In 2026, CFO conferences in the USA and Canada increasingly reflect the pressures finance teams operate under. Tighter reporting timelines, rising expectations around accounting automation, and systems that must perform under real transaction volume, especially in ecommerce, define both the agenda and the conversation.

The conferences listed here emphasize applied finance topics and first-hand experience, with discussions that move beyond high-level trends. The focus is on events where finance leaders share how they manage operational constraints in their day-to-day work.

TL;DR

- CFO conferences in 2026 focus on practical finance leadership, not theory

- The best events help you compare reporting, systems, and decision-making with peers

- Value comes from relevance to your real finance challenges, not event size

Curious how conference insights hold up once you are back in the office? Start a free Synder account or book a demo to see how finance teams keep transaction data accurate and reconciliations dependable long after the event.

9 best finance conferences in 2026

We chose these conferences as they rank among the most attended CFO events in North America, cover distinct finance domains (public companies, private funds, ERP-driven teams, and Canadian finance), and publish agendas built around real operating topics like close, reporting accuracy, systems, and governance.

1. Gartner Finance Symposium and Xpo

- Dates: May 27 to 29, 2026

- Location: National Harbor, Maryland, USA

- Registration: Official Gartner Finance Symposium and Xpo event page

- Pricing: Early-bird approximately $4,375, standard around $4,975, with a reduced public-sector rate near $4,125

If your calendar only allows one large conference in 2026, this is often the safest bet. Not because it promises answers to everything, but because it forces you to think in systems.

This event tends to attract CFOs who are already past basic finance transformation questions. The conversations go deeper. How do reporting structures affect decision speed? Where does finance data break when volume increases? Which metrics sound good in a deck but fall apart during close?

What usually stands out here is the focus on operating models. You hear less about tools in isolation and more about how data flows end-to-end, from transaction capture to reporting to board-level insight. If you deal with multiple payment platforms, subscriptions, or complex revenue timing, that perspective matters.

Key benefits of attending:

- Clear guidance on finance operating models that scale with transaction volume

- Peer insights into reporting design and close structure under pressure

- Practical frameworks for improving confidence in financial data

2. WSJ CFO Council Summit

- Dates: March 23 to 24, 2026

- Location: Palo Alto, California, USA

- Registration: Official Wall Street Journal CFO Council event page

- Pricing: Typically requires CFO Council membership or event-specific registration (exact published pricing varies and may be available upon inquiry)

This summit is designed for CFOs who value candid discussion over packed agendas. The format leans toward smaller sessions and closed room conversations, which makes it easier to talk openly about leadership pressure, capital decisions, and how finance functions under real-world constraints.

The conference attracts finance leaders from growth stages and public companies who are dealing with investor expectations, governance questions, and executive-level tradeoffs. If your role involves balancing long-term planning with constant short-term demands, this event usually feels relevant quickly.

Key benefits of attending:

- Direct conversations with senior finance leaders

- Practical perspectives on board, investor, and executive dynamics

- Exposure to how other CFOs approach risk and decision timing

3. Private Funds CFO New York Forum

- Dates: February 3 to 4, 2026

- Location: New York, New York, USA

- Registration: Official Private Funds CFO Forum event page

- Pricing: Starts from $4,395

This forum is narrowly focused on finance leaders working in private equity, private credit, and alternative investment structures. The agenda usually centers on fund reporting, investor expectations, valuation pressure, regulatory oversight, and operational controls that become harder to manage as portfolios grow.

If your role involves capital structures, complex entity setups, or reporting across multiple funds, this event tends to feel immediately practical. Discussions are often concrete, with less theory and more emphasis on how finance teams handle data accuracy, reporting timelines, and audit readiness in high scrutiny environments.

Key benefits of attending:

- Peer discussions with CFOs facing similar fund-level reporting challenges

- Practical insight into regulatory and investor-driven reporting requirements

- Exposure to how finance teams manage complexity without adding headcount

4. AICPA and CIMA CFO Conference

- Dates: April 13 to 15, 2026

- Location: Miami Beach, Florida, USA

- Registration: Official AICPA and CIMA CFO Conference event page

- Pricing: Ranges from £925 to £1,475, with discounted rates for AICPA and CIMA members.

This conference is a solid choice if your role sits close to accounting standards, controls, and compliance, but still needs to stay connected to operational reality. The agenda usually blends technical updates with applied sessions on close management, reporting accuracy, and governance expectations.

It works well for CFOs who want to stay current without getting lost in theory. Many sessions translate directly into how finance teams document processes, manage audits, and support leadership decisions with defensible numbers.

