Running a large business means being in control of your finances. While traditional accounting software might struggle to handle the complexity and volume of financial data generated by a company, enterprise accounting software is exactly what a large business requires.

Specifically designed to handle the needs of large businesses, enterprise accounting software is a solid financial management system, providing all sorts of tools to help maintain business operations and streamline financial processes. In this article we’re going to look at the key features of enterprise accounting software, factors to consider while choosing one as well as the best enterprise accounting software options for 2024.

Contents:

1. Benefits of enterprise accounting software

2. How to choose enterprise accounting software?

3. Best enterprise accounting software 2024

Key takeaways:

- Enterprise accounting software is a must for large businesses as it helps solve complex business problems and delivers a number of significant benefits like enhanced efficiency and automation, and increased security and compliance.

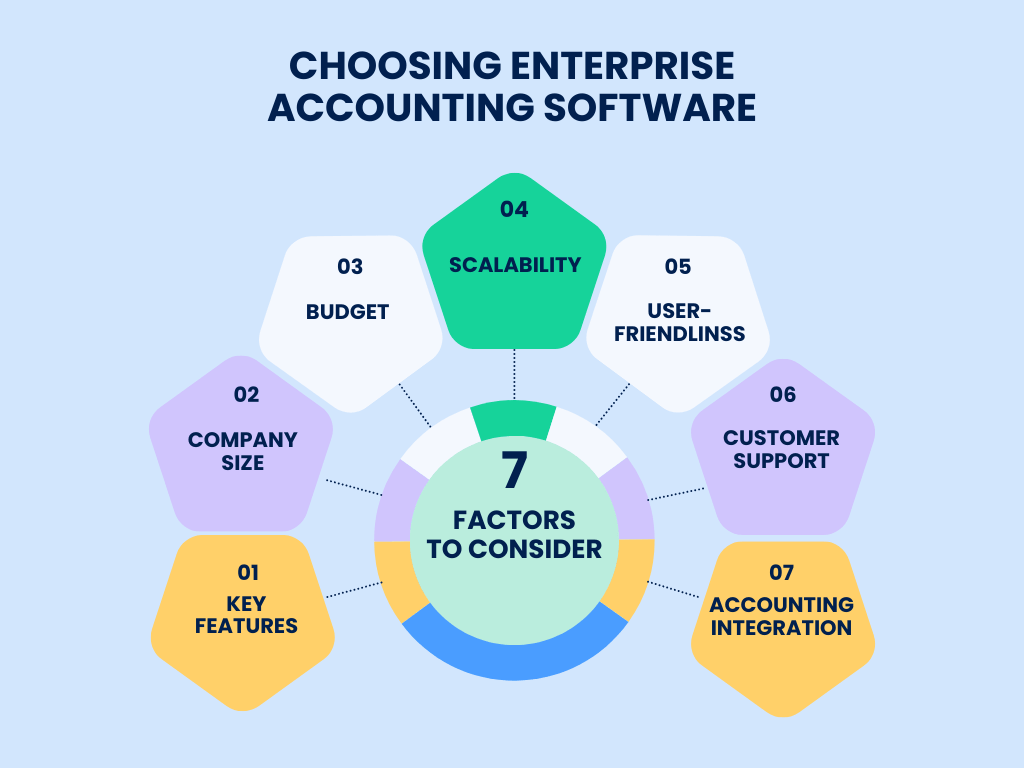

- Key factors to consider when choosing the right enterprise accounting software are the features, industry and company size, budget, scalability, customer support, accounting integration and user-friendliness.

- Popular enterprise accounting software options in 2024 include QuickBooks Enterprise, Sage Intacct, Xero, Oracle NetSuite, and Certinia, all offering a range of solutions and benefits to consider.

Benefits of enterprise accounting software

Enterprise accounting software doesn’t just cover basic accounting tasks like storing and analyzing financial information and overseeing monetary transactions, but provides a business with a set of tools necessary to cover various needs of larger businesses in a centralized and automated way. When it comes to defining what a large business is, according to the IRS, large businesses are those with more than $10 million in assets.

When implementing enterprise accounting software, a business can expect to get a number of benefits:

Improved financial control and visibility

With enterprise accounting software your business can gain real-time insights into its financial health based on centralized data and robust reporting tools. Such a system is vital in navigating the complexities introduced by standards like ASC 842 or ASC 606 revenue recognition guidelines, ensuring that all leasing activities are accurately captured and reported.

