Selling on Amazon is fast, and full of potential. But when your business grows and it’s time to manage your numbers, the reality hits. You’re suddenly confronted with charges, refunds, chargebacks, and Amazon settlement reports that seem like they were written in a different language.

And you’re not alone. 44% of Amazon sellers polled in Jungle Scout’s 2024 State of the Amazon Seller Report list bookkeeping and accounting as one of their biggest pain points of running their business. Add in international sales, changing exchange rates, and multiple sales taxes, and your “side hustle” begins to feel like a full-time accounting job.

That’s where good accounting software can make a difference—if you pick the right one.

But let’s first take a look at what Amazon sellers ought to actually be searching for in an accounting tool.

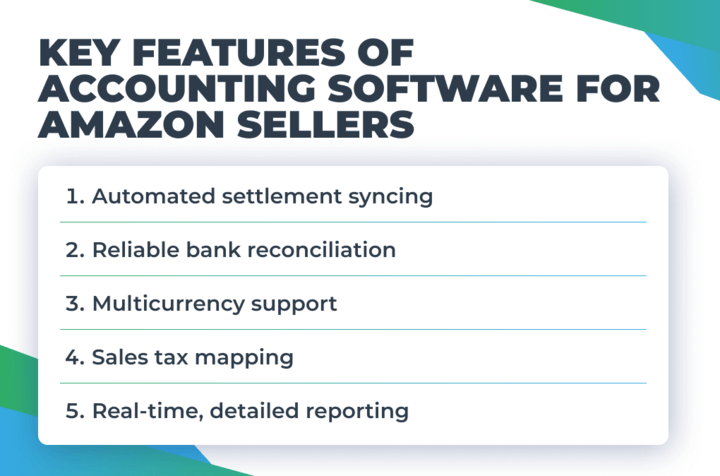

What to look for in accounting software for Amazon sellers

Not every accounting software is designed for an ecommerce business. Ensure the solution you select provides the following:

And now it’s time for the best software for Amazon sellers.

Top 6 accounting tools for Amazon sellers

We’ve picked 6 solid tools that actually make sense for Amazon sellers in 2026. Each one helps keep your numbers clear and your time focused on the business, not the books.

1. Synder (accounting automation)

We’re adding an extra one first, since it’s not exactly traditional accounting software, but rather a powerful accounting automation tool that adapts to your setup. Synder connects directly to Amazon and dozens of other ecommerce platforms, automatically syncing sales data, fees, refunds, and settlements into your accounting system (like QuickBooks, Xero, or Sage Intacct).

Why it works for Amazon sellers

Synder handles Amazon settlements natively, offering clean, auto-synced transaction data without spreadsheets, or manual uploads. It breaks down Amazon payouts into product sales, fees, shipping income, sales tax, and more, mapping each element to the correct accounts. If you’re dealing with FBA, FBM, or both, Synder syncs everything accurately and in real time.

Synder also supports multi-channel sellers integrating with platforms like eBay, Shopify, Etsy, or Walmart, helping unify all sales data for reconciliation, tax reporting, and financial clarity. With multicurrency support and smart automation rules, it greatly reduces manual errors and time spent on cleanup.

What to keep in mind

Synder isn’t a standalone accounting platform, it works alongside your software (QuickBooks, Xero, Sage Intacct). You’ll still need your main accounting tool, but Synder fills in the gaps most others leave open, especially when it comes to ecommerce and Amazon complexity.

Best for

Amazon (and multi-platform) sellers who want a clean, scalable accounting process without the manual grind.

2. QuickBooks Online

QuickBooks Online is a really popular cloud accounting software that allows you to customize invoices, provides real-time dashboards, and includes robust financial reporting, which is ideal for mid-sized to small businesses.

Why it works for Amazon sellers

With QuickBooks’ Amazon Seller Connector and other integrations like Synder, QuickBooks is able to import Amazon payouts and orders, categorize fees and taxes, match deposits, and provide accurate financial data. Multicurrency support (Plus/Advanced plans), basic inventory tracking, and automated sales tax calculation are a few of the features that make it more appealing.

What to keep in mind

QuickBooks lacks deep Amazon-native functionality out of the box, so you’ll need to lean on third-party integrations for full settlement detail, tax mapping, and reconciliation. Inventory tools are sparse for high-volume sellers, and more advanced features are in higher-tier plans.

