

Sage Intacct is a flexible and scalable financial platform that provides comprehensive accounting capabilities, including payroll, tax filings, and inventory tracking, tailored to support various industries. The software provides CFOs with integrated multi-dimensional reporting and invoice customization. The platform offers powerful optimization tools at each step of business growth.

Key features

- Provides multi-entity management;

- Uses AI to detect anomalies and audit transactions for better accuracy;

- Offers robust tools to create and adjust budgets based on real-time data;

- Tracks real-time financial data.

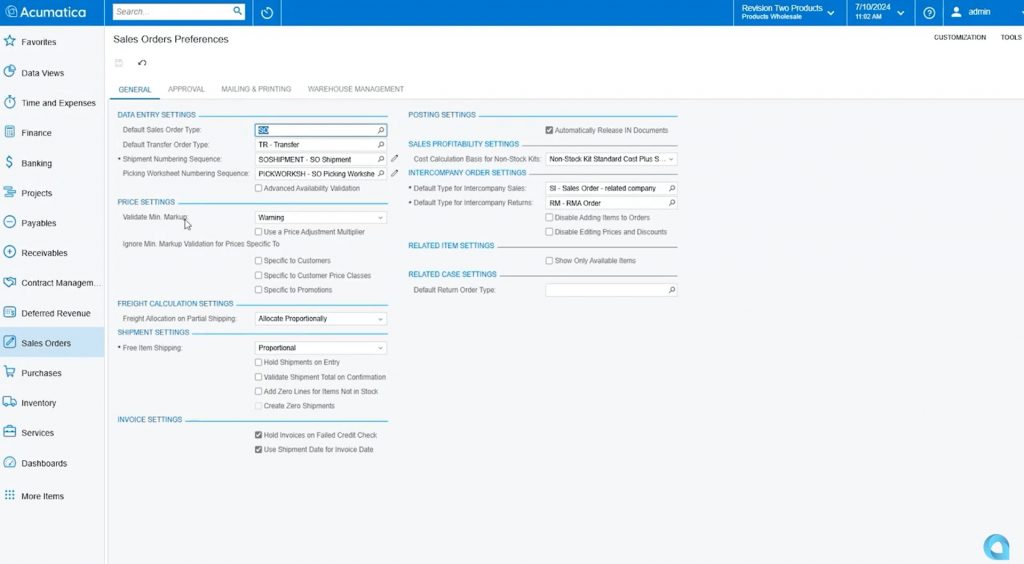

ERP platforms for CFOs

ERP, or enterprise resource planning, is a powerful software that brings together all the tools a business needs to run smoothly — covering everything from HR and manufacturing to supply chain, finance, and accounting — all in one place.

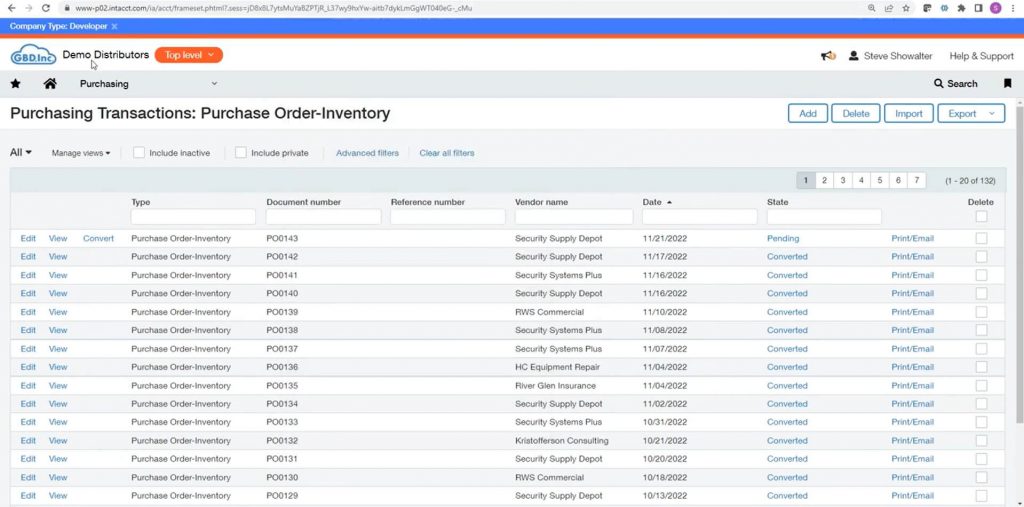

SAP ERP (S/4HANA Cloud)

Source: SAP – YouTube channel

SAP S/4HANA Cloud is an ERP system that uses smart technologies like AI, machine learning, and advanced analytics. The system provides various integrations and deep industry knowledge, all based on a consistent in-memory data model. It helps CFOs quickly adapt to new business models and manage changes while coordinating resources both inside and outside the company.

Key features

- Speeds up month-end and annual closing processes;

- Helps with liquidity and cash flow management in real-time;

- Offers integration with automated tools and Excel;

- Helps ensure compliance with regulations and automates audit trails;

