Are you looking for a way to become a certified QuickBooks ProAdvisor? QuickBooks is the most popular bookkeeping and accounting software for small businesses, and getting a ProAdvisor badge is an excellent way to boost your credentials and make yourself more attractive to potential clients. Becoming a ProAdvisor isn’t a difficult process, but it requires understanding the QuickBooks platform and demonstrating a thorough knowledge of the software.

This step-by-step guide will provide you with the information you need to become a certified QuickBooks ProAdvisor. Let’s embark on this journey to unlock the full potential of QuickBooks expertise and pave the way for a successful and rewarding career in accounting and finance.

Looking for you ProAdvisor? Synder’s directory has many.

Contents:

1. What is a QuickBooks ProAdvisor?

2. What is the role and expertise of a QuickBooks ProAdvisor?

3. Do you need any special certificate before enrolling in the QuickBooks ProAdvisor Program?

4. How to become a QuickBooks ProAdvisor?

5. How long does it take to become a QuickBooks ProAdvisor?

6. Tips for passing the QuickBooks ProAdvisor Certification Exam

7. What are the main QuickBooks features a QuickBooks ProAdvisor should know about?

8. What are the benefits of being a QuickBooks ProAdvisor?

9. How to promote your QuickBooks ProAdvisor status

What is a QuickBooks ProAdvisor?

A QuickBooks ProAdvisor is a certified individual who is knowledgeable about using QuickBooks software and provides support and advice to QuickBooks users. In other words, ProAdvisors are highly trained professionals who have the necessary skills and experience to assist clients in their use of QuickBooks and related services. They can help clients with the software’s setup, maintenance, and use. In addition, ProAdvisors can assist with training QuickBooks users and provide ongoing support.

What is the role and expertise of a QuickBooks ProAdvisor?

The role and expertise of a QuickBooks ProAdvisor encompass a wide range of skills and responsibilities, primarily centered around the proficient use of QuickBooks software for effective financial management. Their key roles and areas of expertise include:

Expert knowledge of QuickBooks

ProAdvisors possess an in-depth understanding of QuickBooks software, including its various versions (Online, Desktop, Enterprise) and features. This expertise allows them to set up, navigate, and troubleshoot the software effectively.

Learn how to migrate from the QuickBooks Desktop to the QuickBooks Online version.

Software setup and customization

They assist businesses in setting up QuickBooks, ensuring that the software is configured to meet the unique needs of each business. This includes customizing settings, creating templates, and setting up accounts and reports.

Training and user support

ProAdvisors often conduct training sessions for business owners and their staff, teaching them how to use QuickBooks efficiently. They also provide ongoing support and answer any questions users may have about the software.

Financial and accounting services

Beyond software support, many ProAdvisors offer a range of accounting services, such as bookkeeping, financial reporting, budgeting, and payroll management, all integrated with QuickBooks.

The knowledge of the software that can simplify the workflow with QuickBooks will be a huge advantage. Especially when you’re searching for real clients. Synder can be your trustworthy companion on this journey! The software provides an automatic sync of your clients’ transactions with QuickBooks Online or Desktop version reducing manual bookkeeping and accounting processes.

Learn how to make the most of your accounting practices with Synder!

Synder demonstrates the perfect combination of machine accuracy with a human approach enhancing bookkeeping and accounting workflow. Experience it yourself by creating a free account to test the features from the inside or booking a spot on a Weekly Webinar with Synder’s specialists.

Tax preparation and advice

With their understanding of QuickBooks and accounting principles, ProAdvisors can assist with tax preparation and planning, ensuring that financial records are accurate and tax-compliant.

Troubleshooting and technical support

They provide solutions to technical issues that users might encounter with QuickBooks, from basic troubleshooting to complex problem-solving.

Business consulting

Leveraging their financial expertise, ProAdvisors often advise businesses on best practices in financial management, helping them make informed decisions based on accurate financial data from QuickBooks.

Financial data analysis and reporting

They help businesses analyze their financial data, create custom reports, and gain insights into their financial performance, aiding in strategic planning and decision-making.