Enhanced efficiency and automation

Enterprise accounting software is a system that’s capable of streamlining workflows and automating repetitive tasks, so that the accounting team can focus on strategic decision making and analysis.

Increased security and compliance

Installing enterprise accounting software means ensuring the safety of sensitive financial data as well as being compliant with the recent regulations.

Better cross-departmental collaboration

Ability to overview financial data and work in close cooperation with the members from different teams allows employees to see things from a different angle and get the whole picture instead of seeing one piece of the puzzle.

Stronger decision-making

The access to accurate financial information fosters comprehensive analysis and making data-driven decisions. A good accounting software helps you create a financial roadmap for your business to follow.

These are just the main benefits that can help your business gain a competitive edge.

How to choose enterprise accounting software?

When it comes to choosing the right accounting software for a business, there are many factors to consider. But probably the first that comes to mind is functionality or key features a reliable enterprise accounting software should possess.

Key features of enterprise accounting software

The set of features that any accounting solution provides should be studied closely to see if it’s the right fit for a particular business. It’s extremely important as aside from the basic accounting functions, many companies will require different features to run their businesses. So, when looking at the features your enterprise accounting software provides, it makes sense to consider the following list and define your priorities.

1. Basic accounting

All accounting solutions feature the function of managing the general ledger, accounts payable and receivable, recording and categorizing transactions and generating financial statements.

2. Payroll processing

Payroll in a big company isn’t something that’s done manually, especially when it involves multiple pay scales, commissions, overtime and benefits, and payroll taxes in different areas. Some accounting software solutions include the option of automatic analysis of timesheets and the option for employees to view the paychecks.

3. Inventory management

Inventory management is one more feature of enterprise accounting software to look for as without it, the company will struggle to achieve the necessary level of operational efficiency. This is especially true for companies selling and delivering a large number of products that have to manage large stocks of inventory .

4. Tax management

It goes without saying that tax management is a task on its own, so having help in counting and paying taxes, and being compliant with the latest tax regulations is a must for every business.

5. Budgeting and forecasting

With the help of data accumulated by enterprise accounting software, the company can track its actual performance, make forecasts about the future, identify and address problems.

6. Billing and invoicing

Billing and invoicing is a part of cash flow that can be automated with the help of enterprise accounting software covering such procedures as generating invoices, managing credit terms and multiple payment methods, scanning incoming bills and controlling disbursement.

7. Reporting and analytics

Preparing financial statements and reports can give valuable insights into a business’s financial health. Enterprise accounting software should provide advanced reporting tools that can help track the most important business metrics like COGS, for example, and follow the latest trends.

8. Mobile support

Today’s trend on being mobile is more relevant for accounting software than ever, as cloud-based accounting and mobile apps give the necessary freedom to the staff and the management who access the up-to-date information from anywhere.

9. Variety of integrations

Integrations with other enterprise applications like CRMs or ERPs as well as a variety of payment gateways and other necessary business applications is simply a must for enterprise accounting software as big businesses have a considerable range of issues to tackle.

Other factors to consider when choosing enterprise accounting software

Aside from the main features, it’s sensible to consider some more factors that can help you choose the right enterprise software.

1. Company size and industry needs

It’s obvious that business needs differ for companies of different sizes and industries and each company has its unique set of requirements and accounting complexities, which should be covered by the chosen accounting software.

2. Budget

As enterprise software can be a significant investment, it has to provide a good value for the money and fit your budget.

3. Scalability

Scalability is an important consideration as a growing business means changing needs and increasing data volume, which enterprise accounting software need to be able to adapt to.

4. User-friendliness and training requirements

One of the crucial characteristics for any software is user-friendliness, as complex software can really slow down workflows, although it’s clear that all new things have some learning curve.

5. Customer support

Reliable customer support is necessary for addressing technical issues and solving problems as they arise, thus maximizing the potential of the software.

6. Accounting integration

Accounting integration is the necessary bridge between your accounting software and multiple ecommerce platforms, payment processors used by your business or your clients. Synder Sync is a great solution for businesses that handle a large volume of transactions as it integrates with more than 25 ecommerce and payment platforms. It facilitates automatic synchronization of transaction data into your accounting system and eliminates the need for manual bookkeeping. Recently, Synder has been featured in the ‘Accountant approved bundles’ category under ‘Professional services’ on QuickBooks, which speaks volumes about its reliability. Moreover, Synder integrates with Sage Intacct, Xero, and Quickbooks Enterprise accounting software.