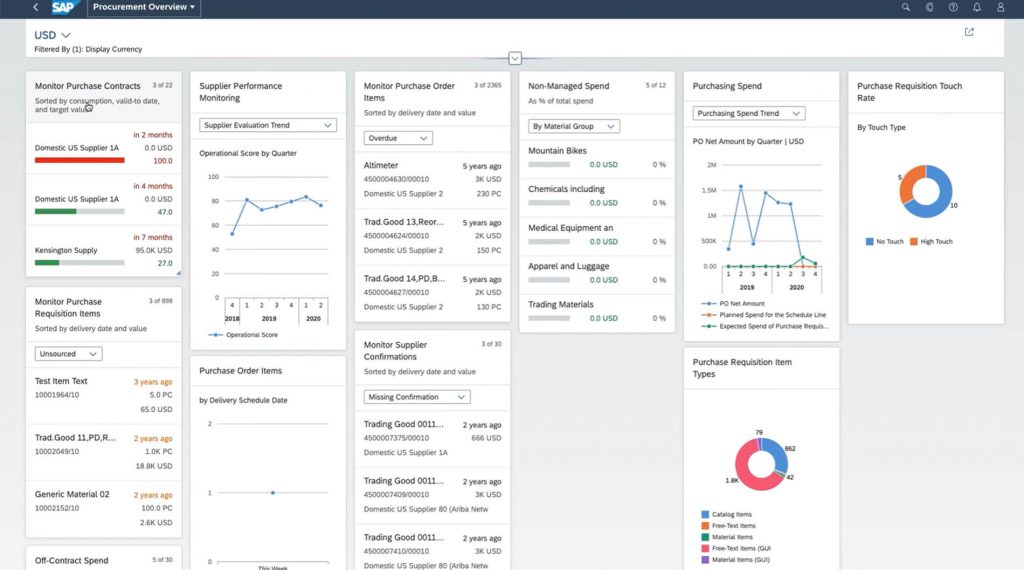

Microsoft Dynamics 365

Source: Microsoft Dynamics 365 – YouTube channel

Microsoft Dynamics 365 Business Central is a robust business management solution that boosts productivity and performance using advanced AI features like Microsoft Copilot. The software works seamlessly with Microsoft 365 apps like Outlook, Excel, and Teams, allowing COFs to access information without switching between programs. It helps CFOs connect finance, sales, service, and operations teams in one easy-to-use application, making processes smoother.

Key features

- Consolidates all financial transactions for streamlined accounting and reporting;

- Manages customer payments and outstanding invoices efficiently;

- Ensures regulatory compliance with detailed reporting, making it easier for CFOs to meet financial regulations;

- Automates routine tasks with AI features and provides insights to improve workflow.

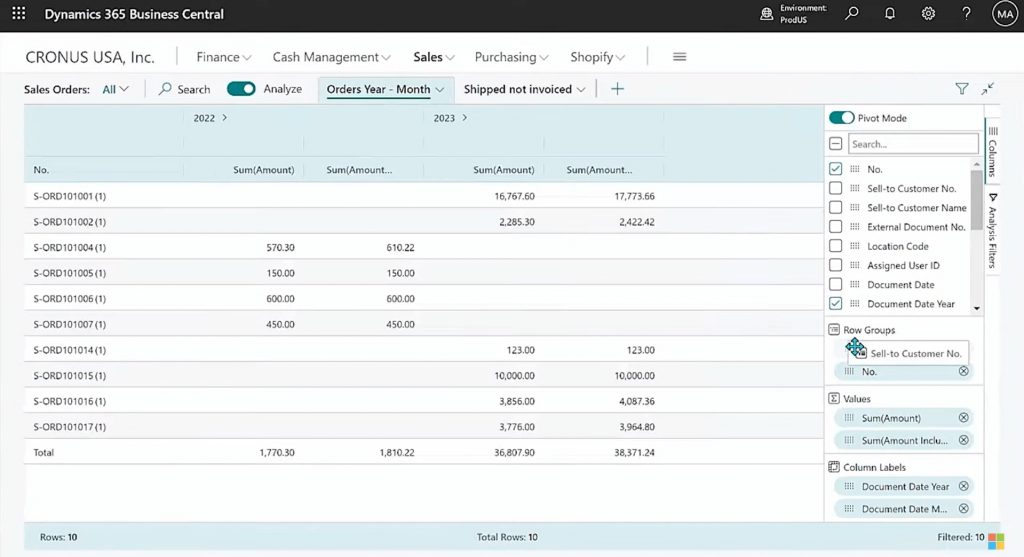

Acumatica

Source: Acumatica. The Cloud ERP – YouTube channel

Acumatica is a cloud-based real estate management system that boosts efficiency and profitability for property management, real estate development, and construction businesses. It offers CFOs a single platform that integrates different solutions, providing clear visibility and supporting data-driven decisions. With automation features, Acumatica saves time and increases accuracy in financial processes.

Key features

- Oversees all aspects of construction projects to ensure timely and budget-friendly execution;

- Manages and tracks real estate portfolios for better investment oversight;

- Provides comprehensive financial management features for accurate accounting and reporting;

- Streamlines accounts receivable processes to improve cash flow and efficiency;

- Generates tailored reports for deeper insights into business performance.

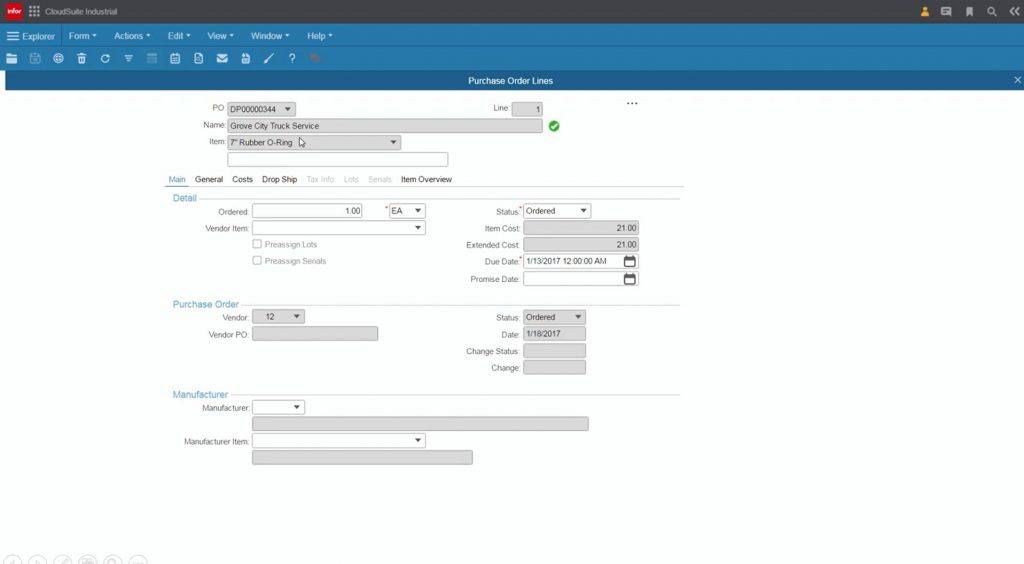

Infor SyteLine

Source: Infor – YouTube channel

Infor SyteLine Equipment Rental is a comprehensive ERP system designed specifically for rental and service businesses, offering enterprise-level financial management. It combines a complete suite of tools for CRM, sales, service, rental, inventory, and financials in a user-friendly interface. The system is fully configurable to adapt to individual business needs, making it versatile and scalable.