Best for

Sellers looking for flexible, reliable accounting software that becomes Amazon-friendly with the right integrations.

3. Xero

Xero is a cloud based accounting platform that is known for its clean interface, intelligent automation, and strong bank reconciliations, suitable for small to medium-sized ecommerce merchants who appreciate simplicity and scalability.

Why it works for Amazon sellers

Xero can connect to Amazon using third-party apps like Synder, which lets you automatically sync sales, fees, refunds, and payouts. It handles multiple currencies, gives you real-time cash flow updates, and works with inventory management tools. Plus, Xero connects with over 1,000 business apps, so it’s a flexible hub for sellers working across different channels.

What to keep in mind

Xero accounting doesn’t include built-in Amazon integration, so proper settlement syncing and comprehensive tax mapping are dependent on third-party connectors. Robust sales tax and inventory functionality entails app integrations and may add to your overall cost. Some setup may also require the help of your accountant or integration partner.

Best for

Amazon businesses who want an automation-enabled accounting solution and ready to enhance functionality through integrations.

4. Sage Intacct

Sage Intacct is a cloud financial management solution aimed at growing companies that need advanced reporting, compliance, and automation. It’s especially useful for sellers who have numerous Amazon marketplaces or selling at scale.

Why it works for Amazon sellers

Through third-party integrations like Synder, Sage Intacct can automatically synchronize comprehensive Amazon transaction data, such as shipping revenue, fees, and refunds. It also features multi-entity reporting, GAAP-compliant revenue recognition (including ASC 606), and real-time dashboards for clear financial insights. These capabilities make it a suitable choice for ecommerce sellers who have outgrown starter systems.

What to keep in mind

Sage Intacct doesn’t natively connect to Amazon and must be integrated using a third-party tool and setup assistance. It’s also quite expensive and has a more challenging learning curve than the other solutions, so it’s a better fit for teams that have in-house financial expertise or access to ecommerce accountants.

Best for

Mid-market to enterprise-level Amazon sellers who require scalable, ready-to-comply financial management with robust automation and multi-entity capabilities.

5. NetSuite

NetSuite is a comprehensive cloud ERP solution for high-volume sellers and growing businesses. It unifies accounting, inventory management, CRM, and order processing in a single system, providing a centralized solution for complex business processes.

Why it works for Amazon sellers

With the appropriate connector, like the NetSuite Connector or third-party integrations, NetSuite can be integrated with Amazon Seller Central with ease. The integration supports automatic synchronization of orders, inventory, customer data, and financials from Amazon to NetSuite. It supports both Fulfillment by Amazon (FBA) and Fulfillment by Merchant (FBM) models and offers real-time visibility into sales and inventory across channels. In addition, NetSuite’s strong financial management functionality allows for accurate reconciliation of Amazon settlements and robust reporting.

Read about Amazon FBA and dropshipping.

What to keep in mind

Implementing NetSuite with Amazon integration entails a thoughtful setup process, normally with third-party connectors and potential customization to fit specific business needs. The complexity of the system may demand specialized IT staff or external support for optimal configuration and maintenance.

Best for

Experienced Amazon vendors or fast-growing companies looking for a complete ERP solution with scalability, extensive integration possibilities, and high-end financial management functionality.

6. Zoho Books

Zoho Books is a cloud based accounting solution that is both versatile and affordable, making it a great option for small to mid-sized Amazon sellers who need basic accounting features without the fuss.

Why it works for Amazon sellers

When integrated with tools like Zoho Inventory, Bookkeep, or Zapier, Zoho Books is able to automatically sync Amazon sales orders, track inventory, and update customer details. It supports multicurrency transactions, auto-calculates taxes, and provides real-time financial reporting. Its integration with Zoho Inventory allows seamless management of FBA and FBM operations with accurate stock levels and smooth order processing.

What to keep in mind

Zoho Books doesn’t natively integrate with Amazon Seller Central. It’d require third-party applications to create the integration, potentially adding costs and configuration. While the system is user-friendly, businesses with more complex operations may find its features less detailed compared to enterprise solutions.

Best for

Amazon sellers who seek an affordable, user-friendly accounting system that efficiently handles key financial tasks and easily integrates with other Zoho applications.