Streamlining business processes

ProAdvisors can help optimize and automate various accounting processes using QuickBooks, improving efficiency and accuracy in financial management.

Staying current with updates

As QuickBooks evolves, ProAdvisors stay tuned with the latest features and updates, ensuring that they can always provide the most current and effective advice.

Do you need any special certificate before enrolling in the QuickBooks ProAdvisor Program?

No, you don’t need any special certificate before enrolling in the QuickBooks ProAdvisor Program. The program is designed to accommodate individuals with varying levels of expertise, from beginners to experienced accounting professionals.

While it’s not a requirement, having a background in accounting, finance, or a related field can be beneficial. It helps in understanding accounting principles and practices, which are essential when working with accounting software like QuickBooks.

Note: For certified accountants or those holding credentials such as CPA (Certified Public Accountant), the ProAdvisor Program can offer CPE credits, which can be a bonus for maintaining their professional certification.

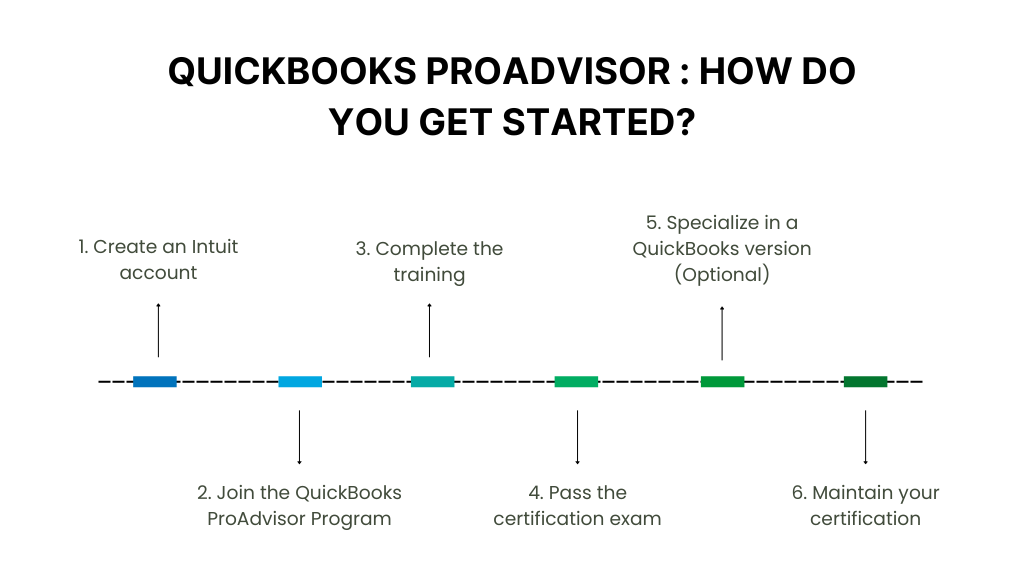

How to become a QuickBooks ProAdvisor?

Becoming a QuickBooks ProAdvisor involves a series of steps focused on training. Here’s a detailed guide on how to achieve this status:

Create an Intuit account

First, create an account with Intuit, the company that produces QuickBooks. This is a necessary step to access the QuickBooks ProAdvisor Program. You can sign up for an account on the Intuit website.

Join the QuickBooks ProAdvisor Program

Enroll in the QuickBooks ProAdvisor Program. This program is designed for accounting professionals and is often free, especially for the online version. Joining the program gives you access to the training materials and certification exams.

Complete the training

Once you’re part of the ProAdvisor Program, you’ll have access to training materials provided by Intuit. These materials include webinars, live courses, self-paced modules, and other educational resources. The training covers various aspects of QuickBooks, from basic functionalities to advanced features and best practices.

Pass the certification exam

After completing your training, the next step is to take and pass the QuickBooks exam, which consists of 80 questions divided into 5 sections. The exam tests your knowledge and proficiency in QuickBooks. It typically includes multiple-choice questions and covers a range of topics, such as setup, navigation, features, and troubleshooting within QuickBooks.