Key features

- Easily tailors invoices to suit customer requirements and branding needs;

- Streamlines payment transactions for better cash flow management;

- Monitors inventory levels and manages orders effectively;

- Provides comprehensive financial reporting.

Spending management tools

Spend management involves tracking, controlling, budgeting, and reporting a company’s expenses — one of the key responsibilities of a CFO. To make decisions about financial efficiency and profitability, CFOs need real-time visibility and control over spending.

A dedicated spend management tool that integrates with accounting software and financial systems helps achieve this by reducing manual errors, saving time for experts, and allowing CFOs to focus on strategic planning and cash flow optimization.

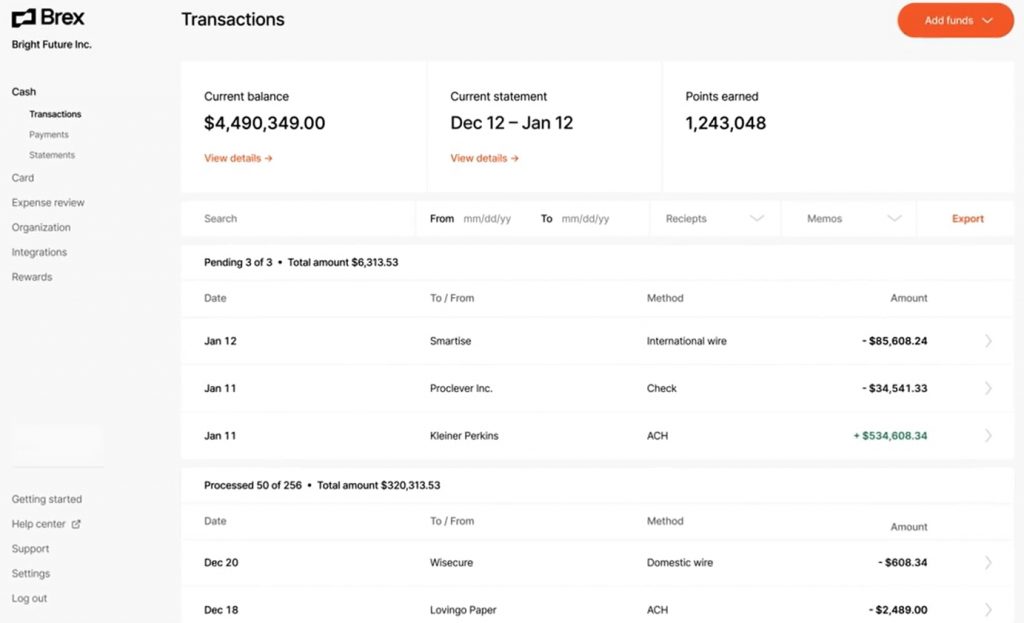

Brex

Source: Brex – YouTube channel

Brex is a financial platform that helps CFOs and finance teams manage spending effectively while promoting growth. It combines payments, cards, capital, and spending management into one account, making it a complete financial solution. With automated features, Brex simplifies expense reporting and employee reimbursements.

Key features

- Connects your existing bank and credit card accounts for easier management;

- Provides real-time data on company spending and answers finance-related questions quickly with AI;

- Simplifies expense tracking and reimbursement processes, ensuring accuracy and compliance;

- Allows CFOs to set spending limits and restrict unnecessary expenses;

- Tracks budgets in real-time, helping CFOs manage and adjust spending as needed.

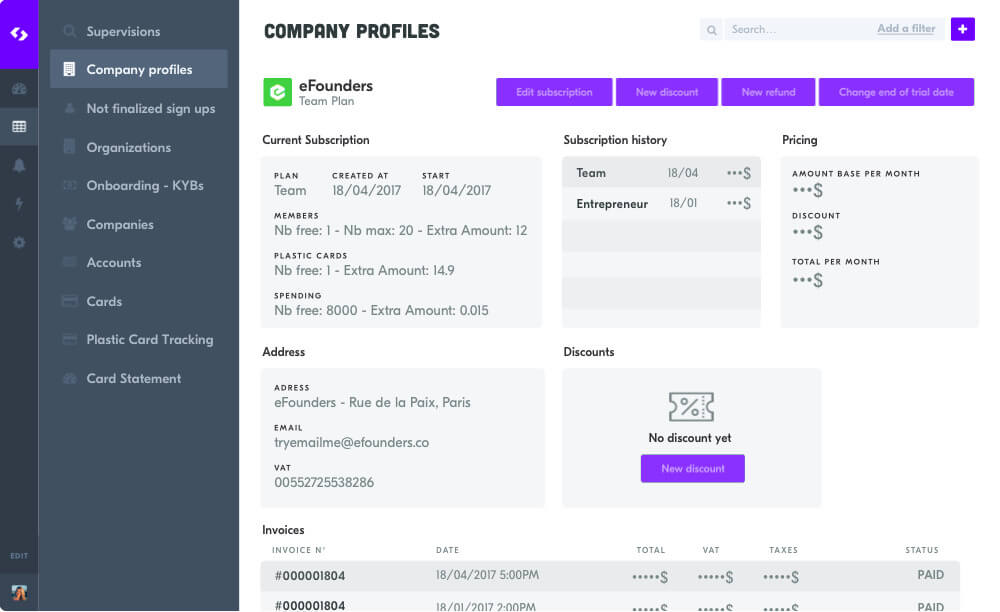

Spendesk

Source: Forest Admin

Spendesk is a spend management solution that simplifies the tracking and processing of payments. With Spendesk, there are no more missing documents or unexpected payments, ensuring a transparent financial process. This solution helps CFOs and finance teams focus on their core responsibilities rather than administrative tasks.

Key features

- Gives CFOs full visibility and control over all expenses as they happen;

- Automates capturing receipts, approvals, and exporting data to accounting systems, reducing manual work;

- Provides real-time tracking of budgets, showing the difference between planned and actual spending;

- Streamlines invoice approval and supplier payments, making procurement easier;

- Enhances team cooperation by providing transparency into who spends what and why.