Why traditional accounting software falls short for Amazon sellers — and how Synder bridges the gaps

Tools like QuickBooks, Xero, and Sage Intacct are powerful for general accounting, but Amazon isn’t your average platform. It comes with dense settlement reports, various fees, multicurrency sales, and shifting fulfillment costs. Accounting software simply isn’t built to handle this level of ecommerce complexity out of the box.

That’s exactly why Synder heads our list of options. It connects the dots between Amazon and your accounting platform, solving the real-world issues sellers face every day, with automation built specifically for ecommerce.

Let’s explore the top problems Amazon sellers face using traditional software and how Synder solves them with real, proven impact.

Problem #1: Amazon settlement reports are hard to unpack

Amazon payouts combine sales, returns, shipping income, FBA fees, reimbursements, and more into a single lump deposit. Standard accounting tools show you the amount, but not the breakdown. That means hours of manual work, spreadsheets, and eventually stress.

How Synder solves it:

Synder connects directly to Amazon Seller Central and automatically breaks down every line in your settlement report. Each transaction, be it revenue, a fee, or tax, is categorized with full detail in your accounting software, eliminating manual uploads and guesswork.

| Real-life example: Moskinto, a fast-growing Amazon-native brand, needed precise visibility into their Amazon sales and fee structure. By using Synder, they fully automated the process of importing detailed Amazon transactions into QuickBooks. This gave their team real-time clarity over performance, making bookkeeping more efficient and freeing up time to focus on growth. |

Problem #2: Reconciliation is inconsistent

Amazon payouts often don’t match what’s in your books. Timing delays, withheld fees, and dealing with different currencies often leads to mismatches that make closing the books a frustrating chore.

How Synder solves it:

Synder ensures every Amazon payout is matched to the underlying transactions in your books. From the original order to the final bank deposit, the flow is clear and reconcilable—so month-end becomes a process, not a problem.

| Real-life example: TJAYZ, a brand selling handcrafted goods through Amazon, Shopify, Etsy, and other platforms, struggled with cross-platform reconciliation before switching to Synder. Once implemented, Synder synced their multichannel sales and aligned every payout with bank records, dramatically reducing time spent on manual matching. |

Problem #3: Multicurrency transactions create confusion

Selling globally means dealing with different currencies and exchange rates. Accounting tools can’t always keep up and even small discrepancies add up fast.

How Synder solves it:

Synder converts international transactions using actual exchange rates from payment processors at the time of sale. That means your reports reflect true values in your home currency, making financial statements accurate and audit-ready.

Problem #4: You sell on more than just Amazon and it’s hard to track

Most successful ecommerce businesses diversify across multiple platforms. But accounting tools typically treat each store as a separate data set, or don’t connect at all, creating fragmentation and reporting blind spots.

How Synder solves it:

Synder unifies data from 30+ platforms (including Amazon, Shopify, Etsy, Walmart, eBay, and Stripe) into one streamlined system. That means one reconciliation workflow, one view of your financials, and performance insights across all sales channels.

| Real-life example: TJAYZ was a textbook case of a multi-platform seller trying to scale without losing control of their books. With Synder, they automated data syncing across channels and gained a clear picture of revenue, costs, and taxes across Amazon and every other platform they used. |

Problem #5: Tax compliance is an ongoing risk

Amazon handles some taxes, but not all. Without proper mapping, your reports may be incomplete, or worse—incorrect, putting you at risk during audits or tax season.

How Synder solves it:

Synder maps sales tax to the right codes in your accounting software automatically, keeping tax records clean and compliant. You can track by region, product type, or jurisdiction, and export audit-ready reports anytime.

So, you might be an Amazon brand like Moskinto or a multi-platform company like TJAYZ, Synder makes ecommerce accounting scalable, compliant, and automatic.

If your accounting software alone isn’t cutting it, it’s time to bring in Synder—the tool that fills the ecommerce accounting gap. Use Synder’s 15-day free trial for easy Amazon accounting, or hop into one of our Weekly Public Demos and get your questions answered right away.

Final takeaway: Why Synder is the missing piece for Amazon accounting

Your accounting system manages the books. Amazon manages the sales. But Synder puts it all together: automatically, perfectly, and at exactly the right moment. It imports all the information: from sales and fees to taxes and currency conversions, keeping everything in sync, so your numbers are always up to date and accurate.

More related reading:

How to Sell on Amazon Without Inventory in 2026: 4 Main Methods Explained

Seller SKU Amazon: What is Amazon Seller SKU? Explore Ways to Create and Manage it