To get to know Synder better, you can opt for a Weekly Public Demo or go for a free trial to see how it can transform your business.

These are some major factors at play that can help you make an informed choice of enterprise accounting software taking control of your finances and giving you a competitive edge.

Best enterprise accounting software 2024

Choosing the best software is always debatable as the best for one particular business may not be as good for others. Who should define the best and based on which criteria? Trying to be objective, we looked through the ratings on software market and software review sites like G2 and Trustpilot, TechRepublic and chose the ones that fared best.

QuickBooks Enterprise

There’s no surprise here as QuickBooks Enterprise is used by more than 20,000 businesses and considered to be a user-friendly accounting software with plenty of features and cloud access. QuickBooks Enterprise has all the features of QuickBooks Online with more tools for larger businesses.

Enterprise Diamond is an option for more complex businesses that can scale up to 40 users, 24/7 premium support, assisted payroll and employee time tracking features.

Features to pay attention to:

- The easiest to use accounting ledger in the mid-market category, according to G2 Crowd

- Advanced inventory , pricing and reporting options

- Industry-specific solutions

- Cloud access

- Order Management

- Job costing

- Time tracking

Sage Intacct

Sage Intacct positions itself as a comprehensive and flexible cloud-based accounting solution for large businesses. It’s considered to be one the most user-friendly solutions and caters to many industries including nonprofit, real estate, software and SaaS, professional services, financial services, healthcare, hospitality, wholesale distribution, and construction.

Features to pay attention to:

- Industry-specific solutions

- AI-powered general ledger, timesheets

- Project-specific accounting

- Multiple entities managing accounts

- Cloud-based

- Time and expense management

- Backed by AICPA

Xero

Although Xero initially built its reputation on serving small businesses, it’s expanded its offerings to cater to enterprise needs as well. Its enterprise-grade accounting tools encompass a wide range, including payment processing, fixed asset management, and much more.

For large organizations, Xero offers features that streamline and automate tasks.

Xero takes it a step further with Analytics Plus, a tool that leverages predictions to offer even more valuable foresight. Moreover, Xero doesn’t charge for additional users.

Features to pay attention to:

- Xero Practice Manager, Xero Workpapers and Xero HQ are some of the accountant and bookkeeper-specific tools

- Built-in bank connections

- Payroll with Gusto

- Project tracking

- Multi-currency accounting

- Intuitive invoicing software

- a 30-day free trial

Oracle NetSuite

Oracle NetSuite is considered to be one of the leaders in the enterprise accounting software industry. It goes beyond just robust accounting features, covering a range of functionalities. The true power of Oracle NetSuite lies in its seamless integration with other NetSuite products, such as customer management and ecommerce tools, which offers enterprises a comprehensive view of their finances, regardless of the industry.

The platform is known for its high level of customization, along with convenient automation scripts that streamline workflows. The user-friendly setup, intuitive dashboard, and scalable plans make NetSuite a compelling choice for businesses to consider.

Features to pay attention to:

- Simplified regulatory compliance with ASC 606 and GAAP standards

- Highly customizable

- A variety of scalable plans

- Cloud-based

- Suitable for global enterprises (B2B, B2C, B2X)

Certinia

Certinia, formerly known as FinancialForce, focuses primarily on large, global businesses and represents itself as a service-as-a-business platform. Consequently, its multi-language and multicurrency capabilities provide seamless management of accounts payable, receivable, assets, and cash flow across international borders.

Certinia offers in-depth analytics powered by Salesforce Einstein and integrates seamlessly with other Salesforce products like customer success best practices playbook, for example, providing customer interactions information alongside financial data. Users consistently praise the software’s clear and user-friendly layout, making it easy to navigate for accounting teams.

Features to pay attention to:

- Multi-language and multi-currency options

- Actionable social feed for teams collaboration

- Personalized reporting and trend analysis

- AI cash flow forecast solution

- CRM, ERP, PSA on one in-house development platform (Salesforce)

Bottom line

Ultimately, the process of choosing the best enterprise software should consist of defining your business priorities and considering the key features, pricing, scalability, mobile access, customer support and integrations the chosen software provides. As an accounting solution is no longer a luxury but rather a must for any business, choosing the best option might really be the turning point giving your business the competitive edge needed.

What is the best enterprise accounting software for your business and why? Share in the comments below!

.png)

Thanks for the article!