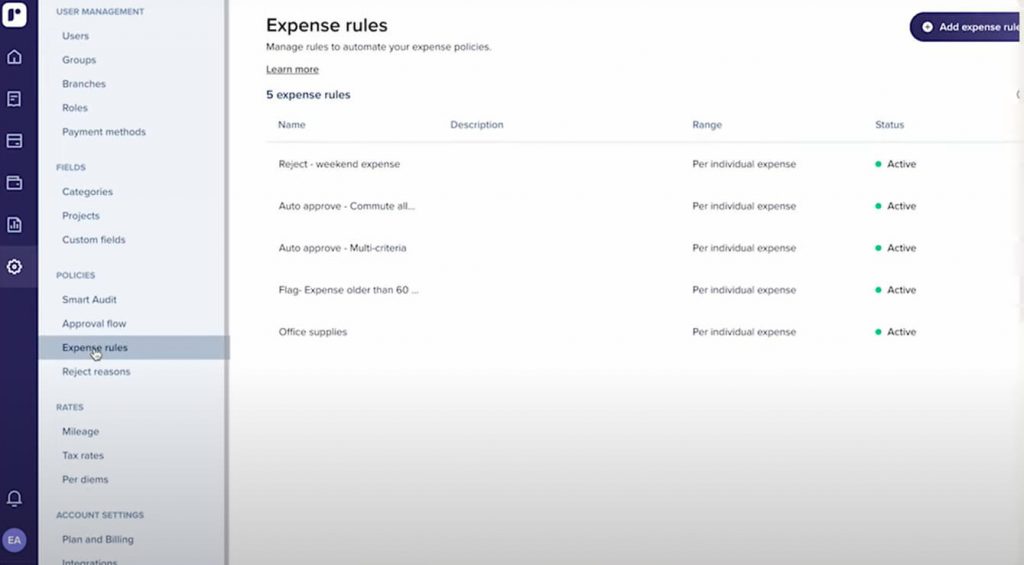

Rydoo

Source: Rydoo – YouTube channel

Rydoo is an intuitive mobile and web app designed to create, submit, and approve expense reports on the go. By integrating with HR, finance, and ERP tools, Rydoo enhances financial oversight and streamlines processes. The app makes it easy for CFOs to manage expenses efficiently while keeping finance teams informed.

Key features

- Monitors expenses as they happen, speeding up reimbursement and cash flow management;

- Uses OCR (optical character recognition) to automatically process receipts, reducing manual work and improving accuracy;

- Supports multicurrency transactions;

- Combines travel booking and expense tracking for simplified management;

- Syncs with accounting software like Xero and QuickBooks.

Payment processing tools

An effective payment solution should provide mobility, cost efficiency, and integration across all areas of your organization. Today’s top options offer a wide variety of features, making them more flexible. Below are three standout tools that serve as ideal CFO software for managing payment processing.

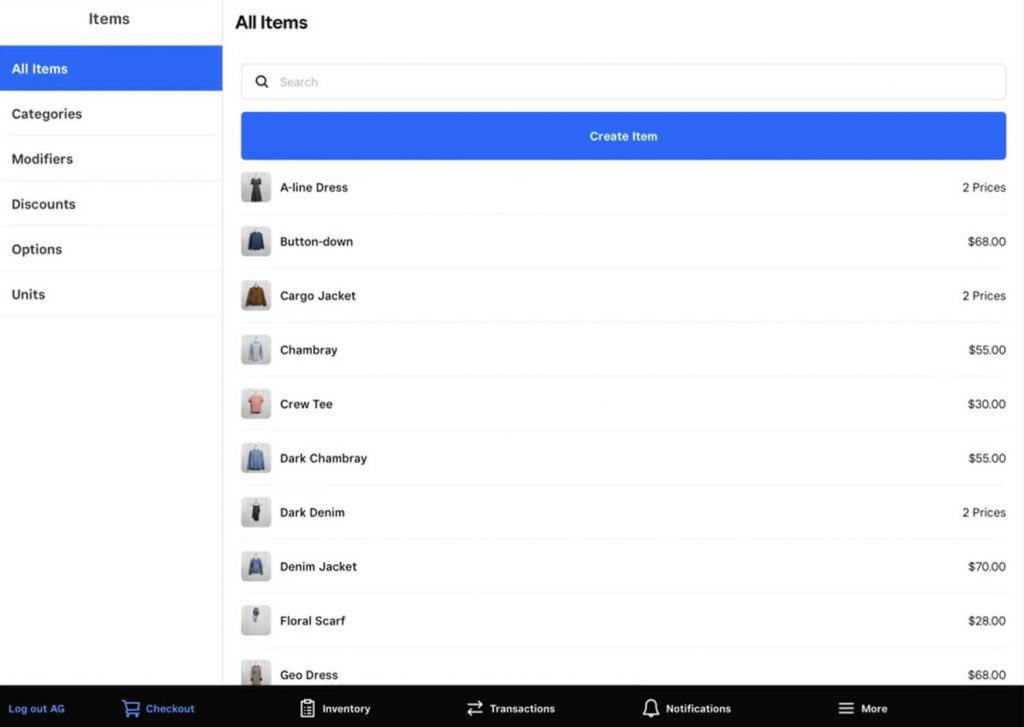

Square Point of Sale

Source: Square – YouTube channel

Square Point of Sale is a versatile POS system designed to simplify business operations for CFOs and business owners. The built-in sales and inventory reports help monitor business performance in real-time. Best of all, Square is free to use – just remember about fees. With no contracts or complicated manuals, it’s a stress-free solution for managing transactions. With features to track customer preferences and feedback, CFOs can gain valuable insights with every sale.

Key features

- Accepts a variety of payment methods quickly and securely;

- Helps track stock levels and manages inventory efficiently;

- Provides detailed reports for insights into sales and performance;

- Manages employee schedules and tracks performance through the POS system;

- Seamlessly integrates with existing ecommerce platforms for online sales.