Key benefits of attending:

- Clear updates on accounting and regulatory developments

- Practical guidance on close, controls, and governance

- A balanced mix of technical depth and operational focus

5. FEI Canada National Conference

- Dates: May 25 to 28, 2026

- Location: Ottawa, Ontario, Canada

- Registration: Official FEI Canada National Conference event page

- Pricing: $1,595 – $1,995 for non-members, discounted rates for FEI Canada members and early registration

This conference is aimed at senior finance leaders operating in the Canadian regulatory and reporting context. The agenda usually covers governance, risk, financial leadership, and how finance teams support strategy without losing control over fundamentals.

It is a good fit if your role spans accounting, finance operations, and executive decision support. Many sessions focus on how finance leaders balance technical requirements with practical execution, especially in organizations facing growth, cross-border exposure, or increased scrutiny.

Key benefits of attending:

- A Canada-specific perspective on regulation and governance

- Experience-driven discussions with senior finance leaders across industries

- Practical insight into aligning finance operations with leadership expectations

6. Canadian Finance Summit

- Dates: May 28, 2026

- Location: Toronto, Ontario, Canada

- Registration: Official Canadian Finance Summit event page

- Pricing: $450 for Super Early Bird, $600 for Early Bird, $750 for General

This is a one-day event that works well if stepping away for a full week or a weekend is not realistic. The agenda typically focuses on current finance leadership issues in Canada, including reporting expectations, economic pressure, and how finance teams adapt their processes as organizations grow.

It attracts CFOs and senior finance leaders who want focused discussions without a heavy time commitment. If you are looking for practical perspectives you can absorb and act on quickly, this format usually delivers.

Key benefits of attending:

- Efficient one-day format with focused sessions

- Canadian market and regulatory context

- Practical takeaways without extended time away from the business

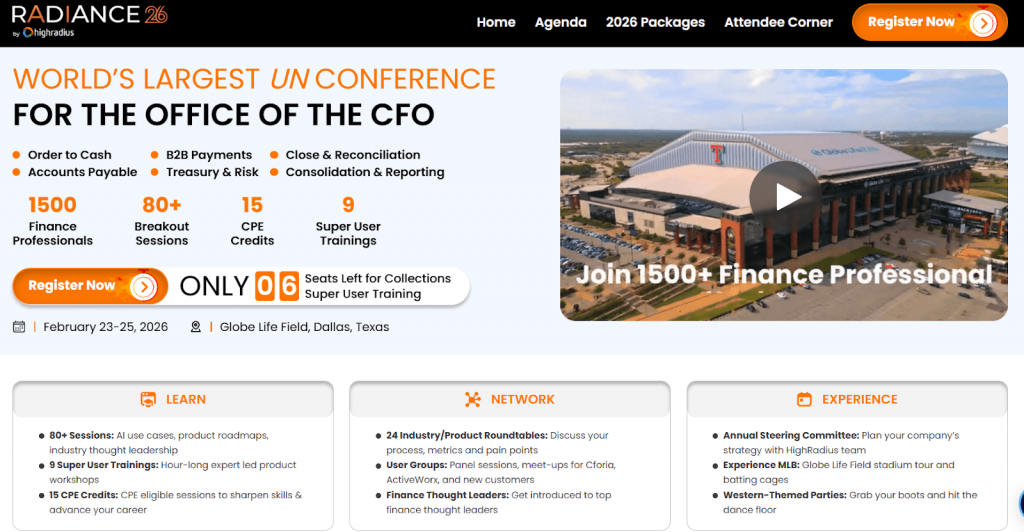

7. Radiance 2026

- Dates: February 23 to 25, 2026

- Location: Dallas, Texas, USA

- Registration: Official Radiance conference website page

- Pricing: Ranges from $799 for a single-day pass to $1,299 for the standard three-day pass. A higher-tier Super User pass is priced at $1,599, and a guest pass costs $399.

Radiance is aimed at CFOs and senior finance leaders who spend a lot of time bridging strategy and execution. Sessions often focus on forecasting discipline, capital planning, performance measurement, and how finance supports growth without losing control of the numbers.

This conference works well if your role requires close coordination with operations, sales, and leadership teams. The discussions usually stay practical and grounded in how financial decisions play out inside real organizations, not just in planning models.