You’ll need to achieve a passing score (80%) to become certified. If you don’t pass on the first try, you can retake the exam, often after a short waiting period.

Specialize in a QuickBooks version (optional)

While the basic certification covers general QuickBooks knowledge, you can also specialize in specific QuickBooks versions, such as QuickBooks Online, QuickBooks Desktop, or QuickBooks Enterprise Solutions. Specialization might require passing additional exams focused on these specific versions.

Learn how to set up and use Chart of Accounts in QuickBooks for efficient financial management.

Maintain your certification

To keep your ProAdvisor status, you need to complete continuing education and regularly pass recertification exams. This ensures you stay up-to-date with the latest QuickBooks features, updates, and best practices.

How long does it take to become a QuickBooks ProAdvisor?

The time it takes to become a QuickBooks ProAdvisor can vary depending on several factors, including your prior experience with QuickBooks, your familiarity with accounting principles, and the amount of time you can dedicate to the training and study process.

- Training duration: The QuickBooks ProAdvisor training consists of several modules. For someone new to QuickBooks, it might take a few weeks to go through all the training materials thoroughly. However, if you’re already familiar with QuickBooks, you might be able to complete the training faster.

- Passing the exam: The certification exam itself can be completed in a few hours. However, if you don’t pass on the first try, you’ll need to factor in additional study time and the waiting period before retaking the exam.

On average, it can take anywhere from a few weeks to a couple of months to become a QuickBooks ProAdvisor, assuming you’re dedicating a few hours each week to studying and training. This timeline can be shorter for those with prior QuickBooks experience or longer for those with no background in accounting software.

Tips for passing the QuickBooks ProAdvisor Certification Exam

Passing the QuickBooks ProAdvisor Certification Exam requires a combination of study, practice, and familiarity with QuickBooks software. Here are some tips to help you prepare effectively and increase your chances of success:

Tip #1. Understand the exam format

Familiarize yourself with the structure of the certification exam. Knowing the types of questions (multiple choice, scenario-based, etc.) and the exam’s focus areas can help you prepare more effectively.

Tip #2. Complete the training modules

Intuit provides comprehensive training modules for QuickBooks ProAdvisors. Make sure you go through all the provided training materials thoroughly, as they cover the key concepts and functionalities of QuickBooks that will likely be on the exam.

Tip #3. Hands-on practice

Use QuickBooks regularly to get hands-on experience. Practical experience with the software will help you understand its features and functionalities better, which is crucial for the exam.

Learn how to reconcile in QuickBooks.

Tip #4. Utilize study guides and practice exams

Look for study guides and practice exams online. Practice exams can be particularly beneficial as they mimic the format of the actual exam and help you get comfortable with the types of questions that will be asked.

Tip #5. Join ProAdvisor forums and groups

Participate in QuickBooks ProAdvisor forums and groups. These can be valuable resources for advice, study tips, and insights from individuals who have already passed the exam.

Tip #6. Prepare for open-book format

The QuickBooks ProAdvisor exam is open-book, meaning you can refer to your notes, training materials, and even the QuickBooks software during the exam. Organize your resources beforehand so you can quickly refer to them if needed.

What are the main QuickBooks features a QuickBooks ProAdvisor should know about?

A QuickBooks ProAdvisor should be well-versed in a wide range of QuickBooks features to provide comprehensive assistance and advice to clients. Here are some of the main features they should be familiar with:

- Advanced inventory management: In-depth knowledge of QuickBooks inventory capabilities, including tracking inventory across multiple locations, setting reorder points, inventory valuation, and handling complex inventory transactions.

- Custom reporting and analysis: Expertise in creating custom reports and utilizing QuickBooks advanced reporting tools. This includes understanding how to extract specific data, customize report layouts, and interpret data to provide valuable business insights.

- Multicurrency transactions: Proficiency in handling transactions in multiple currencies, understanding exchange rate implications, and managing gains and losses due to currency fluctuations.

- Fixed asset management: Understanding how to manage fixed assets in QuickBooks, including tracking purchases, depreciation, and disposals of fixed assets.