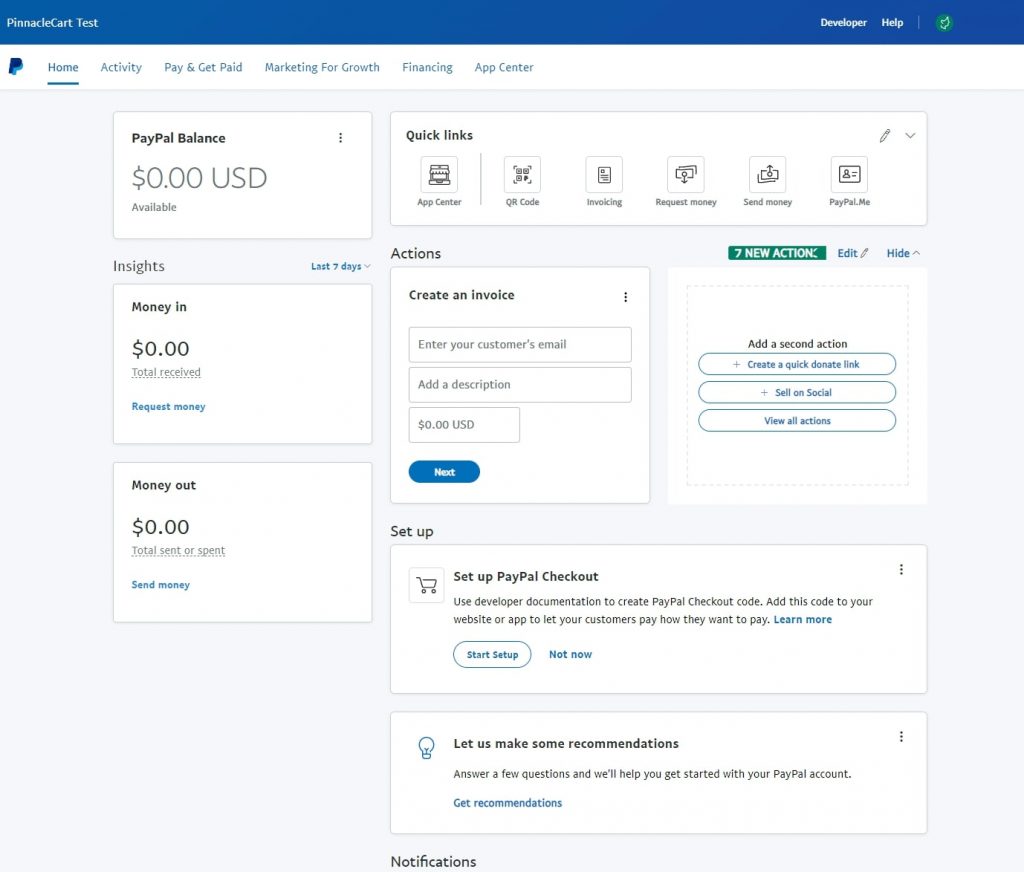

PayPal

Source: PinnacleCart

PayPal for Business is an end-to-end payment solution to meet the needs of a CFO in search of optimizing financial operations and driving growth. Accepting payments worldwide in various currencies enhances both online and in-person sales. With a single seamless integration, businesses can smoothen payment processing, reach more customers, and maintain efficient cash flow. PayPal ensures better financial oversight, enabling CFOs to maintain control and transparency across the payment ecosystem.

Key features

- Accepts debit, credit cards, and over 10 local payment methods in more than 100 currencies across 200+ markets ;

- Provides detailed reports to track transactions, cash flow, and performance in real-time;

- Includes fraud protection and compliance tools to help manage risks and meet regulatory standards;

- Simplifies accounts receivable by automating invoicing and payment tracking;

- Offers loans and working capital solutions to support cash flow and growth.

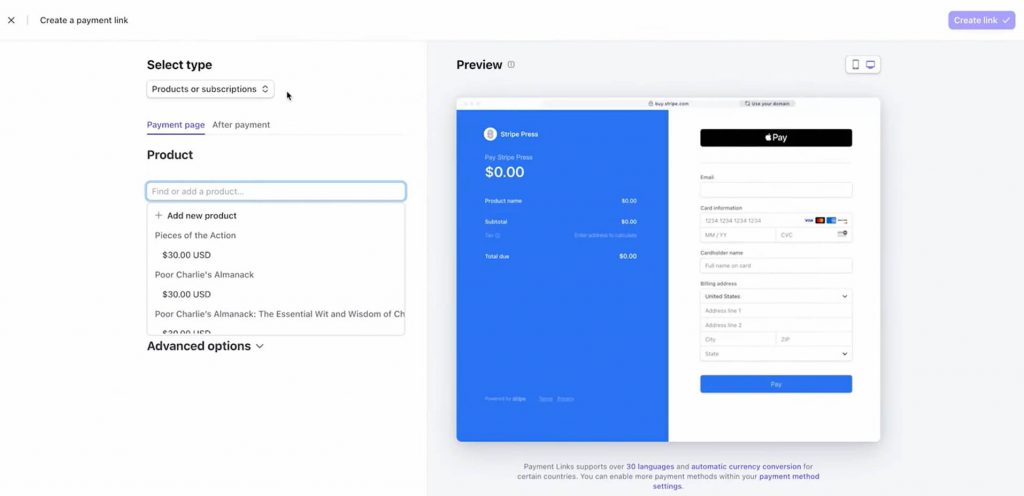

Stripe

Source: Stripe – YouTube channel

Stripe’s payments platform is a strong solution that enables businesses to accept credit and debit cards, as well as popular payment methods worldwide. With features for financial tracking and integrations with online stores and accounting systems, CFOs can easily manage payments and gain valuable insights. Stripe offers user-friendly APIs and no-code payment options, making it perfect for CFOs.

Key features

- Streamlines financial processes like invoicing, payments, and subscriptions;

- Recovers lost revenue from failed payments with tools that save businesses millions.

- Consolidates data from multiple systems, giving CFOs clear, up-to-date financial reports;

- Supports multicurrency transactions.

HR & payroll management

A large part of a company’s capital usually goes toward technology and personnel. Even if they aren’t involved in hiring, CFOs need to understand that investing in employees significantly affects the company’s success. And we’ve selected some of the most convenient and practical software options. Let’s take a closer look at them.