Key benefits of attending:

- Strong focus on CFO-level decision-making and planning

- Practical perspectives on performance management and forecasting

- Peer conversations with finance leaders balancing growth and control

8. CFO Leadership Conference, spring edition

- Dates: June 3 to 5, 2026

- Location: Boston, Massachusetts, USA

- Registration: Official CFO Leadership Conference event page

- Pricing: Early registration for CFO Leadership Council members is $745. The standard Finance Leader rate is $945. There’s also a combined conference plus one-year council membership option costing $1,145.

This conference aims squarely at CFOs who spend a large part of their time leading teams and setting direction, not just reviewing numbers. Sessions often focus on leadership pressure, talent decisions inside finance, communication with boards, and how CFOs adapt their role as organizations evolve.

It’s a perfect fit if your challenges are less about technical accounting questions and more about decision ownership and accountability. Many attendees value the candid tone and smaller setting, which encourages open discussion rather than scripted presentations.

Key benefits of attending:

- Leadership-focused sessions for senior finance roles

- Working-level discussions about executive decision making

- Practical insight into managing finance teams under pressure

9. SuiteWorld

- Dates: October 26 to 29, 2026

- Location: Las Vegas, Nevada, USA

- Registration: Official SuiteWorld event page

- Pricing: Not available yet.

SuiteWorld is most relevant if your finance organization runs on NetSuite or is closely tied to ERP-driven processes. While the event covers a wide range of operational topics, many sessions speak directly to CFO-level concerns such as financial visibility, entity complexity, close structure, and reporting accuracy.

This conference promises to be practical if you want to see how other finance teams configure and govern their systems in real environments. The value usually comes from understanding how ERP decisions affect daily finance work rather than from high-level strategy alone.

Key benefits of attending:

- Deep exposure to NetSuite-based finance operations

- Real examples of handling multi-entity and high-volume reporting

- Practical insight into aligning ERP setup with finance controls

Short list of CFO conferences in 2026

Here’s a concise overview of CFO focused conferences in the USA and Canada currently scheduled for 2026. Dates and locations are based on published information and should always be double-checked closer to registration.

| Conference | Dates | Location | Focus |

| Gartner Finance Symposium and Xpo | May 27 to 29, 2026 | National Harbor, MD, USA | Finance operating models, reporting structure, and data flow at scale |

| WSJ CFO Council Summit | March 23 to 24, 2026 | Palo Alto, CA, USA | Executive-level decision making, governance, and investor dynamics |

| Private Funds CFO New York Forum | February 3 to 4, 2026 | New York, NY, USA | Fund-level reporting, regulatory pressure, and portfolio complexity |

| AICPA and CIMA CFO Conference | April 13 to 15, 2026 | Miami Beach, FL, USA | Accounting standards, controls, close management, and compliance |

| FEI Canada National Conference | May 25 to 28, 2026 | Ottawa, ON, Canada | Canadian governance, risk management, and senior finance leadership |

| Canadian Finance Summit | May 28, 2026 | Toronto, ON, Canada | Current Canadian finance challenges and applied leadership topics |

| Radiance 2026 | February 23 to 25, 2026 | Dallas, TX, USA | Forecasting discipline, planning, and CFO-level performance management |

| CFO Leadership Conference, spring edition | June 3 to 5, 2026 | Boston, MA, USA | Finance leadership, team management, and executive accountability |

| SuiteWorld | October 26 to 29, 2026 | Las Vegas, NV, USA | NetSuite-driven finance operations, ERP configuration, and reporting control |

Conclusion

CFO conferences are most valuable when they help you make better decisions after the badge comes off. The right event gives you clearer reference points, whether that is how peers structure reporting, where they draw the line on detail, or how they keep control as complexity grows.

In 2026, the strongest conferences are the ones that stay close to real finance work. If an event helps you question existing assumptions and sharpen how your finance systems support the business, it has earned its place on your calendar.

FAQ

How do CFO conferences differ from general finance events?

CFO conferences are designed specifically for senior finance leaders and focus on decision-making, governance, reporting accountability, and leadership challenges. Unlike broader finance events, they spend less time on role-level training and more time on how finance functions at the executive level.

Are CFO conferences worth attending for mid-sized companies?

Yes, many CFO conferences are highly relevant for mid-sized companies, especially those dealing with growth, system complexity, or increased reporting pressure. The key is choosing events where speakers and attendees operate in organizations with a similar scale and constraints.

How should a CFO choose the right conference to attend?

The best approach is to match the conference agenda to your current priorities. Look at topics such as reporting structure, finance systems, regulatory focus, and peer profiles. Conferences are most effective when discussions align closely with the challenges you’re actively managing.