- Advanced user permissions and audit trail: Knowledge of setting up user roles and permissions to ensure data security and understanding how to use the audit trail to monitor changes made in the system.

- Integration with ecommerce platforms: Experience in integrating QuickBooks with ecommerce platforms and understanding how to manage online sales, inventory, and customer data.

- Cash flow management: Ability to use QuickBooks to monitor and manage cash flow, including projecting future cash flows and analyzing past cash flow trends.

- Nonprofit accounting features: For ProAdvisors working with nonprofit organizations, understanding how to utilize QuickBooks for fund accounting, donor management, and grant tracking.

What are the benefits of being a QuickBooks ProAdvisor?

Expanding on the benefits of being a QuickBooks ProAdvisor, the program not only enhances your professional skills and knowledge but also provides a suite of tools and opportunities to grow your practice and improve your service offerings, such as:

In-depth QuickBooks expertise

As a ProAdvisor, you gain comprehensive knowledge of QuickBooks. This expertise allows you to handle a wide range of client scenarios, from basic bookkeeping to complex financial management.

Direct access to QuickBooks products

ProAdvisors receive free or discounted versions of QuickBooks software. This enables you to take advantage of the latest versions and features, ensuring that you can provide knowledgeable support to clients using different versions of QuickBooks.

Continuous training and educational resources

The program offers continuous learning through various formats, including webinars, articles, and interactive sessions. This ongoing education is crucial for staying current with accounting practices and software updates.

Marketing and branding tools

Intuit provides ProAdvisors with marketing tools such as listing in the Find-a-ProAdvisor directory, customizable templates for marketing materials, and more. These resources can be invaluable for attracting new clients and building your brand.

Networking and community engagement

The program connects you with a community of accounting professionals. This network is an excellent resource for sharing experiences, seeking advice, and even receiving or giving client referrals.

Discounts and special offers

ProAdvisors receive exclusive discounts on QuickBooks products and services, which can be beneficial both for personal use and for offering discounts to clients.

Increased client trust and satisfaction

Your certification and ability to provide expert advice can lead to increased client trust and satisfaction. Clients are more likely to retain your services and refer others when they’re confident in your skills and knowledge.

How to promote your QuickBooks ProAdvisor status

When you’ve finally become a QuickBooks ProAdvisor, you should take steps to promote your status. You can add the QuickBooks ProAdvisor logo to your website and social media profiles, use it in your email signature, and mention your ProAdvisor status in your communication with clients.

Here are some other strategies to effectively market your ProAdvisor certification:

- Leverage the Find-a-ProAdvisor platform: Intuit’s Find-a-ProAdvisor online directory is a great place to start. Make sure your profile is complete, up-to-date, and highlights your unique skills and services. Clients often use this directory to find certified QuickBooks experts.

- Develop a strong online presence: Create a professional website or blog where you can showcase your services, certifications, client testimonials, and insightful articles about QuickBooks and accounting practices. Use search engine optimization (SEO) techniques to improve your visibility in search engine results.

- Offer workshops or webinars: Conduct training sessions, workshops, or webinars on QuickBooks. These can be in-person or online events where you provide valuable insights into using QuickBooks more effectively. This not only showcases your expertise but also helps in building relationships with potential clients.

- Collaborate with other businesses: Partner with other businesses that serve the same target market but are not direct competitors, like tax preparation firms or business consultants. This can open up opportunities for cross-promotion and referrals.

- Client rates and testimonials: Encourage your clients to review your expertise and leave testimonials about your services. Positive comments can be incredibly persuasive to potential clients researching QuickBooks ProAdvisors.

Conclusion

Becoming a QuickBooks ProAdvisor is a challenging task. The path involves comprehensive training and passing a certification exam, which tests both your knowledge and practical application of the software.

However, once certified, you gain a significant professional edge. This status not only enhances your credibility as an expert in QuickBooks but also broadens your opportunities for client engagement. The effort invested in achieving this certification opens doors to new professional avenues and growth in the accounting and finance sector.