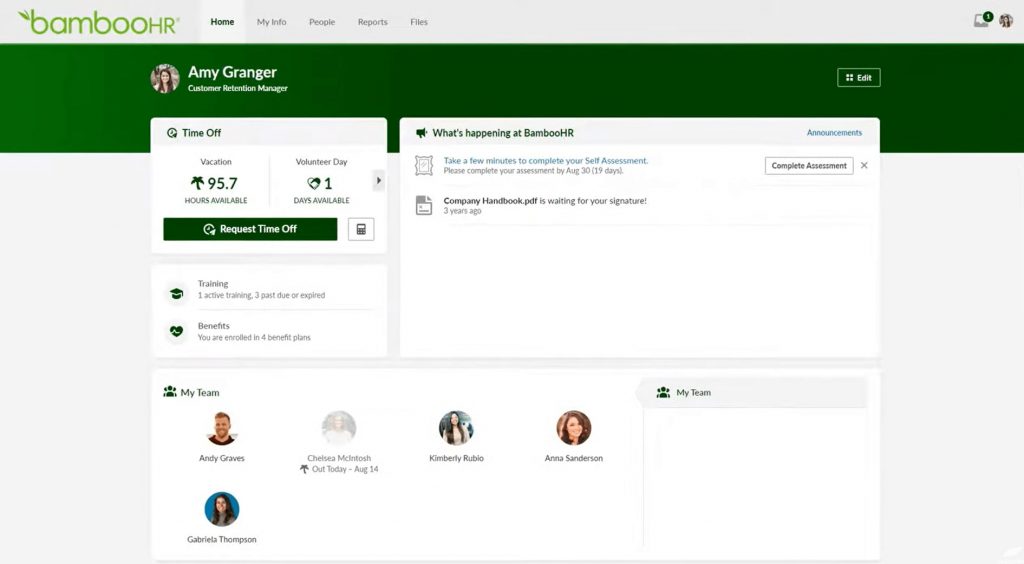

BambooHR

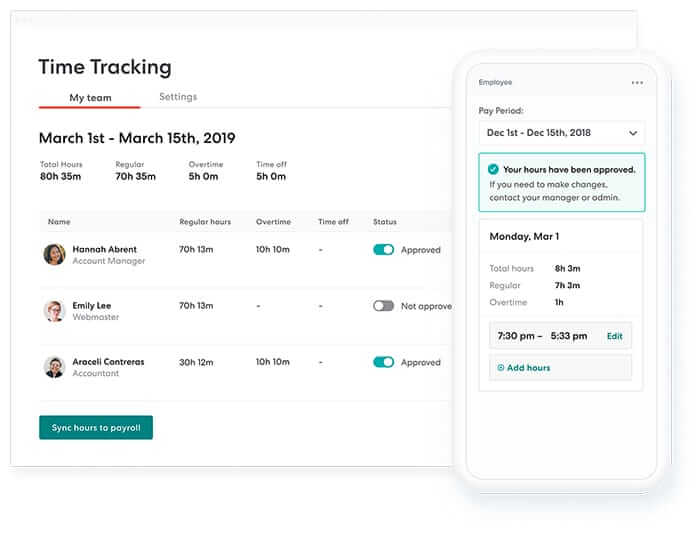

Source: BambooHR – YouTube channel

BambooHR is an all-in-one HR platform built to support growth in organizations, creating a great place to work for both today and tomorrow. It provides users with easier ways to manage core responsibilities by streamlining HR tasks and workflows through the integration of best-in-class solutions and capabilities into one source of data.

Key features

- Automates payroll processes, tax filing, and reporting, reducing manual effort and improving accuracy;

- Tracks employee hours, overtime, and PTO, making payroll and labor cost management more efficient;

- Provides centralized employee data and analytics;

- Simplifies managing employee benefits.

Gusto

Source: Gusto website

Gusto is a payroll platform designed to simplify payroll processing for businesses of all sizes, from startups to rapidly growing companies. It offers modern HR features, including payroll, benefits, hiring, and management resources, all integrated into one system. Gusto is particularly useful for its accurate and efficient payroll solutions.

Key features

- Handles payroll processing and tax filings, including unlimited payroll runs and off-cycle payments;

- Manages employee benefits like health insurance and 401(k) with payroll, automatically deducting premiums;

- Generates detailed payroll and HR reports for insights into labor costs and employee management;

- Syncs payroll with accounting software like QuickBooks and Xero;

- Provides updates on changing laws to help businesses stay compliant.

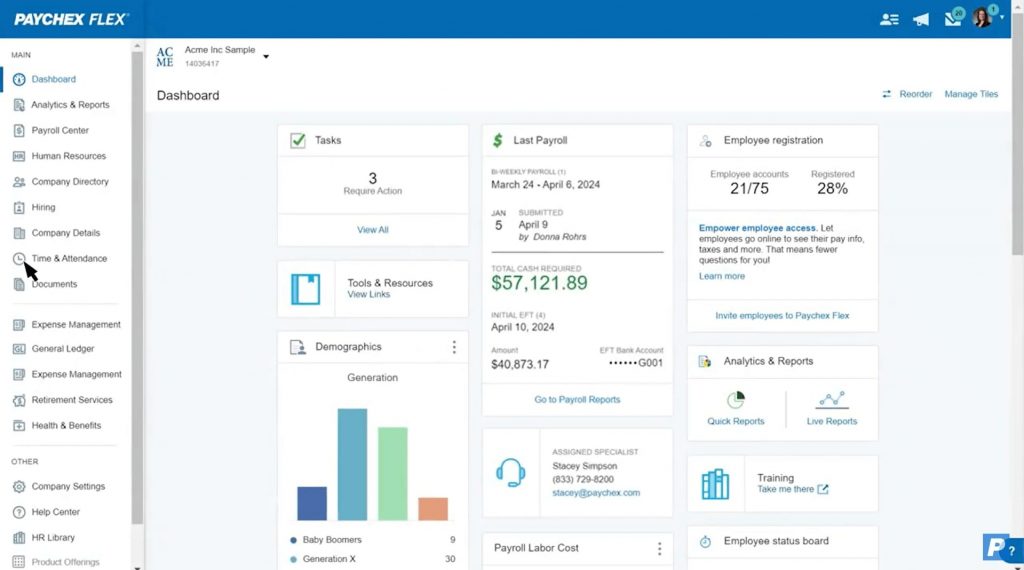

Paychex

Source: Paychex – YouTube channel

Paychex Flex is a complete payroll and HR solution. With expert support on regulations, Paychex Flex helps ensure compliance and reduce risks. Its scalability makes it suitable for businesses of all sizes, adapting to changing needs. Overall, Paychex Flex helps organizations manage their workforce effectively while focusing on growth.

Key features

- Handles payroll calculations, direct deposits, tax filings, and multi-state payroll, ensuring compliance;

- Automatically calculates and files taxes at all levels, reducing compliance risks;

- Provides customizable reports for payroll and benefits;

- Offers mobile and web-based time tracking that integrates with payroll.

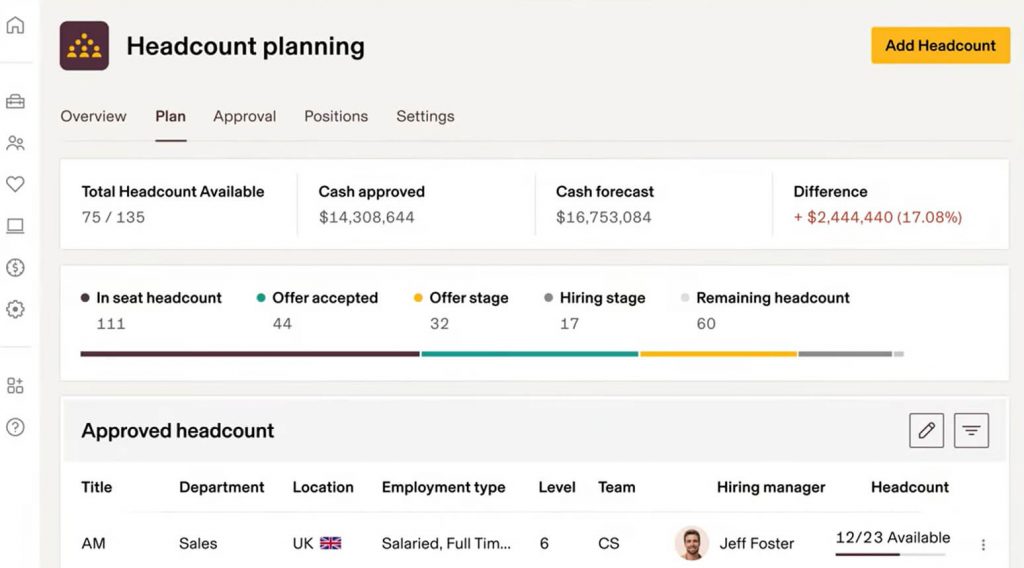

Rippling

Source: Rippling – YouTube channel

Rippling is a payroll system designed to simplify the management and payment of employees and contractors, regardless of their location. When there are changes to an employee’s role, compensation, or benefits, Rippling automatically updates payroll, reducing manual tasks and errors. The platform also calculates payroll taxes and files them with the appropriate agencies, ensuring compliance. Fully customizable and scalable, Rippling Payroll meets your business’s unique needs as it grows.

Key features

- Automates expense tracking and categorizes spending, reducing manual work and giving real-time insights for better cost control;

- Automates payroll, including tax calculations and deductions, while ensuring compliance with local laws;

- Provides detailed reports on payroll, expenses, and benefits, integrating data across systems for better financial management;

- Helps plan hiring, set salary ranges, and track workforce costs for better forecasting.

Marketing management tools

The CFO’s role goes beyond just crunching numbers — part of that budget flows into marketing, so knowing which tools are worth the investment is key. Choosing the right software not only optimizes spending but also helps allocate business capital smartly. Here are the top tools we’ve handpicked.

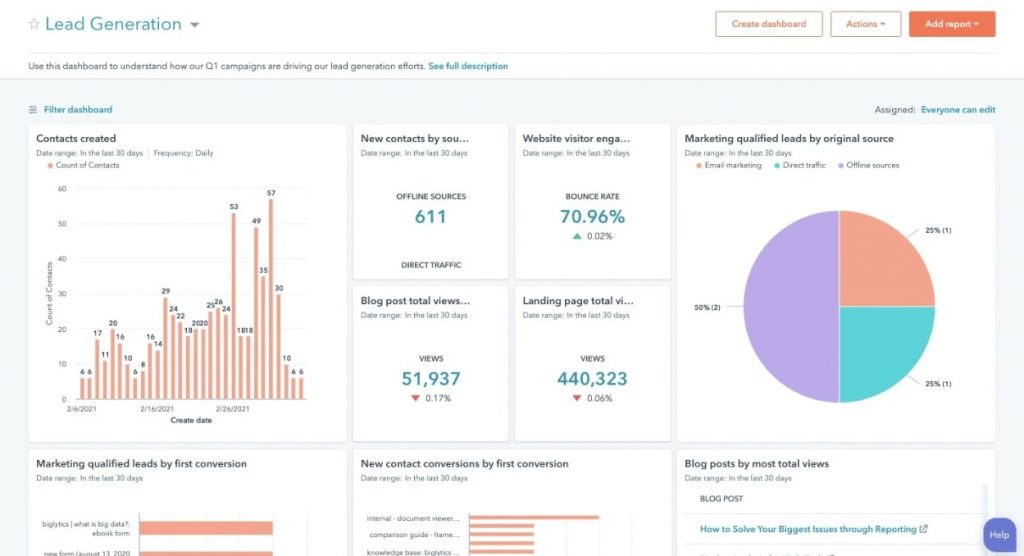

HubSpot Marketing Hub

Source: HubSpot website

HubSpot is a powerful suite of marketing tools designed to help with visitors conversion into leads. By capturing leads and understanding their interests, businesses can optimize their marketing efforts based on data rather than guesswork. With these tools, organizations can start growing their business and improving their marketing ROI .

Key features

- Provides detailed reports and revenue forecasts to help with tracking sales performance;

- Streamlines deal tracking and reduces manual data entry, improving accuracy;

- Automates routine tasks like data entry and reporting, freeing up time for strategic financial planning;

- Implements AI to summarize large data sets into simple reports;

- Connects with platforms like QuickBooks and Stripe to manage billing and invoicing more efficiently.

Klaviyo

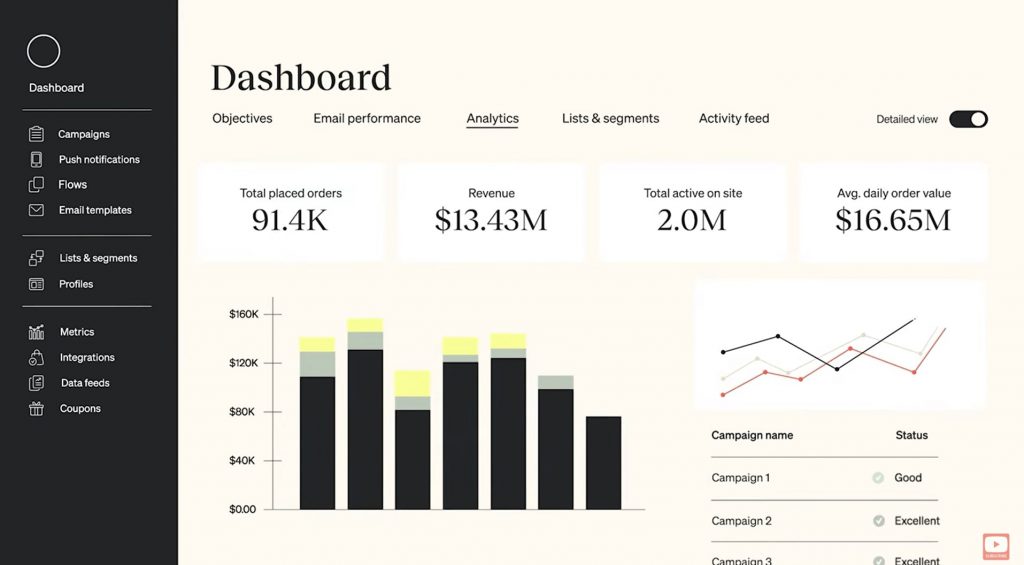

Source: Klaviyo – YouTube channel

Klaviyo is a powerful marketing platform that helps over 100,000 businesses create smarter digital relationships with their customers. With pre-built templates for emails, SMS, forms, and campaigns, businesses can start growing quickly without needing extensive development resources. The platform also offers on-demand education, making it easy for teams to utilize its features effectively. CFOs can benefit from Klaviyo’s ability to integrate and centralize data from various sources.

Key features

- Provides real-time revenue reports, helping CFOs measure the financial impact of marketing campaigns;

- Reduces the need for multiple platforms, saving costs on additional tools;

- Provides segmentation capabilities for better understanding customer lifetime value and optimizing financial decisions based on targeted marketing strategies;

- Allows users to manage multiple accounts with centralized billing, reporting, and security features.

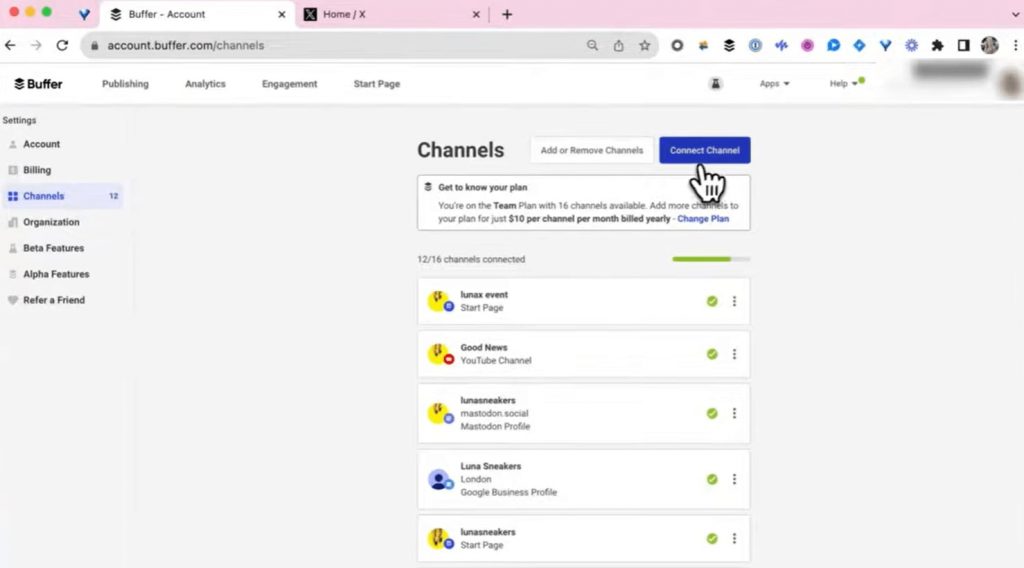

Buffer

Source: Buffer – YouTube channel

Buffer is a trusted social media management software created to enhance engagement and achieve results on social media. The platform helps teams work effectively by providing tools to analyze results and engage with their audience. With its user-friendly interface, Buffer simplifies the management of multiple social media accounts in one place.

Key features

- Tracks social media performance, helping evaluate the ROI of campaigns and monitor engagement rates;

- Allows users to schedule posts and manage social media campaigns efficiently;

- Connects with tools like Canva and Google Analytics;

- Enables users to oversee workflows, assign tasks, and ensure posts align with brand strategies.

Conclusion

Given the wide range of responsibilities a CFO manages, automation is crucial. While the primary focus is on financial tasks, incorporating software for HR management, marketing, and other areas can offer valuable insights into different aspects of the business.

Though it may be challenging to find a single tool that handles everything — from payment processing to HR — using multiple specialized platforms can help streamline operations and improve efficiency. Even if a CFO focuses mainly on finance, understanding and automating other company processes can lead to a more holistic and informed approach to decision-making. Be sure to explore the best options to find what fits your needs.

Thanks for the article! These CFO software tips were excellent for my own financial services UK business.

We are glad that you found this article useful, David!